When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

January 27, 2023

Fiat Lux

Featured Trade:

(JANUARY 25 BIWEEKLY STRATEGY WEBINAR Q&A),

(RIVN), ($VIX), (SPX), (UUP), (NVDA), (TLT), (LLY), (AAPL), (RTX), (LMT), (USO), (OXY), (TSLA), (UNG), (MSFT)

CLICK HERE to download today's position sheet.

Below please find subscribers’ Q&A for the January 25 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley in California.

Q: What do you think about LEAPS on Rivian (RIVN)?

A: Yes, I would do those, but a smaller position with closer strike prices. Go to the maximum maturity 2 years out and be conservative—bet on only a 50% rise in the stock. I’m sure it’ll double, but with the LEAPS you’ll have tremendous upside leverage, like 10 to 1, so don’t get greedy. Go for the 500% profit in 2 years rather than the 1,000%, because it is still a startup, and we need economic recovery for startups to get traction. If anything, Tesla (TSLA) will drag this stock back up as it dragged it down. They all move together.

Q: What’s the number of contracts on your $100,000 model portfolio?

A: Our model portfolio basically assumes we have 10 positions of $10,000 each totaling $100,000 in value. You can then change the number of contracts to suit your own private portfolio—take on as much or as little risk as you want. If you’re new. I recommend trading on paper first to make sure you can make money before you use the real thing.

Q: I’m new to this service. What’s the difference between the long-term portfolio and the short-term portfolio?

A: A long term portfolio is a buy-and-forget portfolio, with maybe a 5- or 10-year view. We only change it and make adjustments twice a year so we can average back into the new positions and take profits on the old ones. The main part of this service is usually front-month, and that’s where we take advantage of anomalies in the options market and market timing to make profits 95% of the time. And a big part of the short-term portfolio is cash; we often go 100% cash when there are no trades to be had. It’s actually more valuable knowing when not to trade than when to trade. If you have any more questions, just email customer support at support@madhedgefundtrader.com and we’ll address them individually.

Q: Is it time for a CBOE Volatility Index ($VIX) trade?

A: I hate trading ($VIX). I only do it from the short side; when you get down to these low levels it can flatline for several months, and the time decay eats you to death. I only do it from the short side, and then only the 5% of the time that we’re peaking in ($VIX). The big money is made on the short side, that’s how virtually the entire options trading industry trades this.

Q: Would you be loading up with LEAPS in February?

A: No, it’s the worst time to do LEAPS. You do LEAPS at long-term market bottoms like we had in October, and then we issued 12 different LEAPS. If you get a smaller pullback, there may be LEAPS opportunities, but only in sectors that are near all-time lows, like gold or silver. It depends on the industry and where we are in the market, but basically, you’re looking to do LEAPS at lows for the year because the leverage is so enormous, and so are the potential profits.

Q: Is the increasing good performance a result of your artificial intelligence? Learning from past mistakes?

A: Partly yes, and partly my own intelligence is improving. Believe it or not, when you go from year 54 to 55 in experience in the markets, you understand a lot more about the markets. Sometimes you just get lucky being on the right side of black swan events. Of course, knowing when the market is especially sensitive and prone to black swans is also a handy skill to have.

Q: Is it too late to get into Freeport McMoRan (FCX)?

A: Yes, I wouldn’t touch (FCX) until we get at least a $10 selloff, which we may get in February, so I think the long term target for (FCX) is $100. The stock has nearly doubled since the LEAPS went out in October from $25 a share to almost $50, so that train has left the station. Better off to wait for the next train or find another stock, there are a lot of them.

Q: Where do you park cash in the holding pattern?

A: Very professional hedge fund managers buy 90-day T-bills, because if you keep your cash in your brokerage account—their cash account—and they go bankrupt, it’ll take you 3 years to get your money back in a bankruptcy proceeding. If you own 90-day T-bills and your broker goes bankrupt, they’re required by law to just hand over the T-bills to you immediately. You take delivery of the T-bills, you park them at another brokerage house, and you keep them there. There is no loss of the use of funds.

Q: What about Long term US dollar (UUP)?

A: We go down for 10 years. Falling interest rates are poison for a currency; our rates are probably going to be falling for the next several years.

Q: Thoughts on Tesla (TSLA)?

A: Short term way overbought, we almost got up 60% from the low in weeks, but that’s Tesla, that’s just how it trades. It is the best performing major stock in the market this year. I wouldn’t be looking to go back into it until we drop back, give up half of that gain, get back down to about $135—then it would be a good options trade and a good LEAPS.

Q: Would you be taking profits in Nvidia (NVDA)?

A: I would take like half here and look to buy it back on the next dip because I think Nvidia’s got higher highs ahead of it.

Q: I can’t get a password for the website.

A: Please contact customer support on the homepage and they will set you up immediately. If not, you can call them at (347) 480-1034.

Q: Would you be selling long term positions?

A: No I would not, because if you sell a long term position they’re very hard to get back into; and I’m expecting $4,800 in the (SPX) by the end of the year. Everything goes up by the end of the year, even things you hate. So no, selling is what you did a year ago, now you’re basically looking for chances to get back in.

Q: Would you hold Tesla (TSLA) over this earnings report?

A: No, I sold my position yesterday, at 70% of its maximum potential profit. I don't need substantial selloff; I’m just going to go right back in again.

Q: Have you heard anything about Tesla silicon roof tiles tending to catch fire?

A: No I have not, but if your house got struck by lightning or if someone fired a bullet at it, that might do the trick. Otherwise, you need a huge input of energy to get silicon to catch on fire as it’s a pretty stable element. And if it was already happening on a large scale, you know the media would be absolutely all over it—the media loves to hate Tesla and loves to hate Elon Musk. That certainly would draw attention if it were happening; what's more likely is that fake news is spreading rumors that are not true. That's been a constant problem with Tesla from the very beginning.

Q: Would you open the occidental spread here today?

A: I would, but I would use strike prices $5 lower. I'd be doing the February $50-$55 vertical bull call spread to give yourself some extra protection, given that the general market itself is so high.

Q: Should I be shorting Apple (APPL) here?

A: No, but the smart thing to do is to sell the $160 calls because I don’t think we’ll get up to $160. You could take any extra premium income, and if you don’t get hit this month, keep doing it every month until you are hit, and then you can take in quite a lot of premium income by the time we get to new highs in Apple, possibly as much as $10 or $15. So, that would be a smart thing to do with Apple.

Q: What's your favorite in biotech and big pharma?

A: Eli Lilly (LLY), which just doesn't seem to let anybody in.

Q: If China were to shut down again, would it hurt the stock market?

A: Yes, but not much. The much bigger falls would be in Chinese stocks (which have already doubled since October) not ours.

Q: Thoughts on biotech?

A: Biotech is the new safety trade that will continue. Also, they’re having their secular ramp-up in technology and new drugs so that is also a good long-term bull call on biotech.

Q: What’s the dip in iShares 20+ Year Treasury Bond ETF (TLT)?

A: $4 points at a minimum, $5 is a nice one, $6 would be fantastic if you can get it.

Q: Could we get a trade-up in oil (USO)?

A: Yes, maybe $5 or $10 a barrel. But it’s just that, a trade. Long term, oil still goes to zero. Short term, China recovery gives a move up in oil and that's why we went long (OXY).

Q: You talk about California NatGas being dead, but California gets 51% of its electricity from natural gas, up from 48% in 2018.

A: Yes, but that counts all of the natural gas that gets brought in from other states. In fact, if you look at the longer-term trend over the last 20 years, coal has gone to zero, nuclear is going to zero, hydro has remained the same at about 10%. NatGas has been falling and green sources like wind and solar, have been rising quite substantially. And now, approximately 25% of all the homes in California get solar energy, or 8.4 million homes, and it is now illegal to put gas piping into any new construction. New York is doing the same. That means it will be illegal to do new natural gas installations in a third of the country. So, I think that points to lower natural gas consumption, and in fact, the 22-year target is to take it to zero, which might be optimistic but you never know. All they need is a smallish improvement in solar technology, and that 100% from green sources is doable by 2045, not only for California but for everybody. All energy plays are a trade only, not an investment.

Q: Any thoughts on the implications for the US and Germany providing tanks to Ukraine?

A: You can throw Poland in there, which is also contributing a tank division—so a total of 58 M1 Abrams tanks are going to Ukraine. By the way, I did command a Marine Corps tank battalion for two weeks on my reserve duty, so I know them really well inside and out. They are powered by a turbine engine, have a suspension as soft as a Cadillac, a laser targeting system accurate to three miles even for beginners, and fire recycled uranium shells that can cut through anything like a knife through butter. The answer is the war gets prolonged, and eventually forces Russia into a retreat or a negotiation. Even though the M1 is an ancient 47-year-old design, its track record against the Russian T72 is pretty lopsided. In the first Gulf War, the US destroyed 5,000 T72s and the US lost one M1 tank because he parked on a horizon, which you should never do with a tank. And every driver of a T72 knows that track record. So that explains why Russian tanks have been running out of gas, sugaring their gas tanks, sabotaging their diesel engines, and doing everything they can to avoid combat because of massive fatal design flaws in the T72. We only need to provide about 50 or 60 of the M1 tanks as a symbolic gesture to basically scare the entire Russian tank force away.

Q: Why do you think Elon kept selling Tesla? Did he think it would go lower?

A: Elon thinks the stock’s going to $10,000, but he needed up-front cash to build out six remaining Tesla factories, and for that, he needed about $40 billion, which is why he sold $40 billion worth of stocks last year when it was peaking. He also is sensitive to selling at tops; it’s better to sell stock in with Tesla at an all-time high than at an all-time low, so he clearly times the market to meet his own cash flows.

Q: What about military contractors?

A: I know Raytheon (RTX) and Lockheed Martin (LMT) have a two-year backlog in orders for javelin missiles and stingers, which are now 47-year-old technology that has to be redesigned from scratch. The US just placed an order for a 600% increase in artillery shells for the 155 mm howitzer. I thought we’d never use these again, which is why US stocks for ammunition got so low. But it looks like we have more or less a long term or even permanent customer in Ukraine for everything we can produce, in old Vietnam-era style technologies. How about that? I’m telling the military to give them everything we’ve got because everything we’ve got is obsolete.

Q: When should we buy Microsoft (MSFT)?

A: On the next 10% dip. It’s the quality stock in the US.

Q: Do you place an order to close the spread at profit as soon as you have filled in the trade?

A: You can do that, but it’s kind of a waste of time. Wait until we get close to the strikes; most of the big companies we deal in, you don't get overnight 10% or 20% moves, although it does happen occasionally.

Q: Natural Gas (UNG) prices are collapsing.

A: Correct, because the winter energy crisis in Europe never showed and spring is just around the corner.

Q: On the Tesla (TSLA) LEAPS, what about the January 2025 $600-$610 vertical bull call spread

A: That is way too far out of the money now. I would write that off and go back into it but do something like a January 2025 $180-$190. It has a much higher probability of going in the money, and still an extremely high return. It would be something like 500% if you get in down at these levels.

Q: How do you see Bitcoin short term/long term?

A: I think the loss of confidence in the asset has been so damaging that it may not come back in my lifetime. It could be another Tokyo situation where it takes 30 years to recover, or only recovers when the entire sector gets taken over by the big banks. So, I don’t see any merit in the crypto trade, probably forever. Once you lose confidence in the financial markets, it’s impossible to get it back. And it turns out that every one of these mainline trading platforms was stealing from the customers. No one ever comes back from that in the financial markets.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH or TECHNOLOGY LETTER, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

At 29 Palms in my M1 Abrams Tank in 2000

Thursday evening

January 26, 2023

Hello everyone,

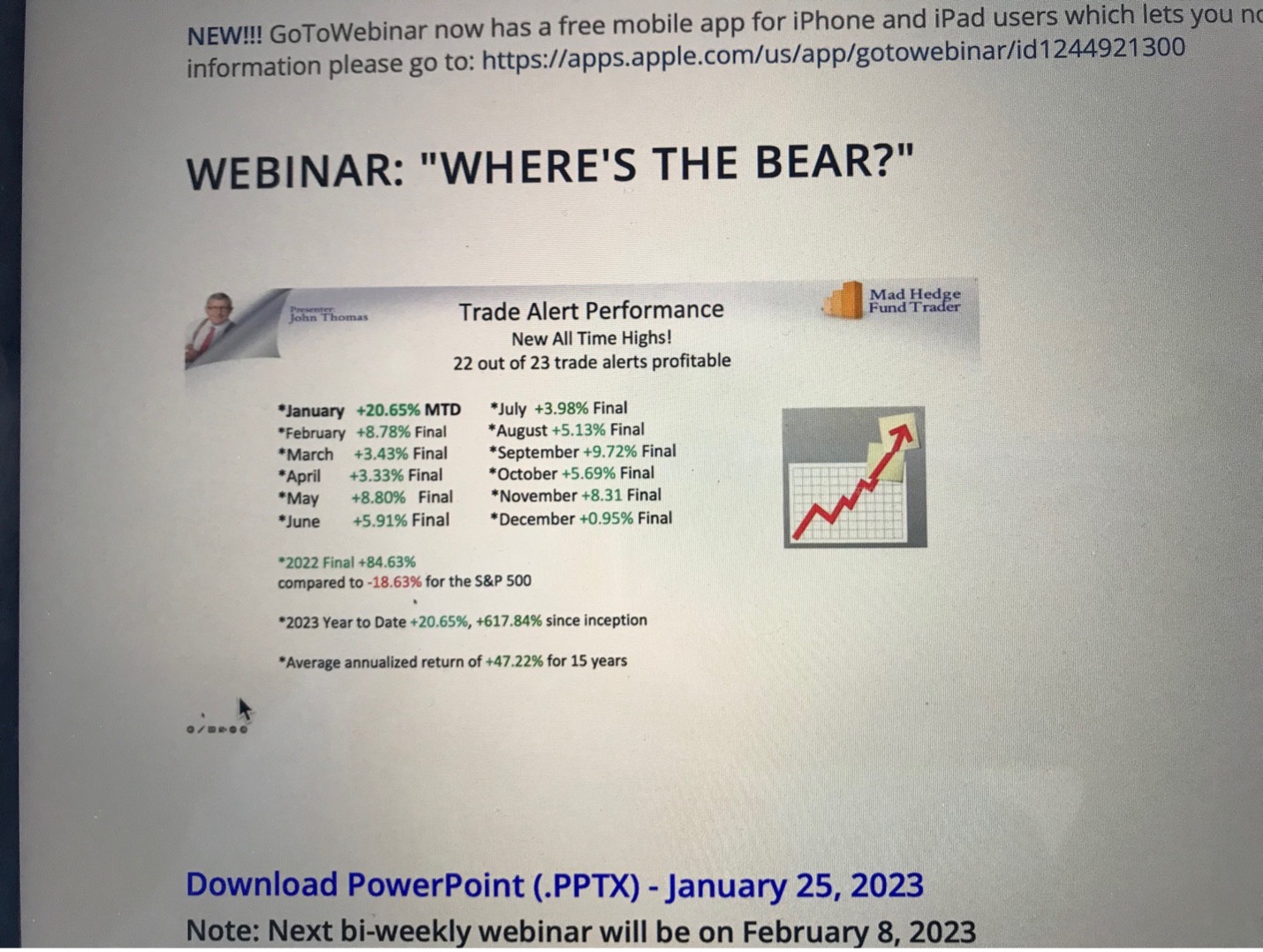

This post will be a summary of John’s recent webinar entitled: “Where’s the Bear?”

Luncheons: Honolulu February 17, 2023

Seminar at Sea July 13, 2023

+++++++++++++++++++++++++++++++++++++++

John’s Positions:

20.65% January, 80% cash, 10% long and 10% short

OXY 55-60 call spread

QQQ 305-315 put spread

Expiration Value: 23.79%

107.27% Trailing one-year return

47.22% Average Annualized return

LEAPS on Rivian but be conservative.

The market is pricing in a 25-basis point rate hike on Feb 1.

Energy – new lows on Russian military failures, warm weather, and a supply glut. Only a Chinese post-Covid recovery can save it.

Gold and Silver deliver upside breakouts, which should continue.

2023 could be the year of the commodities.

John says the U.S.$ has topped and will be weak for a decade.

Look for the S&P 500 at $4,800 by end of 2023.

VIX dives to $18 = No Trade

The main focus of John’s service is front-month trading. And holding cash when there are no trades. He teaches us that it is more valuable knowing when not to trade than when to trade.

According to a new model by JP Morgan Bank, there is a 73% chance of a recession.

Tech layoffs top 70,000 or 2% of workforce. But most tech layoffs aren’t being reported. (They go on to another job or work from home or from anywhere in the world doing side hustles).

Inflation to drop 5% in a year, according to a survey taken by the New York Fed.

If you have cash that is not in your brokerage account or invested, buy 90-day T-bills.

TSLA @ 125 is a good option trade and a good LEAP.

TSLA is the most traded stock in the market. And the most traded option in the market.

RIVN – great LEAP candidate 40-50 or 45-50. Go two years out.

NVDA – buy at 160.

Did you know – there are Russian submarines 30-40 miles off the East and West American coasts with nuclear weapons, which could wipe New York out in a second?

(What a comforting thought).

BRKB – $400 target.

Keep buying TLT calls, call spreads, and LEAPS on dips.

Junk Bonds ETF’s (JNK) & (HYG).

Treasury Secretary warns of coming US Bond Default, runs out of money by June capping price for foreseeable future.

OXY – 50-55 spread.

AAPL – sell 160 calls – keep doing every month until you are hit. This is just a suggestion.

Currencies: Buy FXE, FXA, FXB, FXY.

M1 Tank Battalion going to Ukraine. Will stretch out the war. Russia’s tanks are no match for Western tanks.

CEW – Emerging markets should have growth of 40%.

Precious Metals

Australian Precious Exports Soar. Shipments topped $9 billion in November. 20% higher than the most optimistic forecasts.

Buy Copper (FCX), Aluminium (AA), Iron Ore (BHP, Gold (GLD), & Silver (SLV) on dips.

Crypto loses it shine to Gold. Buy GLD, GDX, GOLD on dips.

That’s all for now.

Have a brilliant weekend.

Have fun.

Cheers

Jacque

Always be looking forward. You can never plan the future by the past.

To be yourself in a world that is constantly trying to make you something else is the greatest accomplishment. Ralph Waldo Emerson.

Mad Hedge Biotech and Healthcare Letter

January 26, 2023

Fiat Lux

Featured Trade:

(SLOW AND STEADY WINS THE RACE)

(REGN), (SNY), (RHHBY), (BAYN)

If you are on the lookout for stocks that have the potential to deliver dramatic gains right away, you’d be hard-pressed to find a better place than the biotechnology industry.

Hardly a month passes without at least one or two biotech names skyrocketing or tumbling thanks to updates about clinical studies. And this year won’t be any different for this group.

A particular biotech to keep on an eye on is Regeneron Pharmaceuticals (REGN).

This 2023, Regeneron has several upcoming trial readouts that could potentially push its stock price to an all-time high. The earliest update to watch out for involves its anti-inflammatory drug Dupixent, which is already a leading treatment for asthma and eczema.

Gaining its first approval back in 2017, Dupixent has been generating over $7 billion in sales every year for both Regeneron and its co-developer, Sanofi (SNY).

Riding this momentum, Regeneron stock could climb higher courtesy of the upcoming results of experimental studies with Dupixent and patients suffering from chronic obstructive pulmonary disease or COPD.

Based on data from the World Health Organization, COPD is the third leading cause of death across the globe. Despite this, there remains a shortage of effective and accessible treatment options for patients. Needless to say, this represents an untapped potential market and a promising fresh revenue stream for Regeneron.

Meanwhile, another product in Regeneron’s portfolio could soon get a shot in the arm. After struggling with unimpressive results in the earlier months of 2022, the company’s shares soared around September. As expected when it comes to biotechs, this type of double-digit percentage is triggered by positive clinical updates.

For Regeneron, the trigger was Eylea.

Aside from its blockbuster drug Dupixent, Eylea is another top-selling product of Regeneron. It is a rare eye disorder treatment that it developed with Bayer (BAYN). Recently, Regeneron disclosed that Eylea proved to be effective in a Phase 3 clinical study that justified a higher dosage of the treatment.

For years, Eylea has been a generous cash cow for the companies. Now, it could become an even more lucrative source. However, this development is even more critical for Regeneron because Eylea’s patent exclusivity is set to expire in 2024.

With the recent development, the company could easily apply for an extension of patent protection, which is obviously excellent news for Regeneron and its shareholders.

This news could not have come at a more timely period since Regeneron stock started tumbling following the biotech’s report of lower sales for Eylea in the fourth quarter of 2022.

In a preliminary report on its fourth-quarter earnings, Regeneron shared that the sales for Eylea during this period only reached $1.5 billion, which fell short of the $1.64 billion expectation from analysts.

The disappointing update scared off some shareholders and caused interested investors to think twice before putting their money in this company. However, these results were justifiable since they coincided with the launch of a rival drug treatment, Vabysmo from Roche (RHHBY).

Nonetheless, Regeneron remains a good investment in these turbulent times. Despite the challenges, its products, especially Eylea and Dupixent, continue to deliver solid financial results.

More importantly, the company has several promising pipeline candidates. To date, Regeneron has roughly 40 clinical trials ongoing, with a quarter of these queued for Phase 3 studies. This indicates the company’s capacity and plans to extend its lineup to launch brand-new treatments.

Meanwhile, it has also been working on label extensions for its already successful products, as seen in its efforts with Dupixent and Eylea.

With these solid products in its portfolio and other promising candidates for regulatory approval this 2023 and early 2024, Regeneron looks ready to deliver solid results in 2023 and beyond. Even if it doesn’t, the company is equipped with the tools to keep churning out strong returns in the long run. I suggest you buy the dip.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

January 26, 2023

Fiat Lux

Featured Trade:

(WHY I AM GOING TO LIVE FOREVER)

CLICK HERE to download today's position sheet.

One of the great things about living in the San Francisco Bay area is that you get to beta test new revolutions in technology before anyone else can. That includes being a guinea pig for medical procedures from the future.

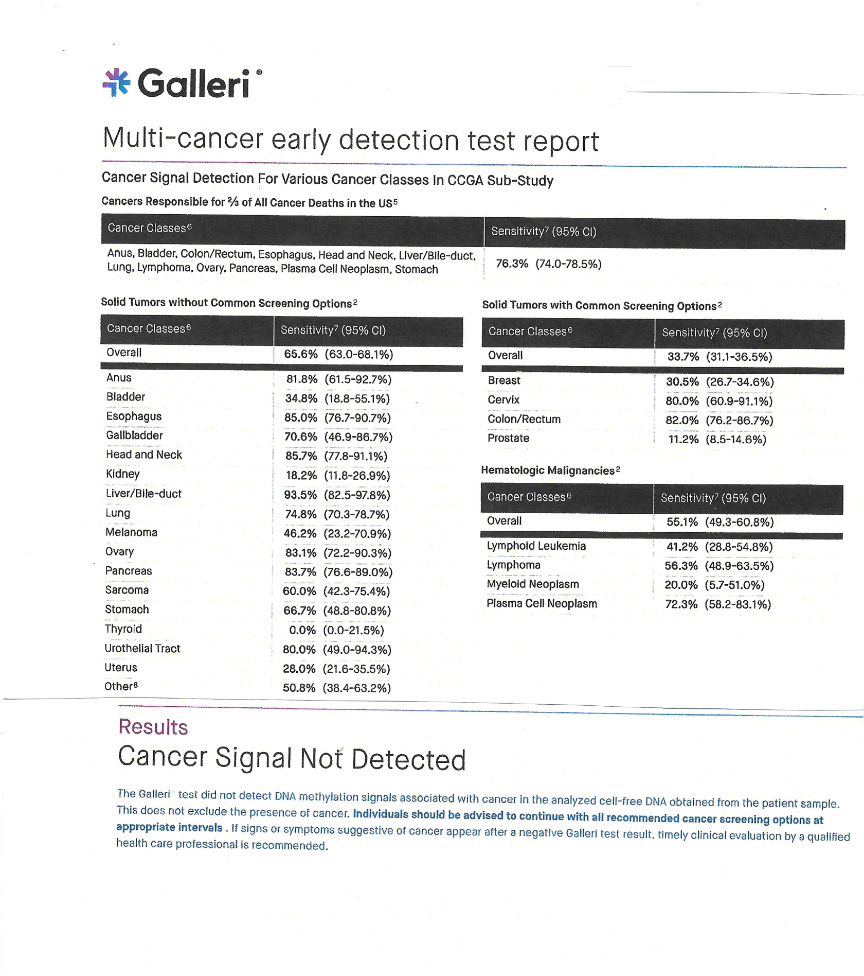

So, when my doctor suggested that I try out an experimental cancer screen by a startup company, I jumped at the chance.

Menlo Park, CA-based Galleri claims it can take a single blood sample and screen for the DNA of all major known cancers at the single cell level. Not only can they tell you what undetectable cancers you may already have now, they can also tell you which cancers might emerge over the next 20 or 30 years.

Galleri is still only open to venture capital investors but hopes to go public sometime in the future once their technology is proven out. To learn more about Galleri and sign up for their test, please click here. Their site shows a cost of $1,250 for the test, but after getting an introduction from my doctor, the price dropped down to $749.

This is what we used to dream about in my lab at UCLA 50 years ago. To see this in operation during my lifetime is nothing less than unbelievable.

Cologuard (click here for their website) is already using DNA analysis for colon cancer screening and has been a profitable business for several years. But it involves taking a small stool sample and mailing it in for screening, not such a pleasant task. Galleri claims they can do this for all cancers with a single blood test.

It was with great anticipation that a large envelope arrived a few days ago with my Galleri test results, which I posted below. They showed No Cancers Detected, which at the single cell level at my age of 70, I am highly unlikely to ever develop any cancers at all.

Thanks to a lifetime of daily heavy backpacking. My doctor tells me that I have the heart of a teenage Olympic athlete. That rules out a future heart attack or congestive heart failure, which both my father and grandfather died of, both at 78.

I am really running out of future causes of death. I guess my end will come by getting shot by a jealous husband.

At Los Alamos, New Mexico with Oppie and Groves

Mad Hedge Technology Letter

January 25, 2023

Fiat Lux

Featured Trade:

(UNIMPRESSIVE FROM THE BEHEMOTH)

(MSFT)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.