Mad Hedge Technology Letter

February 14, 2020

Fiat Lux

Featured Trade:

(DATA TELLS THE WHOLE STORY)

(FB), (GOOGL), (NFLX), (AMZN), (EBAY), (TWTR)

Mad Hedge Technology Letter

February 14, 2020

Fiat Lux

Featured Trade:

(DATA TELLS THE WHOLE STORY)

(FB), (GOOGL), (NFLX), (AMZN), (EBAY), (TWTR)

Behavioral trends have a sizable say in which tech companies will outperform the next and a recent report from SimilarWeb offers insight into how much users navigate around the monstrosity known as the internet.

The optimal way to comprehend the trends are from a top-down method by absorbing the divergence between desktop traffic and mobile traffic.

It’s no secret that the last decade delivered consumers a massive leap in mobile phone performance in which tech companies were able to neatly package applications that acted as monetization platforms by offering software and services to the end-user.

Thus, it probably won’t shock you to find out that desktop traffic is down 3.3% since 2017 as users have migrated towards mobile and the trend has only been exaggerated by the younger generations as some have become entirely mobile-only users.

All told, the 30.6% expansion in mobile traffic has penalized tech firms who have neglected mobile-first strategies and one example would be Facebook (FB), who even though has a failing flagship product in Facebook.com, are compensated by Instagram, who is showing wild growth numbers.

The fact that mobile screens are smaller than desktop screens means that users are staying on web pages not as long as they used to – precisely 49 seconds to be exact.

This trend means that content generators are heavily incentivized to frontload content and scrunch it up at the top of the page. This also means that sellers who don’t populate on Google’s first page of search results are practically invisible.

The high stakes of internet commerce are not for the faint of heart and numerous companies have complained about algorithm changes toppling their algorithm-sensitive businesses.

Even using a brute force analysis and investing in companies that are in the top 15 of internet traffic, then the companies that scream undervalued are Twitter (TWTR) and eBay (EBAY).

Twitter is a company I have liked for quite a while and is definitely a buy on the dip candidate.

The asset is the 7th most visited property on the internet behind the likes of Instagram, Google, Baidu, Wikipedia, Amazon, and Facebook.

This position puts them just ahead of Pornhub.com, Netflix, and Yahoo.

And if you take one step back and analyze traffic from the top 100 sites, traffic is up 8% since 2018 and 11.8% since 2017 averaging 223 billion visits per month.

Rounding out the top 15 is eBay who I believe is undervalued along with Twitter - these two are legitimate buy and holds.

Ebay was the recipient of poor management for many years and they are now addressing these sore points.

Certain content is suitable for mobile such as adult sites, gambling sites, food & drink, pets & animals, health, community & society, sports, and lifestyle.

And just over the last year or two, other categories are gaining traction in mobile that once was dominated by desktop such as news and media, vehicle sites, travel, reference, finance, and others.

Many consumers are becoming more comfortable at doing more on mobile and spending more to the point where people are making large purchases on their iPhones.

The biggest loser by far was news - they are losing traffic in droves.

Traffic at the top 100 media publications was down 5.3% year-over-year from 2018 to 2019, a loss of 4 billion visits, and down by 7% since 2017.

Personally, I believe the state of the digital news industry is in shambles, and Twitter has moved into this space becoming the de facto news source while pushing the relevancy of news sites down the rankings.

Facebook and Twitter are essentially undercutting the news by forcing news companies to insert them between the reader and the news company because they have strategized a position so close to the user’s fingertips.

The negative sentiment in news is broad based on popular news, entertainment news and local news all showing decreases of more than 25%.

Finance and women’s interest news categories are the only ones showing positive traffic growth.

The state of internet traffic growth supports my underlying thesis of the big getting bigger and the subsequent network effect stimulating further synergies that drop straight down to the bottom line.

The top 10 biggest sites racked up a total of 167.5 billion monthly visits in 2019, up 10.7% over 2018 and the remaining 90 largest sites out of the top 100 only increased 2.3%.

This has set the stage for just five gargantuan tech firms to become worth more than $5 trillion or 15.7% of the S&P 500’s market value and 19.7% of the total U.S. stock market’s value.

Now we have real data backing up my iron-clad thesis and these cornerstone beliefs underpins my trading philosophy.

Many of the biggest wield a two-headed monster like Google who has Google.com and YouTube video streaming and Facebook, who have Facebook.com and Instagram.

It doesn’t matter that Facebook has lost 8.6% of traffic over the past year because Instagram compensates for Facebook being a poor product.

And if you are searching for another Facebook growth driver under their umbrella of assets then let’s pinpoint chat app WhatsApp who experienced 74% year-over-year traffic.

Beside the news sites, other outsized losers were Yahoo’s web traffic shrinking by 33.6% and Tumblr, which banned adult sites in 2018, leading to a 33% loss in traffic.

If I can sum up the data, buy the shares of companies who are in the top 15 of internet traffic and be on the lookout for any dip in eBay or Twitter because they are relatively undervalued.

“Some people don't like change, but you need to embrace change if the alternative is disaster.” – Said Founder and CEO of Tesla Elon Musk

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

February 14, 2020

Fiat Lux

Featured Trade:

(FEBRUARY 12 BIWEEKLY STRATEGY WEBINAR Q&A)

(SQ), (TSLA), (FB), (GILD), (BA), (CRSP), (CSCO), (GLD)

(FEYE), (VIX), (VXX), (USO), (LYFT), (UBER)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader February 12 Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: What do you think about Facebook (FB) here? We’ve just had a big dip.

A: We got the dip because of a double downgrade in the stock from a couple of brokers, and people are kind of nervous that some sort of antitrust action may be taken against Facebook as we go into the election. I still like the stock long term. You can’t beat the FANGs!

Q: If Bernie Sanders gets the nomination, will that be negative for the market?

A: Absolutely, yes. It seems like after 3 years of a radical president, voters want a radical response. That said, I don't think Bernie will get the nomination. He is not as popular in California, where we have a primary in a couple of weeks and account for 20% of total delegates. I think more of the moderate candidates will come through in California. That's where we see if any of the new billionaire outliers like Michael Bloom or Tom Steyer have any traction. My attitude in all of this is to wait for the last guy to get voted off the island—then ask me what's going to happen in October.

Q: When should we come back in on Tesla (TSLA)?

A: It’s tough with Tesla because although my long-term target is $2,500, watching it go up 500% in seven months on just a small increase in earnings is pretty scary. It’s really more of a cult stock than anything else and I want to wait for a bigger pullback, maybe down to $500, before I get in again. That said, the volatility on the stock is now so high that—with the short interest going from 36% down to 20%—if we get the last of the bears to really give up, then we lose that whole 20% because it all turns into buying; and that could get us easily over $1,000. The announcement of a new $2 billion share offering is a huge positive because it means they can pay off debt and operate with free capital as they don’t pay a dividend.

Q: Is Square (SQ) a good buy on the next 5% drop?

A: I would really wait 10%—you don't want to chase trades with the market at an all-time high. I would wait for a bigger drop in the main market before I go aggressive on anything.

Q: What about CRISPR Technology (CRSP) after the 120% move?

A: We’ve had a modest pullback—really more of a sideways move— since it peaked a couple of months ago; and again, I think the stock either goes much higher or gets taken over by somebody. That makes it a no-lose trade. The long sideways move we’re having is actually a very bullish indication for the stock.

Q: If Bernie is the candidate and gets elected, would that be negative for the market?

A: It would be extremely negative for the market. Worth at least a 20% downturn. That said, according to all the polling I have seen, Bernie Sanders is the only candidate that could not win against Donald Trump—the other 15 candidates would all beat Trump in a 1 to 1 contest. He's also had one heart attack and might not even be alive in 6 months, so who knows?

Q: I just closed the Boeing (BA) trade to avoid the dividend hit tomorrow. What do you think?

A: I’m probably going to do the same, that way you can avoid the random assignments that will stick you with the dividend and eat up your entire profit on the trade.

Q: When do you update the long-term portfolio?

A: Every six months; and the reason for that is to show you how to rebalance your portfolio. Rebalancing is one of the best free lunches out there. Everyone should be doing it after big moves like we’ve seen. It’s just a question of whether you rebalance every six months or every year. With stocks up so much a big rebalancing is due.

Q: I have held onto Gilead Sciences (GILD) for a long time and am hoping they’ll spend their big cash hoard. What do you think?

A: It’s true, they haven’t been spending their cash hoard. The trouble with these biotech stocks, and why it's so hard to send out trade alerts on them, is that you’ll get essentially no movement on them for years and then they rise 30% in one day. Gilead actually does have some drugs that may work on the coronavirus but until they make another acquisition, don’t expect much movement in the stock. It’s a question of how long you are willing to wait until that movement.

Q: Is it time to get back into the iPath Series B S&P 500 VIX Short Term Futures ETN (VXX)?

A: No, you need to maintain discipline here, not chase the last trade that worked. It’s crucial to only buy the bottoms and sell the tops when trading volatility. Otherwise, time decay and contango will kill you. We’re actually close to the middle of the range in the (VXX) so if we see another revisit to the lows, which we could get in the next week, then you want to buy it. No middle-of-range trades in this kind of market, you’re either trading at one extreme or the other.

Q: Could you please explain how the Fed involvement in the overnight repo market affects the general market?

A: The overnight repo market intervention was a form of backdoor quantitative easing, and as we all know quantitative easing makes stocks go up hugely. So even though the Fed said this wasn't quantitative easing, they were in fact expanding their balance sheet to facilitate liquidity in the bond market because government borrowing has gotten so extreme that the public markets weren’t big enough to handle all the debt; that's why they stepped into the repo market. But the market said this is simply more QE and took stocks up 10% since they said it wasn't QE.

Q: What about Cisco Systems (CSCO)?

A: It’s probably a decent buy down here, very tempting. And it hasn't participated in the FANG rally, so yes, I would give that one a really hard look. The current dip on earnings is probably a good entry point.

Q: Should we buy the Volatility Index (VIX) on dips?

A: Yes. At bottoms would be better, like the $12 handle.

Q: When is the best time to exit Boeing?

A: In the next 15 minutes. They go ex-dividend tomorrow and if you get assigned on those short calls then you are liable for the dividend—that will eat up your whole profit on the trade.

Q: Do you like Fire Eye (FEYE)?

A: Yes. Hacking is one of the few permanent growth industries out there and there are only a half dozen listed companies that are cutting edge on security software.

Q: What are your thoughts on the timing of the next recession?

A: Clearly the recession has been pushed back a year by the 2019 round of QE, and stock prices are getting so high now that even the Fed has to be concerned. Moreover, economic growth is slowing. In fact, the economy has been growing at a substantially slower rate since Trump became president, and 100% of all the economic growth we have now is borrowed. If the government were running a balanced budget now, our growth would be zero. So, certainly QE has pushed off the recession—whether it's a one-year event or a 2-year event, we’ll see. The answer, however, is that it will come out of nowhere and hit you when you least expect it, as recessions tend to do.

Q: Would you buy gold (GLD) rather than staying in cash?

A: I would buy some gold here, and I would do deep in the money call spreads like I have been doing. I’ve been running the numbers every day waiting for a good entry point. We’re now at a sort of in between point here on call spreads because it’s 7 days to the next February expiration and about 27 days to the March one after that, so it's not a good entry point this week. Next week will look more interesting because you’ll start getting accelerated time decay for March working for you.

Q: When are you going to have lunch in Texas or Oklahoma?

A: Nothing planned currently. Because of my long-term energy views (USO), I have to bring a bodyguard whenever I visit these states. Or I hold the events at a Marine Corps Club, which is the same thing.

Q: Would you use the dip here to buy Lyft (LYFT)? It’s down 10%.

A: No, it’s a horrible business. It’s one of those companies masquerading as a tech stock but it isn’t. They’re dependent on ultra-low wages for the drivers who are essentially netting $5 an hour driving after they cover all their car costs. Moreover, treating them as part-time temporary workers has just been made illegal in California, so it’s very bad news for the stocks—stay away from (LYFT) and (UBER) too.

Q: Is the Fed going to cut interest rates based on the coronavirus?

A: No, interest rates are low enough—too low given the rising levels of the stock market. Even at the current rate, low-interest rates are creating a bubble which will come back to bite us one day.

Q: Household debt exceeded $14 trillion for the first time—is this a warning sign?

A: It is absolutely a warning sign because it means the consumer is closer to running out of money. Consumers make up 70% of the economy, so when 70% of the economy runs out of money, it leads to a certain recession. We saw it happen in ‘08 and we’ll see it happen again.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Mad Hedge Biotech & Healthcare Letter

February 13, 2020

Fiat Lux

Featured Trade:

(THE REDEMPTION OF BIOMARIN PHARMACEUTICAL)

(BMRN)

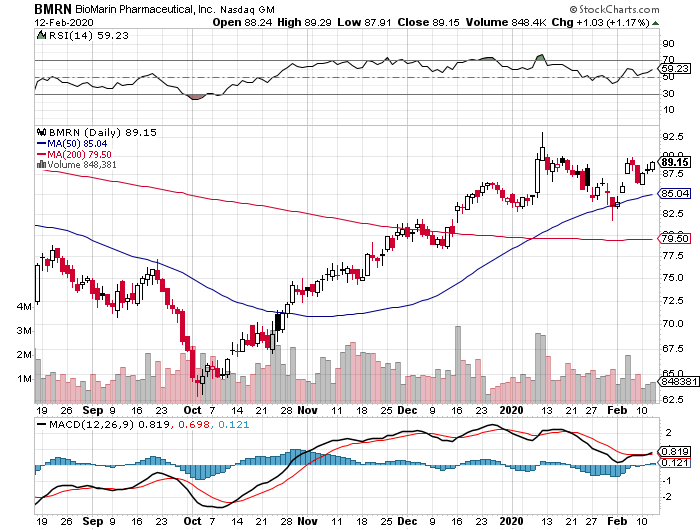

BioMarin Pharmaceutical (BMRN) has been in the doghouse in the past years, but the company is heralding 2020 as its redemption year.

This California-based biotechnology innovator has been watching its stock plummet since 2014, with the downward trend starting with BioMarin’s grand plan to find the cure for Duchenne muscular dystrophy.

This vision led to a $680 million gamble on an experimental treatment, Kydrisa. Even before the deal was finalized, however, industry experts opposed the idea like bats out of hell but BioMarin decided to go through with the ill-fated deal.

Unfortunately, the naysayers were proven right all along when the FDA rejected Kydria in 2016.

Four years after, BioMarin has come back swinging.

At the center of its redemption story are two high-value clinical assets: hemophilia gene therapy Valrox and dwarfism treatment Vosoritide.

Valrox is expected to become the most expensive drug in existence with a price tag somewhere between $2 million and $3 million. In comparison, Roche Holdings’ (RHHBY) own hemophilia A treatment, Hemlibra, costs roughly $500,000 annually.

If it receives the go-ahead from the FDA, BioMarin’s treatment will be the first-ever gene therapy available in the United States, with the company planning to target the most common types of hemophilia.

Based on the clinical trials, the patients exhibited significant improvements after the treatment. In fact, some patients had reported zero bleeding incidents for years following their first Valrox injection.

Hemophilia, which hinders a patient’s blood from clotting and causes nonstop bleeding, is known as one of the most expensive diseases to manage. At the moment, the average annual cost of hemophilia medications is $270,000 per patient. If approved, Valrox will actually be able to cut down the costs in the long run.

Barring any unforeseen roadblock, BioMarin’s hemophilia gene therapy will get the FDA green light by the third quarter of 2020.

Meanwhile, dwarfism treatment Vosoritide is now in Phase 3.

This drug is intended for children suffering from achondroplasia, which is the most widely known form of dwarfism and affects 1 in 25,000 infants. Basically, this condition is caused by an error in the patient’s gene that’s supposed to regulate bone growth, particularly in the arms and legs.

So far, BioMarin’s Vosoritide has induced faster bone growth in the patient’s bones compared to a placebo after a year of treatment.

The company plans to discuss the marketing strategy for Vosoritide in early 2021, which means the treatment will be launched in the same year.

Vosoritide is expected to rake in $700 million in peak sales.

If this also gains an FDA nod, Vosoritide will be the first-ever therapy focused on treating the underlying cause of this type of dwarfism.

In and of itself, Valrox is estimated to generate over $1.4 billion in peak sales. Vosoritide has the potential to achieve that level of blockbuster status as well simply because it will be the only approved therapy available in the market for this particular type of disease.

Taken together, both Valrox and Vosoritide have the capacity to more than double the annual revenue of BioMarin as early as 2024.

Given these expectations, the success of both drugs would catapult BioMarin to the top of the biotechnology industry and transform it into the most sought-after stock over the next decade.

So, although the company’s shares don’t exactly come cheap, this rare-disease biotech stock can still post substantial gains in 2020. After all, the primary force behind BioMarin’s growth this year is the company’s decision to create a pipeline focused on finding cures for rare, genetic conditions.

If you carefully think about it, BioMarin is actually undervalued when you consider the progress achieved by its direct competitors and the company’s near-term growth prospects.

Needless to say, BioMarin stock will be one of the red-hot commodities in a few short years.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.