That was a great lead into Halloween last week, where frightening share price movements scared the living daylights out of all of us. The Dow Average dove by 7.0% last week and is down 8.9% from the September 1 peak. It was the worst performance in seven months.

Of course, I saw it all coming a mile off, predicting a selloff going into the November 3 presidential election and a rally once the great uncertainty is removed. That’s why I have run several short positions over the past month, all of which proved successful, and am long flipping to the long side.

The next generational peak at 120,000 is now only 93,499 points away. Time to get moving.

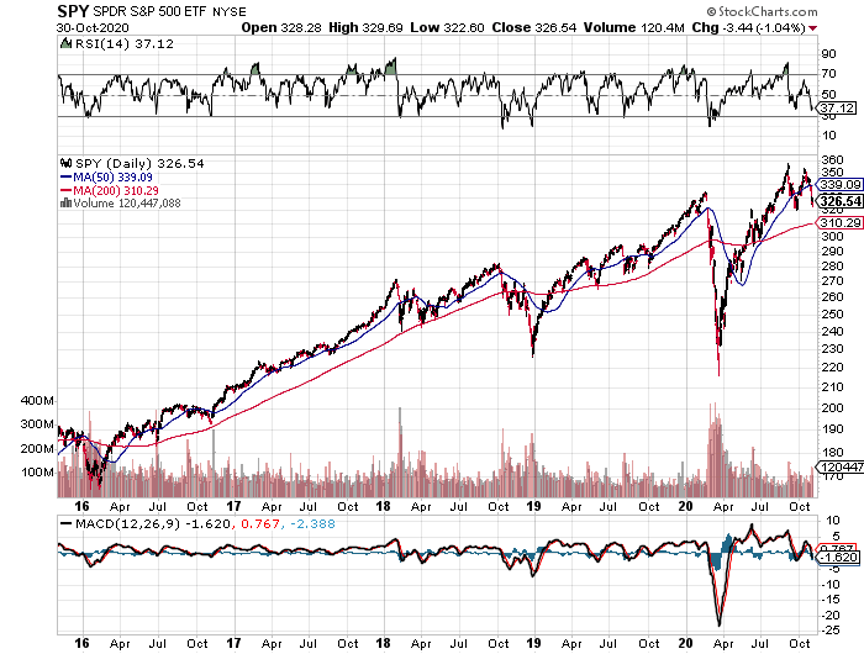

Of course, technical analysts who were eternally bullish at the market top are now wringing their hands over the double top on the charts that even a two-year-old can spot. It’s only giving us a better entry point for longs that will carry us through to yearend.

The stock market has priced in a contested election. If that doesn’t happen, and the winning candidate takes the White House by a landslide, markets will have to immediately back out that dire scenario. Stocks could soar by 1,000 points immediately on the first whiff of a challenge0-proof victory margin.

This time, we have the luxury of trading against a line in the sand at a (SPY) of $310, the 200-day moving average. Look at the chart below and you’ll see that this was not only close to the highs in 2018 and 2019 and a recent bottom in 2020. As if driven by the force of gravity, the market seems strangely driven to the $310 level.

It’s almost impossible to lose money on call spreads bought at market bottoms when the Volatility Index (VIX) is over 40%, as it was on Thursday and Friday. It’s time to strike while the iron is hot, and other investors are jumping off of bridges.

I’ll be piling into domestic recovery stocks like banks, construction, couriers, railroads, and gold and selling short bonds and the US dollar.

The election has already taken place, as 85 million votes have been cast in early voting. Many states have already seen double their 2016 turnouts. We just don’t know the outcome yet. It’s likely that new Covid-19 infections could top 100,000 on election day.

I’ll be up all night on Tuesday watching the results come in and keeping a hawk-eye on the overnight futures trading in Asia, the only open markets. Watch for Florida and North Carolina to report first.

One of the great ironies of trading last week was that after delivering the best earnings performance in stock market history, we saw one of the worst share price performances.

That’s because all of the great stimulants for the economy in recent months, the prospect of a massive stimulus package, declining Covid-19 cases, and plunging interest rates, will take a three-month vacation while the United States changes governments.

We really do work in a “what have you done for me lately” industry.

It was all about tech earnings last week, with Amazon (AMZN), Alphabet (GOOGL), and Microsoft all reporting. We have to wait until next week for Apple (AAPL). They all knocked the cover off the ball. Only Apple (AAPL) disappointed on a 20% YOY sales drop.

It seems everyone was waiting for the iPhone 12. Stock was off $10. Sales in China also took a big hit. Expect a massive resurgence in Q4. iPhones are selling faster than Apple can make them. Buy (AAPL) on dips. The stock jumps 8%. Forget about the DOJ antitrust suit. Buy (GOOGL) on dips.

Crashing bond prices show that a recovery is imminent, with ten-year US Treasury yields ($TNX) jumping 20 basis points in a month to a four-month high. Buy (SPY) on dips and sell short (TLT) on rallies.

Existing Home Sales soared by 9.4% in September, up a staggering 20% YOY. Inventories fell to a record low 2.7 months. Median prices are up an astounding 14.8% YOY to $311,800. Zillow believes this madness will continue for at least another year. Sales were strongest in the Northeast, with most of the action in single-family homes. Homes over $1 million have doubled, and vacation homes are up 35%.

Q3 GDP exploded with a 33.1% rate, double the highest on record and in line with expectations. All cylinders are firing, except for the 20% of the economy that went bankrupt during the pandemic. The stock market fully discounted this on September 1 when stocks peaked. The US won’t recover its 2019 GDP until 2023. With Corona cases now soaring, are we about to go back into the penalty box?

Weekly Jobless Claims posted at 751,000, an improvement, but still near a record high. It’s the lowest report since pre-pandemic March 14. I think a lot of these losses are structural….and permanent.

The World’s Biggest ETF is bleeding funds, with the (SPY) losing $33 billion this year. Massive selling at market tops has been a major factor. Most of the selling was in February and March when the pandemic started, and the money never came back. It also belies the widespread shift into tech stocks this year. Out with the boring, in with the exciting. Dry powder for the coming Roaring Twenties?

When we come out the other side of the pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

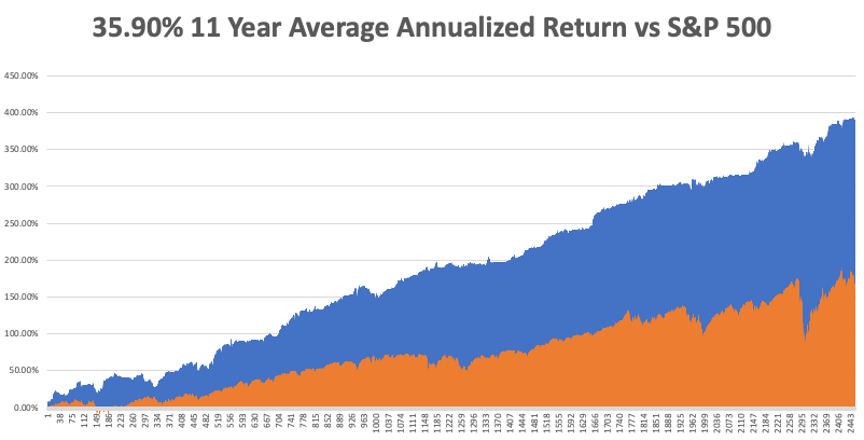

My Global Trading Dispatch hit another new all-time high last week. October closed out at a moderate 1.51% profit.

I took a big hit on a long in Visa (V), thanks to a surprise prosecution from the Department of Justice over their Plaid merger. I more than offset that with short positions in the (SPY) and (JPM). Then on Friday, I leaned into the close, picking up new longs in the (SPY), (TSLA), and (CAT) betting on a post-election rally.

That keeps our 2020 year-to-date performance at a blistering +36.03%, versus a LOSS of -7.5% for the Dow Average. That takes my 11-year average annualized performance back to +35.90%. My 11-year total return stood at a new all-time high at +391.94%. My trailing one-year return appreciated to +42.48%.

The coming week will be one of the most exciting in history as election results trickly out Tuesday night. As if we didn’t have enough to worry about, it is also jobs week. We also need to keep an eye on the number of US Coronavirus cases and deaths, now over 9 million and 232,000, which you can find here.

On Monday, November 2 at 8:00 PM EST, US Vehicle Sales for October are released. Alibaba (BABA) and Sanofi (SNY) report earnings.

On Tuesday, November 3, we get the US Presidential Election. Early results in Florida will start coming out at 7:30 PM EST. TV networks, makers of campaign tchotchke and bumper stickers, and talking heads will go into mourning. Coca-Cola (K) reports earnings.

On Wednesday, November 4 at 9:15 AM EST, the ADP Private Employment Report is out. QUALCOMM (QCOM) and Wynn Resorts (WYNN) report earnings.

On Thursday, November 5 at 8:30 AM EST, the Weekly Jobless Claims are announced.

On Friday, November 6 at 8:30 AM EST, the October Nonfarm Payroll Report is announced. Barrick Gold (GOLD) reports earnings. At 2:00 PM we learn the Baker-Hughes Rig Count.

As for me, I went to San Francisco for dinner with an old friend last night and I couldn’t believe what I saw. Storefronts were boarded up, the streets vacant, with only the homeless ever present. The cable cars have quit running.

We ate outside at my favorite Italian restaurant Perbacco on Market Street where the heat lamp blasted away. The restaurant is owned by my transplanted Venetian friend Umberto Gibin. He was running it at 50% capacity with 25% of the staff just to break even.

I hope he makes it.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader