Bitcoin (BTC) is going corporate and that is great for the digital currency and the stock market.

That is the big takeaway from Tesla (TSLA) investing $1.5 billion into the cryptocurrency and announcing that Tesla lovers will be able to buy the car with the digital gold.

Hard to believe that Bitcoin has come so far so fast, but with governments doing their best to cultivate fiscal distrust along with a pandemic driving the entire global business world to the internet, Bitcoin is well placed to reap the benefits just like digital cloud companies.

The big question is what is next for the computer gold?

This could open the floodgates for the likes of Apple, Microsoft, Facebook, Google, and Amazon to join the bitcoin party by making their own investments into the industry.

This could come in the form of just dipping their toe by holding bitcoin reserves or buying a fintech company that facilitates the operations of it.

Have you noticed that as of late, fintech companies like PayPal and Square have broken out to the upside representing a proxy of bitcoin exuberance?

No doubt some of the established tech titans are taking note of Elon Musk’s plunge into the digital unknown, but it does send the message the next leg up in tech development is via bitcoin and the synergies surrounding it.

Apple was the one that, out of thin air, brought us the iPod and iPhone which spawned a million copycats from China and a tsunami of capital that came along with it.

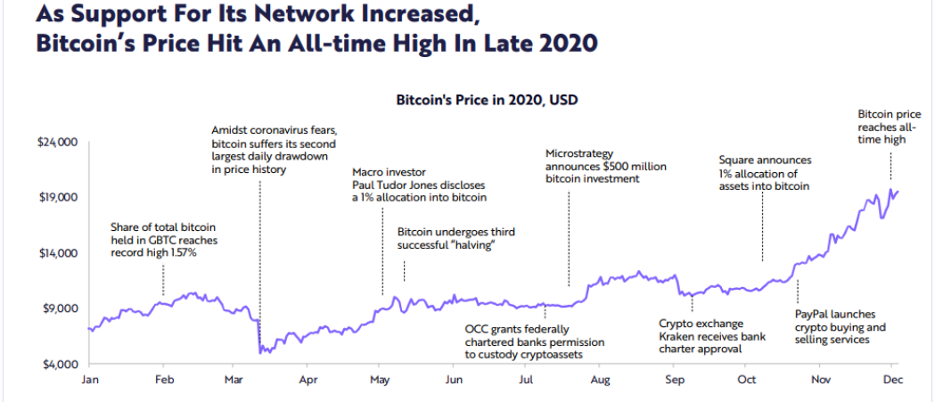

It’s undeniable that bitcoin is picking up traction with recent news in October 2020 that Square invested $50 million into Bitcoin.

That was about 1% of the company’s total assets at the end of Q2 2020.

That move came after the Cash app had offered the ability to buy Bitcoin for several years.

2020 also saw more traditional veteran investors like Stanley Druckenmiller and Paul Tudor Jones become Bitcoin promoters.

Long-term investment analysts have determined that today, bitcoin gives corporations a foothold into the future while operating in the real world.

Asset preservation is also another phenomenon where many insiders believe that the value of the dollar is in slow decline which could hurt U.S. corporation’s ability to compete globally.

Bitcoin bulls believe more institutional investments will lead to more stability and naturally, increased value and I agree that is exactly what is happening no matter if Warren Buffet and his sort go on air to proclaim the asset is snake oil.

It’s getting to the point where large companies cannot deny the potential upside to bitcoin because of fear of missing out.

They do not want to be the new Blackberry to the Apple’s iPhone.

Then is the brute fact that the aforementioned tech giants have the resources to take the jump.

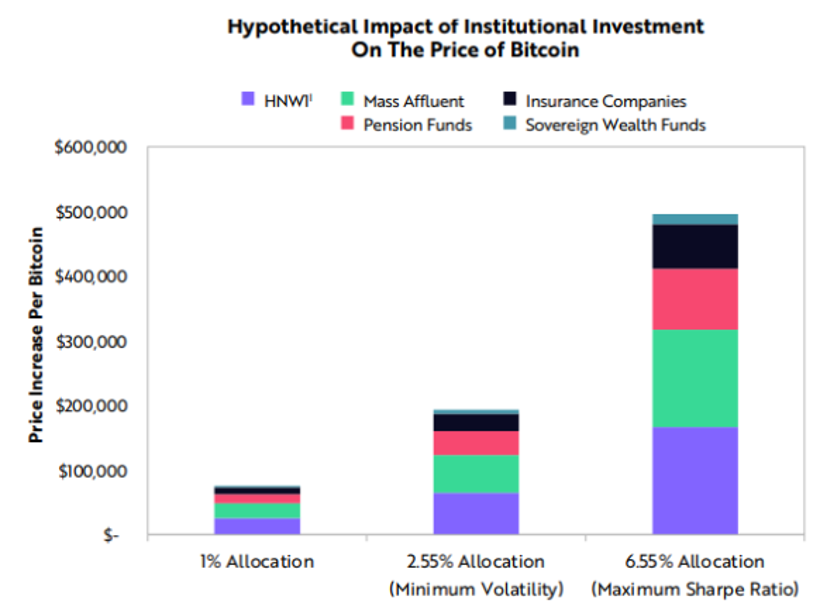

Ark Investments sees Bitcoin growing to $70,000 per coin if US companies put 1% into it, and $400,000 a coin if companies put 10% into the cryptocurrency.

If bitcoin finally becomes convertible globally, US companies will be tearing their hair out because they missed the chance to get in at a cheaper price.

What I just said would be absolutely bonkers in the financial world before the pandemic, but that shows how much the narrative has moved along and there are even more outlandish analysts who believe the likes of Apple and Amazon should move 50% of total assets into bitcoin.

Apple does have Apple Pay which they could integrate with the digital currency much like Square and PayPal have done.

If Tesla invested 1% of total assets into bitcoin and if a solid case nudging other companies to outdo this 1% and go to 2-3% comes to realization even if it’s a speculative bet on the future appreciation of the asset, it could be a moneymaker.

A company like Apple currently has $207 billion and so the pieces are on the board to make a bold move if they are willing to do so.

If we stand back and look at the bigger picture, US companies will undoubtedly lead the digital currency revolution for the next 25 years.

Europe is too regulated for their companies to jump in and Chinese authorities will stop companies like Alibaba hoping to operate in a currency that isn’t the Renminbi.

Like US companies created the cloud, internet, personal computer, and so on, they are on the cusp of making the bitcoin industry their own.

Another strong aspect I love is that Elon Musk clearly felt comfortable with the bitcoin’s foundational security, infrastructure and mechanisms in place in 2021 to facilitate this deal.

I am convinced that he had his best developers go into the meat and bones of the technology to find any structural flaws or lack of them.

Remember that bitcoin has been dogged by security breaches and hackers.

There is so much to love about this move and long term, bitcoin will hit $100,000.