When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

February 22, 2024

Fiat Lux

Featured Trade:

(HOW TO GAIN AN ADVANTAGE WITH PARALLEL TRADING),

(GM), (F), (TM), (NSANY), (DDAIF), BMW (BMWYY), (VWAPY),

(PALL), (GS), (EZA), (CAT), (CMI), (KMTUY),

(KODK), (SLV), (AAPL)

OpenAI, the research lab behind groundbreaking AI models like ChatGPT and DALL-E, has unveiled a new frontier in artificial intelligence: Sora. This powerful video generation model promises to disrupt the creative industry. Its potential impact is predicted to drive substantial new investment in OpenAI, fueling further advancements in AI.

What is Sora?

Sora is a multimodal AI model capable of generating high-quality videos from simple text descriptions. This breakthrough simplifies video creation. Users will no longer need specialized equipment, editing software, or extensive technical expertise. Instead, they can use their imagination and a few lines of text to produce professional-looking video content.

Disruption Across Industries

Sora's impact is far-reaching:

- Marketing and Advertising: Marketers could generate eye-catching ads and product demos in a fraction of the time and cost it takes now.

- Film and Entertainment: Indie filmmakers and creators gain a powerful tool for generating special effects, animated sequences, and even short films, on a far more accessible budget.

- Education: Teachers and institutions could create engaging educational videos tailored to specific lessons and subjects.

OpenAI's Competitive Edge

Sora has the potential to solidify OpenAI's position as a frontrunner in the AI race. Its ease of use and versatility make it appealing to a broad user base, attracting businesses and individual creators alike. This widespread adoption could significantly boost OpenAI's influence and revenue streams.

Why Investors Are Taking Notice

Investors are drawn to disruptive technologies with the potential to transform industries. Sora fits this profile perfectly:

- Market Potential: The global video creation and editing market is vast and growing. Sora's potential to capture a significant share of this market makes it a highly attractive investment opportunity.

- Data Advantage: Training Sora requires massive amounts of video data. OpenAI's existing partnerships and data collection capabilities give it an edge in developing increasingly powerful and sophisticated models.

- AI Leadership: OpenAI is already a recognized leader in AI research. Sora's success further strengthens their reputation, making the company and its future innovations even more desirable for investors.

Conclusion

Sora's revolutionary video generation capabilities foreshadow a wave of innovative applications and use cases. This positions OpenAI to attract further substantial investment, powering even more transformative AI breakthroughs in the years to come. Investors who recognize Sora's potential stand to benefit from the coming surge in creative and technological possibilities.

Mad Hedge Technology Letter

February 21, 2024

Fiat Lux

Featured Trade:

(THE HIRING QUAGMIRE IN TECH)

(GENZ)

A slightly worrisome trend is emerging from the tech world and it has to do with the future of the American tech worker.

These employees could pose quite a conundrum to tech companies in the near future that could drastically affect the results they desire.

Something needs to change or there could be many open gaps that cannot be filled.

As the baby boomers age out of the job market and are replaced, it’s not necessarily the Millennial generation that is the big problem, it’s Gen Z.

Gen Z is more or less having a hard time committing to even an interview based on fresh data from digital recruitment sites.

As tech companies vow to make leanness mandatory, this doesn’t bode well for the volume of tech hiring for Gen Z who are in their 20s.

Remember when friends of friends could get Facebook management jobs only to sip on lattes all day at the in-house coffee bar, well, that job doesn’t exist anymore because even Facebook is ridding itself of the slack. Those jobs were mainly dominated by Millennials up until the pandemic and have vanished with the pressure of higher inflation.

No more hiring to make it look like tech companies are bigger than they are. Tech firms can’t afford it anymore.

Results matter now and the up-and-coming generation who were extremely coddled as teenagers are having a hard time coming to terms with reality.

Now Gen Z is treating their would-be employers like bad first dates and not showing up for scheduled job interviews or even their first day on the job without as much as a phone call.

Employment website Indeed found that job ghosting is rampant by Gen Z, with 75% of workers saying they’ve ignored a prospective employer in the past year.

A head-spinning 93% of Gen Zers told the global recruitment platform that they’ve flaked out of an interview.

Worse still, a staggering 87% managed to charm their way through interviews, secure the job, and sign the contract, only to leave their new boss stranded on the very first day.

Unsurprisingly, it’s having the opposite effect on businesses left high and dry: More than half of businesses surveyed have said that ghosting has made hiring a harder and costlier process.

Almost half of those surveyed said they plan on pulling a disappearing act again, with a third deeming it acceptable to do so before an interview.

However, unlike Gen Z who feel emboldened, older workers say they instantly regret it.

What’s more, while more than half of Gen Zers are repeat offenders, the researchers found that a candidate’s likelihood to ghost again decreases with age.

For many employers, Indeed’s data will finally confirm their suspicions that Gen Z has commitment issues.

Indeed found that the cost-of-living crisis has exacerbated ghosting, with around 40% of those surveyed admitting that they're more likely to ghost if they find a job offering better pay or a cheaper commute.

Tech companies are in a race against time to automate using AI, because dipping into the Gen Z talent pool could be not being able to fill staff numbers.

Even if Gen Z employees do get hired, they do tend to disappear without a trace quite quickly.

Either way, tech companies will need to find a solution for a young US workforce that isn’t Silicon Valley material.

AI is arriving at just the right time to save their bacon.

(WITH TECH TOPPY, INVESTING IN REITS NOW COULD BE REWARDING)

February 21, 2024

Hello everyone,

Five stocks – Apple, Microsoft, Nvidia, Amazon, and Meta Platforms – appear to be driving global markets. Euphoria about artificial intelligence and its potential to bolster profits have seen these stocks rally strongly in the past year.

This lack of diversification is concerning as it puts the U.S. and the world at risk. All it takes is for one or two of these names to stumble or waver, and the ramifications could be felt globally.

The party around these stocks may wind down at the end of this year.

Make sure you are diversified in your portfolio.

Is it a good time to invest in real estate?

I’m talking about REITS or direct ownership.

Inflation and interest rates have put significant pressure on several sectors – especially real estate. But if we are forecasting interest rates to decline over the next 12 months, now might be an opportune time to invest.

Commercial properties occupied by tenants such as drugstores, retailers, food outlets, and gas stations are not overly sensitive to economic conditions and can post gains even if a recession hits. One name to consider here is Realty Income. Its portfolio includes over 13,000 commercial properties with a 98.8% occupancy rate.

Kevin Brown, equity analyst at Morningstar points out that Realty Income has a triple net lease structure, which means their tenants are responsible for everything – all expenses that can be generated by the property. Furthermore, Brown says that the company is part of the S&P 500 Dividend Aristocrat index and has raised its dividend payout for 25 consecutive years. The REIT has a 5-year average dividend yield of 4.5% and is trading at around a 10% discount to net asset value – a key measure of a REIT’s value – according to FactSet data.

There is also an opportunity in data centers. There is a supply shortage now in conjunction with the severe demand spike due to AI. Data-centred focused REITs include Prologis and Equinix.

Prologis – which owns almost 800 properties globally, including several data centers – is trading at a premium of around 4% to net asset value. Equinix with 250 data centers, is trading at a premium of around 17% according to FactSet data.

As the baby boomer generation ages, we can also think about senior housing facilities. Welltower has exposure to senior housing, outpatient care facilities, and care spaces. Ventas is another REIT which has over 1,400 properties including senior housing facilities and outpatient medical buildings across the U.S., U.K., and Canada. According to FactSet Ventas is trading at a discount of around 3% to its net asset value, while Welltower is trading at a premium of around 55%.

“Personal finance is only 20% head knowledge. It’s 80% behavior!” Dave Ramsey

Happy Wednesday.

Cheers,

Jacquie

Global Market Comments

February 21, 2024

Fiat Lux

Featured Trade:

(HOW FREE ENERGY WILL POWER THE COMING ROARING TWENTIES),

(SPWR), (TSLA)

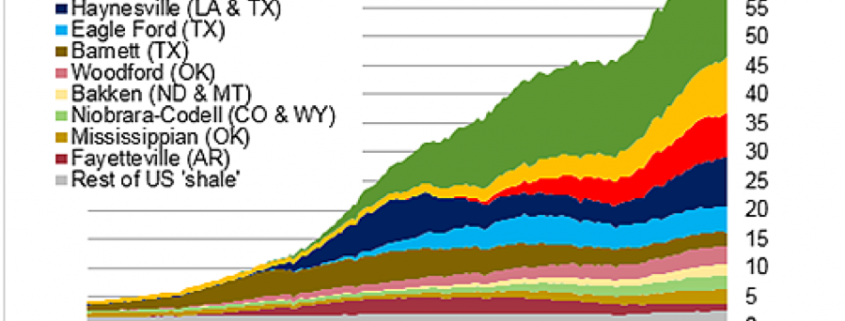

With the price of Texas tea barely scratching $78 a barrel today it is time to revisit the doomed future of this ancient energy source.

With energy stocks now trading like they’re having a going out of business sale, you have to wonder if the sector will ever come back. The short answer is short-term yes, long term no.

A key part of my argument for a new Golden Age to take place during the current Roaring Twenties is that the price of energy is effectively going to zero.

It may not actually make it to zero. I’ll settle for down 90%-95%, which is good enough for me.

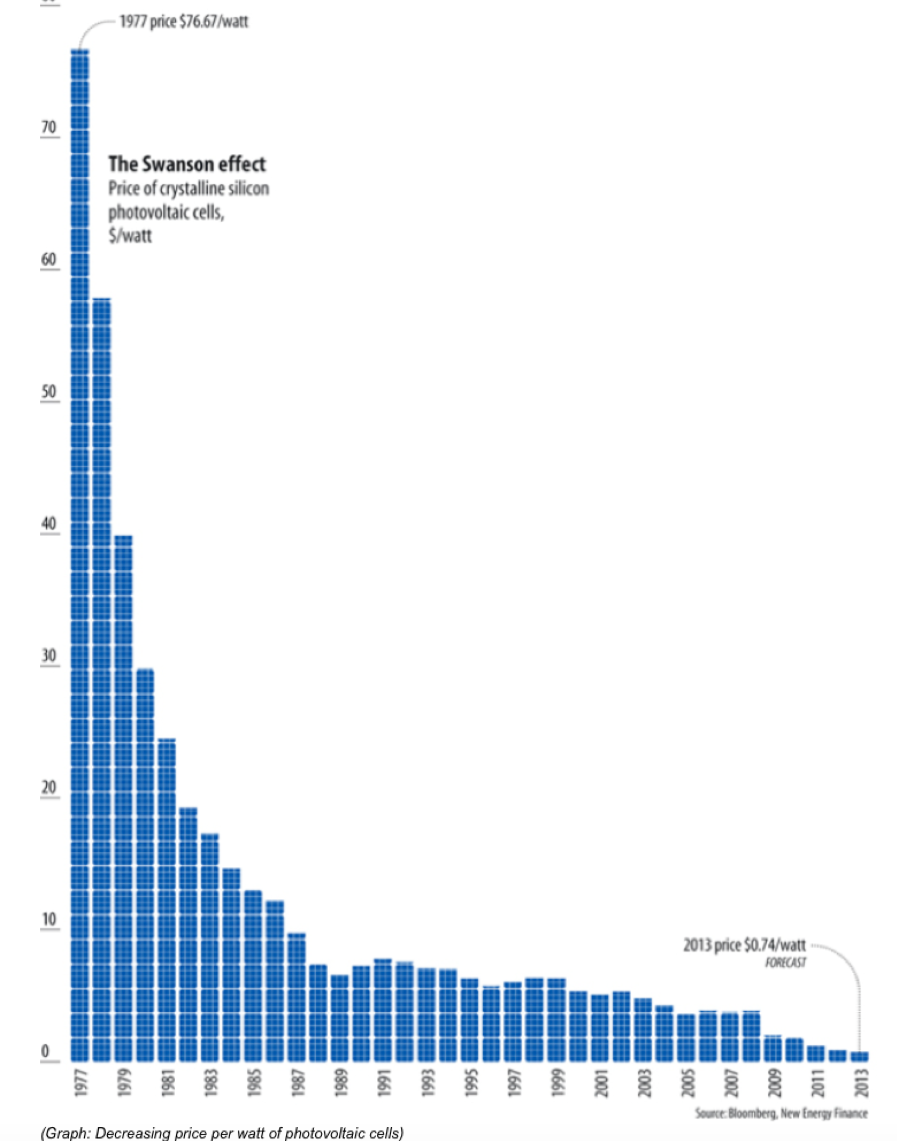

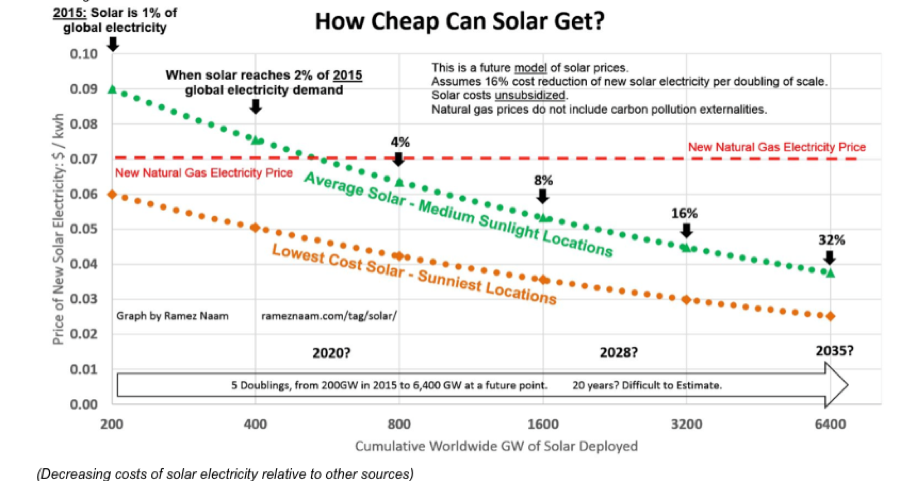

Take a look at the charts below.

The first one shows how the price of a watt of solar generated electricity has plunged by 99.03% since 1977, from $76.67 to $0.74.

Just in the past six years, retail prices for completed solar panels dropped by a staggering 80%. That is cheaper than electricity supplies generated by new natural gas plants

The potential price declines for natural gas from here are near zero. After all, it’s hard to improve on the near 100% burn rates you get with gas, and many producers are already losing money at current price levels of $1.61 per MM BTU.

Squeezing efficiencies out of our existing solar technology through improved software, production methods, chemistry, and design are nearly unlimited, are expected to drive solar costs by half down to 3 cents per kwh by 2035.

And here is the great shortcoming of all these wonderful predictions. Technology NEVER stays the same.

My own SunPower (SPWR) SPR A420 panels with their Maxeon solar cell technology deliver an efficiency of 20.1%, the best on the market available four years ago.

This means that they convert 22.5% of the solar energy they receive into electricity.

SunPower is now producing 25.1% efficiency panels in the lab. Another research lab in Germany, Fraunhofer, is getting 44.7%.

And my friends at the Defense Department tell me they have functioning solar cells delivering 70% efficiencies which they use in space. Whether they are economic and scalable is anyone’s guess.

(Warning: most cheap Chinese made solar cells have only lowly 15% efficiencies, so don’t be tricked by any great “deals”).

And this is how most long-term predictions fall short.

When I bought the system, I was warned the electricity production would fall 1% a year thanks to the natural degradation of the solar cells.

Instead, output has risen by 1% annually. Global warming is the only possibly explanation.

Not only do they assume that technology doesn’t change, they fail to account for dramatic improvements in other related fields.

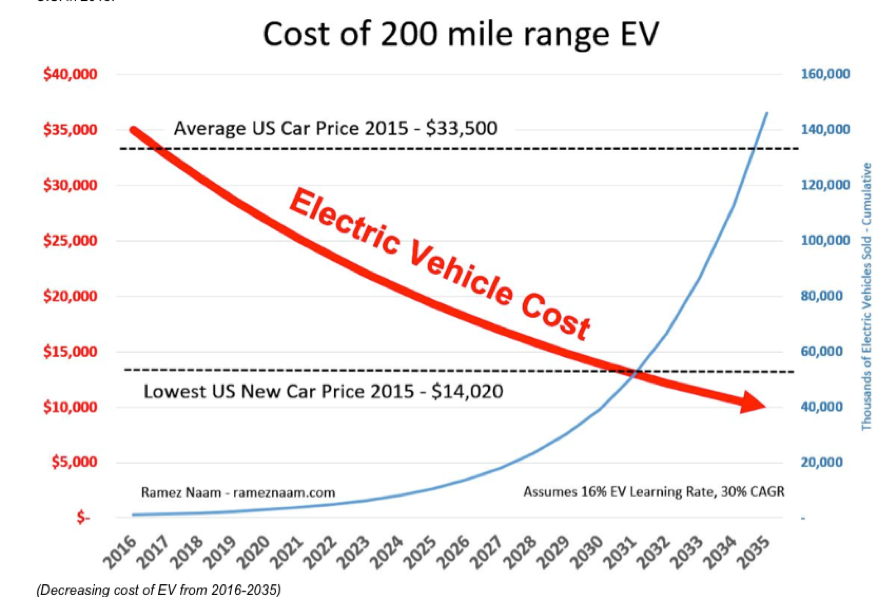

EV technology is a classic example. Battery costs are currently falling off a cliff.

When I bought the first Nissan Leaf offered for sale in California in 2010, the battery cost $833 per kilowatt. In 2012, I purchased a high-performance Tesla (TSLA) P85 Model S-1 at $353 per kilowatt.

When the Tesla 3 became available in 2017, the 60-watt battery will ran at $250 per kilowatt. Efficiencies gained through the economies of scale from the Sparks, Nevada Gigafactory took that under $100.

However, that is not the end of the story.

The car industry will start to move towards carbon fiber in five years, which has ten times the strength of steel at one-tenth the weight. The only issue now is mass production cost.

Some 67% of the weight of a Tesla S-1 is in the body, with the four motors at 13%, and the 1,200-pound lithium ion battery at 20%.

What happens when the body weight falls by 90%, to only 6.7% of total weight? The battery weight, and cost declines by two thirds. That cuts the effective cost of the battery to $66/kilowatt.

Add up all of this, and it is easy to see how energy costs can plunge by 90% or more. And it will happen must faster than you expect.

This has been the experience with memory costs, processor speeds, and hundreds of other digital technologies over the past 70 years. The cost of cotton yarn fell by 1,000 times during the 17th and 18th century, wiping out hundreds of existing industries but creating thousands more.

I could go on and on.

This is why the State of California has mandated to get 50% of its energy from alternative sources by 2030, and to ban the new sale internal combustion engines by 2035.

Some researchers believe a 100% target could be achieved. And it is doing this while closing its last remaining nuclear power plants at Diablo Canyon by 2030.

It already hit that target on several days this year when winter filled up all the dams, producing excess hydroelectric power.

As a result, the wholesale price of electricity fell to zero on those days. The grid was producing more power than could be consumed.

To say that free energy would be a game changer is a huge understatement.

The elimination of energy as a cost has enormous consequences for all companies. You can start with the energy intensive ones in transportation, steel, and aluminum, and work your way down the list.

My bet is that you won’t recognize the car industry in 10 years.

At a $66/kilowatt effective battery cost it will make absolutely no sense to build internal combustion engines in new cars.

Too bad Detroit is a decade behind in this technology.

Lose transportation, and you lose 50% of US oil consumption, or about 10 million barrels a day. Guess what that does to oil prices?

Goodbye Middle East. Go blow yourself up.

The profitability and efficiency of the entire economy will take a great leap forward, much like we saw with the mass industrialization that was first made possible by electricity during the 1920’s.

Share prices of all kinds will go ballistic.

Since energy costs will eventually fall effectively to near zero, that wipes out the present business model of the entire electric power, coal, oil, and gas industries, about 10% of US GDP.

Their business models will be reduced to trying to sell something that is free, like air.

Dow 250,000 anyone?

Goodbye Electric Power Bills

Getting Ready for the 2020’s

When asked about the urban legend that the vaults at Fort Knox are empty and that the Fed has no gold, former Federal Reserve Chairman Ben Bernanke responded, "I've been to the basement of the New York Fed. The gold is there. I've seen it."

(WHEN IT COMES TO INVESTING DIVERSIFICATION IS KEY)

February 20, 2024

Hello everyone.

The darling of the AI space reports this week. (We all know which stock that is.) And investors will watch closely to see if the frenzied rally will fizzle or fly higher. Even if Nvidia meets or beats expectations, the stock may pull back because of profit-taking.

The path forward for interest rates will also be a talking point this week as the Federal Reserve meeting minutes are also set to be released on Wednesday. The CME Fed Watch Tool reveals that markets are now pricing in only a roughly 50% chance of a quarter percentage point cut in June, based on interest rate futures trading.

There are multiple factors keeping investors on edge about equity markets. High valuations in mega-cap tech stocks, the potential for downside risk in interest rate sensitive sectors such as regional banks, geopolitical risks, and possible volatility around the U.S. election later this year. Many investors believe any of these may limit upside in the equity markets.

Isn’t diversification key here?

If you are wringing your hands about stocks, balance out your portfolio with some bonds. When you invest in the market, you must be comfortable with a certain amount of risk, but having some weight in bonds, if risk materializes out of nowhere, is going to pay if volatility rips through the stock market. With all that being said, any 5-10% pullback in stocks should be seen as an opportunity to buy back in. When rate cuts do happen, they will be fuel for small caps, which have underperformed this year. The Russell 2000 is ahead just 0.7% in 2024.

Markets are closed Monday in celebration of the President’s Day holiday.

Week ahead calendar

Monday Feb. 19, 2024

Presidents Day Holiday

Australia RBA Meeting Minutes

Previous: N/A

Time: 7:30 pm ET

Tuesday, February 20, 2024

10 a.m. Leading Indicators (January)

Canada Inflation Rate

Previous: 3.4%

Time: 8:30 am ET

Earnings: Public Storage, Palo Alto Networks, Diamondback Energy, Caesars Entertainment, Walmart, Home Depot.

Wednesday Feb. 21, 2024

2 p.m. FOMC Minutes

Earnings: Nvidia, Marathon Oil, Etsy, Analog Devices, Exelon.

Thursday Feb. 22, 2024

8:30 a.m. Chicago Fed National Activity Index (January)

8:30 a.m. Continuing Jobless Claims (02/10)

8:30 a.m. Initial Claims (02/17)

9:45 a.m. PMI Composite preliminary (February)

9:45 a.m. S&P PMI Manufacturing preliminary (February)

9:45 a.m. S&P PMI Services preliminary (February)

10 a.m. Existing Homes Sales (January)

Earnings: Booking Holdings, Live Nation Entertainment, Intuit, Edison International, Dominion Energy, Moderna, PG&E, Keurig Dr. Pepper

Friday, Feb. 23, 2024

Euro Area Business Climate (DE)

Previous: 85.2

Time: 4:00 am ET

Earnings: Warner Bros, Discovery

REVIEW

S&P500

The S&P is playing cat and mouse with the 5,000 level – now considered a Big Number, a sort of psychological resistance, which may continue for a while yet. Any sustained break above the 5,048 high of February 12th signals the resumption of Uptrend.

Support lies at 4,920, 4,850/4,820.

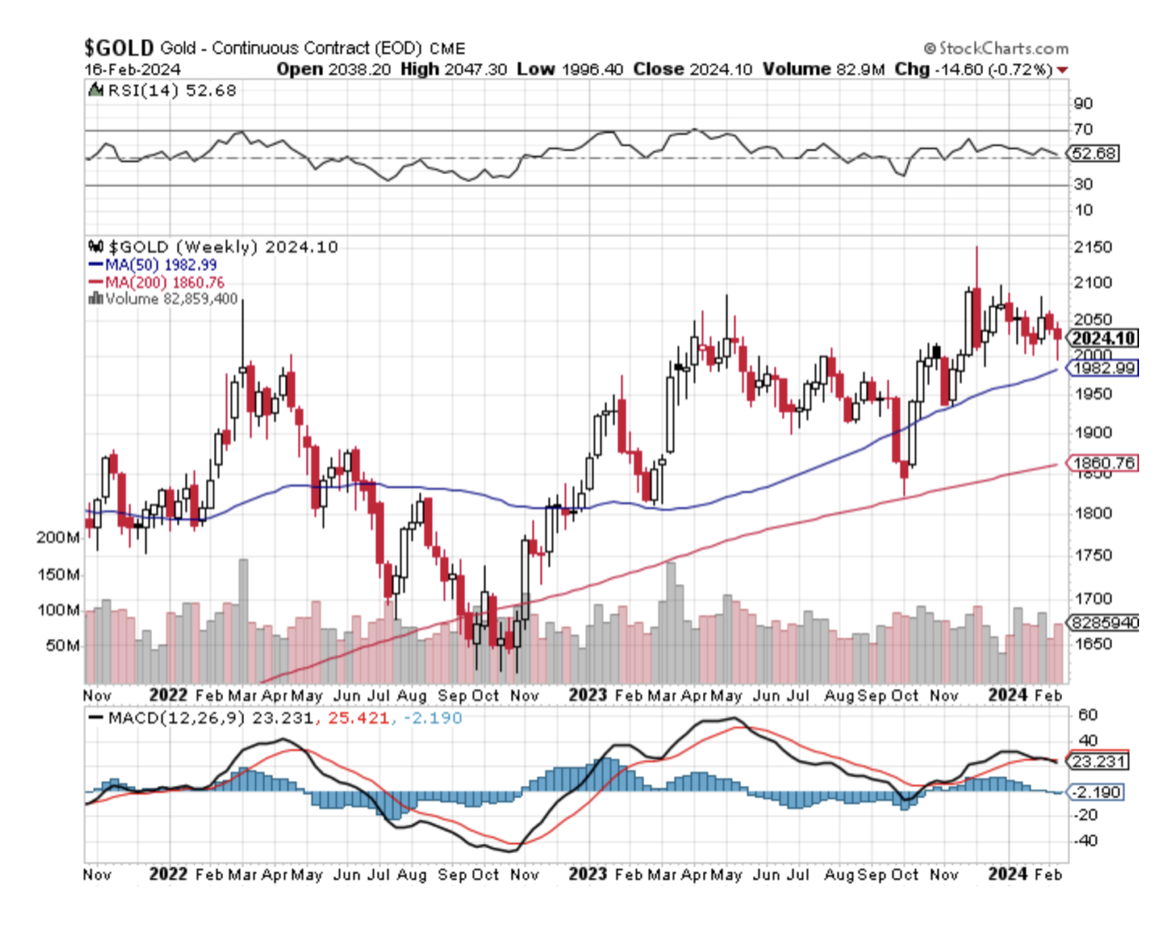

GOLD

Gold has been undergoing a broad corrective consolidation, which may be morphing into a larger Symmetrical Triangle pattern. On every pullback, keep accumulating small parcels in gold/silver stocks – average in.

BITCOIN

Uptrend in progress. Using Elliott Wave analysis, Bitcoin is interpreted to be advancing toward its next target around $57,000.

The Bigger Picture remains bullish with the potential to advance toward Key $69,000 resistance and beyond.

Ethereum also presents a bullish picture.

Something to keep in mind…

When investing in equities it pays for individual investors to be long-term investors as opposed to traders.

Cheers

Jacquie

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.