When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

March 20, 2025

Fiat Lux

Featured Trade:

(PLEASE USE MY FREE DATABASE SEARCH)

The original purpose of this letter was to build a database of ideas to draw on in the management of my hedge fund.

When a certain trade comes into play, I merely type in the symbol, name, currency, or commodity into the search box, and the entire fundamental argument in favor of that position pops up.

You can do the same. Just type anything into the search box with the little magnifying glass in the upper right-hand corner of my home page, and a cornucopia of data, charts, and opinions will appear.

Even the prices of camels in India (click here to find out why they’re going up).

The database goes back to February 2008, totaling 4 million words. Watching the traffic over time, I can tell you how the database is being used:

1) Small hedge funds want to see what the large hedge funds are doing.

2) Large hedge funds look to see what they have missed, which is usually nothing.

3) Midwestern advisors to find out what is happening in New York and Chicago.

4) American investors to find out if there are any opportunities overseas (there always are).

5) Foreign investors to find out what the heck is happening in the US (about 1,000 inquiries a day come in through Google’s translation software).

6) Specialist traders in stocks, bonds, currencies, commodities, and precious metals looking for cross-market insights which will give them a trading advantage with their own book.

7) High net-worth individuals managing their own portfolios so they don’t get screwed on management fees.

8) Low net worth individuals, students, and the military looking to expand their knowledge of financial markets (lots of free online time in the Navy).

9) People at the Treasury and the Fed trying to find out what the private sector is doing.

10) Staff at the SEC and the CFTC to see if there is anything new they should be regulating.

11) More staff at the Congress and the Senate looking for new hot-button issues to distort and obfuscate.

12) Yet, even more staff in Obama’s office gauging his popularity and the reception of his policies.

13) As far as I know, no justices at the Supreme Court read my letter. They’re all closet indexers.

14) Potential investors/subscribers attempting to ascertain if I have the slightest idea of what I am talking about.

15) Me trying to remember trades that I recommended long ago, but have forgotten.

16) Me looking for trades that worked so I can say ‘I told you so.’

It’s there, it’s free, so please use it.

(TEM), (ILMN)

Last weekend, my daughter, the computer science whiz studying at UC, called me with a question about healthcare AI companies for her investment project.

"Dad, my professor says these healthcare AI stocks are just cash incinerators with no path to profitability," she explained. "Should I avoid the whole sector?"

I was cutting vegetables for dinner as we talked – my homemade pasta sauce is legendary in three counties. I set down the knife and gave her my perspective, which I'll share with you now.

Back in the early '90s, when I was covering Asian markets for The Economist, I encountered countless biotech companies making grand promises about revolutionizing healthcare.

The pattern was always the same – ambitious visions, heavy cash burn, and perpetually delayed profitability. Few survived.

So when a healthcare AI company crosses my radar these days, my first instinct is skepticism, honed by decades of watching promising technologies evaporate along with investors' capital.

But Tempus AI (TEM) has me breaking my own rules.

You see, there's a moment in every significant technological shift when the numbers start telling a different story than the narrative.

TEM's financials have significantly improved, with positive cash flow expected by year-end and Q4FY24 delivering record revenues.

The Data & Services segment – where the real money is – grew by a stunning 44.6% YoY.

FY24 revenues hit an all-time high of $693.4 million, bolstered by deals with Boehringer Ingelheim and Illumina (ILMN).

Management is now guiding for $1.24 billion in 2025 revenues – a 79% YoY growth. This isn't idle talk – these are numbers that give hardened skeptics like me reason to take notice.

The first question I ask about any AI company is whether they actually have the data to do what they claim.

Tempus AI has amassed over 240 petabytes of healthcare data – an information advantage that reminds me of trading Japanese equities in the 80s when having access to real company data was worth its weight in yen.

In Q4FY24, Tempus released Olivia, their AI-enabled personal health app.

Unlike other health apps that fragment patient information, Olivia consolidates data from multiple providers into a single interface. It gives patients access to their complete health records and delivers AI-powered insights about their conditions.

Having watched numerous healthcare startups flame out during my reporting days, I can tell you this approach solves a genuine problem that most tech companies miss.

For FY24, revenues grew by 30% compared to 77% in FY23.

Don't be fooled by the apparent slowdown – TEM is working from a much larger base, with higher-margin services taking center stage.

The company holds $448 million in cash and short-term investments with a quarterly burn rate of $39 million, giving them a runway of nearly three years.

The Ambry Genetics acquisition is a game-changer for TEM, adding genetic testing capabilities and a cool $300 million in revenue.

Back when I was tramping through biotech labs in Asia for The Economist, I learned a critical lesson - the bottleneck in genetic medicine isn't sequencing but interpretation. TEM knows this and is planting its flag exactly where the gold is.

When Q4 revenues came in a hair below Wall Street's guesses, the stock took a hit. I've seen this movie before.

The algorithms panic, creating beautiful entry points for those of us with enough battle scars to know better.

The CEO barely contained his satisfaction: "Our Data and Services business just had a really strong Q4, finishing a really strong year."

Translation: "We're killing it but I'm not going to brag."

Sure, TEM has rivals. PathAI, Prognos Health, and Healwell AI are all scrambling for a piece of this pie.

But none has TEM's data treasure chest, and none has figured out how to monetize in three directions at once - genomic testing, data licensing, and consumer apps.

The market size is staggering - somewhere between $317 billion and $490 billion by 2032. That's bigger than the GDP of most countries I've reported from.

And here's the kicker with AI companies - the rich get richer. More data attracts more customers, generating even more data. Once you're ahead, staying ahead gets easier.

For those who care about valuation (and you should), I'm looking at 2026 projected revenues of $1,612 million with a P/S multiple of 6.57. That math gives me significant upside from today's price of around $49.87.

Is that multiple too rich? Not when you're dealing with a company that's cracked the code on healthcare AI profitability.

Are there risks? Of course. Profitability might take longer than expected.

The data moat could theoretically be bridged by a determined competitor with deep pockets. The field is getting crowded.

But I’ve witnessed enough market transformations to recognize when a company sits at the perfect intersection of powerful trends. And right now, TEM is riding three unstoppable waves—AI, precision medicine, and healthcare’s digital overhaul.

The recent market jitters have created a textbook buying opportunity. When Wall Street's short-term anxiety gives you a chance to buy long-term winners at a discount, you take it.

TEM has multiple ways to win, and that's the kind of bet I've made my career on.

With that, I had to end our call before my sauce burned. Yesterday, she texted me that she'd bought TEM on the pullback.

After decades navigating markets from Tokyo to Wall Street, there's nothing quite like seeing the next generation apply those lessons – sometimes even better than their teacher.

The student becomes the master, as they say.

Mad Hedge Technology Letter

March 19, 2025

Fiat Lux

Featured Trade:

(ONE TO KEEP AN EYE OUT FOR)

(ORCL), (TIKTOK)

The U.S. administration has kicked around the idea of Oracle (ORCL) chairman Larry Ellison as a possible buyer to one of the hottest social media assets TikTok.

Oracle isn’t intending to outright acquire a majority stake, but their involvement shows that Oracle is at the seat with the big boys in tech and that seat carries a great deal of clout today.

Remember that Oracle’s stock was dead as a doornail a few years ago.

But the AI revolution seemingly revived a slumbering stock jolting it to higher highs.

Before that AI boom, Oracle was known as the company with outdated database cloud software and even today, most people don’t know what they even do.

Oh, how do just a few years change everything?

Realistically, Oracle likely doesn’t have the cash to buy into the asset.

The company is spending much of its cash on building new AI data centers and has over $90 billion in debt, partly due to a prior acquisition. Plus, the infrastructure-focused company has little experience running a consumer-oriented app.

The likelier scenario, and the one that’s under consideration with Trump administration officials, would involve Oracle reprising its role in providing a security backstop for US users’ data backstop would guarantee that TikTok’s US operations under new ownership would not contain a back door that China’s government could exploit.

Under a prior arrangement, the cloud giant would have taken a minority ownership stake in TikTok’s global business and provided technology and data storage services for the app to protect US user data.

But the arrangement hit a snag when officials in Washington and Beijing disagreed over whether ByteDance would maintain any involvement in the new TikTok entity.

The second challenge is more technical. Chinese authorities are unlikely to approve a deal that involves selling the new buyer TikTok’s valuable content algorithm, which determines the posts that users see in their feeds.

We are still trying to analyze where the dust will settle because it is not clear to the outside lens.

As it stands, Oracle pouring capital into AI data centers is a strategic move that has benefited the stock price and there is a high chance that shareholders start to bid up the stock after the macro contagion passes.

If somehow Oracle can even finagle a massive contract to managing TikTok’s data, I do believe the stock will be up 12-15% on that news. That development isn’t in the price yet and investors haven’t been sniffing it out yet.

In short, there is a great deal of upside potential in Oracle’s share price and outsiders shouldn’t minimize or water down the possibility for a short-term short squeeze of monumental proportions.

At the very minimum, it is hard to bet against Oracle even if the stock is down YTD by 8% and investors should expect some sort of appreciation when the broader landscape settles down.

“I think it is possible for ordinary people to choose to be extraordinary.” – Said Elon Musk

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

(THE TARIFF FIX)

March 19, 2025

Hello everyone

We all know that markets and uncertainty don’t mix well. And right now, there is a lot of uncertainty surrounding U.S. trade policy.

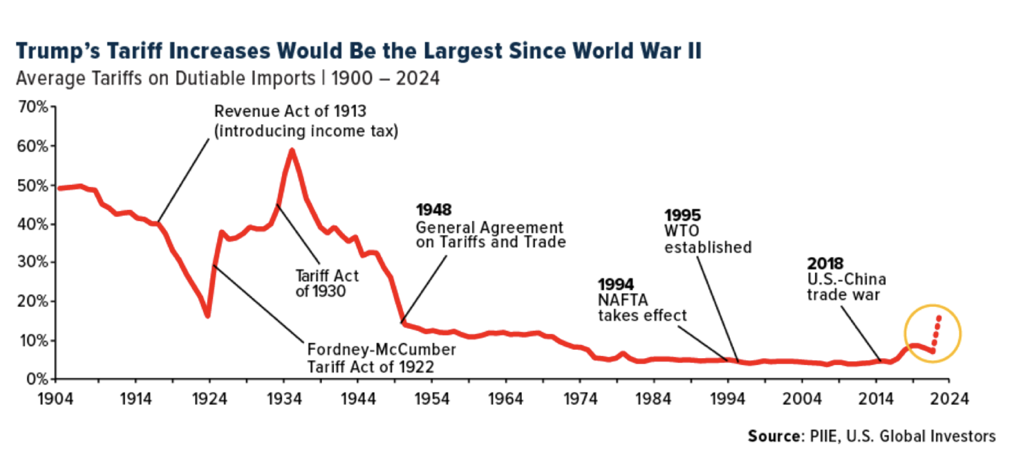

While the Trump administration tariffs on Mexico and Canada have been delayed for a month, the 10% tariff on Chinese goods has gone into effect. The move has rattled markets, leaving many American businesses and consumers wondering what comes next.

Tariffs are a double-edged sword. On the one hand, they can serve as a powerful negotiating tool, as President Trump has pointed out. The U.S. economy is the largest in the world, and many countries rely on American consumers to buy their goods. By imposing tariffs, the U.S. can pressure trading partners into more favourable deals and protect domestic industries from unfair competition.

On the other hand, tariffs raise costs for businesses and consumers. About half of America’s annual imports – more than $1.3 trillion annually – come from China, Canada and Mexico.

We know that certain sectors will be impacted harder than others. The automotive industry, for instance, relies heavily on parts from Mexico and Canada. Energy prices could spike as well, given that over 70% of U.S. crude oil imports come from these two countries. Let’s also not forget about gas. Just in the Midwest alone, gas prices could rise by as much as $0.50 per gallon, according to the Council on Foreign Relations. And then there’s something we all rely on – food. Mexico supplies over 60% of the fresh vegetables and nearly half of all fruit and nuts consumed in the U.S. Higher import costs could mean higher prices at the grocery store.

A historical perspective on Tariffs

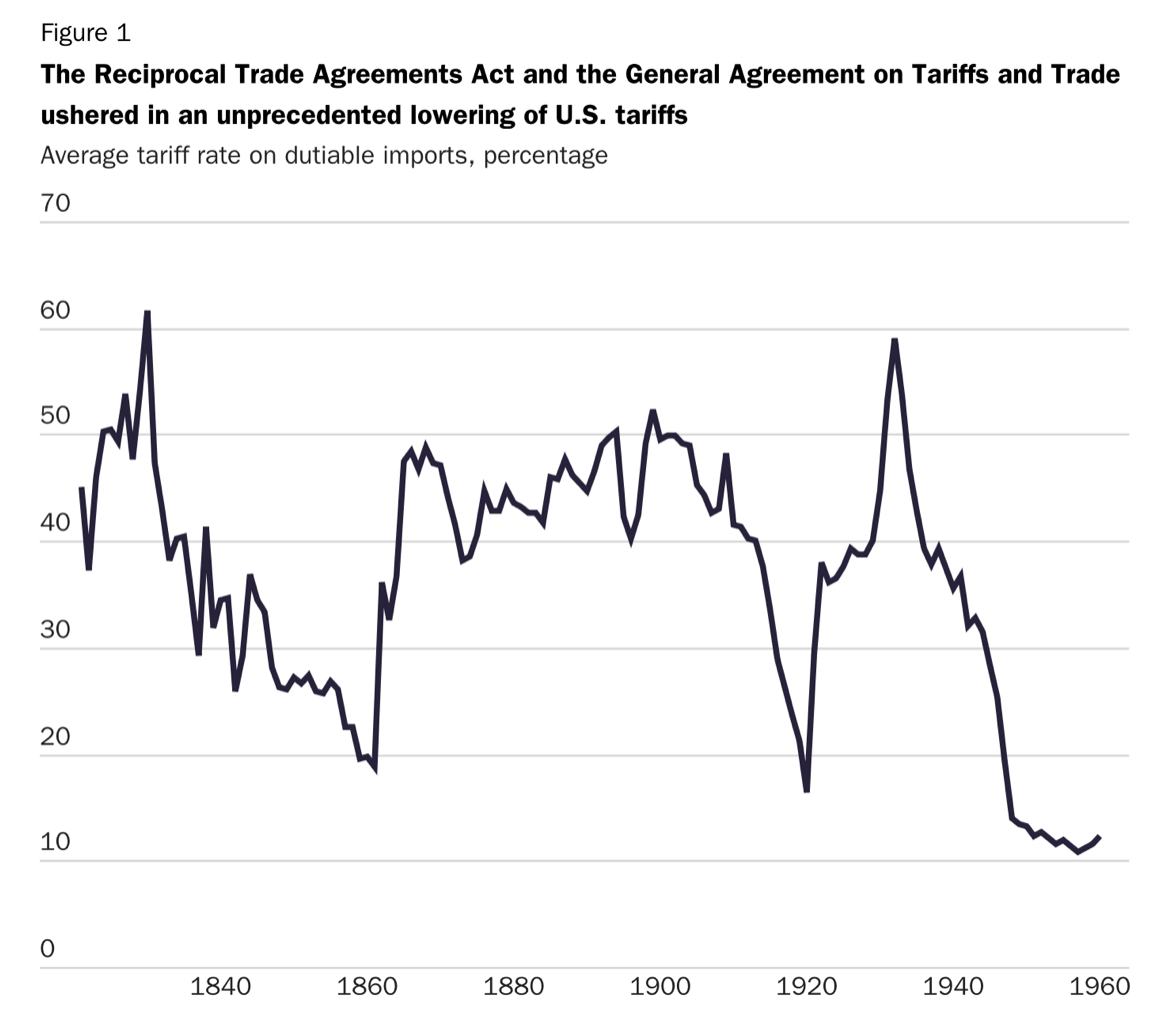

Historically, tariffs used to be a major source of government revenue. Between 1798 and 1913, they accounted for anywhere from 50% to 90% of federal income.

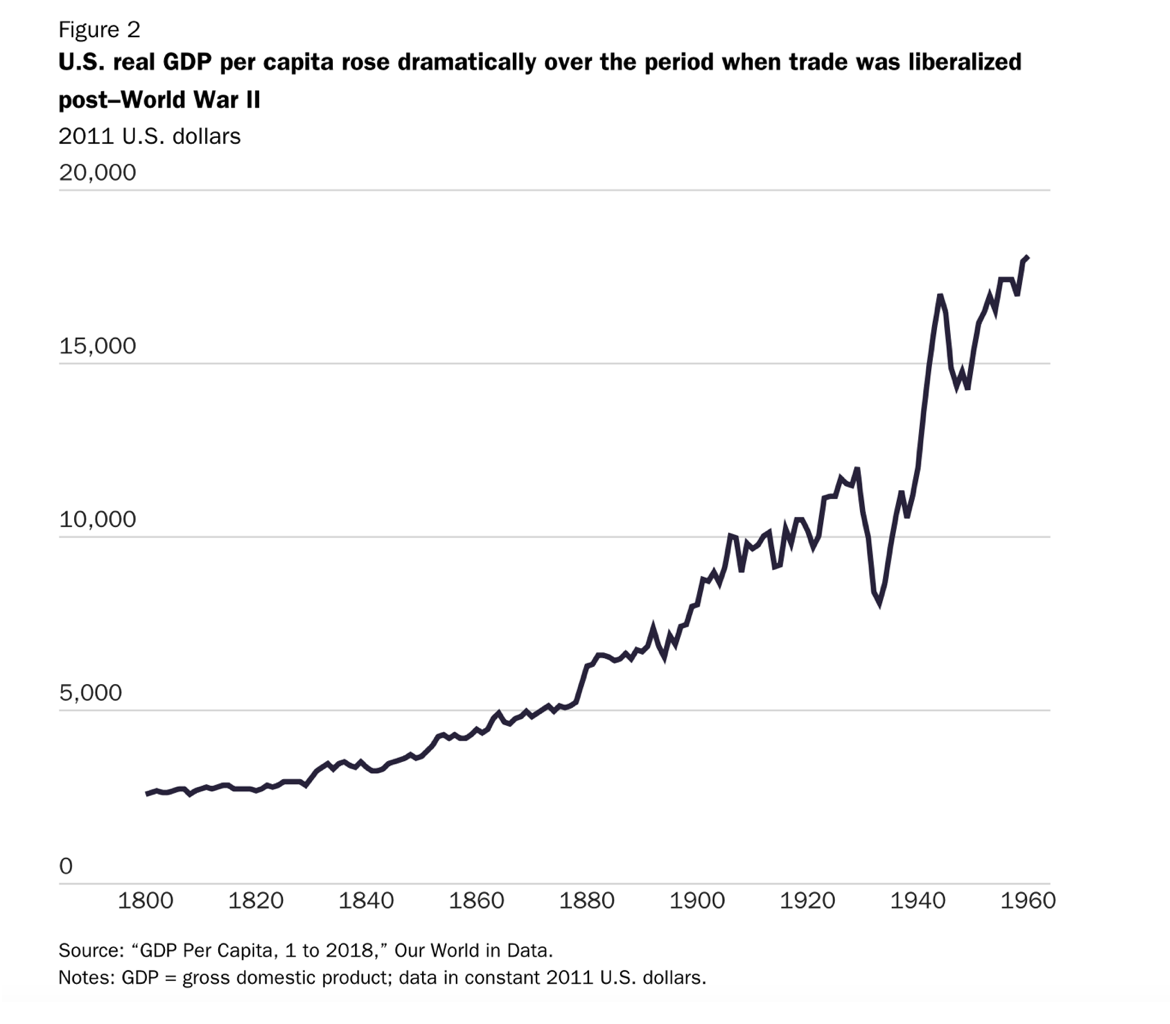

Then, times changed. Over the past 70 years, tariffs have rarely contributed more than 2% of federal revenue. Free trade was the typical landscape.

For example, last year, U.S. Customs and Border Protection collected $77 billion in tariffs – just 1.57% of total government income. Since the 1930s, the U.S. has moved away from protectionism in favour of trade liberalization. Agreements like the General Agreement on Tariffs and Trade (GATT) and its successor, the World Trade Organization (WTO), have dramatically lowered global tariffs. Today, roughly 70% of all products enter the U.S. duty-free.

Trump’s approach marks a shift back toward tariffs as a policy tool. Arguably, the U.S. has more leverage than most countries – as many economies depend on access to the U.S. market – but tariffs aren’t without consequences.

China has already retaliated, imposing its own tariffs on U.S. goods. These include a 15% duty on coal and liquefied natural gas (LNG), as well as 10% tariffs on agricultural machinery, crude oil, and some vehicles. Beijing has also launched an antitrust investigation into Google – likely as a form of economic retribution.

Time will tell how well the U.S. economy navigates the changing trade policy.

Bitcoin and its short to medium-term movement

Bitcoin is attempting to form a base. There is a possibility it could fall to make a third point, (see the trendline drawn above) thereby making two points makes a third pattern, which is usually bullish. Or it could rally from its present position. Another week or so of messy price action is possible before a move to the upside is seen.

Cheers

Jacquie

Global Market Comments

March 19, 2025

Fiat Lux

Featured Trade:

(PROFITING FROM AMERICA'S DEMOGRAPHIC COLLAPSE)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.