Below please find subscribers’ Q&A for the May 12 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Lake Tahoe, NV.

Q: Is it too risky to run a double position on the US Treasury Bond Fund (TLT)?

A: Absolutely not, if anything it’s now risky enough. You need to be running triple and quadruple short positions in the (TLT) and skipping all the other marginal trades out there.

Q: Where do I find the put LEAPS recommendations?

A: If you did not get the put LEAP recommendation as part of your regular Global Trading Dispatch service, just log in to the www.madhedgefundtrader.com website and do a search on put LEAPS. Our concierge members get many more LEAPS recommendations, and they get them earlier. I happen to have an opening now, provided you can afford $10,000 a year for the service.

Q: With the inflation numbers coming at 4.2% YOY, how does that affect our strategy?

A: It kills techs, gets them too much lower levels that are much more attractive, and you make a fortune on all of your US Treasury (TLT) shorts. That's the main goal of our strategy right now. In other words, it’s great news.

Q: Would you sell technology stocks here and wait for a bounce?

A: No, ideally you would have hedged last week, buying Invesco QQQ Trust NASDAQ (QQQ) and TLT put spreads, and that hedged all your losses in your technology portfolio. The next move is to take profits on your (QQQ) and bond (TLT) shorts and then go unhedged on your tech longs. This is how hedge funds are executing their barbell strategies.

Q: Is the (TLT) $130-$135 vertical bear put spread okay for September, or should I pay more for January?

A: I would go to January because, as you noticed, this market could enter a long sideways period that goes on for months, like we just had. If you have a September and we go into another one of those sideways moves, you’re going to be wishing you did January. You don’t have to pay much more for January, only a few cents and even then, you’re looking at a 100% return.

Q: Is Tesla (TSLA) under $600 a good buy?

A: It's even a better buy at $545, which is the double bottom low of the last selloff; so, I would wait for that. And then I would essentially not do the stock, but a $450 call spread to reduce your risk even further.

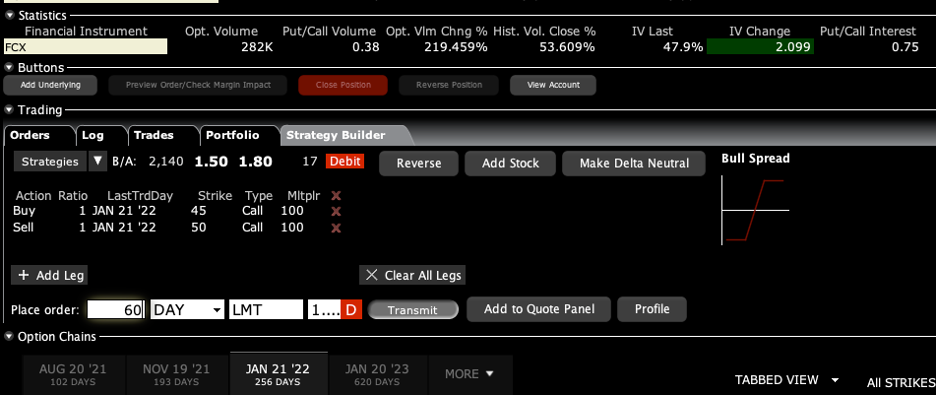

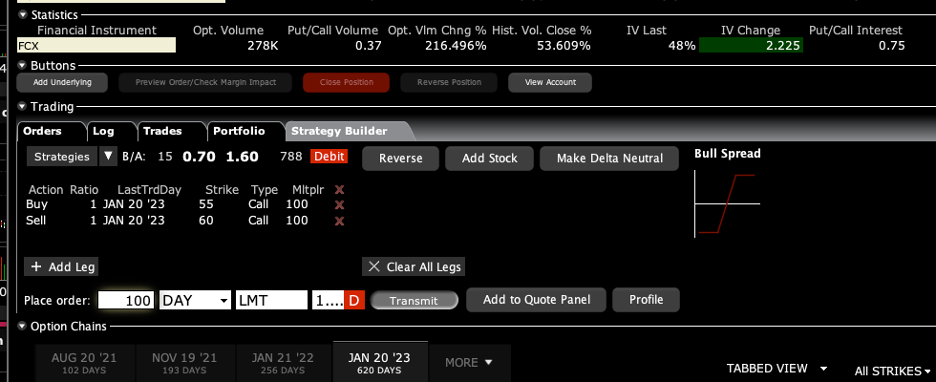

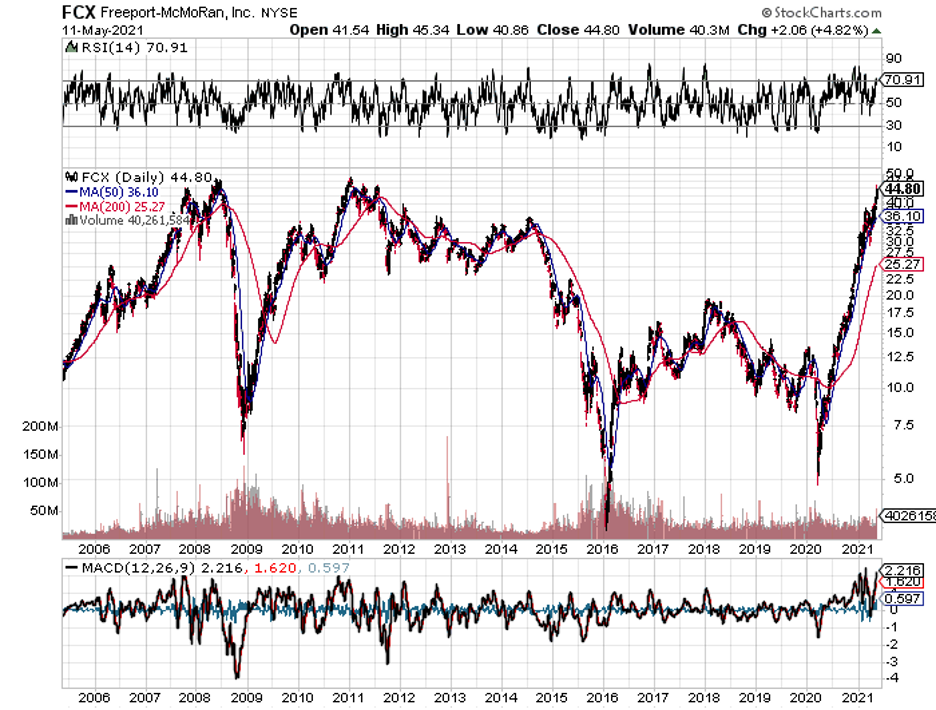

Q: I just entered the Freeport McMoRan (FCX) LEAPS today. Should I average in a lower price?

A: Absolutely yes, I don't think it drops much from here since everyone expects it to double. And if you have the 8- or 20-month LEAPS, the day-to-day price move isn’t very big, given how much the stock is moving. That's the great thing about LEAPS—it reduces the volatility of your portfolio because you have such enormous time value in these long-dated LEAPS. It's really good to have a couple of these in your portfolio, just to act as a sort of sea anchor to reduce volatility; and of course, the (TLT) and (FCX) are two of the best trades out there.

Q: Would you roll a losing position?

A: I do that maybe once a year, in extraordinary circumstances. I would rather take a short-term loss on Microsoft (MSFT) and if it drops $10 more, then I go back into the position. You never know when you get one of these huge selloffs and you can take the full 10% hit on these call spreads. Remember these are highly leveraged positions; they are leverage ten to one or more. When the stock moves even a little bit against you, you don't want leverage whatsoever. Better to get out of a small hole now than a much bigger hole later. But that's just me after 52 years of trading.

Q: The hedge fund legend Stanley Druckenmiller said the current Fed monetary policy puts the US dollar at risk of losing its reserve currency status. What do you think about this?

A: I’m totally in line with him on being short the dollar and short treasuries, but I don't think the dollar will lose reserve status in my lifetime. What would they replace it with? Anything you look at has far more problems with liquidity and stability than the US dollar. I literally have been asked this many times a year for the last 50 years, ever since the US went off the gold standard in 1972. The strongest reserve currency in the world has the strongest military, and as long as that’s true, the US dollar will not lose its reserve status. That has been true since the Roman Empire. In fact, you still find Roman coins floating around.

Q: When do we stop out of Delta (DAL)?

A: When we break 43. Very simple. You break your first strike price at $43.00 and you are out of there, losing about $800 on the position, which is our hard and fast stop loss rule. Never let emotion into the equation. Stop losses should be automatic and mechanical.

Q: What do you think of Nordstrom (JWN)?

A: I think they were close to bankruptcy, but I'm looking at the higher end retailers to make a recovery. While the bricks and mortar were shut down, they did develop pretty big online businesses. That's true for Macy’s (M), Kohls (KSS) and a lot of the other businesses that survived the pandemic.

Q: Is Mastercard (MA) better than Visa (V)?

A: All three credit card companies are more or less six of one and half a dozen of the other. So, buy all three if you’re not sure. American Express (AXP) has more exposure to business travel, so if you’re looking for a business travel recovery, that's the one you want to own.

Q: Is it too late to get into (TLT) LEAPS today?

A: I think it is kind of late for the short term. We have dropped $5.00 since I put this thing out on Friday, and I would rather let it wait and fall two more points and then rally five points and then put more on. You should sell the next rally peak, wherever that is, even if we start from $130. You can even do in the money LEAPS, like a $135-$140 (TLT) going out to January—the profit on that is still well over 50%. So even today returns are very high on that position.

Q: Would you buy more Palantir (PLTR) on the recent dip?

A: Yes, but only if you have a long-term view. The CEO said he could care less about the stock price, and when CEOs say that, the stock sells off huge. If the CEO doesn't care about the stock, then nobody else does either. I think their business model is interesting for the long term and I think eventually some kind of tech rally will take it back up. That is not now.

Q: Is First Solar (FSLR) a buy?

A: We’re getting into buy territory. They had a monster 4X rally off the bottom last year. But the entire green sector got wildly overbought by February and was then dragged down with the rest of the tech selloff. I think solar is going to have a major long-term bull market. Look to buy for the long term. It’s not in call spread or LEAP territory for me yet, but it will be. Another good one to buy is SunPower (SPWR).

Q: Do you have several different subscriptions? How do I find out about them?

A: Yes, go to the www.madhedgefundtrader.com store. We have services that go from free all the way up to $10,000 a year. Just pick one that suits your level of experience, risk tolerance, and the amount of capital you have to work with.

Q: How do I get trade alerts?

A: Email customer support at support@madhedgefundtrader.com , send them your cell number and they will set you up with the trade alert service which goes straight to your phone.

Q: How do existing subscribers get a price break on your other subscriptions?

A: You make so much money trading from your existing service, that you never have to ask a price on anything again. JP Morgan once said that “If you have to ask the price of a yacht you don’t need to know.

Q: I’m doing extremely well in the Invesco Currency Shares Australian Dollar Trust (FXA) that you recommended a year ago.

A: Yes, you and everyone else who believed my story. Australia is a call option on a global economic recovery with all its commodity exports like iron ore and natural gas. My target is $100 in two years.

Q: Should I buy the US dollar (UUP) or wait for another down move?

A: I wouldn't touch it with a 10-foot pole. I think the move down in the dollar is a 10-year event that we’re one year into. By the way, currencies do go down for decades at a time because it will take that long to cut back our borrowing and start paying back some of the principle. That is a long way off.

Q: If Bitcoin drops do tech stocks drop as well?

A: I don't think there's that much of a correlation between Bitcoin and tech stocks. Tech stocks have major valuation support about 10% down and for sure 20% down. That gets you a price-earnings multiple for the big tech stocks of only 18X, which was the low in the 2008 crash and the 2000 Dotcom crash. So major historical support at an 18X multiple Bitcoin has no technical or fundamental support whatsoever because there are no fundamentals, there are only charts.

Q: Do you think Chinese carmakers like Nio (NIO) and Xpeng Inc. (XPEV) will ever catch up with Tesla?

A: No, never. China has never been able to reach the safety standards necessary to export cars to the US. They've been making electric cars in China longer than Tesla has. I was visiting electric car factories in China around 2007-2008, and they just can’t get the quality up. In the meantime, Tesla is moving ahead at warp speed, so I don't see a risk to them.

Q: I have a big position in Clorox (CLX) that I’ve made a lot of money on; should I sell it?

A: Yes, you’ll never get more reasons to buy Clorox at a great price than in a pandemic. There's actually a shortage of Clorox right now. So yes, take profits on (CLX).

Q: Would you buy Kathy Wood’s Ark Innovation ETF (ARKK) right here today?

A: No, I think we have more interest rate rallies to go and more tech selloffs to go. I would wait and buy it with ten-year US Treasury yields at 2.00%. I would rather be buying this on the way up and averaging up, than buying on the way down and averaging down.

Q: How will stocks be affected at 2.00% yields in the ten-year?

A: I think what happens is we run up 2.00%, bonds collapse, and then it stops. And when it stops and starts to pull back from 2.00%, then you get a new rally in the stock market, especially in technology stocks.

Q: Is it a good idea to hold 30-year US treasury bonds?

A: It's a terrible idea. I would be selling short US Treasury bonds up the wazoo—especially the 30 year which has the greatest price sensitivity to a move up in interest rates.

Q: Should we buy put LEAPS on oil (USO) and energy (XLE)?

A: Yes but not yet; as long as you have a red hot economy in the short term, you don’t want to be shorting anything in energy. Next year, however, may be a different story. The economic growth rate will start to slow down, oil demand starts to slow down, and the rate of replacement of gasoline cars by EV’s accelerate with all the new production. So that's next year’s trade, not this year’s trade, but it’s a good idea.

Q: When the Volatility Index (VIX) hits $30, what would be your first choices to pick up?

A: I would go for all the domestic recovery, interest rate, and industrial plays that have been working so well this year. They will continue to lead the market until we get a major reversal down in interest rates.

Q: When do I buy semiconductor stocks (SOX)?

A: When the rest of tech bottoms out and starts its way back up. It’s better to average up than average down.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last ten years are there in all their glory.

Good Luck and Stay Healthy

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader