When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Biotech and Healthcare Letter

April 30, 2024

Fiat Lux

Featured Trade:

(HITTING CTRL+ALT+DELETE ON DRUG R&D)

(DNA), (GOOGL), (JNJ), (ILMN), (JNJ), (ALTO), (GROIV)

Forget your classic biotech launch story. One of 2024's most lavishly funded biotech upstarts is taking a massively ambitious swing at reinventing the entire drug development process.

I'm talking AI, venture billions, and some serious star power all rolled into one wild capital extravaganza.

The company behind this cash-flushed disruption bid is Xaira Therapeutics. And they've snagged a bona fide heavy hitter as CEO — Marc Tessier-Lavigne, the ex-president of Stanford and former chief science officer at Genentech (DNA).

His mandate is simple: turn Xaira's billion-dollar AI vision into cold, hard, realized potential.

Tessier-Lavigne is a true believer when it comes to AI's potential for transforming every clunky, painfully inefficient step of conventional drug R&D. We're not just talking incremental improvements here.

The man thinks smart deployment of generative AI could legitimately deliver "two- or three-fold" increases in both speed AND success rates across the entire confounding slog of getting new medicines approved.

That's one heckuva rallying cry.

But Tessier-Lavigne has legitimate grievances with the antiquated status quo. We all know the drug development game is brutal.

By most credible estimates, only about 1 in 10 drug candidates that make it to human trials ever get approved for use. Attrition rates are staggering, even before reaching those do-or-die clinical trials – that's money, research hours, and hope down the drain.

Xaira plans to flip that script. Their pitch: AI is their ace in the hole.

We're talking about designing entirely new drugs from scratch, pinpointing disease targets faster than ever, and finally cutting those mammoth clinical trials down to size. Think of it as the entire process of getting a machine learning upgrade.

And they're not starting from zero. Xaira tapped into the brains behind groundbreaking protein science: biochemist and computational biologist David Baker's team at the University of Washington. These are the geniuses who revolutionized protein structure prediction, and several of their top scientists are now on Xaira's payroll.

For the key task of AI-driven lead design, Xaira is leaning heavily on the advanced protein modeling systems developed in David Baker's acclaimed lab at the University of Washington.

To actually design the new candidate drug molecules, Xaira is deploying advanced AI systems developed in Baker's lab. We're talking cutting-edge tech like RFdiffusion and RFantibody.

These use similar "diffusion" AI architectures that power viral image generators like DALL-E, except instead of churning out weird digital art, they generate brand-new protein structures from scratch.

On the biology side, Xaira has assembled specialist teams from genomics titan Illumina (ILMN) and proteomics upstart Interline Therapeutics. The goal is to use AI to decipher complex disease mechanisms on a molecular level at an unprecedented scale and quality.

As for the money side, Xaira's co-founders are a duo of biopharma's biggest VC shot-callers: Bob Nelsen from ARCH Venture Partners and Vik Bajaj, who leads the investment crew over at Foresite Capital's in-house incubator.

The rest of Xaira's bulging investor list reads like a who's who of the VC world's heaviest hitters from coast to coast.

But let's get one thing straight: deploying AI for drug discovery itself isn't new. Investors have poured hundreds of millions into previous AI-oriented biotech upstarts with remarkably little tangible progress to show for it so far.

That’s why plenty of scientists remain deeply skeptical about the real-world viability of using in silico methods to design brand-new proteins capable of becoming actual medicines.

But Xaira's leaders are taking an unmistakably bullish stance. As Tessier-Lavigne brazenly stated, "We believe the technology is ready for making therapeutics today. And it's only going to get better and better going forward." Shots fired.

And this startup isn't just flexing impressive scientific ambition and bravado, either.

Xaira's boardroom and executive lineup is stacked with certified rockstars spanning the lofty peaks of biopharma's regulatory, academic, and corporate pillars.

The company's board alone includes former FDA head Scott Gottlieb, Stanford chemist Carolyn Bertozzi (you know, the Nobel laureate), and even ex-Johnson & Johnson (JNJ) CEO Alex Gorsky.

Clearly, this isn't some penny-ante upstart's advisory council.

Speaking of going big, let's talk about Xaira's huge VC funding for a minute. Their over $1 billion haul puts them in a seriously elite company among the top five largest VC-backed biopharma raises of all time.

We're talking the same rarified air as anti-aging disruption play Altos Labs (ALTO) and Roivant Sciences' (ROIV) $1.1 billion mega round from 2017.

That's an outrageously rich launch valuation for an upstart AI biotech without a single disclosed pipeline product. But it reflects the blazing hot enthusiasm and optimism around applying machine learning to overcoming drug development's biggest bottlenecks and inefficiencies.

In that vein, Xaira's most direct competition comes from other prominent AI drug trailblazers like Alphabet's (GOOGL) Isomorphic Labs and Flagship Pioneering's Generate Biomedicines.

All three of these hyper-funded disruptors are in a race to develop superior AI systems for accurately modeling protein structures or generating wholly new proteins from digital representations.

Of course, Xaira's monster ambitions will ultimately live or die based on tangible results and clinical execution over the long haul.

Love it or hate it, though, the great AI-powered biopharma upheaval is officially underway thanks to Xaira's monster VC haul. Whether the company can truly live up to its gargantuan hype and disruption premise, well, that multi-billion dollar enigma should start getting some added clarity in the not-too-distant future.

Let's see if these self-professed drug R&D revolutionaries have the disruptive chops to put their lofty money where their mouths are.

Global Market Comments

April 30, 2024

Fiat Lux

Featured Trade:

(MAY 8 GALAPAGOS ISLANDS STRATEGY LUNCHEON)

SPECIAL AMAZON ISSUE

(WHY I’M LOOKING AT AMAZON), (AMZN)

Come join me for lunch for my Global Strategy Luncheon, which I will be conducting in the Galapagos Islands at 12:00 PM on Friday, May 8, 2024. A three-course lunch is included.

I’ll be giving you my up-to-date view on stocks, bonds, currencies commodities, precious metals, and real estate.

And to keep you in suspense, I’ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $279.

The Galapagos Islands are 600 miles west of South America in the middle of the Pacific Ocean and are a possession of Ecuador. It is one of the most remote places in the world.

The lunch will be held in the only city on the islands of San Cristobal. The Galapagos Islands are where Charles Darwin developed his Theory of Evolution back in 1835 courtesy of the HMS Beagle. The islands are overrun with marine iguanas (Amblyrhnchus Cristatus).

I’ll be arriving early and leaving late in case anyone wants to have a one-on-one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at an exclusive hotel in San Cristobal, the details of which will be emailed to you.

I look forward to meeting you, and thank you for supporting my research.

To purchase tickets for this luncheon, please click here.

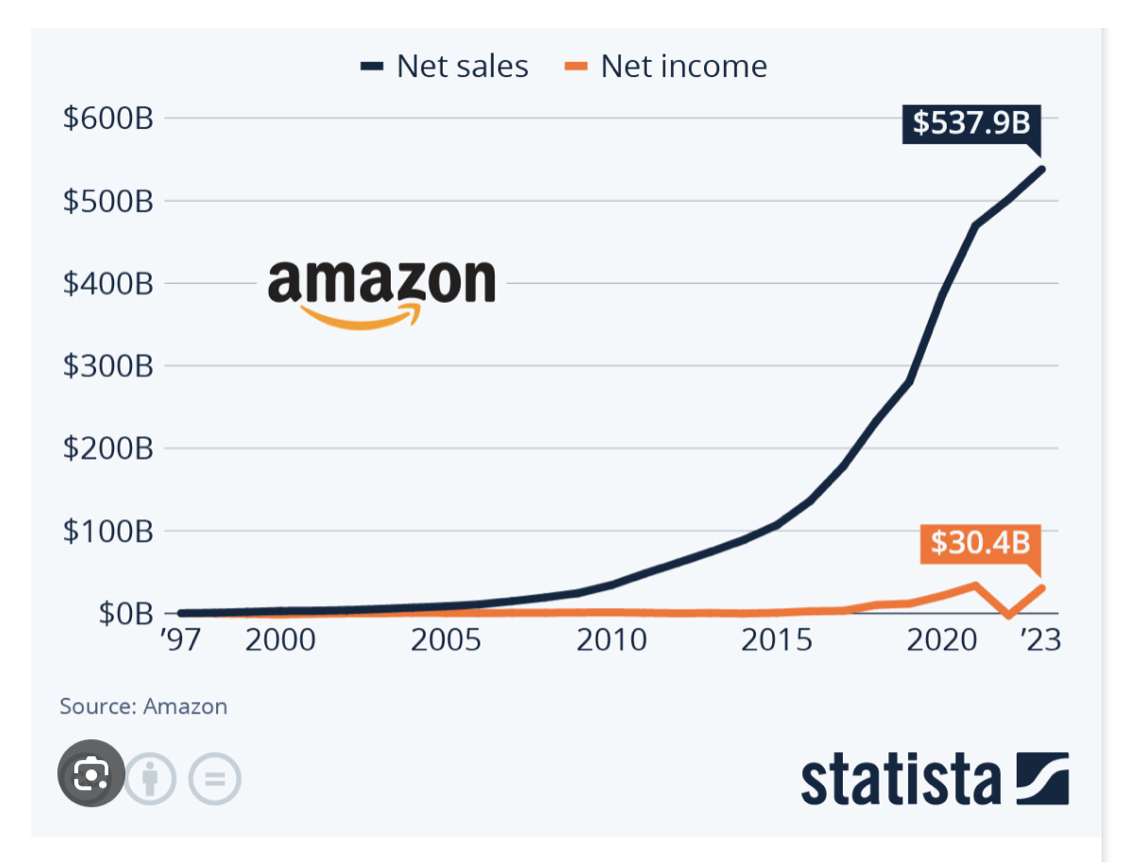

At the beginning of 2023, Amazon was universally despised. It shares having dropped by more than half during 2022, the company was believed to be hobbled by rising competition, an out-of-date business model, and an imminent antitrust suit.

What a difference 16 months makes.

I believe there is a good chance that this creation of Jeff Bezos will see its shares double from here over the next five years. If the antitrust suit succeeds it will double again.

Amazon, is in effect, taking over the world.

Jeff Bezos, born Jeff Jorgensen, is the son of an itinerant alcoholic circus clown and a low-level secretary in Albuquerque, New Mexico. When he was three, his father abandoned the family. His mother remarried a Cuban refugee, Miguel Bezos, who eventually became a chemical engineer for Exxon.

I have known Jeff Bezos for so long that he had hair when we first met in the 1980s. Not much though, even in those early days. He was a quantitative researcher in the bond department at Morgan Stanley, and I was the head of international trading.

Bezos was then recruited by the cutting-edge quantitative hedge fund, D.E. Shaw, which was making fortunes at the time, but nobody knew how. When I heard in 1994 that he left his certain success there to start an online bookstore, I thought he’d suffered a nervous breakdown, common in our industry.

Bezos incorporated his company in Washington state later that year, initially calling it “Cadabra” and then “Relentess.com.” He finally chose “Amazon” as the first interesting word that appeared in the dictionary, suggesting a river of endless supply. When I learned that Bezos would call his start-up “Amazon,” I thought he’d gone completely nuts.

Bezos funded his start-up with a $300,000 investment from his parents who he promised stood a 50% chance of losing their entire investment. But then his parents had already spent a lifetime running Bezos through a series of programs for gifted children, so they had the necessary confidence.

It was a classic garage start-up with three employees based in scenic Bellevue, Washington. The hours were long with all of the initial effort going into programming the initial site. To save money, Bezos bought second-hand pine doors, which he placed on sawhorses for desks.

Bezos initially considered 20 different industries to disrupt, including CDs and computer software. He quickly concluded that books were the ripest for disruption, as they were cheap, globally traded, and offered millions of titles.

When Amazon.com was finally launched in 1995, the day was spent fixing software bugs on the site, and the night wrapping and shipping the 50 or so orders a day. Growth was hyperbolic from the get-go, with sales reaching $20,000 a week by the end of the second month.

An early problem was obtaining supplies of books when wholesalers refused to offer him credit or deliver books on time. Eventually, he would ask suppliers to keep a copy of every book in existence at their own expense, which could ship within 24 hours.

When I bought my first Amazon book, I think it was HG Wells’ A Short History of the World, the operation was so dubious that I paid with a low-limit credit card. I figured that if the wheels fell off I’d only lose $500.

Venture capital rounds followed, eventually raising $200 million. Early participants all became billionaires, gaining returns of 10,000-fold or more, including his trusting parents. I know one guy who missed out on becoming a billionaire because he only checked his voicemail occasionally, missing the opportunity to subscribe to the (AMZN) IPO.

Bezos put the money to work, launching into a hiring binge of epic proportions. “Send us your freaks,” Bezos told the recruiting agencies, looking for the tattooed and the heavily pierced who were willing to work in shipping late at night for low wages. Keeping costs at rock bottom was always an essential part of the Amazon formula.

Bezos used his new capital to raid Wal-Mart (WMT) for its senior distribution staff, for which it was later sued.

Amazon rode on the coattails of the Dotcom Boom to go public on NASDAQ on May 15, 1997, at $18 a share. The shares quickly rocketed to an astonishing $105, and in 1999 Jeff Bezos became Time magazine’s “Man of the Year.”

Unfortunately, the company committed many of the mistakes common to inexperienced managements with too much cash on their hands. It blew $200 million on acquisitions that, for the most part, failed. Those include such losers as Pets.com and Drugstore.com. But Bezos’s philosophy has always been to try everything and fail them quickly, thus enabling Amazon to evolve 100 times faster than any other company.

Amazon went into the Dotcom crash with tons of money on its hands, thus enabling it to survive the long funding drought that followed. Thousands of other competitors failed. Amazon shares plunged to $5.

But the company kept on making money. Sales soared by 50% a month, eventually topping $1 billion by 2001. The media noticed Wall Street took note. The company moved from the garage to a warehouse to a decrepit office building in downtown Seattle.

Amazon moved beyond books to compact disc sales in 1999. Electronics and toys followed. At its New York toy announcement, Bezos realized that the company actually had no toys on hand. So, he ordered an employee to max out his credit card cleaning out the local Hammacher Schlemmer just to obtain some convincing props.

A pattern emerged. As Bezos entered a new industry, he originally offered to run the online commerce for the leading firm. This happened with Circuit City, Borders, and Toys “R” Us. The firms then offered to take over Amazon, but Bezos wasn’t selling.

In the end, Amazon came to dominate every field it entered. Please note that all three of the abovementioned firms no longer exist, thanks to extreme price competition from Amazon.

Amazon had a great subsidy in the early years as it did not charge state sales tax. As of 2011, it only charged sales tax in five states. That game is now over, with Amazon now collecting sales taxes in all 45 states that have them.

Amazon Web Services originally started out to manage the firm’s own website. It has since grown into a major profit center, with a monster $24.2 billion earned in 2024 Q4 alone. Full disclosure: Mad Hedge Fund Trader is a customer.

Amazon entered the hardware business with the launch of its e-reader Kindle in 2007, which sold $5 billion worth in its first year. The Amazon Echo smart speaker followed in 2015 and boasts a 71.9% market share. This is despite news stories that it records family conversations and randomly laughs.

Amazon Studios started in 2010, run by a former Disney executive, pumping out a series of high-grade film productions. In 2017 it became the first streaming studio to win an Oscar with Manchester by the Sea with Jeff Bezos visibly in the audience at the Hollywood awards ceremony.

Its acquisitions policy also became much more astute, picking up audiobook company Audible.com, shoe seller Zappos, Whole Foods, and PillPack. Since its inception, Amazon has purchased more than 115 outside companies, the most recent being the AWS firm Fig.

Sometimes, Amazon’s acquisition tactics are so predatory they would make John D. Rockefeller blush. It decided to get into the discount diaper business in 2010, and offered to buy Diapers.com, which was doing business under the name of “Quidsi.” The company refused, so Amazon began offering its own diapers for sale 30% cheaper for a loss. Diapers.com was driven to the wall and caved, selling out for $545 million. Diaper prices then popped back up to their original level.

Welcome to online commerce.

At the end of 2021, Amazon boasted some 1.6 million employees worldwide. In fact, it has been the largest single job creator in the United States for the past decade. Also, this year it disclosed the number of Amazon Prime members at 230 million, then raised the price from $120 to $139, thus creating an instant $4.37 billion in annual profit.

The company’s ability to instantly create profit like this is breathtaking. And this will make you cry. In 2023, Amazon made $3 billion from Amazon gift cards left unredeemed! Cleaning out my desk the other day I found $200 worth.

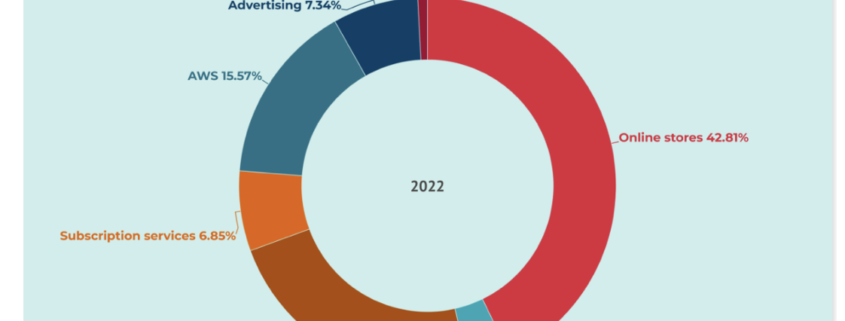

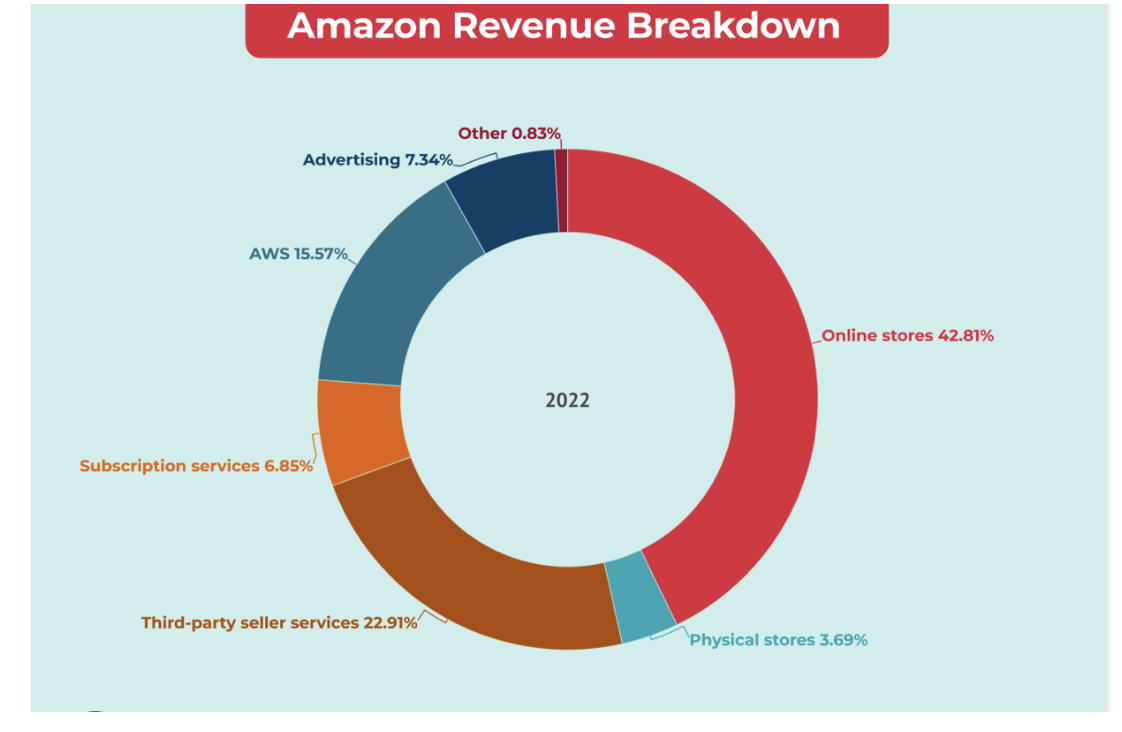

Amazon's annual revenue for 2023 is an eye-popping $574.785 billion, an 11.83% increase from 2022. It is currently capturing about 50% of all new online sales.

So, what’s on the menu for Amazon? There is a lot of new ground to pioneer.

Harvard-educated Andy Jassy took over as CEO of Amazon in July of 2021. Since then the shares have been unchanged but did recover a big drawdown. Jassy has since launched a ferocious cost-cutting program that has had an exponential effect on Amazon's profits.

That freed Bezos up to sell $8 billion worth of (AMZN) shares, dump his wife, date Hollywood movie stars, and fly into space on his own Blue Origin rocket as you would expect the richest man in the world today.

1) Health Care is the big one, accounting for $3 trillion, or 17% of U.S. GDP, but where Amazon has just scratched the surface. Its recent $1 billion purchase of PillPack signals a new focus on the area. Who knows? The hyper-competition Bezos always brings to a new market would solve the American healthcare crisis, which is largely cost-driven. Bezos can oust middlemen like no one else.

2) Food is the great untouched market for online commerce, which accounts for 20% of total U.S. retail spending, but sees only 2% take place online. Essentially this is a distribution problem, and you have to accomplish this within the prevailing subterranean 1% profit margins in the industry. Books don’t need to be frozen or shipped fresh. Wal-Mart (WMT) will be targeted as No. 1, which currently gets 56% of its sales from groceries. Amazon took a leap up the learning curve with its $13.7 billion purchase of Whole Foods (WFC) in 2017. What will follow will be interesting.

3) Banking is another ripe area for “Amazonification,” where excessive fees are rampant. It would be easy for the company to accelerate the process by buying a major bank that already had licenses in all 50 states. Amazon is already working on the credit card angle.

4) Overnight Delivery is natural, as Amazon is already the largest shipper in the U.S., sending out more than 1 million packages a day. The company has a nascent effort here, already acquiring several aircraft to cover its most heavily trafficked routes. Expect FedEx (FDX), UPS (UPS), DHL, and the United States Post Office to get severely disrupted.

5) Amazon is about to surpass Wal-Mart this year as the largest clothing retailer. The company has already launched 30 private labels, with half of them in the fashion area, such as Clifton Heritage (color and printed shirts), Buttoned Down (100% cotton shirts), and Goodthreads (casual shirts) as well as subscription services for all of the above.

6) Furniture is currently the fastest-growing category at Amazon. Customers can use an Amazon tool to design virtual rooms to see where new items and colors will fit best.

7) Event Ticketing firms like StubHub and Ticketmaster are among the most despised companies in the U.S., so they are great disruption candidates. Amazon has already started in the U.K., and a takeover of one of the above would ease its entry into the U.S.

8) Artificial Intelligence Amazon has a record of every mouse click of everything you bought for the past 25 years or even thought about buying. It has never deleted anything. In a world of rapidly accelerating AI, this is immensely valuable information. Amazon was making advances in AI when was just a term from science fiction for the rest of us. As with Tesla, this data is worth more than the company. That alone could double the value of the company.

If only SOME of these new business ventures succeed, they have the potential to DOUBLE Amazon’s shares from current levels, taking its market capitalization up from the present $1.86 trillion.

Perhaps this explains why institutional investors continue to pour into the shares, despite being up a torrid 155% from the 2023 lows.

Whatever happened to Bezos’s real father, Ted Jorgensen? He was discovered by an enterprising journalist in 2012 running a bicycle shop in Glendale, Arizona. He had long ago sobered up and remarried. He had no idea who Jeff Bezos was. Ted Jorgensen died in 2015. Bezos never took the time to meet him. Too busy running Amazon, I guess. I guess the richest man in the world had better things to do.

Artificial Intelligence (AI) has transitioned from a buzzword to a bottom-line driver for the world's largest tech companies. Recent earnings reports from industry giants like Google (Alphabet), Microsoft, Amazon, and Meta (Facebook) underscore the immense and multifaceted impact AI is having on everything from revenue streams to growth strategies. The AI revolution is still in its early stages, but it's clear that those who master this technology stand to reap tremendous rewards while those left behind might face stagnation or decline.

The Cloud AI Powerhouse: Microsoft & Google

Microsoft and Google (Alphabet) have emerged as clear leaders in leveraging AI to bolster their cloud computing divisions. Microsoft's Azure cloud platform has seen impressive growth, driven in large part by the integration of powerful AI tools and services. Azure's cognitive services, which provide capabilities like natural language processing and computer vision, are a major attraction for enterprise customers. This AI-powered cloud strategy delivered strong earnings for Microsoft in recent quarters, and analysts predict this trend to continue.

Similarly, Google Cloud has made significant strides thanks to its AI prowess. Google's deep expertise in AI research, stemming from its renowned Google AI division, translates directly into cutting-edge cloud offerings. The company is aggressively developing custom AI chips like TPUs (Tensor Processing Units) to further optimize its cloud infrastructure for AI workloads. Google is also heavily focused on its generative AI efforts, particularly its language model "Gemini". Analysts believe this blend of AI research and cloud deployment positions Google favorably for long-term success.

Amazon's AI Infusion: E-commerce, Logistics, and Beyond

Amazon, the reigning king of e-commerce, has a long history of utilizing AI to optimize its operations. From recommendation engines that personalize shopping experiences to warehouse robots that streamline fulfillment, AI is woven into Amazon's DNA. The company's massive cloud platform, Amazon Web Services (AWS), also boasts a comprehensive suite of AI tools. Customers utilize these tools for everything from forecasting demand to detecting fraud.

While the growth of Amazon's retail business has begun to decelerate, investments in AI could drive new revenue sources for the company. The continued focus on AI optimization within their logistics operations promises to increase efficiency and reduce costs. Further, Amazon is looking towards innovative uses of AI in areas like healthcare and physical retail, where AI-powered solutions could create significant opportunities.

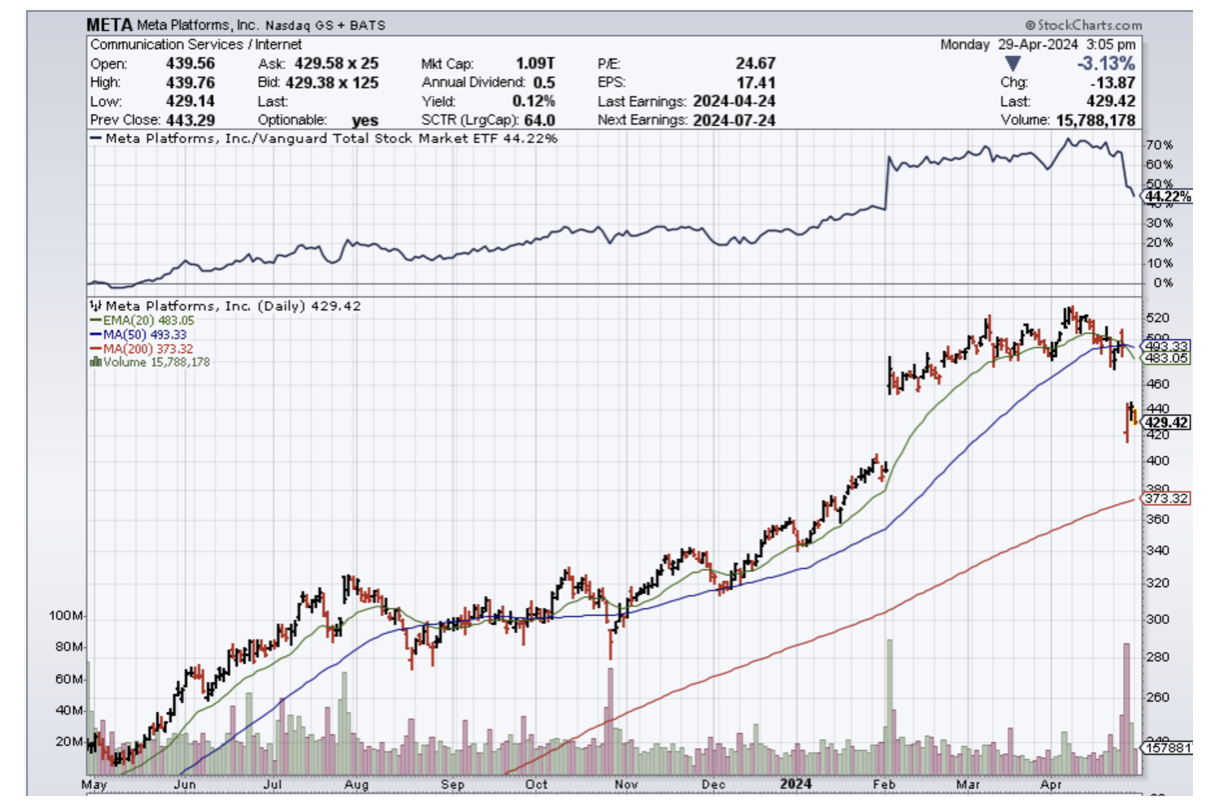

Meta's High-Stakes AI Gamble

Meta (Facebook) stands out as an example of the risks and rewards inherent in massive AI investments. The company has staked a substantial portion of its future on its vision of the metaverse, a virtual world powered by AI and augmented reality. Meta's aggressive spending on AI research and infrastructure has alarmed some investors, but the company is convinced this is a necessary step to maintain its dominance in social media and seize new opportunities in emerging immersive technologies.

Early results on Meta's AI bet are mixed. The company's Reality Labs division, responsible for metaverse development, continues to hemorrhage money. However, there are glimpses of promise in Meta's work on large language models and their application to content recommendation. AI-driven improvements in ad targeting could also boost Meta's core advertising business in the near term. Ultimately, Meta's success will hinge heavily upon its ability to generate a tangible return on its immense AI investment.

The Generative AI Revolution

The explosion of interest surrounding generative AI tools like ChatGPT and DALL-E has sent shockwaves through the tech industry. While still in their nascent stage, the potential applications of this technology are vast. Big Tech companies are scrambling to integrate generative AI capabilities into their existing products and develop entirely new offerings.

Microsoft has been notably aggressive with its strategic investment in OpenAI, the creator of ChatGPT and DALL-E. The company is infusing OpenAI's technology across its product suite, including the Bing search engine, Office productivity tools, and Azure cloud platform. Google is acutely aware of the threat posed by this new generation of AI technology to its search business. The company is countering with its own internal efforts like "Gemini" as well as investments in competing generative AI startups.

Mad Hedge Technology Letter

April 29, 2024

Fiat Lux

Featured Trade:

(JUST GOOD ENOUGH)

(META), (F), (IBM), (MSFT)

This earnings season is chugging along exactly like I thought it would play out.

The haves are covering for the have-nots.

Sadly, the pixie dust isn’t encompassing all tech stocks, but just enough sprinkles so investors don’t start selling.

That is what matters most and sure, investors can knit-pick all they want, but there have been just enough positive numbers to be repackaged as a win for AI and the advancement of tech even if the proverbial goalposts are widening.

Competition has reared its ugly head as tech services fight for the extra consumer and enterprise dollar in a global economy where demand is being squeezed by sticky inflation.

That’s not good news for many of the smaller companies that are unproven and tap debt by delivering a promising story to prospective investors.

Remember that Mr. Market is undefeated and price will always find its natural equilibrium.

The question is how long will it take to find that natural equilibrium?

Since 2020, many would say that the irresponsible monetary policy in many areas of the world has contributed to markets unable to match up buyers and sellers at a reasonable price.

There is some truth to that but let’s see who that benefits.

My belief is that strong tech companies have overly benefited from this type of fiscal backdrop because they can always fall back on a strong balance sheet like in Google’s case where it suddenly issued a dividend.

View it as a rainy day fund if you will where they can wield when need be.

The extra buffer zone of safety has allowed a company like Microsoft to focus on Azure growth, of which 7% was related to AI, up from 6% of impact in the previous quarter.

Microsoft provides cloud services for the ChatGPT chatbot from startup OpenAI, and companies have been increasingly adopting Azure AI services to develop their capabilities for summarizing information and writing documents.

It’s a good problem to have when capacity bottleneck cuts into the AI portion of Azure growth.

Companies tapping that AI story are the only tech companies in 2024 that Mr. Market is keeping safe and that must scare or enthrall you depending on who you are.

Meta (META) materially lifted its full-year capital expenditures guidance and signaled even bigger spending in 2025 — all because of unknown AI projects. Running tech businesses isn’t getting cheaper so imagine how small companies feel about that.

It’s Ford (F) losing lots of money on EVs because of higher-than-expected costs.

Meanwhile, IBM (IBM) CFO Jim Kavanaugh struck a more cautious note when asked about soft sales at its lucrative consulting business blaming the macroeconomic backdrop.

It’s not all smooth sailing in tech land and readers need to be vigilant.

It’s not the time to take some speculative Hail Mary on some far reach.

Don’t draft a 7th-round prospect in the 1st round.

Price action has been unkind to tech firms with poor balance sheets in 2024 and I believe that trend to continue until the Fed can finally tamper inflation back to reasonable levels.

“The future doesn't belong to the fainthearted; it belongs to the brave.” – Said Former US President Ronald Reagan

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.