While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

January 23, 2020

Fiat Lux

Featured Trade:

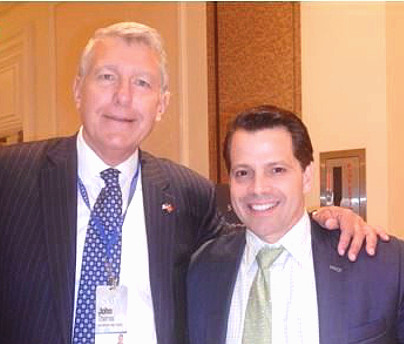

(AN AFTERNOON WITH ANTHONY SCARAMUCCI OF SKYBRIDGE),

(BRK/A), (EEM)

Mad Hedge Biotech & Healthcare Letter

January 23, 2020

Fiat Lux

Featured Trade:

(BIOGEN’S BIG ALZHEIMER’S BET),

(BIIB), (BMY), (PFE), (IONS), (MYL)

I asked Anthony Scaramucci, CEO and founder of Skybridge Capital, why we should attend his upcoming SALT conference point-blank.

“It’s going to be exciting,” he said.

“How exciting?” I enquired.

“I’ve invited former White House chief of staff General John F. Kelley to be my keynote speaker.” General Kelley, an old friend from my Marine Corps days, fired Anthony after only eight days on the job as Donald Trump’s Press Secretary.

“That’s pretty exciting,” I responded. “Humble too.”

This was the answer that convinced me to attend the May 7-10 SkyBridge Alternative asset management conference (SALT) at the Las Vegas Bellagio Hotel. You all know the Bellagio. That is the casino that was robbed in the iconic movie Oceans 11.

That is not all Scaramucci had to offer about the upcoming event, known to his friends since his college days as “The Mooch”.

Among the other headline, speakers are former UN ambassador Nikki Haley, AOL Time Warner founder Steve Case, artificial intelligence guru Dr. Kai-fu Lee who I have written about earlier, and Carlyle Group co-founder David Rubenstein.

SALT will give seasoned investors to update themselves on the hundreds of alternative investment strategies now in play in the market, raise or allocate money, meet fascinating people, and just plain have fun. Some SkyBridge services accept client investments as little as $25,000. Their end of conference party is legendary.

SkyBridge is led by Co-Managing Partners Anthony Scaramucci and Raymond Nolte. Ray serves as the Firm’s Chief Investment Officer and Chairman of the Portfolio Allocation and Manager Selection Committees. Anthony focuses on strategic planning and marketing efforts.

While I had “The Mooch” on the phone, I managed to get him to give me his 30,000-foot view of the seminal events affecting markets today.

The proliferation of exchange-traded funds and algorithms will end in tears. There are now more listed ETFs than listed stocks, over 3,500.

The normalizing of interest rates is unsustainable, which have been artificially low for ten years now. One rise too many and it will crash the market. The next quarter-point rise could be the stick that breaks the camel’s back (an appropriate metaphor for a desert investment conference).

However, rising rates are good for hedge funds as they present more trading opportunities and openings for relative outperformance, or “alpha.”

There has been a wholesale retreat of investment capital from the markets, at least $300 billion in recent years. The end result will be much higher volatility when markets fall as we all saw in the Q4 meltdown until this structural weakness has been obscured by ultra-low interest rates. The good news is that banks are now so overcapitalized that they will not be at risk during the next financial crisis.

Ever the contrarian and iconoclast, Scaramucci currently has no positions in technology stocks. He believes the sector has run too far too fast after its meteoric 2 ½ year outperformance and is overdue for a rest. Earnings need to catch up with prices and multiples.

What is Anthony’s favorite must-buy stock today? Berkshire Hathaway (BRK/A), run by Oracle of Omaha Warren Buffet, is almost a guarantee to outperform the market. Scaramucci has owned the shares in one form or another for over 25 years.

While emerging markets (EEM) are currently the flavor of the day, Anthony won’t touch them either. The accounting standards and lack of rule of law are way too lax for his own high investment standards.

SkyBridge is avoiding the 220 IPOs this year which could total $700 billion. Many of these are overhyped with unproven business models and inexperienced management. The $100 billion in cash they actually take out of the market won’t be enough to crash it.

SkyBridge Capital is a global alternative investment firm with $9.2 billion in assets under management or advisement (as of January 31, 2019). The firm offers hedge fund investing solutions that address a wide range of market participants from individual investors to large institutions.

SkyBridge takes a high-conviction approach to alpha generation expressed through a thematic and opportunistic investment style. The firm manages multi-strategy funds of hedge funds and customized separate account portfolios, and provides hedge fund advisory services. SkyBridge also produces a large annual conference in the U.S. and Asia known as the SkyBridge Alternatives Conference (SALT).

Finally, I asked Anthony, if he were king of the world what change would he make to the US today? “If I could wave a magic wand, I would reduce partisanship,” he replied. “It prevents us from being our best.” Will he ever go back into politics again? “Never say never,” he shot back wistfully.

With that, I promised to give him a hug the next time I see him in Vegas which I have been visiting myself since 1955 during the rat pack days.

To learn more about SkyBridge, please visit their website here.

To obtain details about the upcoming May 7-10 SALT conference at the Bellagio Hotel in Las Vegas, please click here. Better get a move on. Their discount pricing for the event ends on March 15. Institutional Investors are invited free of charge.

Biotech giant Biogen (BIIB) failed to impress in 2019. Surprisingly, the company is sticking to its strategy this 2020.

Despite the majority of biotech companies posting market-beating gains last year, Biogen’s shares suffered a 1.4% loss to their value. Taking a look at its performance, there are three obvious reasons why Biogen stock lost ground in 2019.

For one, its revenue generation, particularly for the multiple sclerosis portfolio, flatlined last year. Another reason is the company’s move not to acquire another company the way Bristol-Myers Squibb (BMY) took over Celgene.

Biogen’s decision to not make any major acquisition in 2019 was deemed as an inability to achieve significant business development milestones, thereby failing to positively influence the company’s near-term outlook.

The third reason is Biogen’s decision to halt trials for its widely anticipated Alzheimer’s drug candidate, Aducanumab, in March 2019.

With so much invested in the development of this product, the investing community expected Biogen to completely drop the project altogether.

However, it seems that Biogen has found a way to resolve the issues it initially encountered in the Aducanumab study.

In October 2019, the company announced its plan to resurrect all its Aducanumab-related efforts. To show its commitment to the plan, Biogen kicked off 2020 with a massive purchase from Pfizer (PFE).

Since Biogen aims to apply for regulatory approval by early 2020, the company has been aggressively pursuing avenues to ensure that its Alzheimer’s drug candidate will get the green light as soon as possible.

One of its efforts is its $700 million deal to buy Pfizer’s castoff drug, PF-05251749.

The Pfizer drug was created to treat Irregular Sleep-Wake Rhythm Disorder suffered by Alzheimer’s and Parkinson’s disease patients. This condition, also known as Sundowning, affects 20% of those afflicted by these neurological diseases.

According to the terms of the deal, Biogen will shell out $75 million upfront to gain the rights to the Pfizer drug.

The company will also pay an additional $635 million in the form of milestone payments. Pfizer will receive tiered royalties as well.

On top of this $700 million deal with Pfizer, Biogen also added another $45 million to fund its Alzheimer’s research with Ionis Pharmaceuticals (IONS). Apart from these, the two companies have been working on ION859, which is a possible treatment for Parkinson’s disease.

As if all of these are not enough to show Biogen’s dedication to finding the cure for Alzheimer’s disease, the company has a similar drug in its pipeline: BAN2401. This new drug, which uses a similar approach to Aducanumab, is actually already in its late-stage testing phase.

However, Biogen’s deal with Pfizer is not the first of its kind.

Prior to this, the company paid a whopping $300 million upfront to Bristol-Myers Squibb to own the rights to neurological drug Gosuranemab. Unfortunately, that study failed to deliver the desired results.

Even though Biogen has yet to actually file for regulatory approval for Aducanumab, the company is already preparing for the treatment’s launch this year. This is a rather confident move especially in light of the niggling doubts on the drug’s approval.

Apart from working on Aducanumab, Biogen has been testing for a higher dosage for spinal muscular atrophy medication Spinranza. This is done as a precautionary measure against Novartis’ (NVS) blockbuster gene therapy Zolgensma.

Its exclusive rights on Tecfidera, which has been challenged by Mylan (MYL), is also anticipated to hold until 2028. This means Biogen can still expect to reign supreme in this niche, hanging on to its blockbuster drug that raked in $4.3 billion in 2018 alone and $2.15 billion in the first half of 2019.

In addition to Alzheimer’s and Parkinson’s disease, Biogen is active in searching for treatments for Lou Gehrig’s disease along with stroke and choroideremia as well.

Biogen has also set in motion its plan to venture into rare eye diseases via its $800 million acquisition of Nighstar Therapeutics back in June 2019.

Notably, though, Biogen has been steering away from any major acquisition in 2020.

This strategy could be a stroke of genius if the company’s bet on Aducanumab pays off.

Today, I would like to make a suggestion on a debit spread. The stock is Docusign, Inc. (DOCU).

DOCU is trading at $74.72 as I write this.

I am going to suggest a trade using the February monthly options. DOCU does not have weeklies, and the February monthlies will allow enough time to see if the stock continues to run.

My suggestion today is this:

Buy to Open February 21st - $75.00 call @ $2.45

Sell to Open February 21st - $80.00 call @ $0.70

Net debit is $1.75 per spread with a maximum gain of $3.25 per spread if DOCU trades above $80.00 by February 21st.

Based on the nominal portfolio, limit the trade to 5 spreads or 0.8% of the portfolio.

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to a six-month time frame, Mad Day Trader, provided by Bill Davis, will exploit money-making opportunities over a brief ten minute to three-day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

January 22, 2020

Fiat Lux

Featured Trade:

(LAST CHANCE TO ATTEND THE TUESDAY, FEBRUARY 4 SYDNEY, AUSTRALIA STRATEGY LUNCHEON)

(WHY THERE’S ANOTHER DOUBLE IN CRISPR THERAPEUTICS)

(CRSP), (BLUE), (EDIT), (NVS), (GILD)

Come join me for lunch at the Mad Hedge Fund Trader’s Global Strategy Update, which I will be conducting in Sydney Australia at 12:30 PM on Tuesday, February 4, 2020.

An excellent meal will be followed by a wide-ranging discussion and an extended question-and-answer period.

I’ll be giving you my up-to-date view on stocks, bonds, currencies, commodities, precious metals, energy, and real estate.

And to keep you in suspense, I’ll be throwing a few surprises out there too.

Tickets are available for $233.

The lunch will be held at an exclusive downtown hotel the details of which will be emailed with your purchase confirmation.

I look forward to meeting you and thank you for supporting my research. To purchase tickets for this luncheon, please click here.

Mad Hedge Technology Letter

January 22, 2020

Fiat Lux

Featured Trade:

(THE HOLLOW VICTORY FOR TECH IN THE CHINA TRADE DEAL)

(MSFT), (AMZN), (HUAWEI)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.