When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

November 4, 2024

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD or TRADING ONE UNCERTAINTY FOR ANOTHER plus RECOLLECTIONS OF A MARINE),

(NVDA), (DHI), (LEN), (KBH), (PHM), (TOL), (JPM)

Here I am holed up in a mountaintop retreat.

I have six months of canned food, one month of water, and a year supply of ammo. There is an AR-15 and 12 gauge shotgun at the front door. There is a 45 caliber Colt Peacemaker and a Browning 45 at the backdoor. I sleep with a 9mm Glock 17 under my pillow and a baseball bat next to the bed. There are empty tin cans strung from the shrubbery to sound the alarm for any unexpected intruders.

Let the election begin!

Actually, I think the big surprise will be how little violence takes place. The violence threatened by one political party will fail to show. It was all talk, no substance, and just one big con. That alone should be worth a thousand-point rally in the Dow Average.

Of course, the passing of the election isn’t going to end the uncertainty for the stock market. All we are really doing is trading one kind of uncertainty for another. If Harris wins, will she be able to govern from the middle and how much will she be able to keep her party’s left wing at bay?

If Trump is elected, how many of his threats will be carried out, or was it all just talk? And how much will the courts allow him to carry out extreme policies? Then, there is the issue of who has control of the House and the Senate.

It will all add up to increased market volatility, which I love as a trader. Volatile markets yield much higher returns.

Buy this year’s winners and sell the losers. That is what every professional money manager will be doing on Wednesday morning. They want to window dress their holdings for yearend and harvest tax losses, mostly in energy. That makes the post-election rally really very easy to play.

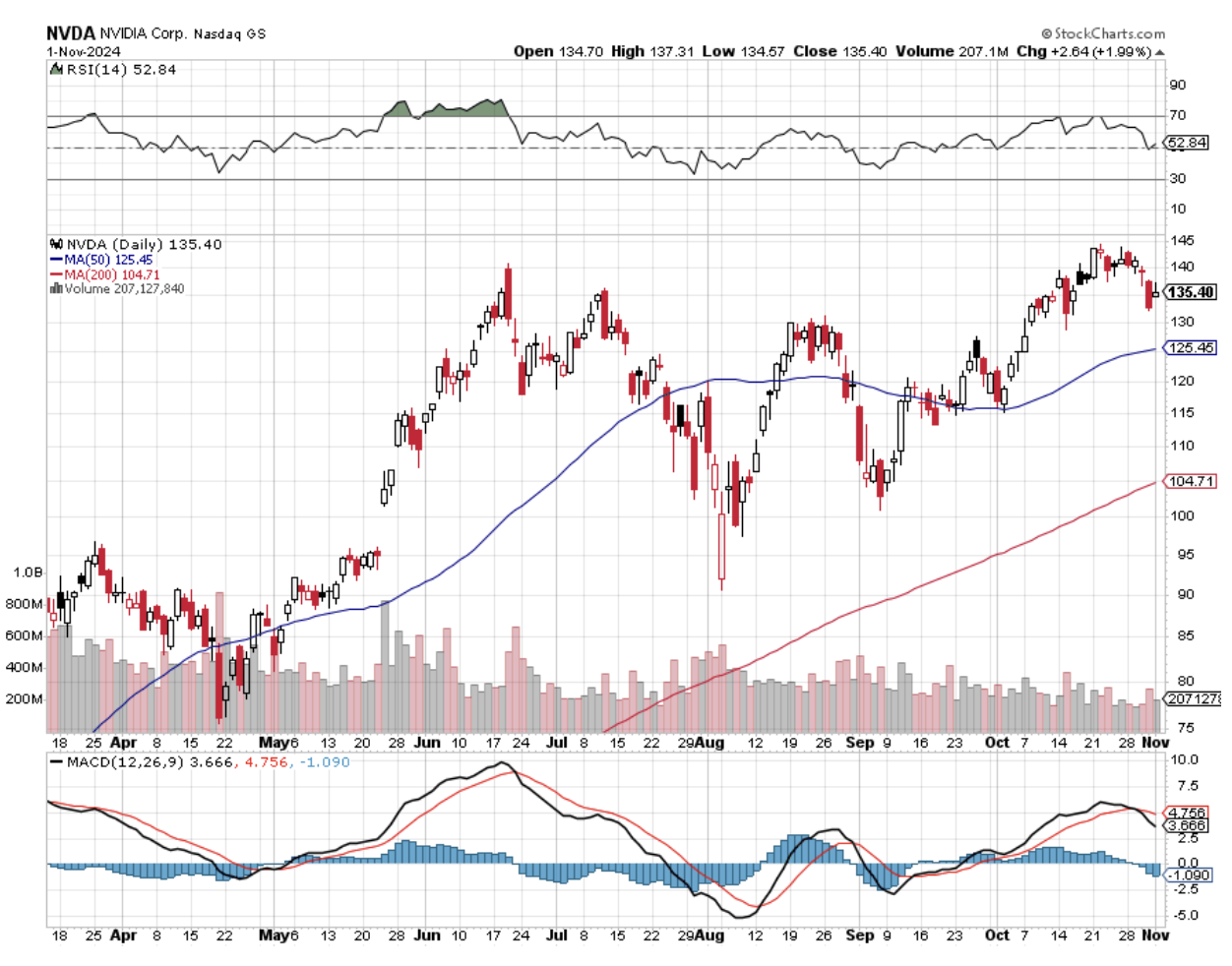

In one of the most curious market timings in history, Dow Jones announced that it is adding Nvidia (NVDA) to their 30-strong stock market average on Friday, November 8, just three days after the presidential election, and possibly when the outcome is not yet known.

The Dow Jones Industrial Average was the only major US equity benchmark that didn't hold Nvidia. Intel (INTC) will be taken out to the woodshed, which just announced a massive $16 billion loss and has shrunk to a mere $100 billion in market cap. (INTC) is a mere shadow of its former self with a caricature of a CEO.

The normal reaction by the market is a 5-10% pop in the new Dow entrants and a similar 5-10% decline in the shares of the banished company. This is good news for followers of the Mad Hedge Fund Trader because virtually everyone now has (NVDA) as their largest holding, either by selection or capital appreciation.

The 19th century Dow has been playing catchup in gaining exposure to the largest technology companies. The Dow became 30 stocks in 1928. The DJIA was originally created by Charles Dow in 1896 and contained just 12 stocks. The number of stocks in the DJIA increased to 20 in 1916.

The move will increase the volatility of the Dow by adding a stock that is up 170% this year while removing one that has fallen 50%. It will lead to higher highs and then lower lows. Remember, (NVDA) fell 40% in July. It also continues to technology drift of the Dow to keep up with its main competitor, NASDAQ. The last company to join the Dow was Amazon.

When you do the hard work and perform your research well, all surprises tend to be happy ones.

A number of readers have expressed concern over DH Horton’s (DHI) disappointing results. But if anything, the bull case for the industry is stronger than ever. An imminent post-election rally in the bond market and drop in interest rates is about to cause the industry to explode to the upside.

The US new homes market is massively underbuilt. We are short anywhere from 10-20 million homes. Normal inventory is 6 months, and we are currently at 3 months. We went into the pandemic short of homes and then demand exploded. The average home price is now $420,000 against an average income of $75,000, requiring $130,000 in annual income to qualify for a conventional 30-year fixed rate loan.

If you want to live in San Jose, CA you need to earn $463,000 a year. Half of the new homes built this year are in only ten cities, with four in Texas as Americans continue a century-long trend of moving from north to south and from the coasts to the southwest. Building permits are actually falling, down 7% this year.

Concentration of the industry, and therefore the elimination competition, has continued at an incredible pace. Only ten firms control 50% to 80% of new home construction, making it difficult for new entrants. That’s up from only 10% 30 years ago. As a result, the number of floor plan options has shrunk dramatically.

Vice President Harris is proposing a $25,000 tax credit for first-time buyers if elected. She has also suggested subsidies to build 3 million affordable housing units. You always buy a sector that is about to see a big inflow of government largess. Buy (LEN), (KBH), (PHM), (TOL), and (DHI) on dips.

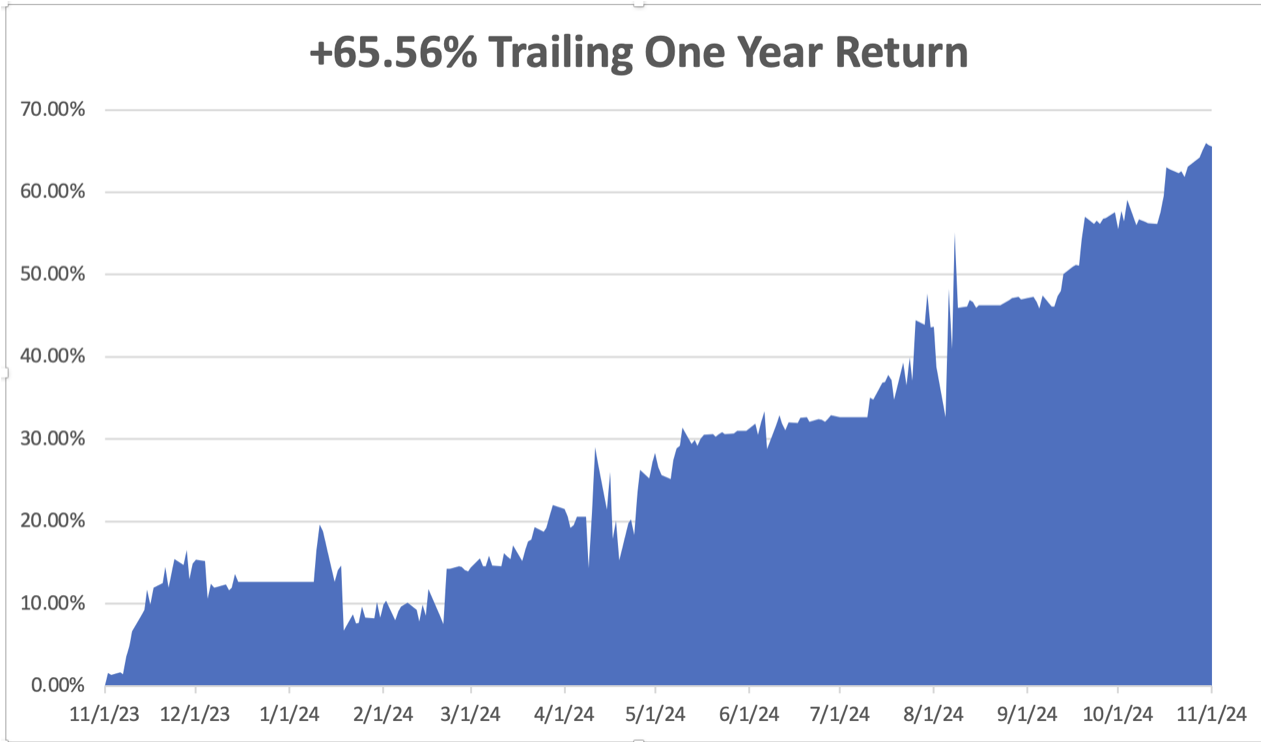

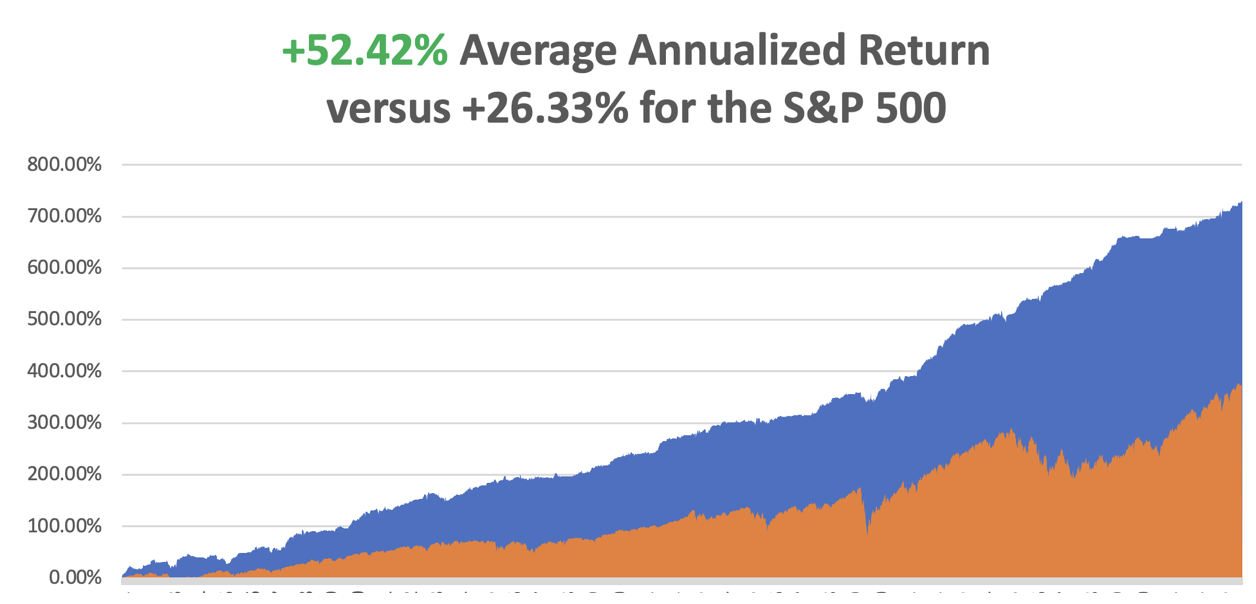

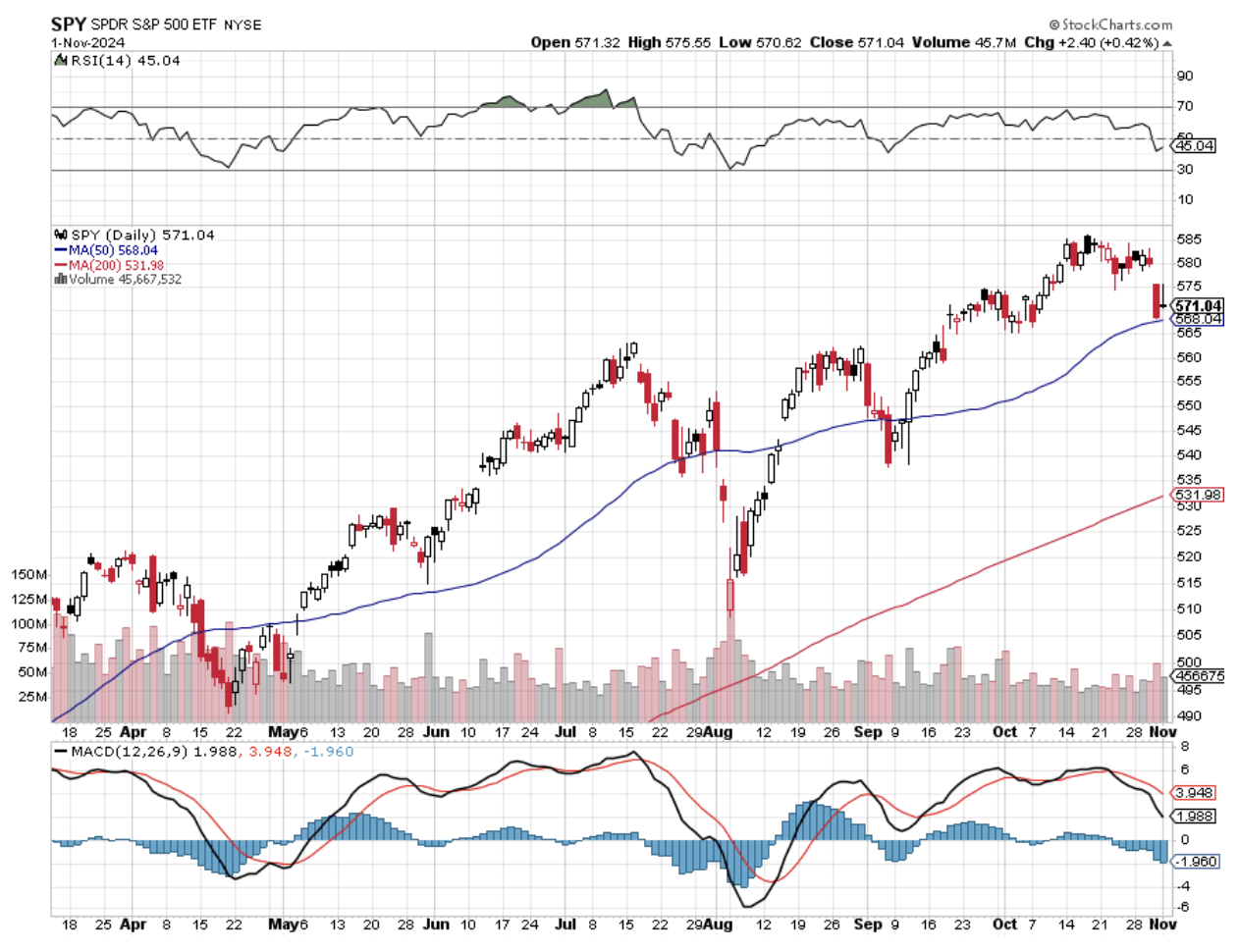

In October, we have gained a breathtaking +7.68%. My 2024 year-to-date performance is at an amazing +52.92%. The S&P 500 (SPY) is up +19.92% so far in 2024. My trailing one-year return reached a nosebleed +65.56. That brings my 16-year total return to +729.55%. My average annualized return has recovered to +52.42%.

I am going into the election as cautious as possible, with 80% in cash and 20% long. When you’re up this much you don’t take chances. I maintained two longs in (DHI) and (JPM) that are well in the money.

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 63 of 82 trades have been profitable so far in 2024, and several of those losses were really break-even. Some 22 out of the last 23 trade alerts were profitable. That is a success rate of +76.82%.

Try beating that anywhere.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, November 4 at 8:30 AM EST, the US Factory Orders are published.

On Tuesday, November 5 at 6:00 AM, the US Presidential Elections take place. The last polls close in Hawaii at 1:00 AM EST.

On Wednesday, November 6 at 11:00 AM, the MBA Mortgage rate is printed.

On Thursday, November 7 at 11:00 AM, the Federal Reserve announces its interest rates decision. A 25-basis point cut is in the bag. A press conference follows at 11:30 AM.

On Friday, November 8 at 8:30 AM, the University of Michigan Consumer Sentiment is announced. At 2:00 PM the Baker Hughes Rig Count is printed.

As for me, as the son of a Marine who served on Guadalcanal in 1942, I had an unusual childhood. The memories all came flooding back to me as the HBO program, The Pacific, which aired once again over last Memorial Day weekend.

Every scene in the ten-hour series I had already heard about around campfires, at veteran’s reunions, or in officers clubs around the world. At five, I learned how to open a coconut by tapping around the three eyes with a bayonet. At ten, I could shinny up a palm tree with a belt wrapped around my ankles.

I learned that you can shoot down a Japanese zero fighter by leading with four hand widths and aiming high. A tank can be disabled by ramming a log into its tracks. There was the survival training; practicing how to find water in the desert, setting a snare trap to catch small animals to eat, and starting a fire with only flint and steel. All the sniper training was fun but was fortunately never put to use.

I can still thrill the kids by hitting a quarter taped to a tree 50 feet away with a Winchester lever action 30-30. We outfitted ourselves with surplus WWII equipment from the “Supply Sergeant” for camping trips, which you could buy for a couple of dollars. Now, you only find these things in museums. We ate leftover C-rations.

Perhaps it was dad’s explanation of how to make highly alcoholic hooch out of canned peaches that led to my degree in biochemistry. In the end, I had my own Marine career as a combat pilot in Desert Storm, and many tasks that followed. There you learn the true meaning of “gung ho.”

At 73, I stay in boot camp shape. In my free time, I hike 100 miles in the High Sierras over 8,000 feet in eight days. I am carrying a 50-pound pack, and living on only 500 calories a day entirely composed of fruit and nuts. I love every minute of it.

Watching the series, I was reminded how feeble and meaningless my profession is, toiling away all year just to create a spreadsheet full of numbers, and how the men of eight decades ago were made of sterner stuff. Buying a dip on a bad day just doesn’t equate to “taking out that machine gun.”

How times have changed. Fall down on your knees and give thanks for your simple life.

You can buy the Hugh Ambrose book the series was based on by clicking here. You can purchase the DVD by clicking here.

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

(NVDA)

Well, well, well. It looks like the $3.2 trillion elephant in the room is about to get company. After watching Nvidia (NVDA) morph into a multi-trillion behemoth that now makes up 6% of the S&P 500, I've been scanning the horizon for the next big play. And folks, I think I may have a contender.

Meet Cerebras Systems, a gutsy newcomer that reminds me of the early semiconductor players I covered in Tokyo back when transistors were still considered cutting edge. They're eyeing a $1 billion IPO with a valuation north of $7 billion, which might sound ambitious until you see what they're bringing to the table.

So what’s their secret? They have a monster chip called the Wafer-Scale Engine that makes conventional processors look like pocket calculators. We're talking about 4 trillion transistors packed into silicon that's 57 times larger than Nvidia's best offerings.

After decades of watching tech cycles come and go, I've learned that sometimes the most promising plays come from companies willing to completely reimagine the fundamentals. And that's exactly what Cerebras is doing.Let's dive into the nuts and bolts.

Founded in 2016 by CEO Andrew Feldman, Cerebras took the traditional chip design playbook and tossed it out the window.

Instead of dealing with thousands of individual dies - each with their own defects that need to be tossed - they went big. Really big. Their WSE-3 chip can train models ten times larger than OpenAI's GPT-4 and pushes out 125 petaflops with over 21 PB/sec bandwidth.

The clever bit? They've integrated the memory right into the chip. Anyone who's spent time optimizing systems knows that shuffling data between memory and processors is like trying to drink through a coffee stirrer.

Cerebras just eliminated that bottleneck entirely.

But here's where it gets even more interesting. Cerebras is planning to list on the Nasdaq under CBRS, which would make them the first pure-play AI chip maker to IPO during this AI gold rush.

The timing could be perfect - or perfectly terrible.

The challenge? They're going up against Nvidia's full-stack empire. Jensen Huang and his team haven't just built chips; they've created an entire ecosystem that runs from silicon to software. That's a tough act to follow.

And there's a red flag we need to talk about.

Right now, 87% of Cerebras' revenue comes from one client - G42, an Abu Dhabi-based AI outfit. That's the kind of customer concentration that keeps risk managers up at night. While they claim to be in talks with major U.S. tech players, they'll need to diversify fast to be taken seriously.

But the performance numbers? They're eye-popping.

Recent tests show their CS-3 system smoking Nvidia's H100 GPUs by up to 22 times in inference tasks. They're pushing 2,100 tokens per second as of October, up from 450 in August. That's the kind of improvement curve that makes tech investors salivate.

There are limitations, of course. The current SRAM setup puts a ceiling on their memory capacity. To handle the really big models - like the 405 billion parameter Llama - they'll need some clever engineering solutions.

Now, let's talk dollars and sense.

Cerebras is playing the cost game smart. Their cloud offerings run about 2.75 times cheaper per token per second than Nvidia's H100 systems.

For public cloud users, that advantage jumps to 5.2 times. That's the kind of math that makes CFOs pay attention.

So what's the play here?

Cerebras isn't going to dethrone Nvidia overnight. Nobody is. But they don't need to. In the AI chip space, even capturing a small slice of the pie means billions in potential revenue.

For investors looking at the upcoming IPO, here's my take: This is classic high-risk, high-reward territory.

The technology is solid. The market opportunity is massive. But they'll need to execute flawlessly to justify that $7-8 billion valuation.

Keep your eye on three things: customer diversification, U.S. market penetration, and their ability to scale up production without scaling up problems.

Remember, today's underdog can become tomorrow's top dog faster than you can say "semiconductor." Just ask anyone who passed on Nvidia at $25 a share.

The AI chip war is far from over. And Cerebras just might be the dark horse worth watching.

Mad Hedge Technology Letter

November 1, 2024

Fiat Lux

Featured Trade:

(WILL THE TRIFOLD PHONE SAVE TECH?)

(HUAWEI), (AAPL)

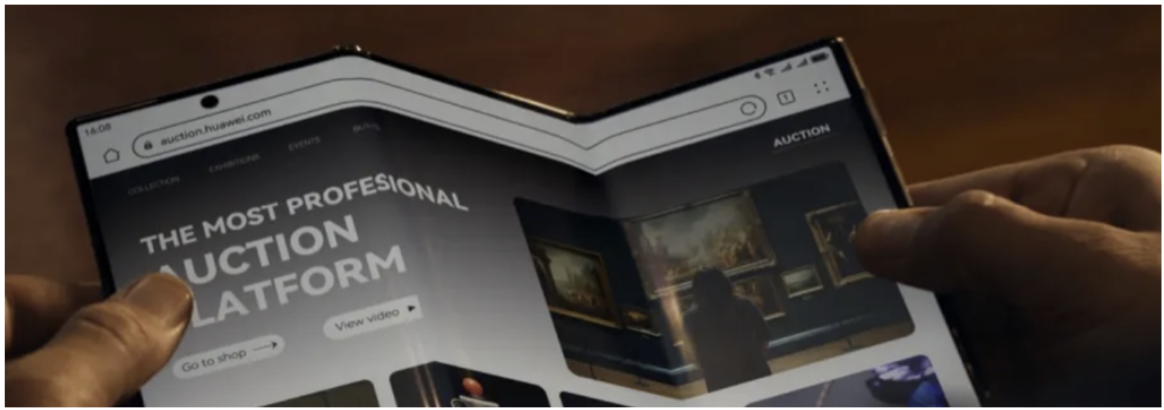

Silicon Valley is usually on top of the innovation game, and as Huawei announced the launching of its trifold smartphone, one must ask whether Silicon Valley is late to the party or if this technology is even worth their time.

My guess is that foldable devices won’t move the needle, and these announcements aren’t really about moving revenue but to offer bluster in a global game of cat and mouse.

In general, the smartphone super cycle is about tapped out, and I don’t see a foldable phone as a reason for another re-acceleration of revenue.

There is a higher chance that in the next few years, this foldable technology is adapted for some other technology and written off on the balance sheet.

To think it could be some revolutionary new trend is beggars’ belief.

To be honest, many consumers are tired of screen time and can’t get off their screen because work duties connect them to the screen.

When needing a bigger screen to watch global sporting events, many would prefer a large-screen TV that doesn’t fold. This phone has no TV screen – not by a long shot.

It is a little difficult for me to understand the use case here for Huawei going big in the foldable screen business.

It’s not like the new phone will be cheap either, the new trifold smartphone will start at around $2,800, which is more expensive than most premium laptops.

Huawei announced its foldable product on the same day as Apple unveiling the new iPhone.

Apple announced its iPhone 16 Pro Max will start at $1,199 and the iPhone 16 at $799.

The first set of Apple Intelligence AI features will be available in a free software update next month.

Huawei’s Mate XT also comes with artificial intelligence features, such as text translation and cloud-based content generation.

The device is 3.6 millimeters thick when unfolded, with a 10.2-inch screen.

More than 3.5 million people had pre-ordered Huawei’s trifold Mate XT smartphone as of midday Tuesday.

The Chinese company has sought to make a comeback in the smartphone industry, which was hard hit after the U.S. slapped sanctions on the company in 2019. The U.S. in October 2022 imposed broader restrictions on American sales of advanced chips to Chinese businesses.

Apple fell out of the list of top five smartphone vendors in China in the second quarter of this year. It was the first time that domestic players held all five spots.

Clearly, Chinese tech views Apple as the top dog to compete against, but I would say that Apple’s star is waning in China.

They are being pushed out by the Chinese government, who are indirectly suggesting to Chinese consumers to go with domestic alternatives.

National champions and protecting them are the modus operandi in the age of deglobalization, and that will not change anytime soon.

As for the tech, foldable screens are a mediocre and lateral upgrade.

The size of a screen has a size limit to its usefulness, and building gargantuan screens does not suggest that it could trigger some new wave of untapped profits.

I believe Apple is smart in not aggressively pursuing foldables, and the quest continues to find the new killer tech that will take over.

Until then, tech stocks should grind up, but not in a dramatic fashion.

(DIGITAL GOLD – WHAT’S IT ALL ABOUT?)

November 1, 2024

Hello everyone

DEFINITION

Digital gold represents a modern evolution in precious metal investments, bridging traditional assets and innovative technology. In other words, it’s a way to invest in gold electronically. As a digital counterpart to physical gold, it enables investors to engage with gold markets online, eliminating challenges related to storage and security.

HOW DO YOU BUY/SELL DIGITAL GOLD?

The process of buying and selling digital gold involves a series of straightforward steps facilitated through online platforms or apps.

To buy gold digitally, users must create and verify an account and fund it using net banking or mobile wallets.

Once the account is funded, users specify the amount of digital gold they wish to purchase, enabling them to buy gold or buy gold online.

The platform will display the current market rate, and the equivalent physical gold will be securely stored in insured vaults.

When selling digital gold, users simply log in to their account, view the current market rate, and confirm the sale. The funds from the sale are then credited to their bank account. Users who prefer to receive physical gold can submit a redemption request, which may incur additional charges.

This entire process ensures a transparent and secure investment experience, providing peace of mind to investors. Moreover, an investor who buys and sells electronic gold enjoys enhanced liquidity and flexibility while also benefiting from the assurance of limited supply.

DIGITAL GOLD & TANGIBLE GOLD: THE DIFFERENCES

Physical and digital gold differ significantly in ownership, storage, and transaction methods. Digital gold allows investors to purchase virtual units backed by actual gold stored in secure vaults, with taxation and investment aspects including tax rates on selling, holding time for long-term capital gains, and benefits as an efficient and safe alternative to traditional physical gold purchases. This approach offers the convenience of online transactions, with the value directly tied to the market price of physical gold.

Physical gold ownership involves direct possession of tangible items such as gold coins, gold bars, or jewelry, requiring secure storage and physical handling. Both options serve as viable investments; digital gold provides enhanced convenience and ease of transaction, while physical gold offers a tangible asset that some investors may prefer for diversification.

BENEFITS OF INVESTING IN DIGITAL GOLD ASSETS

Investing in digital gold offers several advantages over physical gold. One significant benefit is greater convenience; investors can purchase gold online without the need to store it physically. This eliminates the challenges and costs associated with storage, insurance, and transportation.

Gold mutual funds investors can also benefit from digital gold, which provides a way to diversify their portfolios without requiring physical ownership.

Digital gold platforms also allow for fractional ownership, enabling investors to build their holdings even with smaller amounts of money. This feature increases accessibility for a broader range of investors.

Digital gold is highly liquid, allowing for quick conversion to cash, which is often more cumbersome than physical gold, which requires finding buyers.

Transaction costs for digital gold are generally lower than those for physical gold. Since digital gold is often linked to gold exchange-traded funds (ETFs) or gold mutual funds, it provides transparency and real-time tracking. This is particularly beneficial for investors looking to mitigate market volatility and ensure a trustworthy investment process.

DISADVANTAGES OF INVESTING IN DIGITAL GOLD

Investing in digital gold offers numerous advantages, but it’s important to consider the accompanying disadvantages. Unlike physical gold, digital gold lacks tangibility, potentially leading to a less satisfying experience for some investors. (Some people just like that security of holding a piece of gold). On the other hand, physical gold investment often carries an emotional value and can have different taxation considerations.

Buying digital gold exposes investors to cybersecurity risks, as the security of digital gold holding depends on the robustness of the issuing platform. (That’s why I always recommend transferring your digital assets to a decentralized wallet for safekeeping).

While accumulating digital gold is relatively easy, platform fees and transaction charges may affect overall returns. Furthermore, digital gold holdings may face limitations on investment amounts and acceptance, distinguishing them from physical gold in terms of utility. You may also want to consider exploring gold futures contracts, which offer a different approach to trading precious metals.

BEST PLATFORMS TO USE FOR DIGITAL GOLD TRADING

You can buy and sell digital gold in the United States on several reputable online platforms and mobile apps. Major financial institutions like JPMorgan Chase and specialized digital gold providers such as Paxos, Uphold, Gold Money, and Vaulted offer blockchain-based digital gold products.

These platforms allow investors to add digital gold to their portfolios seamlessly. Each unit of digital gold is backed by physical metal stored in insured vaults, ensuring it remains a solid store of value. Investors purchase tokens representing specific amounts of precious metals, enabling secure and transparent digital transactions.

This approach offers a reliable way to incorporate digital gold into diversified investment strategies.

SECURE STORAGE SOLUTIONS FOR DIGITAL GOLD HOLDINGS

The physical gold bullion supporting digital gold holdings is stored in highly secure, insured, and audited vaults managed by reputable companies such as MMTC-PAMP and Safe Gold. These vaulting facilities employ advanced security systems to ensure the utmost safety and integrity of the stored physical gold.

Security measures include:

- Armed guards: Ensuring constant vigilance and immediate response to threats.

- Biometric access controls: Restricting access to only authorized personnel.

- CCTV surveillance: Offering 24/7 monitoring to deter and document any unauthorized activities.

- Theft prevention: Utilizing state-of-the-art technology to safeguard digital assets.

- Unauthorized access prevention: Implementing multi-layered security protocols to prevent breaches.

These insured vaults undergo regular audits to maintain transparency and trust in the system, providing investors with peace of mind when they accumulate digital gold.

BLOCKCHAIN & ENCRYPTION

Blockchain technology underpins the recording and security of all transactions involving digital gold, ensuring an immutable and transparent distributed ledger. Digital gold platforms utilize advanced encryption and cryptographic techniques to safeguard user data and digital wallets. These methods prevent hacking and maintain the integrity of ownership records, thereby fostering a high level of trust and reliability.

- Immutable records: Transactions are permanent and unchangeable.

- Data protection: Advanced encryption secures user information.

- Hacking prevention: Security measures block unauthorized access.

- Reliable ownership: Precise records of digital gold ownership are maintained.

- Secure storage: Digital wallets provide a safe repository for digital gold.

CONVERTING DIGITAL GOLD TO PHYSICAL GOLD BULLION

You can convert your digital gold holdings into physical gold through reputable digital gold platforms, as physical gold remains a tangible investment option. These platforms offer a redemption process that transforms your digital gold into physical gold, such as coins or bars.

The process involves de-tokenizing your digital holdings and converting them into physical gold using blockchain technology. You typically need to submit a request specifying the denomination and quantity, following the platform’s terms and conditions.

Additional fabrication, shipping, and insurance fees may apply for physical delivery. To ensure a smooth transition, carefully review the terms and conditions provided by your digital gold platform.

THE OUTLOOK FOR DIGITAL GOLD

The outlook for digital gold is promising, driven by advancements in technology and shifting investor preferences toward more accessible and liquid investment options. As the investment landscape evolves, digital gold is gaining traction, particularly among younger investors. Blockchain technology enhances digital gold's resilience against market volatility and economic uncertainties.

Digital gold provides greater accessibility and convenience, improved security through blockchain technology, diversification potential in volatile markets, and lower costs compared to physical gold. These attributes particularly appeal to tech-savvy, younger investors.

Digital gold’s potential for diversification and growth positions it as a compelling alternative within the investment landscape.

HOUSEKEEPING

I’ll be sending out Zoom links shortly for our monthly meeting for October.

Cheers

Jacquie

Global Market Comments

November 1, 2024

Fiat Lux

Featured Trade:

(PLEASE USE MY FREE DATABASE SEARCH)

The original purpose of this letter was to build a database of ideas to draw on in the management of my hedge fund.

When a certain trade comes into play, I merely type in the symbol, name, currency, or commodity into the search box, and the entire fundamental argument in favor of that position pops up.

You can do the same. Just type anything into the search box with the little magnifying glass in the upper right-hand corner of my home page, and a cornucopia of data, charts, and opinions will appear.

Even the prices of camels in India (click here to find out why they’re going up).

The database goes back to February 2009, totaling 4 million words. Watching the traffic over time, I can tell you how the database is being used:

1) Small hedge funds want to see what the large hedge funds are doing.

2) Large hedge funds look to see what they have missed, which is usually nothing.

3) Midwestern advisors to find out what is happening in New York and Chicago.

4) American investors to find out if there are any opportunities overseas (there always are).

5) Foreign investors to find out what the heck is happening in the US (about 1,000 inquiries a day come in through Google’s translation software).

6) Specialist traders in stocks, bonds, currencies, commodities, and precious metals looking for cross-market insights, which will give them a trading advantage with their own book.

7) High net-worth individuals managing their own portfolios so they don’t get screwed on management fees.

8) Low net worth individuals, students, and the military looking to expand their knowledge of financial markets (lots of free online time in the Navy).

9) People at the Treasury and the Fed trying to find out what the private sector is doing.

10) Staff at the SEC and the CFTC to see if there is anything new they should be regulating.

11) More staff at the Congress and the Senate looking for new hot-button issues to distort and obfuscate.

12) Yet, even more staff in Obama’s office gauging his popularity and the reception of his policies.

13) As far as I know, no justices at the Supreme Court read my letter. They’re all closet indexers.

14) Potential investors/subscribers attempting to ascertain if I have the slightest idea of what I am talking about.

15) Me trying to remember trades that I recommended long ago but have forgotten.

16) Me looking for trades that worked so I can say, ‘I told you so.’

It’s there, it’s free, so please use it.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.