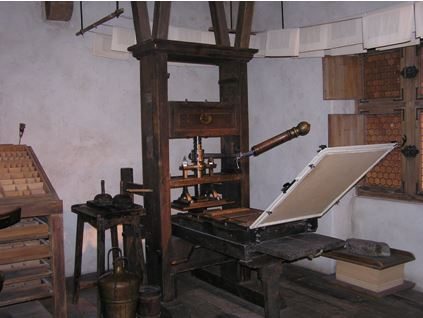

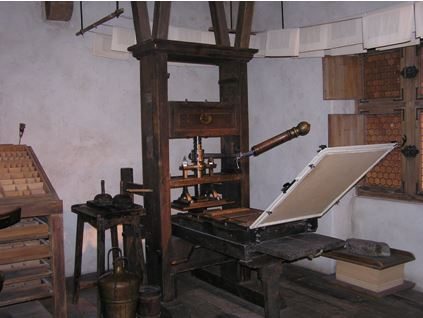

"Freedom of the press is only true if you own a press," said A.J. Liebling, a famed journalist for the New Yorker.

"Freedom of the press is only true if you own a press," said A.J. Liebling, a famed journalist for the New Yorker.

Seven AI Stocks to Invest in and Why

Artificial Intelligence (AI) has transformed industries, revolutionizing the way businesses operate and the services they offer. As AI continues to advance, it presents significant investment opportunities for those looking to capitalize on its growth. In this article, we will explore these seven AI stocks to invest in and delve into the reasons behind their promising outlook.

NVIDIA Corporation (NASDAQ: NVDA)

NVIDIA is a tech giant at the forefront of AI innovation. The company specializes in graphics processing units (GPUs), which are essential for AI applications, particularly in the fields of deep learning and data analytics. NVIDIA's GPUs are widely used in AI training and inference, making them a critical component of AI infrastructure.

Why invest in NVIDIA:

Alphabet Inc. (NASDAQ: GOOGL)

Alphabet, the parent company of Google, is a powerhouse in the AI industry. Google has been investing heavily in AI research and development, integrating AI into its various products, including Google Search, YouTube, and Google Assistant.

Why invest in Alphabet:

Amazon.com, Inc. (NASDAQ: AMZN)

Amazon, the e-commerce and cloud computing giant, has made significant investments in AI to enhance its customer experience, logistics, and data analysis. The company's AI-driven recommendation systems are a key factor in driving sales and customer loyalty.

Why invest in Amazon:

Microsoft Corporation (NASDAQ: MSFT)

Microsoft, a tech giant, has made significant strides in AI development, integrating AI into its software products and cloud services. The company's Azure cloud platform offers a wide array of AI services for businesses.

Why invest in Microsoft:

Tesla, Inc. (NASDAQ: TSLA)

Tesla, led by Elon Musk, is a trailblazer in AI within the automotive industry. Tesla's electric vehicles are equipped with advanced driver-assistance features and a full self-driving package, which relies on AI and machine learning.

Why invest in Tesla:

International Business Machines Corporation (NYSE: IBM)

IBM, a stalwart in the tech industry, is undergoing a transformation by focusing on AI and hybrid cloud solutions. The company's Watson AI platform is a prominent player in enterprise AI applications.

Why invest in IBM:

Salesforce.com, Inc. (NYSE: CRM)

Salesforce, a cloud-based customer relationship management (CRM) company, has embraced AI to enhance its services and help businesses make data-driven decisions. Salesforce Einstein is an AI-driven feature that augments the CRM platform.

Why invest in Salesforce:

Reasons for Investing in AI Stocks

Considerations for Investing in AI Stocks

While AI stocks offer promising opportunities, it's crucial to consider the following factors before making investment decisions:

Conclusion

Investing in AI stocks can be a smart move for those looking to capitalize on the continued growth of artificial intelligence. The seven companies mentioned in this article, including NVIDIA, Alphabet, Amazon, Microsoft, Tesla, IBM, and Salesforce, are at the forefront of AI innovation in various industries. However, it's crucial to conduct thorough research, assess your risk tolerance, and align your investments with your financial goals. As AI continues to evolve and shape the business landscape, investing in the right AI stocks can offer long-term growth potential and diversification in your investment portfolio.

Mad Hedge Technology Letter

October 27, 2023

Fiat Lux

Featured Trade:

(CRYPTO IS BACK AT IT AGAIN)

(MSTR), (BTC)

Cryptocurrency prices have been on a tear lately as bitcoin continues to rally on hopes a spot bitcoin exchange-traded fund will launch soon.

Last week Bitcoin had a 24-hour time period where it exploded 13% to the upside as the digital gold wakes up from its slumber.

Lately, it certainly is odd to see US treasury yield surpassing any type of volatility that crypto can offer proving that volatility is more about a time and place dynamic rather than a certain asset class.

The volatility meant that Bitcoin passed $35,000 for the first time since May 2022 even though it has pulled back a little today.

The rally could be fueled in part by investors who were betting against the crypto asset scrambling to cover short positions as well.

Bitcoin led cryptocurrency prices higher over the past two weeks after the SEC declined to challenge its court loss against Grayscale Investments (GBTC) and its effort to convert its Grayscale Bitcoin Trust into a spot bitcoin ETF on Oct. 13.

A U.S. appeals court ordered the SEC to review Grayscale's ETF application. The regulator could still reject the spot bitcoin application, but it would need a new justification to do so.

Institutional demand for a spot bitcoin ETF is stronger than ever before. For many institutions, it is a matter of when — not if — the SEC will approve a spot bitcoin ETF.

A spot bitcoin ETF would provide a regulated and accessible vehicle for bitcoin exposure, and also mark a major vote of institutional confidence.

MicroStrategy (MSTR) added 21% and the computer software company holds 158,245 bitcoin with an average purchase price of $29,582.

Sooner or later, unless regulation totally wipes out Bitcoin, crypto is likely to find itself finagling its way into 401K’s.

The longer it lingers around, institutional pockets, which are deep, will find a way to onboard it into its business model.

For many years, institutional money has stayed away from crypto primarily because it is built on nothing and most conservative investors want to see cash flow.

At least an asset like gold bullion, there is a physical nature of what one buys.

Yet, as the world becomes more digitized and globalized, institutional money is starting to take the bait.

To Bitcoin’s credit, the absolute collapse of volatility in the past few years has been an interesting talking point because too much volatility used to be the problem for this asset class.

There is a chance that as we begin to start a new economic cycle because of a Fed pivot, that $16,000 per Bitcoin at the end of December 2022 could register the low of the next cycle.

Bitcoin is more appealing as a risk-reward proposition now than it was exactly a year ago as the Fed embarked on an epic tightening cycle.

Throw into the mix that the quality of global government has cratered to a generational low and it makes sense for institutional backers from Blackrock to front-run the next bull market in crypto as capital looks to de-risk from fiat currencies.

This could finally end up being the run-up to $100,000 per bitcoin that everyone expected during the last bitcoin spike.

Readers can play this in the equity market by buying MSTR.

(AN AUSTRALIAN VET MAKES A DIFFERENCE IN UKRAINE)

October 27, 2023

Hello everyone,

There is something that nearly always gets left behind during hard times or in wartime.

Animals.

Thousands of animals have been brought back to Animal Shelters in Australia because owners can no longer afford to keep them. Most people don’t seem to think about the long-term costs of keeping an animal, and just assume it will all work out in the end. The animal seemed like a good idea during the pandemic, but now is an expense that many Australians can no longer carry.

In wartime, animals are thought of last or not at all. That’s why in war-torn areas, like Ukraine, animals have been abandoned and are now just roaming the streets or are left chained to a post. Some have terrible injuries: gunshot wounds, broken bones, and are malnourished.

One Australian vet is now making a difference to those animals’ lives.

Dr. Lachlan Campbell, a Sunshine Coast vet has flown to Ukraine on two occasions to assist the animals there. Early in October, on his second visit, he travelled to Kramatorsk – less than an hour drive from Bakhmut. Whilst there, he has treated animals and built shelters for pets displaced by the war in preparation for winter.

He teamed up with the British animal charity, Nowzad, and worked with a team of four (from dawn to dusk) to build animal shelters. He commented that the “shelters we built are enough to house 80 dogs in warmth and more comfort – and off chains – which some have been on for up to four years”. He and his team provided quality food, parasite preventatives, and toys for the animals. Dr. Campbell pointed out the building materials for the shelters were transported all the way from the UK by semi-trailer.

He reported that air raid sirens sounded as frequently as six to eight times a day. He said he also wore body armour and helmets if they were required. He had some near misses with a missile hitting within metres of the shelter Dr Campbell had been building.

During his most recent trip, Dr Campbell vaccinated, microchipped, and treated around 100 cats and dogs for diseases.

In Australia, Dr. Campbell works as a veterinarian at Vets Central on the Sunshine Coast in Queensland.

Nowzad opened its first animal clinic in Kabul, Afghanistan, in 2007, and have since opened an additional donkey/horse sanctuary in Afghanistan.

Market Update

We are in correction mode.

If we get a very good break of 4100 on the S&P, we could fall to 3800.

There is still a chance we could rally in November/December.

In other news

The Australian Prime Minister, Anthony Albanese, is in the U.S. on a State visit to the White House. Australia’s relationship with China was one of the talking points. Albanese’s State visit is intended to deepen an alliance that’s increasingly viewed as a critical counterweight to China’s influence in the Pacific. It’s the ninth and most high-profile meeting between the two leaders, which is intended to facilitate closer ties on climate change, technology, and national security. The United States also plans to provide nuclear-powered submarines to Australia in the coming years, part of a collaboration with the United Kingdom.

The Australian government is sending military aircraft and defence personnel to the Middle East to be on standby in the event the situation “gets worse”.

Australian fighter jets and defense personnel arrive in The Middle East.

Happy weekend to you all.

Cheers,

Jacquie

Global Market Comments

October 27, 2023

Fiat Lux

Featured Trade:

(SIX REASONS WHY GOLD WILL CONTINUE RISING),

($GOLD), (GLD), (IAU), (NEM), (GOLD), ($TNX),

(A CONVERSATION WITH THE BOOTS ON THE GROUND)

If you are a current gold investor, you have to love the latest monthly statistics just published by the World Gold Council.

After years of a death by a thousand cuts inflicted by endless redemptions of gold ETFs and ETNs, recent reports showed a sudden influx into the barbarous relic.

North American ETFs led the charge, with some 28.8 metric tonnes valued at $1.3 billion pouring into the funds.

The SPDR Gold Shares (GLD) took in the most, 22.4 tonnes worth $1.03 billion, followed by the IShares Gold Trust (IAU), which added 4.6 tonnes worth $266 million.

Europe followed with 6.4 tonnes worth $321 million.

Asia was a net seller of 2 tonnes worth $80 million as investors pulled money out of precious metals and placed it in Bitcoin, Ethereum, and other cryptocurrencies.

Global gold-based ETFs collectively hold 2,295 metric tonnes of gold valued at and have picked up 143.5 tonnes so far this year.

For those used to using American measurements of precious metals, there are 32,150.7 troy ounces in one metric tonne.

The figures augur well for continued cash inflows and higher gold prices.

My experience is that sudden directional shifts of fund flows like this are NOT one-offs. They continue for months, if not years.

Of course, the trigger for these large inflows was the yellow metal’s decisive breakout on big volume from a two-year trading range.

Not only did now longs pile into the market, there was frantic short covering as well.

Too many options traders had gotten comfortable selling short gold call options just above the $1,800 level.

Once key upside resistance was shattered, gold tacked on another $50 very quickly. Bearish traders were smartly spanked.

Gold plays that did well, including Van Eck Vectors Gold Miners ETF (GDX), Barrick Gold (ABX), Newmont Mining (NEM), and Global X Silver Miners ETF (SIL), turned profitable.

There are six reasons why gold has gone off to the races.

1) Ten-year Treasury bond yields are peaking out at 5.0%. The opportunity cost of holding gold is about to drop sharply.

2) Falling interest rates guarantee a weaker US dollar, another big pro gold development.

3) The last of the pandemic stimulus is fading fast.

4) The new conflict in the Middle East has poured the fat on the fire.

5) General concerns about the increasing instability in Washington have driven nervous investors into EVERY flight to safety play.

6) The collapse of trust in crypto has propelled a lot of assets back into gold.

Inflation has historically been the great driver of all hard asset prices.

After such a meteoric move, I would expect gold to consolidate here around this level for a while to digest the recent action. It may drift sideways, or fall slightly.

That’s when I’ll pick up my next basket of longs.

I have spent many hours speaking at length with the generals who are running our wars in the Middle East, like David Petraeus, and James E. Cartwright.

To get the boots-on-the-ground view, I attended the graduation of a friend at the Defense Language Institute (DLI) in Monterey, California, the world's preeminent language training facility.

As I circulated at the reception at the once top-secret installation, I heard the same view repeated over and over in the many conversations swirling around me. While we can handily beat armies, defeating an idea is impossible.

With the planet's fastest-growing population (Muslims are expected to double from one to two billion by 2050), terrorists can breed replacements faster than we can kill them. The US will have to maintain a military presence in the Middle East for another 100 years.

The goal is not to win, but to keep the war at a low cost, slow burn, over there, and away from the Americans.

I have never met a more determined, disciplined, and motivated group of students. There were seven teachers for 16 students, some with PhDs and all native Arabic speakers. The Defense Department calculates the cost of this 63-week, total immersion course at $200,000 per student.

They are taught not just the language, but also the history, culture, and politics of the region as well. I found myself discussing at length the origins of the Sunni/Shiite split in the 7th century, the rise of the Mughals in India in the 16th century, and the fall of the Ottoman Empire after WWI. This was with a 19-year-old private from Kentucky whose previous employment had been at Walmart! I doubt most Americans his age could find the Middle East on a map.

Students graduated with near-perfect scores. If you fail a class, you get sent to Afghanistan, unless you are in the Air Force, which kicks you out of the service completely.

As we feasted on hummus and other Arab delicacies, I studied the pictures on the wall describing the early history of the DLI in WWII, and realized that I knew several of the former graduates, now long gone.

The school was founded in 1941 to train Japanese Americans in their own language to gain an intelligence advantage in the Pacific war.

General 'Vinegar Joe' Stillwell said their contribution shortened the war by two years. General Douglas MacArthur believed that an army had never before gone to war with so much advanced knowledge about its enemy.

To this day, the school's motto is 'Yankee Samurai'.

My old friends at the Foreign Correspondents' Club of Japan will remember well the late Al Pinder. He spent the summer of 1941 photographing every eastern-facing beach in Japan. He? successfully smuggled the photographs out hidden in a chest full of Japanese sex toys.

He then spent the rest of the war working for the OSS in China. I know this because I shared a desk in Tokyo with Al for nearly ten years. His picture is there in all his youth, accepting the Japanese surrender in Korea with DLI graduates.

I Guess I Should Have Studied Harder

“The Fed only knows two speeds; too fast, and too slow,” said Nobel Prize-winning economist Milton Friedman to me over lunch one day.

Mad Hedge Biotech and Healthcare Letter

October 26, 2023

Fiat Lux

Featured Trade:

(A CENTURY-OLD CONTENDER)

(JNJ)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.