Global Market Comments

January 20, 2021

Fiat LuxFeatured Trade:

(I HAVE AN OPENING FOR THE MAD HEDGE FUND TRADER CONCIERGE SERVICE),

(SOME SAGE ADVICE ON ASSET ALLOCATION)

Mad Hedge Biotech & Healthcare Letter

January 19, 2021

Fiat Lux

FEATURED TRADE:

(CAN NOVAVAX EXTEND ITS WINNING STREAK?)

(NVAX), (MRNA), (PFE), (AZN), (BNTX), (BTC)

Would you believe that there was a bigger winner than Bitcoin (BTC) in 2020?

Amid the fanfare generated by COVID-19 vaccine developers like Moderna (MRNA) and Pfizer (PFE), there’s one biotechnology company that has quietly boosted its humble $4 share price to an impressive $128: Novavax (NVAX).

As incredible as that sounds, this isn’t the most unbelievable prediction for Novavax.

Despite recording a jaw-dropping 2,600% increase last year, this Maryland-based biotechnology company is projected to sustain the momentum in 2021 and beyond.

Let me share how Novavax can achieve a long-lasting winning streak.

Unlike Moderna and Pfizer, Novavax did not utilize RNA technology to develop NVX-CoV2373. Instead, the company opted for a more established approach.

The decision to pursue a more established technology could be viewed as a cost-cutting strategy for Novavax.

Doing so means dramatically lowering supply chain pressures, such as storage issues.

In effect, the Novavax vaccine would be the more convenient option that offers an equally potent result.

At this point, Novavax has yet to reveal its Phase 3 trial results. The tests, which involve trials in the UK, would prove to be the turning point for the company’s future.

Here’s a rough estimate of how the results could affect Novavax shares.

If the results show that NVX-CoV2373 is 90% effective, this would put the vaccine in the same league as Pfizer and Moderna. Consequently, shares will go up by 30% with this news.

Meanwhile, an efficacy result clocking in at less than 80% would have the stock falling by up to 20% primarily due to the strong competition in the COVID-19 market.

Approximately $40 billion in COVID-19 revenue is at stake this year.

While competitors Pfizer, Moderna, and AstraZeneca (AZN) have already had their vaccines approved for emergency use, Novavax still has a strong chance of getting a piece of the action.

Despite these candidates getting rolled out in other countries, Novavax’s NVAX-CoV2373 remains a heavy favorite among experts and analysts alike.

At this rate, NVX-CoV2373 could generate at least $4 billion of the $40 billion COVID-19 market in 2021.

Considering that Novavax has an $8 billion market capitalization, this alone more than justifies the company’s valuation.

Admittedly, Pfizer and Moderna hold the competitive advantage in being the first to market. It wouldn’t be surprising if both would end up gobbling up market share while Novavax awaits regulatory approval.

More importantly, both have achieved the coveted name recognition when it comes to COVID-19 vaccine so that could offer them power in the soon-to-be-crowded marketplace down the road.

However, both vaccine leaders have a considerable drawback.

Their vaccines require extremely delicate storage and transportation.

In fact, Pfizer and BioNTech’s (BNTX) BNT162b2 must be stored at minus 94 degrees—a requirement that not all countries, much less commercial distributors could adhere to.

This is where Novavax’s vaccine comes in.

NVX-CoV2373 can be stored and transported at refrigerated temperatures. This means it would be easier to distribute particularly in remote areas.

Any hiccups with storage or transportation involving the Moderna or Pfizer vaccines could offer Novavax an opening to generate vaccine sales that would otherwise no longer be available.

This scenario would translate to a more dominant presence of Novavax in the second half of 2021 until the early part of 2022.

Pfizer and Moderna may have been the first to market, but Novavax’s vaccine holds the potential to generate a sizable impact on sales over the long term.

In terms of revenue, the vaccine would be a significant boost for Novavax. It would transform from a zero product revenue to billions in a short period.

While Novavax has yet to announce the official pricing for the product, we can use its US price of $16 per dose as a benchmark for the rest of the contracts.

So far, Novavax has secured roughly orders for 300 million doses in the US alone. This would amount to $4.8 billion in sales—and all signs point to the number climbing higher this year.

Novavax has been ramping up its capacity to produce as many as 2 billion doses by mid-2021.

In comparison, Pfizer has a maximum capacity of 1.3 billion doses this year while Moderna would peak at 1 billion.

Evidently, Novavax holds an edge over the two companies in terms of capacity to fill orders.

Outside its COVID-19 efforts, Novavax has another potential blockbuster in its pipeline.

Although data is sparse, the company is expected to file for regulatory approval for its experimental flu vaccine called NanoFlu.

Oddly enough, NanoFlu was the reason that Novavax trounced the cryptocurrency surges in 2020.

Investors got all fired up following the promising showing of the flu vaccine candidate, with the stock gaining unprecedented attention when it reported remarkable results in a head-to-head study against the leading flu vaccine in the market today, Sanofi’s (SNY) FluZone Quadrivalent.

With all these in mind, Novavax’s earnings outlook is showing strong signs of even more stellar and stronger performance than that of Moderna this year.

So far, earnings per share for Novavax this year is estimated at $21 while Moderna’s is $10.

Another possible game-changer for Novavax is its plan to combine a flu-coronavirus vaccine to be marketed post-pandemic.

Before making any moves though, it’s important to invest in Novavax with all the facts out in the open.

Inasmuch as it’s a promising stock, this is still a risky investment. This means that only aggressive investors should consider buying this biotechnology stock.

In a number of ways, Novavax and Bitcoin share some similarities.

Both are speculative assets that could either skyrocket or sink. They’re extremely attractive to aggressive investors on the lookout for big wins but also unafraid of massive risks.

The main difference is that with Novavax, it’s simpler to understand the reason for its rise or fall.

The potential drivers for its success or failure appear to be less cryptic than those behind the cryptocurrency.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

January 19, 2021

Fiat LuxFeatured Trade:

(WHY THERE’S ANOTHER DOUBLE IN CRISPR THERAPEUTICS)

(CRSP), (BLUE), (EDIT), (NVS), (GILD)

Occasionally, I discover a piece of research from one of my other Mad Hedge publications that is so important that I send it out to everyone immediately.

Recently, a piece from the Mad Hedge Biotech & Healthcare Letter is one of the instances. It makes the case and provides the numbers as to why Biotech & Healthcare will be one of two dominant sectors to follow for the next decade. It also is a key plank in my argument for a return of a new Golden Age and a second “Roaring Twenties.”

Here it is.

Biotech investors, take note: 2019 was a great year for the industry, but the best is yet to come.

In the final three months of 2019, the biotech sector grew by 32% -- notably outpacing the pharmaceutical industry, which only recorded a 9.5% gain.

However, the biotechnology sector is estimated to grow substantially in 2021 and reach over $775 billion in revenue by 2024 as more and more treatments for previously incurable diseases get discovered.

Looking at all the progress in the biotechnology space, this could even be the year we’d finally discover the cure to many life-threatening and debilitating conditions like cancer and Alzheimer’s disease.

With all these technological advancements, two revolutionary tools have been overhauling the entire biotechnology and healthcare industry from the ground up: precision medicine and CRISPR. Actually, the impressive growth of the biotechnology industry has been largely attributed to the excitement generated by the gene-editing sector.

While the majority of companies concentrating on the human genome are still in the research phase, the growth of this industry is undeniable.

Here’s tangible proof.

Just 20 years ago, reading all the DNA of a single person cost approximately $3 billion. Now, this price is down to only $1,000. In the future, this number will go even lower at $100. There are now gigantic factories in China sequencing DNA for companies like Ancestry.com and 23andMe.

This is just one example of how the biotechnology industry has grown by leaps and bounds. It’s also the reason behind the surge of CRISPR shares.

In effect, the specialists in this niche, including Crispr Therapeutics (CRSP), Bluebird Bio (BLUE), and Editas Medicine (EDIT), are amplifying their efforts.

Among the specialist companies, CRISPR Therapeutics is considered as one of the frontrunners -- if not the top stock. This is because compared to its rivals, which are still in preclinical phases of development, CRISPR Therapeutics already has two drugs going through Phase 1 trials: CTX001 and CTX110.

The promising results of the company’s research resulted in a 113% rise in shares last year, with the bulk of the surge starting in October. In fact, CRISPR Therapeutics’ performance had been so impressive that its market cap reached $3.4 billion.

CTX001 is created to target patients suffering from genetic blood disorders, specifically sickle-cell disease and transfusion-dependent beta-thalassemia.

Meanwhile, CTX110 is a CAR-T treatment. The process involves the extraction of immune cells from the patient. These are then retrained and later re-introduced to the human body.

CRISPR Therapeutics’ CAR-T treatment is anticipated to be offered at a cheaper price compared to the other CAR-T therapies.

Both Novartis (NVS) and Gilead Sciences (GILD) are pursuing the same treatment. However, the cost of the therapy from the latter two is expected to reach as much as $475,000 for every patient annually.

Apart from CTX001 and CTX110, CRISPR Therapeutics has two more immunology candidates, currently dubbed CTX120 and CTX130.

If both phase trials succeed, these will bring massive home runs for CRISPR Therapeutics, especially since the cancer immunology market is expected to reach $127 billion by 2026. Over the next 10 years, this niche is estimated to reach $25 trillion in sales.

Among the gene-editing treatments under development today, CRISPR is projected to grow tenfold in the number of applications and potentially curing 89% of disease-causing genetic variations by 2026.

Taking this pace into consideration, the valuation for this market is expected to grow from $551 million in 2017 to reach roughly $3.1 billion by 2023 and $6 billion by 2025.

Meanwhile, precision medicine as a whole is estimated to show a significant jump from $48.6 billion in 2018 to $84.6 billion by 2024. In 2028, this market is expected to rake in $216 billion.

Hence, further success with CTX001 and CTX110 along with additional treatments in the drug pipeline would all but guarantee that Crispr Therapeutics could beat the market again in 2021.

To subscribe to the Mad Hedge Biotech & Healthcare Letter for a bargain $1,500 a year, please click here.

Global Market Comments

January 18, 2021

Fiat LuxFeatured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or WHAT WOULD KILL THIS MARKET?)

($INDU), (TLT), (TBT), (GLD), (GOLD), (WPM), (TESLA)

With the Dow Average now up 13,300 points, or 73.89%, since April, I’m getting besieged by questions from readers as to what could make the market go down. This is, after all, the sharpest move up in stocks in history.

With $20 trillion about to hit the US economy, $10 trillion in stimulus, $10 trillion in quantitative easing, and overnight interest rates remaining at zero for three years, there’s not much.

Still, even the most Teflon of bull markets eventually go down. Let’s explore the reasons why. I’m not intending to give you sleepless nights. But the best traders always believe that anything can happen to markets all the time.

1) The Pandemic Ends – If Covid-19 can take the market up 13,300 points in nine months, its disappearance may take it down. That’s because the all-clear on the disease may prompt investors to pull money out of stocks and put it in the real economy.

A lot of people are buying stocks because there is nothing else to do and you can execute trades in the safety of your own home without going outside. Still, this effect may be muted as there are at least 2 million fewer businesses today than before the pandemic.

2) Interest Rates Rise – The Fed has promised not to raise overnight rates for three years, or until the inflation rates top 2% for at least a year (it’s now 0.4%). That seems to give the most aggressive investors a green light for the foreseeable future.

However, the Fed has no control over long term rates, which are set by the bond market. Since January 1, the yield on the ten-year US Treasury bond has soared from 0.90% to an eye-popping $1.20%, and 1.50% is certainly within reach during the first half.

The markets could easily handle that. But if the ten-year yield jumps to 3.0%, which it could do in two years, stocks could suffer, especially if we are at much higher levels by then.

3) Stocks Go Down – A lot of new traders are buying stocks simply because they are going up, independent of the thought process. What if stocks go down? Scads of you are now promising to buy on the next 10% pullback. I guarantee you that when we ARE down 10%, the only thing on your mind will be selling. That’s the way it always works. Loss of upside momentum could easily turn into vicious downside momentum.

4) The Pandemic Gets a Lot Worse – The Teflon market (which was invented during the Manhattan Project to prevent the corrosion of the insides of steel pipes by uranium or plutonium) has matched rising share prices with increasing Corona deaths tic for tic since March. We are now at 4,000 deaths a day and many hospitals now have fleets of freezer trucks parked outside because they can’t bury the bodies fast enough.

Government health officials tell us the pandemic is peaking right now. What if they are wrong? What if in the coming months, deaths top 10,000 a day? That would definitely be worth a 10% correction, if not a 20% one.

Summary

It all sets up a continuing run for stocks that could last at least two years and take the Dow as high at 45,000, or up 50% from here.

Which leads me to a different subject.

What if I am wrong?

I know that many of you have invested in two-year call options (LEAPS, or long term equity participation securities) at the March-May bottom and are sitting on the biggest profits in your life. Lots of these are several thousand percent in the money and have turned into 10X leveraged long equity positions, essentially synthetic futures. As a result, you now have no downside protection whatsoever.

If you bought the 2022 $120-$130 call spread at $20, it is now worth $765, a gain of 38.25X, or 3,825%. You have essentially just won the lottery.

This is what you need to do right now: roll up your strikes.

I shall explain.

Let’s say that when Tesla was at $80 on a split-adjusted basis, I begged many of you to buy the 2022 $120-$130 call spread. Tesla shares then rose by a mind-boggling 1,006%.

Here’s what you do. Sell your 2022 $120-$130 call spread immediately. Lock in the profit. Then buy a 2023 $900-$950 call spread. If Tesla falls, it will be at a much slower rate than your existing position.

Long-dated out-of-the-money options fall at a much slower rate than stocks because they have immense time value. They demonstrate a downside “hockey stick” effect. Very roughly speaking and without doing any math, a 50% drop in the stock will deliver only a 25% drop in the options. However, if Tesla shares rise, you will still participate in the upside and get 95% of the gain.

It’s a classic “heads I win, tails you lose” set up.

This is what professional traders do automatically, without thinking about it as if it were second nature.

I just thought you’d like to know.

About Last Week

A second insurrection is in play for January 20 according to the FBI, with armed demonstrations planned in the capitols of all 50 states. Don’t plan on traveling that day. Public access to the capitol building has ceased for the foreseeable future. Washington is now an armed camp, with 25,000 National Guard called in. The FBI is attempting to arrest the ring leaders as fast as possible. Market will keep seeing this as a buying opportunity, the fires under the market are burning so hot.

The US budget deficit soared to $573 billion in Q4, up 61% YOY. For the full calendar year, the deficit reached a mind-boggling $3.3 trillion, triple the previous year. Almost all the increase went to spending on pandemic related benefits. It’s another nail in the coffin for the bond market. Keep selling the (TLT), even on small rallies. This could be the trade of the century.

The US has 3 million fewer jobs than when Trump took office four years ago. It’s the worst performance since Herbert Hoover took office in 1928. That’s exactly what I predicted back in 2016. Up to March 2020, we also had a zero return in the stock market under Trump, which only started to improve when Biden took the lead in the primaries in May. In the meantime, the National Debt soared from $20 trillion to $28 trillion and it is still soaring. Over 100% of US growth during the Trump administration has been borrowed from the future on credit. It’s not a way to run a country.

The semiconductor shortage is slowing the auto industry, with Toyota, Ford, and Fiat cutting back production. It’s a global problem. Modern cars use more than 100 chips each and are becoming more apps than hardware. I’ve been predicting this for a year, and the problem will continue as it takes billions of dollars and years to ramp up new production. Buy the daylights out of (NVDA), (AMD), and (MU).

Technology is 2% of US employment but 27% of market capitalization and 38% of profits, says my old friend Jeffrey Gundlach of Double Line. Bitcoin is a bubble, inflation will be 3% by June, and bonds (TLT) are beyond terrible. Stocks are expensive but could run for a long time.

Weekly Jobless Claims delivered a horrific print, up 181,000 to 965,000, the worst since the spring. Covid-19 is clearly the reason. Stocks could care less and pushed on to new all-time highs, up eight days in a row. It really is a “Look Through” market.

No rate hike until 2% inflation for a year, said Fed Governor Clarida. It could be a long wait as indicated by the recent 0.4% report.

US air travel is down 61% in November YOY, and that includes the big Thanksgiving travel bump. A trend up will start later this year, but airlines will still emerge from the pandemic with tons of debt. Avoid.

Netflix is launching a movie a day, for all of 2021. It’s disrupting legacy Hollywood at Internet speed, which Covid-19 has brought to a screeching halt. The stock has seen a sideways correction since tech peaked in sideways. Buy at the bottom end of the recent range.

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

My Mad Hedge Global Trading Dispatch shot out of the gate with an immediate 6.25% profit for the first ten trading days of the year. That is net of a 4% loss on a Tesla short which I added one day too soon. I went pedal to the metal immediately, again going 100% invested with a 50% long/50% short market-neutral portfolio.

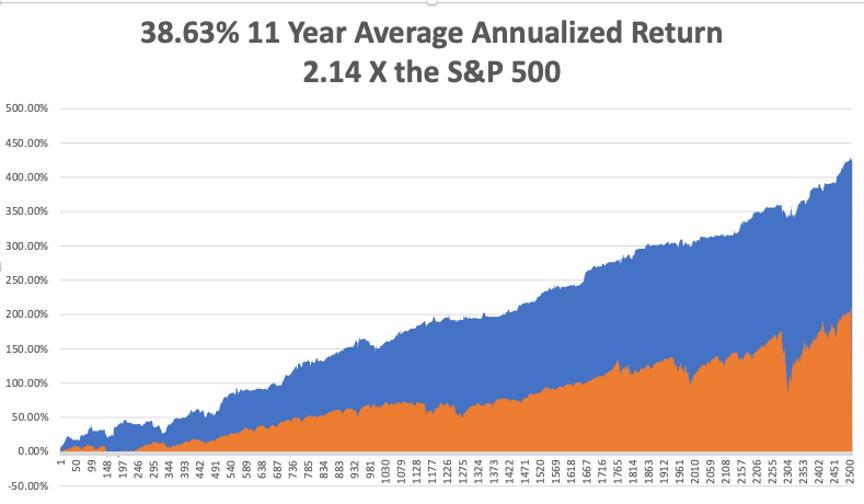

That brings my eleven-year total return to 428.80% double the S&P 500 over the same period. My 11-year average annualized return now stands at a nosebleed new high of 38.63%, a new high. My trailing one-year return exploded to 72.34%, the highest in the 13-year history of the Mad Hedge Fund Trader. We have earned 90% since the March low.

I did bail on my precious metals positions on (GOLD), (NEM), and (WPM) for small profits. The metals hate rising interest rates and competition from Bitcoin. They have effectively gone into a long bond, short Bitcoin position and I am not interested in either.

The coming week will be a slow one on the data front with Q4 earnings reports coming out daily.

We also need to keep an eye on the number of US Coronavirus cases at 24 million and deaths at 400,000, which you can find here. We are now running at a staggering 4,000 deaths a day.

When the market starts to focus on this, we may have a problem.

On Monday, January 18 at 11:00 AM EST, the US Markets will be closed for Martin Luther King Day.

On Tuesday, January 19 at 4:30 PM, Bank of America (BAC), Goldman Sachs (GS), and Netflix (NFLX) report.

On Wednesday, January 20 at 10:00 AM, we get the NAHB Housing Market Index. Morgan Stanley (MS) and Proctor and Gamble (PG) report.

On Thursday, January 21 at 8:30 AM, December Housing Starts are printed. Intel (INTC) and Union Pacific (UNP) report.

On Friday, January 22 at 10:00 AM, Existing Home Sales for December are out. Schlumberger (SLB) reports. At 2:00 PM, we learn the Baker-Hughes Rig Count.

As for me, I’m still waiting for orders on where to report for my Pfizer Covid-19 vaccination. In the meantime, since I will still be locked up for months to come, I have been viewing precious old pictures and videos from my past travel extravaganzas.

In 2019, I took my girls around the world via New Zealand, Sydney, Brisbane, Melbourne, Perth, Manila, New Delhi, Dubai, Cairo, Athens, Venice, Budapest, Brussels, Zermatt, and then back to San Francisco. We don’t do anything small in my family. Click here for the link to my favorite video of us arriving in Venice.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

“You don’t want to invest based on a political prism,” said Oracle of Omaha Warren Buffet.

Mad Hedge Technology Letter

January 15, 2021

Fiat Lux

Featured Trade:

(THE CHIP BONANZA)

(MU), (QCOM), (TSM)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.