When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Biotech & Healthcare Letter

October 20, 2020

Fiat Lux

FEATURED TRADE:

THE MOST FAMOUS CANCER STOCK YOU’VE NEVER HEARD OF

(TRIL), (NVAX), (PFE), (IMMU), (SHOP), (GILD), (ABBV)

Biotechnology stocks have proven time and time again to be excellent growth vehicles for risk-tolerant investors.

Underscoring this claim are companies like COVID-19 vaccine frontrunner Novavax (NVAX), which generated jaw-dropping returns on capital for their investors within an impressively short period.

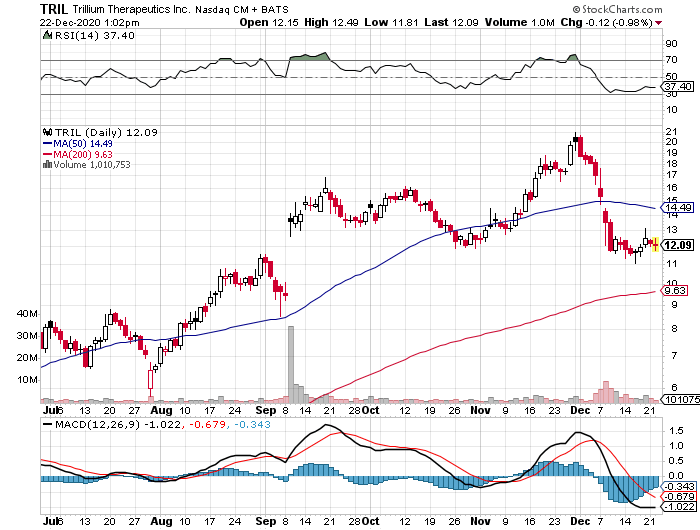

Now, another biotechnology stock is showing telltale signs of following their footsteps: Trillium Therapeutics (TRIL).

Trillium’s story is a familiar one in the biotechnology industry.

Trading only in the penny stock range back in 2019, the company’s share price practically quadrupled since the start of 2020.

Taking into consideration that this meteoric rise actually happened while COVID-19 was blasting the world to smithereens, it’s hardly surprising that this news didn’t receive much media attention.

Trillium’s shares are currently up by an astounding 1,260% -- and the company still has so much room to grow from here.

For context, Trillium had a market capitalization of $7 million in November 2019. This number skyrocketed to $1.3 billion since its shift to cancer technology.

Although a lot of factors came into play, the key turning point for Trillium was when the company decided to go all-in on its cancer programs.

Ultimately, Trillium’s goal is to challenge chemotherapy.

The move to shutter its lead programs on tumor treatments and instead focus on developing cancer-fighting technology was the gamble of a lifetime for the company.

This gutsy move impressed investors, and Trillium was never the same since then.

Today, Trillium is the No. 1 stock on Canada’s S&P/TSX Composite Index, overtaking its previous leader e-commerce giant Shopify (SHOP) by almost 10-fold.

In the US, Trillium shares rank as the No. 4 best-performing company on the Nasdaq Composite Index.

While its epic stock market rally may have some investors feeling left out, all signs point to further gains in the future even for those who missed the initial boom.

Among the major capitalists of this biotechnology company is giant biopharmaceutical company and COVID-19 vaccine leader Pfizer (PFE), which invested $25 million in Trillium’s common stock.

While this equity stake may seem small in relation to Pfizer’s $212.16 billion market capitalization, this initial show of confidence is hailed as a prelude to an even bigger investment in the future.

So far, the most exciting cancer treatments in Trillium’s pipeline are TTI-621 and TTI-622.

These programs are in the same class of emerging cancer technologies, called CD47-based therapies, that prompted Gilead Sciences’ (GILD) $4.9 billion acquisition of Forty Seven, Inc. in April this year.

Aside from Gilead, AbbVie (ABBV) has also been reported to have invested a huge sum in this technology.

In simplest terms, CD47-based therapies can bypass the “don’t eat me signal” put up by some cancer cells in an effort to evade immune detection.

Thus far, both TTI-621 and TTI-622 have been showing promising results. Trillium recently announced that it will increase the dosage in these programs.

While Trillium leaders have not been specific in terms of being open to an acquisition, their recent statements indicate that they are not completely opposed to one.

It’s either that or a partnership with a company as big or even bigger than Pfizer.

As with all the biotechnology stocks, however, there will always be a risk.

For Trillium, the most evident one is competition.

While it’s true that the company has been recognized as the leader in the CD47 arena, more and more competitors are entering the immuno-oncology space.

Right now, the most obvious rival is Gilead, which added Immunomedics (IMMU) to its arsenal via a $21 billion acquisition deal.

Given the sheer amount of money that Gilead has been spending to practically corner the immuno-oncology market, it’s to be expected that more biopharmaceutical titans will enter the fray.

This is one of the reasons Trillium has been tagged as a prime candidate for a massive acquisition deal soon. So far, Pfizer is considered the most probable suitor.

Despite its astonishing performance this year, Trillium’s market capitalization still remains within the small-cap territory. That’s to be expected since its lead assets are still undergoing trials.

Considering that it is an early-stage biotechnology stock, Trillium does not have much in terms of income.

However, the company does have enough cash to last for a while. At the moment, it has $130 million cash.

With its total expenses of $38.8 million in 2019, I say this could offer the company more than three years of breathing room financially.

But it would be shocking if Trillium’s value won’t enter the large-cap territory (higher than $10 billion) if and when the company’s high-value assets reach the late-stage studies.

The fact that it’s also an attractive acquisition candidate offers incredible incentive to its investors.

Simply put, Trillium’s stock could get as much as 1,000% gain over the coming two to three years, making it an ideal investment for risk-tolerant investors.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

October 20, 2020

Fiat Lux

Featured Trade:

(WHY SPAC’S ARE A SCAM)

(PSTH), (SPAK)

“Nobody knew it was August 1982 until it was August 1984,” said Christopher Verrone, head of technical analysis at research boutique Strategas.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Technology Letter

October 19, 2020

Fiat Lux

Featured Trade:

(ROLL OUT THE OVERSTOCK.COM PLAYBOOK)

(OSTK), (AMZN)

As the virus engulfs the U.S. once again — I can’t help but think it’s time for the 2nd wave of Overstock.com (OSTK) going ballistic again.

Highlighting the insanity of 2020, Overstock.com shares were trading at a pitiful $2 on March 11 and then lockdowns happened, and the stock never looked the same again.

To say that underlying shares went parabolic is an understatement, the meteoric rise from $2 to $115 in a 5-month span is stuff of legends.

Remember that Overstock.com was just a middling backwater stock almost as Myanmar’s mediocre geopolitical status is to the Asian continent.

In fact, shareholders were in the process of searching for a buyer — in a way waving the white flag as a resentful ending to a half-hearted try to catch Amazon’s (AMZN) e-commerce business.

Overstock.com sells everything from baby toys to wrought iron firepit décor.

If it’s for the home or something related, they probably have it in store for you and as Covid has throttled the population’s go-to shopping places from strip malls to the shopping lanes of America, Overstock.com has become an outsized winner.

Let’s get into the weeds of their business.

With the tectonic shift to e-commerce likely permanent, shares can keep rallying specifically because the risk of another lockdown is increasing and the virus spreads again.

Multiple catalysts, both on the macro and micro level that can drive continued upside to revenue meaning high estimates for Ebitda (earnings before interest, taxes, depreciation, and amortization).

Bricks-and-mortar stores will continue to bleed market share to online competition even if the virus is handled, providing a tailwind for Overstock into 2021.

The company’s improved pricing model will shoot margins higher, while it also works to broaden its target audience and expand marketing.

Overstock has evolved in recent years, thanks to new management and a new strategy, which includes a timely focus on home goods, a retail standout during the pandemic. It also has blockchain-based ventures that bulls say the market is ignoring.

The one-sentence answer to why the stock has gone ballistic is easy — 109% revenue growth year over year.

The company ended the quarter with a healthy balance sheet that included a cash balance of over $300 million.

Overstock Retail's exceptionally strong second-quarter performance was on fire supporting a 200% increase in new customers, and profitability, as measured by adjusted EBITDA, improved by $51 million year over year.

A key takeaway here is the scalability of Overstock’s pure-play e-commerce model and efficiencies created through partner drop-ship program.

Overstock’s overarching goal is to create operating leverage by growing top line at a faster pace than operating expenses.

Overstock is profitably gaining new customers and making progress toward achieving sustainable, profitable growth long term.

Last quarter, revenue from their Retail business was a record $767 million and customers are increasingly finding and purchasing products in core home furnishings categories.

Compared to the second quarter of 2019, new customer growth increased by over 200%, and Overstock has experienced strong customer purchase repeat behavior.

Gross margin improved by almost 3.5% year over year and the margin improvements were fueled largely by operational efficiencies, as well as several onetime items unique to the second quarter of 2020.

The onetime items included lower costs from being understaffed in the customer care organization as Overstock adjusted to increased sales volumes, a benefit from fulfillment-related charges as part of the service level agreements to protect customers' experience, and lower discounting activity as they strategically balanced marketing efforts against product availability and stockouts.

Operating expenses improved 5% as management was able to leverage technology expenses, illustrating the strong operating leverage inherent in an e-commerce business.

Overstock is one of a slew of internet companies that will harvest the fallout from another spread of the virus.

I believe it’s time to roll out the Overstock playbook again and buy and hold shares.

For short time traders, this is a beast of a stock to execute short-dated trades on because of the elevated volatility, but in general, I am bullish on this company through 2021.

“Almost everything is like a machine.” – Said Hedge fund Manager Ray Dalio

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.