When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Hello everyone,

I hope life is treating you well wherever you are in the world.

The market is still in a slugfest. Rallies are punctured by the bears now. It’s a waiting game until we find a market bottom. The market will see it before you do.

Have you thrown your hands in the air and gone to cash? This is what many people have done, according to a UBS strategist. Some $89 billion has poured into money market funds in the past week. People are trying to time the markets. Most can’t do it. Most people don’t get back into the market until the train has well and truly left the station. Will your cash work for you sitting in the bank? Long-term opportunities can be found in the environment, technology, and food. Always monitor and record John’s suggestions.

Janet Yellen says the U.S. economy is doing well. It has slowed down, but jobs reports still indicate a quite sturdy labour market.

On Thursday, the inflation report is released. Let’s wait and see what it says. Volatility will probably surround this report.

It’s the 20th anniversary of the Bali bombings on October 12. A very sad day for so many. All I know is that violence begets more violence, so let’s all do our bit to keep peace in the world.

The forecast for Australia from the weather bureau is bleak. Rain, cyclones, and extreme weather events are expected between October 2022 and April 2023. I guess that means no BBQs on the beach this Christmas Day???

The IMF is also forecasting a bleak outlook for economic growth for Australia. Cost of living, mortgage rates, job cuts in companies will all put pressure on economic activity. Many people are now looking at alternative ways to build a home – tires, bales of hay, and shipping containers all now feature as cheaper options for a home.

That’s your lot for today.

Do take care.

Happy trading.

Cheers,

Jacque

The pessimist complains about the wind; the optimist expects it to change; the realist adjusts the sails.

-- William Arthur Ward

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

October 11, 2022

Fiat Lux

Featured Trade:

(DINNER WITH BEN BERNANKE)

You would never guess Dr. Ben Bernanke was once one of the most powerful men in the world, indeed in all of human history.

There he sat across the table from me in a popular San Francisco Italian restaurant wearing a poorly made grey suit and a cheap pair of shoes, with rubber soles.

Only the occasional interruption from an autograph seeker belied his true importance.

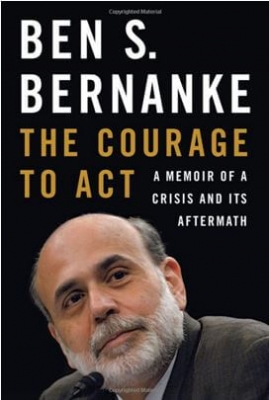

I managed to snare Ben for a couple of hours on his national book tour promoting his just released “The Courage to Act.” Out only days, it was already at the top of the New York Times Best Seller list.

Ben is a different guy now. For a start, you can now call him “Ben” instead of “Governor.”

Remember those carefully parsed, measured, and deliberate words he used to use to explain Federal Reserve monetary policy and his future intentions? That guy is long gone.

The new Ben is funny in a subtle but wickedly clever manner. He is also instructional, thoughtful, even professorial. At the end of the day, Ben Bernanke is now your favorite university faculty member.

Ben’s big revelation to me was that there were no potential triggers out there for another 2008-09 type financial crisis.

American banks have been recapitalized to the extent that they now have a stronger safety net with which to weather any future volatility. US banks are bigger and more profitable than ever.

The big global concern right now is with emerging markets, where trillions of dollars worth of US dollar-denominated debt have been borrowed, collateralized by depreciating local currencies.

Another worry is the perceived “Fed put,” which allowed investors to get complacent with their risk-taking, at least until 2021.

Bernanke believes that rising income inequality is the biggest structural problem we face. It means that not all are benefiting from an improving economy, a goal of Fed policy.

This has been unfolding for 40 years, and won’t be solved in a day, as several presidential candidates are promising.

As a result, the “Horatio Alger” effect, whereby the poorest can rise to success through brains, hard work, and thrift, is now much less likely to occur than in the past.

Bernanke himself is a perfect example of that phenomenon.

Ben and I spoke at length about the dark days of the 2008-2009 crash, and he remembered the daily emails I used to pepper his staff with proposing fixes or patches on an almost daily basis.

Regulation dating from the 1930s had become outmoded and was woefully out of touch with modern-day finance. It was far too lax in the run-up to the crisis.

For example, insurance giant AIG was monitored by the Office of Thrift Supervision, which was utterly clueless when it came to pricing mathematically complex derivatives.

Bernanke warned President Bush as early as 2005 that real estate prices were getting too high and that a crash was coming.

His predecessor, Alan Greenspan, had cautioned during the 1990s that Fannie Mae and Freddie Mac had a flawed business model that would eventually blow us and take down the financial system with it.

In the end, every major financial institution was tottering on the edge.

Bernanke had the benefit of completing his PhD thesis on the causes and mistakes of the Great Depression, once an arcane area of economic study.

Thanks to the laissez fair philosophy of the 1920s, the Fed let the money supply collapse, and one-third of all banks went under, some 8,000 in total. This froze the entire credit system.

Eight decades later, Ben therefore saw the answer to another looming depression in an inflated money supply, which we saw with QE 1, 2, 3, and 4.

He also helped engineer the $700 billion TARP that bailed out the 20 biggest banks, which he described as the “the most successful, but most hated government policy in history.”

When it was wound down, the US Treasury made an enormous $15.3 billion profit on the program by selling its big bank shares. Bank shareholders picked up the tab through the dilution of their ownership.

Part of the problem in selling the TARP, and later, president Obama’s 2009 $831 billion stimulus budget, was that while the crisis started in New York, Washington, it was slow to reach the hinterlands.

One Republican congressman in Iowa called local car dealers in his district and asked what the big deal was. Ben said, “Just wait,” and General Motors filed for bankruptcy months later.

I asked Ben who was his favorite president, as he was appointed by both George W. Bush and Barrack Obama. He confirmed that he liked working for the two men, but that Bush was the natural practical joker.

When Chairman of the Council of Economic Advisors, Bernanke was required to give a weekly briefing on the state of the economy. Once he committed the grievous sartorial error of wearing tan socks with his trademark grey suit.

Bush complained, stating that the White House had dress standards to maintain.

Bernanke answered that he thought the Bush administration was one of fiscal responsibility, and that he had bought a four-pack of the controversial socks at the Gap for only $10.

When Ben attended the next meeting a week later, he wore the required grey socks with his grey suit. He couldn’t help but notice that everyone else at the meeting was wearing tan socks with their navy suits, including the president.

When Bush met Bernanke to discuss his appointment as Chairman of the Federal Reserve in 2006, he asked if he had any political experience.

Bernanke replied that he had served two terms on the Montgomery County, Maryland Board of Education in rural South Carolina. Bush said, “that was fine.”

Bernanke is an extremely intelligent man. You can almost hear the wheels whirring when he is thinking.

I asked him my “gotcha” question.

Wasn’t quantitative easing just a means of bridging the demographic chasm of the 2010s, when 85 million baby boomers are retiring? Isn’t it just a way to pull growth forward from the 2020s?

He paused for a moment, and then changed the subject.

Finally, I had to ask if Bernanke ever got a chance to read The Diary of a Mad Hedge Fund Trader while Fed Chairman. He diplomatically responded that the “Fed takes great pains to take in all views.”

Touché.

To learn more about Ben Bernanke’s amazing “only in America” rise from obscurity, please click the following links for “Who Is Ben Bernanke,” and “Why Ben Bernanke Hates Me.”

To buy “The Courage to Act” at discount Amazon pricing, please click here.

Mad Hedge Technology Letter

October 10, 2022

Fiat Lux

Featured Trade:

(SOFTWARE THAT DRIVES YOU)

(SELF-DRIVING TECH)

Isn’t it interesting that self-driving cars and the software that launched this phenomenon are not required to pass a driving test, yet humans are?

I am here today to challenge the basic premise that software backed by artificial intelligence can drive a car better than a human.

Take left turns without a traffic light.

Artificial intelligence has consistently failed to successfully complete this standard objective.

This somewhat riskier driving maneuver must take into account drivers on the other side of the road which humans can do, but the back-tested data in the self-driving software cannot predict external variables that could come into play.

This is why the software malfunctions on a left turn when a bird defecates on the windshield believing it’s an accident worthy of a full stop and yes a full stop right in the middle of oncoming traffic.

These types of poor decisions occur more often than you think with this “cutting-edge” technology.

The truth is that self-driving car technology is coming close to the point where I will be comfortable calling it a $200 billion tech scam.

This scam is right up there with the Madoffs.

Twenty years on, no real product to show for except many unintended road deaths and rich Silicon Valley software engineers that peddle this false theory that software is better at driving than humans.

What’s the current situation today?

The industry still amounts to little more than a bunch of glorified tech demos.

It’s basically a performance and that’s it.

In demos, you see what the creators want you to see, and they control for things that they'd rather you didn't.

To an AI, a slight change could be catastrophic. After all, how is it supposed to know what an appropriate response to a slight or sudden change is when it doesn’t understand everything it’s looking at?

How will it handle when the weather goes from sunny to hail, or when there’s deer in the headlights at the edge of the road?

It is unequivocally wrong to believe that software is better at real-time driving than a human, and therefore this industry will never mushroom into what investors think it might.

This will never be a multi-trillion dollar industry where tech companies can license out self-driving technologies to bidders around the world.

Self-driving cars are a 2-ton weapon ready to kill pedestrians, cyclists, and little kids.

The interesting thing to look for is whether these venture capitalists and investors double down on failed technology and pull strings to get this circus on public roads with the rest of us.

It’s entirely possible that this could happen in limited areas like the states Arizona and California.

At the very minimum, I don’t believe that all 50 states would ever green-light such rotten technology.

I would advise anyone to move away from those states and find a state where human driving is mandatory.

As for tech, the write-downs for this botched job won’t hurt much to big firms like Google.

However, add this to the dustbin of failed tech.

The metaverse is a project that appears to be headed for that same dustbin too.

Outdoing the smartphone is proving to be almost impossible and this is just another symptom of it.

Tech is still utterly reliant on smartphone revenue until someone can supplant it.

The search goes on with another grave in the rearview mirror.

PROBABLY NOT GONNA HAPPEN

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.