Below, please find subscribers’ Q&A for the June 11 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Incline Village, NV.

Q: Will the LA riots have any impact on the market?

A: So far, they have not. The demonstrations have been confined to just a two-block area around the federal building—although on TV, it looks like the entire city is engulfed. The press coverage has been wildly exaggerated. They now have the problem of: where do you put 6,700 troops? So far, they’ve been sleeping on concrete in the Federal Building underground parking lot, but if you add more troops in there, where are they going to stay? I doubt they’re going to move into the Ritz-Carlton. I have talked to Marine division commanders down there, and the whole thing is a cluster…. No planning, no coordination. And it cost $134 million, which will have to be added to the deficit.

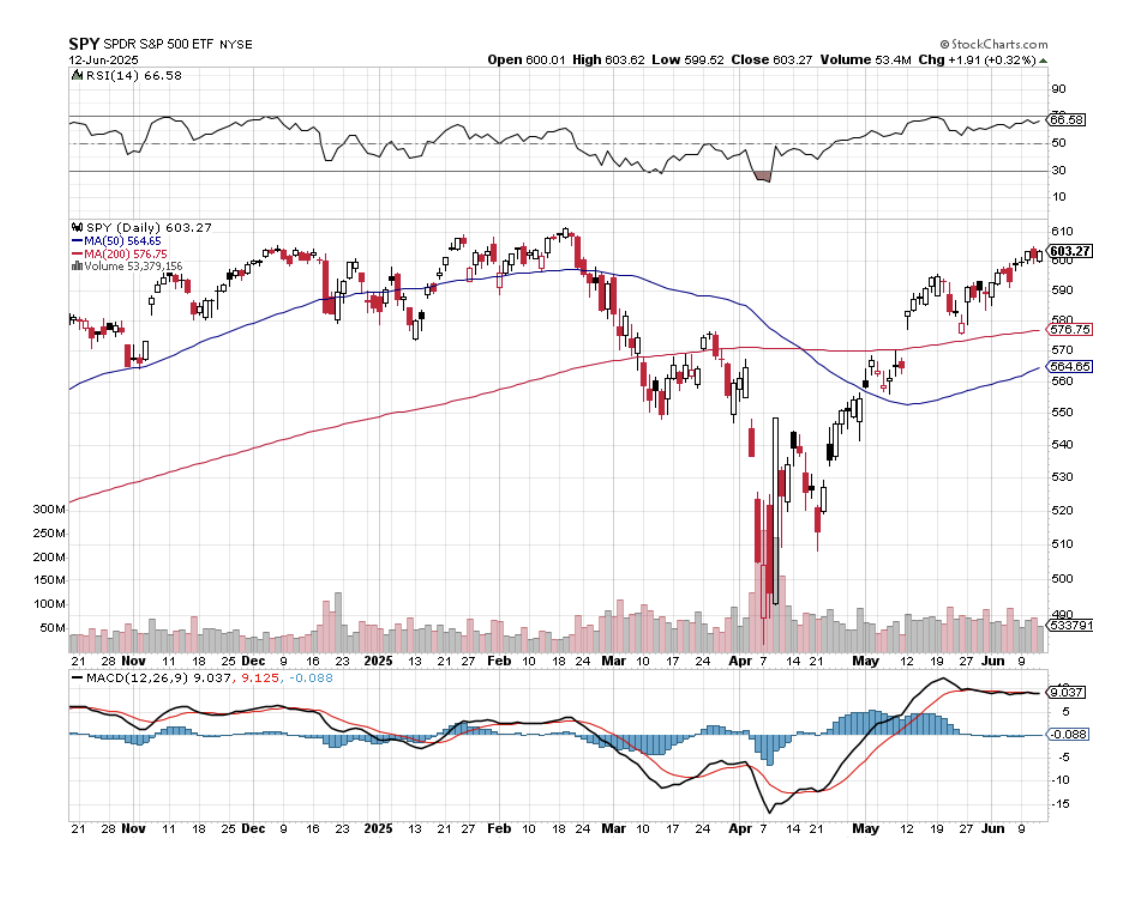

Q: What kind of market are you expecting this summer?

A: I expect we’ll peak out pretty soon and then go flat for the rest of the summer, and then attempt another year-end rally up maybe 10% from here, unless we get bad news on the trade front or inflation takes off. If we do get another supply shocker on the trade front, we could give up at least half of the recent gains and go down to 5,500 in the S&P 500. The new range for 2025 might be $5,500 – $6,500 for the S&P 500 (SPX).

Q: What is your favorite agricultural commodity stock to invest in?

A: Well, John Deere (DE) is the best play in the sector, and they are moving from a sales to a subscription model. They have a new software app that lets farmers predict when best to harvest their crops, and they’re selling that on a subscription basis, so it’s turning it into a technology stock. It’s already had great runs this year. If we get any more market selloffs, pick up John Deere (DE). If you assume the trade war with China ends someday, pick up (SOYB) as a pure ag play. The Chinese are the biggest buyers.

Q: Inflation seems to be easing up. Do you expect the Fed to cut 25 basis points later this year?

A: The answer is No, I do not. As long as you have the unknown of tariffs out there, the main concern of the Fed will be possible future inflation, which means no cuts. The longer these negotiations with China drag out, the more uncertain we are about the level of interest rates, and that’s going to cause the Fed to do nothing, which is their favorite thing to do. So, you may not get any interest rate cuts for a year. Employment seems to be holding up, but there are some chinks on the armor there, as I’ll show you in the numbers.

Q: Is the Fed likely to lower interest rates once the new Fed governor is appointed next year?

A: Absolutely, you can count on the next Fed government being hired specifically for the purpose of taking interest rates to zero. So, you can expect a half-point cut on the first day of the new Fed governor in June next year, and many successive cuts after that. Of course, if there is inflation at that time, it’ll cause it to take off and really catch on fire. We could get up to the 5%, 6%, 7% inflation rates very quickly if they do that.

Q: What is the best way to invest in oil other than directly in the futures?

A: Well, most people are not registered to trade futures, that’s why we don’t make specific futures recommendations. You can always buy the United States Oil Fund ETF (USO) that tracks fairly closely with oil itself, but the real bang for buck in the oil industry is buying oil companies, because they have a lot of upside leverage to the price of oil. My favorites there are going to be Occidental Petroleum (OXY) and Exxon Mobil (XOM), for the dividend.

Q: If foreigners boycott the US Treasury bond auctions, where are they deploying their U.S. Dollars (UUP)?

A: The answer is, foreigners are buying their own bonds—they’re buying Eurobonds or bringing the money back into Europe to the Euro, which is an appreciating currency now against the U.S. dollar. Remember, from the European point of view, everything American is depreciated by 20% just on the currency, and that includes our bonds.

Q: Do you recommend investing in the Australian dollar (FXA)?

A: I do. I think the weak dollar will continue for years—possibly as long as the current administration remains in power, which has a very vocal weak dollar policy. You could get another 10%-20% rise in the Australian dollar and the other currencies like (FXE), (FXY), (FXB) very easily.

Q: They are selling off the market, but I don’t really understand why. I haven’t heard any news.

A: It could be a sell-the-news on the end of the Chinese trade talks, or people getting out of the way ahead of tomorrow’s bond auction—the expectations are not great. We have NASDAQ down 16 on the day, (QQQ)’s are negative on the day now, and people are moving into precious metals. By the way, we took profits on our last gold trade first thing this morning.

Q: Why did Netflix (NFLX) suddenly sell off 10%?

A: If the London trade negotiations with Chinese hint at the end of the trade war, why do you need a trade war-proof stock like (NFLX)? Plus, the stock is up 50% in two months, so there’s pure profit taking and reallocation.

Q: With the U.S. economy slowing, do you see that corporate earnings will increase?

A: No, I do not. Corporate earnings grew at a 14% rate in Q1. I expect the growth rate to fall to zero by Q4, and that is another reason why stocks are very risky here. You don’t want to be paying up all-time-high prices for stocks that are seeing their earnings growth go to zero—not a good combination.

Q: Is there a chance the Chinese Yuan (CYB) will take over the dollar as a world currency?

A: Absolutely not—not in a million years. The Chinese yuan is at the very bottom of the list of currencies that would take over from the dollar. It is a manipulated currency, controlled by a dictatorship, and heavily dependent on international trade. It lacks the depth of a financial system to handle large amounts of international transactions, and all of their reserves are secret. We don’t know how much gold they really own. So, no transparency at all, whereas the United States has all the transparency in the world (or at least it used to.) So, that is a very safe statement to make.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, TECHNOLOGY LETTER, or JACQUIE’S POST, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

2021 Camping at Yosemite