Global Market Comments

May 27, 2021

Fiat Lux

Featured Trade:

(WHY AMAZON IS BEATING ALL), (AMZN)

Global Market Comments

May 27, 2021

Fiat Lux

Featured Trade:

(WHY AMAZON IS BEATING ALL), (AMZN)

I believe there is a good chance that this creation of Jeff Bezos will see its shares double over the next five years.

Amazon is, in effect, taking over the world.

Jeff Bezos, born Jeff Jorgensen, is the son of an itinerant alcoholic circus clown and a low-level secretary in Albuquerque, New Mexico. When he was three, his father abandoned the family. His mother remarried a Cuban refugee, Miguel Bezos, who eventually became a chemical engineer for Exxon.

I have known Jeff Bezos for so long he had hair when we first met in the 1980s. He was a quantitative researcher in the bond department at Morgan Stanley, and I was the head of international trading.

Bezos was then recruited by the cutting-edge quantitative hedge fund, D.E. Shaw, which was making fortunes at the time, but nobody knew how. When I heard in 1994 that he left his certain success there to start an online bookstore, I thought he’d suffered a nervous breakdown, common in our industry.

Bezos incorporated his company in Washington state later that year, initially calling it “Cadabra” and then “Relentess.com.” He finally chose “Amazon” as the first interesting word that appeared in the dictionary, suggesting a river of endless supply. When I learned that Bezos would call his start-up “Amazon,” I thought he’d gone completely nuts.

Bezos funded his start-up with a $300,000 investment from his parents who he promised stood a 75% chance of losing their entire investment. But then his parents had already spent a lifetime running Bezos through a series of programs for gifted children, so they had the necessary confidence.

It was a classic garage start-up with three employees based in scenic Bellevue, Washington. The hours were long with all of the initial effort going into programming the initial site. To save money, Bezos bought second-hand pine doors which he placed on sawhorses, which stood in for proper desks.

Bezos initially considered 20 different industries to disrupt, including CDs and computer software. He quickly concluded that books were the ripest for disruption, as they were cheap, globally traded, and offered millions of titles.

When Amazon.com was finally launched in 1995, the day was spent fixing software bugs on the site, and the night wrapping and shipping the 50 or so orders a day. Growth was hyperbolic from the get-go, with sales reaching $20,000 a week by the end of the second month.

An early problem was obtaining supplies of books when wholesalers refused to offer him credit or deliver books on time. Eventually, he would ask suppliers to keep a copy of every book in existence at their own expense, which could ship within 24 hours.

Venture capital rounds followed, eventually raising $200 million. Early participants all became billionaires, gaining returns or 10,000-fold or more, including his trusting parents. There is one guy out there who missed becoming a billionaire because he didn’t check his voicemail often enough, which invited him into the initial funding round.

Bezos put the money to work, launching into a hiring binge of epic proportions. “Send us your freaks,” Bezos told the recruiting agencies, looking for the tattooed and the heavily pierced who were willing to work in shipping late at night for low wages. Keeping costs rock bottom was always an essential part of the Amazon formula.

Bezos used his new capital to raid Wal-Mart (WMT) for its senior distribution staff, for which it was later sued.

Amazon rode on the coattails of the Dotcom Boom to go public on NASDAQ on May 15, 1997 at $18 a share. The shares quickly rocketed to an astonishing $105, and in 1999 Jeff Bezos became Time magazine’s “Man of the Year.”

Unfortunately, the company committed many of the mistakes common to inexperienced management with too much cash on their hands. It blew $200 million on acquisitions that, for the most part, failed. Those include such losers as Pets.com and Drugstore.com. But Bezos’s philosophy has always been to try everything and fail them quickly, thus enabling Amazon to evolve 100 times faster than any other.

Amazon went into the Dotcom crash with tons of money on its hands, thus enabling it to survive the long funding drought that followed. Thousands of other competitors failed. Amazon shares plunged to $5.

But the company kept on making money. Sales soared by 50% a month, eventually topping $1 billion by 2001. The media noticed Wall Street took note. The company moved from the garage to a warehouse to a decrepit office building in downtown Seattle.

Amazon moved beyond books to compact disc sales in 1999. Electronics and toys followed. At its New York toy announcement, Bezos realized that the company actually had no toys on hand. So, he ordered an employee to max out his credit card cleaning out the local Hammacher Schlemmer just to obtain some convincing props.

A pattern emerged. As Bezos entered a new industry, he originally offered to run the online commerce for the leading firm. This happened with Circuit City, Borders, and Toys “R” Us. The firms then offered to take over Amazon, but Bezos wasn’t selling.

In the end Amazon came to dominate every field it entered. Please note that all three of the abovementioned firms no longer exist, thanks to extreme price competition from Amazon.

Amazon had a great subsidy in the early years as it did not charge state sales tax. As of 2011, it only charged sales tax in five states. That game is now over, with Amazon now collecting sales taxes in all 45 states that have them.

Amazon Web Services originally started out to manage the firm’s own website. It has since grown into a major profit center, with $17.4 billion in net revenues in 2017. Full disclosure: Mad Hedge Fund Trader is a customer.

Amazon entered the hardware business with the launch of its e-reader Kindle in 2007, which sold $5 billion worth in its first year. The Amazon Echo smart speaker followed in 2015 and boasts 71.9% market share. This is despite news stories that it records family conversations and randomly laughs.

Amazon Studios started in 2010, run by a former Disney executive, pumping out a series of high-grade film productions. In 2017 it became the first streaming studio to win an Oscar with Manchester by the Sea with Jeff Bezos visibly in the audience at the Hollywood awards ceremony.

Its acquisitions policy also became much more astute, picking up audiobook company Audible.com, shoe seller Zappos, Whole Foods, and most recently PillPack. Since its inception, Amazon has purchased more than 86 outside companies. Make that 89 with MGM Entertainment.

Sometimes, Amazon’s acquisition tactics are so predatory they would make John D. Rockefeller blush. It decided to get into the discount diaper business in 2010, and offered to buy Diapers.com, which was doing business under the name of “Quidsi.” The company refused, so Amazon began offering its own diapers for sale 30% cheaper for a loss. Diapers.com was driven to the wall and caved, selling out for $545 million. Diaper prices then popped back up to their original level.

Welcome to online commerce.

At the end of 2018, Amazon boasted some 306,000 employees worldwide. In fact, it has been the largest single job creator in the United States for the past decade. Also, this year it disclosed the number of Amazon Prime members at 100 million, then raised the price from $80 to $100, thus creating an instant $2 billion in profit.

The company’s ability to instantly create profit like this is breathtaking. And this will make you cry. In 2016, Amazon made $2.4 billion from Amazon gift cards left unredeemed!

In Q1 of 2021, Amazon revenues totaled an unbelievable $108.5 billion, up 44% YOY. Both operating profits of $8.1 billion and operating margins of 8.2% set new records. It is currently capturing about 50% of all new online sales. Clearly, it was a huge pandemic winner.

So, what’s on the menu for Amazon? There is a lot of new ground to pioneer.

1) Health Care is the big one, accounting for $3 trillion, or 17% of U.S. GDP, but where Amazon has just scratched the surface. Its recent $1 billion purchase of PillPack signals a new focus on the area. Who knows? The hyper-competition Bezos always brings to a new market would solve the American health care crisis, which is largely cost-driven. Bezos can oust middlemen like no one else.

2) Food is the great untouched market for online commerce, which accounts for 20% of total U.S. retail spending, but sees only 2% take place online. Essentially this is a distribution problem, and you have to accomplish this within the prevailing subterranean 1% profit margins in the industry. Books don’t need to be frozen or shipped fresh. Wal-Mart (WMT) will be target No. 1, which currently gets 56% of its sales from groceries. Amazon took a leap up the learnings curve with its $13.7 billion purchase of Whole Foods (WFC) in 2017. What will follow will be interesting.

3) Banking is another ripe area for “Amazonification,” where excessive fees are rampant. It would be easy for the company to accelerate the process through buying a major bank that already had licenses in all 50 states. Amazon is already working the credit card angle.

4) Overnight Delivery is a natural, as Amazon is already the largest shipper in the U.S., sending out more than 1 million packages a day. The company has a nascent effort here, already acquiring several aircraft to cover its most heavily trafficked routes. Expect FedEx (FDX), UPS (UPS), DHL, and the United States Post Office to get severely disrupted.

5) Clothing-Amazon has already surpassed Wal-Mart this year as the largest clothing retailer. The company has already launched 76 private labels, with half of them in the fashion area, such as Clifton Heritage (color and printed shirts), Buttoned Down (100% cotton shirts), and Goodthreads (casual shirts) as well as subscription services for all of the above.

6) Furniture is currently the fastest-growing category at Amazon. Customers can use an Amazon tool to design virtual rooms to see where new items and colors will fit best.

7) Event Ticketing firms like StubHub and Ticketmaster are among the most despised companies in the U.S., so they are great disruption candidates. Amazon has already started in the U.K., and a takeover of one of the above would ease its entry into the U.S.

If only SOME of these new business ventures succeed, they have the potential to DOUBLE Amazon’s shares from current levels, taking its market capitalization up to $3.2 trillion. Perhaps this explains why institutional investors continue to pour into the shares, despite being up a torrid 134% from the February lows.

Whatever happened to Bezos’s real father, Ted Jorgensen? He was discovered by an enterprising journalist in 2012 running a bicycle shop in Glendale, Arizona. He had long ago sobered up and remarried. He had no idea who Jeff Bezos was. Ted Jorgensen died in 2015. Bezos never took the time to meet him. Too busy running Amazon, I guess. Worth over $200 billion, Bezos is now the second richest man in the world after Elon Musk.

Mad Hedge Technology Letter

May 26, 2021

Fiat Lux

Featured Trade:

(SHOULD READERS DIP BACK INTO AIRBNB AT $135?)

(ABNB)

Airbnb (ABNB) was disproportionately affected by the public health crisis because tech firm relies on travelers booking accommodation on their platform which they pocket a substantial commission.

To learn they only lost revenue of 22% over the past year was quite extraordinary because it could have been worse.

Looking forward, this is an intriguing stock that is trading around $135 today which is a more reasonable valuation from the $220 it was trading at after its direct listing.

I am net positive on Airbnb because the business is dramatically improving with the rollout of vaccines and the easing of some travel restrictions.

While conditions aren’t back to what they were, they are improving.

People's desire to travel combined with tightly managed expenses drove a return to positive top-line growth and materially improved adjusted EBITDA last quarter when Airbnb did quarterly revenue of $887 million.

It was an increase of 5% year over year, and it exceeded Q1 2019 levels as well.

Their business improved without the recovery of two of the strongest historical segments: urban travel and cross-border travel.

They expect the return of urban and cross-border travel to be significant tailwinds over the coming quarters.

What are some of the new trends from the travel data?

Travelers are visiting smaller cities, towns, and rural communities. And when people do travel, they’re staying longer. 24% of nights booked in Q1 were for stays of 28 nights or longer. People are not just traveling in Airbnb, they’re now living on Airbnb.

In New York City, in Los Angeles, they had almost as many nights booked for stays longer than 28 days as they had stays under 28 days.

Why do I see sustained health in this business?

Listing growth has stayed strong with more than 5.6 million listings which is more than 1 million more than they had this time in 2019.

The growth is in nonurban listings.

Their host churn in Q1 is actually lower than host churn in the same period in 2019.

The 30% growth in nonurban and vacation rental listings is a harbinger for growth to come and shows that Airbnb was able to build out more capacity for the future travel mania once borders open up.

One interesting thing to note is that business travel appears to be never coming back because many employees are working remotely. They're going to need to go back to headquarters occasionally. You're going to see longer stays going in cities and accessing offices in a hybrid sort of way.

But the bigger trend is going to be flexibility. I think that most of us working around the world if we are privileged enough to say this, are more flexible than we were before the pandemic. Because the world of Zoom means a world where we can work anywhere, it is a world where many people are also choosing to live anywhere.

As hosts begin to ramp up for the summer travel season, Airbnb is seeing Average Daily Rates (ADRs) in Q1 up 35% year over year. That was after being up 13% year over year in Q4. But the year-on-year comparable data were up against March 2020 that had a catastrophic performance.

Right now, 80% of nights booked in Q1 were domestic, and with domestic travel being consistent is now the main strength all around the world.

The rebound has been drastically earlier in the U.S., which has a higher average daily rate.

The incremental growth is in the non-urban single-family home and even larger homes, and those are just, on average, a higher ADR because bigger homes go for higher prices.

The problem I have is that the business model has changed away for this cash cow of cross-border travel where it used to be 50% of total nights were cross-border nights.

International travelers are usually willing to pay a premium when they go to different countries compared to domestic travelers who understand the local pricing better.

If net cross-border nights don’t come back to pre-2020 numbers, and I don’t think they would completely, it’s clearly a net negative for the company.

Management has kept saying, “Our model is inherently adaptable”, yet what is the game plan if the blur between work and life corresponds to more 6-month and 1-year leases signed which would cut out the need for Airbnb?

Is Airbnb so adaptable they can slug it out in the property management business?

Management kept saying that trends are a “little hard to pinpoint” but it's clear that if these 28 days or more stayers get more comfortable with a location and start dabbling more with long-term leases or even long-term property ownership, or might I even say, for the elite to purchase multiple vacation homes, then the use case for using Airbnb is minimized greatly.

What I understood from this public health crisis is that consumers have become a great deal savvier in how they allocate money to housing and that means vacation housing too along with what they demand and expect from it.

This new machination inherently means that servicers and listings will need to increase the quality of their listings since workers who work from home will be living in the home more and not just drop their bags upon entrance and go to the beach for a day or 2.

Many listings have incomplete kitchen equipment and the lowest option internet and other ugly shortcuts.

Yes, I do believe there will be a revision to the mean via the “tailwind to urban travel and cross-border” but that mean has a lower ceiling than before 2020 which will cap the underlying shares’ potential appreciation.

I also believe that non-urban, suburban homes won’t be able to meet capacity for the U.S. demand because of HOA rules and stringent enforcement of them. Just read about the Lake Tahoe ordinances to get a little flavor about how difficult it is to put Airbnb places where they don’t fit naturally. It’s easier to get away with it in big cities when entire buildings and even blocks are Airbnb investment properties, but not in suburbia.

Travel will come back hardcore and even 8% of Google search today is travel-related.

I do believe Airbnb is a good stock to buy right now, but the world has forever changed, and their business model has been damaged by it.

I’ll go for the low-hanging fruit now in Airbnb, but their growth story has been in fact pulled backwards instead of forward, and that wasn’t supposed to happen to “tech” companies.

That being said, they are good for a short-term trade today, but I would have said it was a buy-and-hold before the pandemic.

Enjoy this recovery story but remember to take profits when momentum fizzles out.

“The Internet is so big, so powerful and pointless that for some people, it is a complete substitute for life.” - Said English Journalist Andrew Brown

Global Market Comments

May 26, 2021

Fiat Lux

Featured Trade:

(STORAGE WARS)

(CSCO), (IBM), (SWCH), (MSFT)

No, this piece is not about the reality TV show that has a gruff lot of hopeful entrepreneurs blindly bidding for the contents of abandoned storage lockers.

With hyper-accelerating technology creating data at an exponential rate, it is getting far too big to physically store.

In 2018, over $80 billion was spent on data centers across the country, often in the remotest areas imaginable. Bend, OR, rural West Virginia, or dusty, sun-baked Sparks, NV, yes, they’re all there.

And you know what the biggest headache for the management of many tech companies is today? A severe shortage of cost-effective data storage and the skyrocketing electric power bills to power them.

During my lifetime, storage has evolved from one-inch magnetic tape on huge reels to highly unreliable 5 ¼ inch floppy disks, then 3-inch discs, and later to compact discs.

The solid-state storage on silicon chips that hit the market six years ago was a dream, as it was cheap, highly portable, and lightning-fast. Boot up time shrank from minutes to seconds. The only problem was the heat and sitting on it when you forgot those ultra-slim designs on the sofa.

Moore’s Law, which has storage doubling every 18 months while the cost halves, has proved faithful to the bitter end. The problem now is, the end is near, as the size of an electron becoming too big to pass through a gate increasingly a limiting factor.

As of 2017, the world needed 44 gigabytes of storage per day. According to the International Data Corporation, that figure will explode to 460 billion gigabytes by 2025, in a mere seven years.

That’s when the global data sphere will reach 160 trillion gigabytes, or 160 zettabytes. It all sounds like something out of an Isaac Asimov science fiction novel.

You can double that figure again when Google’s Project Loon brings the planet’s 5 million residents currently missing from the Internet online.

In the meantime, companies are making fortunes on the build-out. Some $50 billion has to be spent this year just to keep even with burgeoning storage demand.

And guess what? Thanks to rocketing demand from electric cars and AI, memory-grade silicon is expected to run out by 2040.

All I can say is “Better pray for DNA.”

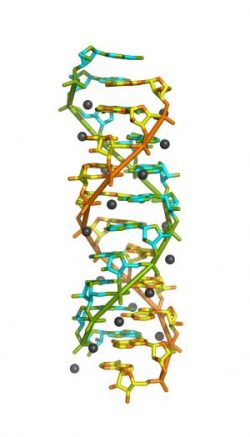

Deoxyribonucleic acid has long been the Holy Grail for data storage. There is no reason why it shouldn’t work. After all, you and I are the product of the most dynamic data storage system known to man.

All of the information needed to replicate ourselves is found in 3 trillion base pairs occupying every single cell in the human body.

To give you some idea of the immense scalability of DNA, consider this. One exabyte of data storage using convention silicon would weigh 320 metric tonnes. The same amount of information in DNA would occupy five cubic centimeters weighing five grams, or 0.18 ounce!

And here is the big advantage of DNA. Conventional silicon permits only two programming choices, “0” or “1”. Even with just that, we have been able to achieve incredible gains in computing over the last 50 years.

DNA is made of four different bases, adenine, cytosine, guanine, and thymine, which allow four squared possible combinations, or 16. The power demands are immeasurably small and it runs cool.

Also known as NAM, or nucleic acid memory, it has already burst out of the realm of science fiction. Microsoft Research (MSFT), the University of Washington, and (IBM) have all gotten it to work on a limited basis.

So far, retrieval is the biggest problem, something we ourselves do trillions of time a day every day without thinking about it.

DNA is organic, requires no silicon, and can replicate itself into infinity at zero cost. The information can last tens of thousands of years. Indeed, scientists were recently able to reconstruct the DNA from Neanderthals who lived in caves in Spain 27,000 years ago.

Yes, you can now clone your own Neanderthal. Gardening work maybe? Low-waged assembly line workers? Soldiers? Traders? I think I already know some. Look for that tell-tale supraorbital brow (click here for details).

But I diverge.

If you want to make money, like tomorrow, instead of in a decade, there are still a few possibilities on the storage front.

If you want to take a flyer on the ongoing data storage buildout, you might look at Las Vegas-based Switch (SWCH). The company IPO’d in October and has since seen its shares drop by 32%, which is normal for these small tech companies.

A much cleaner and safer play is Cisco Systems (CSCO), one of my favorite lagging old technology companies. After all, everyone needs Cisco routers on an industrial scale.\

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

May 25, 2021

Fiat Lux

Featured Trade:

(THE BEST COLLEGE GRADUATION GIFT EVER),

(TESTIMONIAL)

Mad Hedge Technology Letter

May 24, 2021

Fiat Lux

Featured Trade:

(THE MOST UNIQUE SOFTWARE COMPANY TODAY)

(MSTR)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.