Mad Hedge Technology Letter

July 7, 2025

Fiat Lux

Featured Trade:

(HUMANOIDS TO THE RESCUE OR NOT)

(TSLA)

Mad Hedge Technology Letter

July 7, 2025

Fiat Lux

Featured Trade:

(HUMANOIDS TO THE RESCUE OR NOT)

(TSLA)

Dr. Doom Nouriel Roubini needs to lay off the fear porn – I’m not taking the bait this time. Sorry Roubs!

Roubini is sounding the alarm bells on humanoid robots, but I think it is more of a case of fear-mongering than anything else.

After all, like most economists, Roubini isn’t a trader, and he is an academic who sits behind the scenes and goes after those juicy sound bites that the media need to publish stories.

He wasn’t taking profits in great tech trades like when I captured profits on Netflix just the other day.

His idea goes like this…

He thinks the big breakthrough right now is the evolution of humanoid robots that essentially follow individual workers on the factory floor, on a construction site, and even a chef in a restaurant, or a housekeeper. It’s terrifying, but it’s happening in the next literally year or two.

For this level of transformation in one year, I believe the percentage chance of this coming to fruition is less than 2%.

My understanding of the humanoids is that the software will take 10 years to figure out the nuances.

Roubini — known as Dr. Doom for his bleak economic forecasts — said human jobs would be lost to humanoids.

Instead, an LLM (large language model) learns about everything in the world, the entire internet follows your job or my job or anybody else’s job in a few months, then learns everything that a construction worker, factory worker, or any other service worker can do, and then can replace them. And I think that it’s going to be a revolution — it’s going to affect blue-collar jobs like we’ve never, ever seen before.

The humanoid robot market could reach $7 trillion by 2050, Citi research recently found. Those robots — such as Tesla’s (TSLA) Optimus — may be able to do everything from cleaning your home to folding your laundry. The robots could create job loss as routine tasks get automated.

There is a higher likelihood that this humanoid from Tesla will be used as staging to convince investors to buy more tech stocks.

Tech companies have a huge problem on their hands and there hasn’t been a lot of great brain activity to find a real solution.

Venture capitalists have been lamenting the lack of real innovation in tech products like Mark Andreessen and Peter Thiel.

The humanoid is here to get investors to buy more tech stocks in companies that aren’t innovating.

Tech companies are cutting staff to beat earnings, and that isn’t the sign for top-notch growth.

Investors need to separate the fluff from reality.

The reality is that big tech companies still make enormous amounts of profit but have failed miserably in finding something new.

Apple CEO Tim Cook is still figuring out what to do next after selling the iPhone to Chinese people.

The humanoid operating on AI software might give tech stocks an extra 6-month cushion before investors pull the rug.

Enjoy the bull market while it lasts. I executed a bullish trade in Dell which is part of the AI story.

AI stocks will go higher and humanoid stocks will too – not because they will make money, but because investors still buy the hype.

(TRUMP, MUSK, TARIFFS, & THE BILL – WELCOME TO AN ECONOMIC UPHEAVAL)

July 7, 2025

Hello everyone

WEEK AHEAD CALENDAR

July 8-9 Tariff deadline

MONDAY, July 7

9:30 p.m. Australia Business Confidence

Previous: 2

Forecast: -5

TUESDAY JULY 8

12:30 a.m. Australia Rate Decision

Previous: 3.85%

6:00 a.m. NFIB Small Business Index (June)

3:00 p.m. Consumer Credit (May)

U.S. Treasury Auction 3-year note

WEDNESDAY JULY 9

10:00 a.m. Wholesale Inventories final (May)

2:00 p.m. FOMC Minutes

U.S. Treasury Auction 10-year note

THURSDAY JULY 10

8:30 a.m. Continuing Jobless Claims (06/28)

8:30 a.m. Initial Claims (07/05)

4:30 p.m. US Fed Balance Sheet

Previous: $6.7T

Forecast: $6.8T

U.S. Treasury Auction 30-year bond

Earnings: Conagra Brands, Delta Air Lines

FRIDAY JULY 11

8:30 a.m. Canada Unemployment Rate

Previous: 7.0%

Forecast: 7.0%

2:00 p.m. Treasury Budget (June)

MARKET UPDATE

S&P500

The index makes all-time highs after breaking the Feb. peak at 6147. There is strong upside momentum and still no confirmation of even a short-term peak. This argues for continued gains ahead. Risks to be aware of include an overbought market, which is very evident since its surge from the April low (up 30% in just 3 months). Also, sentiment is slowly shifting to the bullish side (even though this is a much hated move the market has been making, and some are still sitting on the side lines).

Resistance: 6285, 6350/75

Support: 6225/35 and 6140 area

GOLD

Gold is the temperamental dingo, Criss-crossing a patch of land multiple times in its search for food. It will probably find its oasis when it crosses a border on the horizon (representing $3000). Until then, the dingo will continue its unpredictable movements, which are controlled by the macro environment.

Resistance: $3365/75 and $3455-65

Support: $3287/97 and $3247

BITCOIN

Choppiness is the theme with Bitcoin lately. And there is scope for this behaviour to continue. In fact, don’t be surprised if we chop in the range between 95k and 112k for a few weeks/months. We may not see a new high in Bitcoin until close to year-end or early next year.

Resistance: 112k

Support: 106k/107.2k and 104-105k + 96k-98k

The S&P500 futures have fallen early this week after the market reached all-time new highs last week before July 4th Independence Day holiday.

Nevertheless, we must admit that the second half of the year has started strongly.

There appears to be a broadening of the market beyond the tech-heavy Mag 7, which is a sign of a healthier market.

Despite some hiccups along the way, we should finish the year at a new all-time high.

Democrats, Republicans and maybe… the America Party

Elon Musk says he wants to launch another political party after President Trump signed a historic spending bill that Musk opposed.

After his stint as the leader of DOGE, Musk has taken aim at Trump’s legislative centrepiece by likening it to an exercise in “debt slavery”. He went on to say that it would destroy millions of jobs, give handouts to industries of the past and damage the industries of the future.

The Committee for a Responsible Federal Budget last week said it was the most expensive reconciliation bill in history and would add “$US4.1 trillion to the national debt through 2034. If its temporary provisions are extended permanently, that total would rise to $US5.5 trillion.”

The Committee pointed out that the bill would lift the national debt from about 100 per cent of the economy today to 127 per cent by 2034. The sugar high would wear off after a couple of years. And often what comes next is a crash.

Musk was the largest individual donor to the Trump campaign leading into the 2024 election, providing more than $US250m to the cause.

The July 9 deadline for tariffs has been extended

The Trump administration has extended a freeze on sweeping US tariffs, pushing the July 9 deadline back to August 1.

Trump announced his “reciprocal tariffs” on April 2 but paused them for 90 days to give countries time to negotiate deals with Washington.

Those countries that do not make a deal before August 1 will boomerang back to the April 2 tariff level.

So, August 1 is when “it’s happening”, not a deadline.

So far, only the UK and Vietnam have negotiated a deal with the US.

There is a long way to go.

In Down Under land, Aussies are waiting for the RBA to cut rates on Tuesday, which would lighten the grip on wallets, and give breathing room to those with a mortgage. It is widely expected that the Reserve Bank will cut again in September and again in December. The one downside to this is it will send house prices on a tear again, preventing first home buyers from securing a reasonably priced home. An auction observed on television today showed bidding for a two-bedroom unit started at $400,000. The final sale price was $770,000. Prices are already over the top.

HISTORY CORNER

On July 7

QI CORNER

SOMETHING TO THINK ABOUT

Cheers

Jacquie

Global Market Comments

July 7, 2025

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE UNITED STATES OF DEBT),

(TSLA), (AMGN), (TLT), (SPY) (NVDA), (MSFT),

(META), (SNOW), (GOOGL), (AMD)

There is only one number traders and fund managers need to know that came out of the US budget for fiscal 2026, which starts on October 1, 2025: $5.0 trillion.

This is the new debt ceiling increase that was signed into law on Friday and is guaranteed to take the National Debt from $37 trillion to $42 trillion by the end of 2026, or 150% of GDP. We have become the United States of Debt.

What about the mere $3.5 trillion deficit last week’s budget promised? On top of that, you have to add $1.5 trillion in maturing debt that has to be rolled over by the end of next year. The government is rolling over bonds with 0.64% coupons and reissuing ones with 4.4% interest rates. This will increase America’s debt service at a tremendous rate, which already stands at over $1 trillion a year. It is a perfect money-destruction machine. Only a government could do this.

And here is the big problem.

No large country has ever tried to borrow this amount of money before, not in all of human history. Smaller ones have, like Argentina, which saw their borrowing binge trigger inflation topping 200% and render the currency worthless, and Zimbabwe, which saw inflation reach millions of percent.

What will happen when borrowing reaches 150% of GDP in the United States? No one really knows. We are in uncharted territory, terra incognita.

It gets worse.

The government is going to try and sell this $5 trillion in debt when the US dollar is collapsing, down 20% so far this year. And that is when dollar interest rates are among the highest in the world, with a 90-day T-bill rate of 4.40%. What happens when US interest rates fall, which they almost certainly will do no later than May next year? The government is going to try to unload this massive amount of debt just when our long-term debt has become the pariah of international markets.

Another problem that Congress failed to notice in its pell-mell rush to pass the budget at all costs is that the growth assumptions are necessary to service this gargantuan level of debt. Their calculations were based on a 3.0% annual growth rate. In reality, the economy is currently shrinking at a -1.0% annual growth rate.

Growth may improve next year when the aforementioned interest rates fall and tariffs become less opaque. But I doubt we’ll see a 3.0% growth rate anytime during this administration. I can only assume that the people in Washington are terrible at math, as they are mostly lawyers and entertainers.

Experts in the debt markets who are far more knowledgeable and experienced than I are predicting that a 13.5% increase in the National Debt from these levels in 18 months will lead to a super spike in borrowing costs that will take interest rates easily up to double digits, crashing the economy. If that occurs, you can count on stocks to give back half of their current values, as they did in 2008-2009. A stock market crash is a sure thing.

I am not so sure.

My half-century in the markets tells me that usually, the world doesn’t end. I am but a dilettante in the bond world. I am only there when there is easy money to be made. There are usually far more fruitful and frequent pickings in the stock markets. I do know that hedge funds and institutions aren’t chasing this rally. “Discretion is the better part of valor”, said William Shakespeare in Henry IV.

If by some miracle the US Treasury is able to borrow more than the GDP of Germany over the next 18 months with no market consequences, stocks will continue to grind up to new all-time highs, lured by the vision of AI. The price-earnings multiple will rise to 24X, 25X, and 26X, but who cares? What will happen then?

The government will borrow another $5 trillion, taking the National Debt from $42 trillion to $47 trillion. That’s what the current administration did the last time it was in office when, shockingly, tax cuts failed to pay for themselves. Then, you really need to look out below.

On a happier note, one question I get from clients several times a day is how AI will affect the stock market and society as a whole. It has been revolutionary for my own business, which has seen our own Mad Hedge AI Market Timing Index double our trading performance since 2013, and it keeps improving. It gets smarter every year.

I couldn’t function without it. I believe over time, AI will create more jobs than it destroys, should add 1% a year in GDP growth per year, and continuously take the stock market to new highs.

But lately, the growth of AI has vastly accelerated, and it has also become more aggressive. Wives are complaining that their husbands have been kidnapped by Grok or ChatGPT, as they spend all day on it. The person who transcribed my biweekly Global Strategy Webinar was out last week, so we asked Zoom to do the job for us instead. See the results below.

Q: What is your range for the S&P 500 (SPY) this year?

A: I see us stuck in the 5,500 to 6,500 range. Best-case scenario, we get a low single-digit return for the year. But with tariffs, inflation, and political dysfunction, the risks are tilted to the downside.

Q: Which tech names are you watching?

A: NVIDIA (NVDA), Microsoft (MSFT), Meta (META), Snowflake (SNOW), Alphabet (GOOGL), and Advanced Micro Devices (AMD). I’ve traded them all. But many are overbought — I’ll be looking to sell calls or wait for dips before going long again.

Unknown to me, Zoom recently added an AI function to their transcription app and as a result, it tried to enhance my answers. I never actually said the answers highlighted red above, certainly never used the word dysfunction, and didn’t even recommend (AMD). AI added that name because it saw (AMD) as the natural logical progression from the previous six names.

Maybe I should buy (AMD)?

MIT did some interesting research on AI lately. It had two groups of students write an SAT-style essay. One did it on their own. The second used AI apps to assist them. It was found that the brain activity in the AI-using group was far lower than the original writing group.

AI is creating a lot of boring, anodyne, uninspiring, and average answers. There is no originality or creativity. I can spot AI writing a mile away. Are we headed for a boring, anodyne, uninspiring, and average world?

The good news is that humans will still be in demand for the rest of my life. As for yours, I’m not so sure. I am also getting about five new AI-generated job offers a day. It’s nice to be in demand in my old age. Apparently, I am overqualified to do everything.

And because you can never get enough steam engines in your life, here are links to videos I took last week at Golden Spike National Historic Park. They were ordered in 1969 for the 100-year anniversary of the Golden Spike ceremony completing the Transcontinental Railroad.

They were completed in 1979 at a cost of $4 million each in today’s money and just completed a 45-year rebuild. Some 156 years ago, the original 119 steamed all the way out from New York, while the more ornately decorated Jupiter rolled in from Sacramento, California, crossing the High Sierras. They run every day at 1:00 PM Mountain Time. And no, they won’t let you drive the engine no matter how much money you offer them. I tried. (I went to steam engine school in Birmingham, England 40 years ago).

Click here and then hit the PLAY arrow and here.

Another drag on the economy is the resumption of student loan repayments. This will remove 10 million consumers because it will eat up their disposable income. They came from the economy as they had been suspended since the pandemic. The new 2025 budget resumes collections as part of the administration’s wide-ranging war against higher education. Student loans at $1.8 trillion are now the single largest source of consumer borrowing, exceeding credit cards and auto loans. Some 21% of student loans are now in default. They grew from 10% of consumer debt in 2010 to 33% by 2010.

My July performance started off with a bang, with a +2.22% gain, taking us to new all-time highs on all metrics. That takes us to a year-to-date profit of +47.39%. My trailing one-year return exploded to a record +102.63%. That takes my average annualized return to +51.29%, and my performance since inception to +799.28%. These are all non-compounded numbers.

It was a week when the market ground up every day except for Friday. I doubled up my short position in Tesla since the sales decline was worse than I expected. I added a new long in Amgen (AMGN), which looks like it is bottoming out. That leaves me 70% cash, 20% short, and 10% long.

Some 63 of my 70 round trips in 2023, or 90%, were profitable. Some 74 of 94 trades were profitable in 2024, and several of those losses were really break-even. That is a success rate of +78.72%.

Try beating that anywhere.

Nonfarm Payroll Report Delivers Upside Surprise, at 114,000. The headline Unemployment Rate dropped to 4.1%. No case for interest rate cuts here.

Powell Says Inflation to Surge this Summer. He also admitted he would have to cut rates by now before tariffs injected massive uncertainty into the Economy. I think he’s telling us no interest rate cuts this year.

June ADP Collapses. Private payrolls lost 33,000 jobs in June, the first decrease since March 2023. Economists polled by Dow Jones forecast an increase of 100,000 for the month. The May job growth figure was revised even lower to just 29,000 jobs added from 37,000. I hate to state the obvious, but this is another recession indicator.

US Dollar Plunging to Four-Year Low. The $5 trillion debt ceiling increase in the Budget bill is the main reason, which would take the National Debt from $37 trillion to $42 trillion. Pay for that European vacation now before it gets too expensive to go.

US Manufacturing Says We’re Still in Recession. The Institute for Supply Management (ISM) said on Tuesday that its manufacturing PMI nudged up to 49.0 last month from a six-month low of 48.5 in May. It was the fourth straight month that the PMI was below the 50 mark, which indicates contraction in the sector that accounts for 10.2% of the economy.

Tesla US Sales Dive 13% in Q2, on a YOY basis. Global sales declined 13% to 384,122 vehicles in the last three months. The company’s sales were expected to be boosted by the redesigned Model Y, but its otherwise stale lineup is losing ground to competitors in China and the US electric-car market. Most analysts now expect Tesla to report its second consecutive annual decline in vehicle sales, with an average projection of 1.65 million vehicles in 2025, an 8% drop from last year. I hate to state the obvious, but this is another recession indicator. Tesla (TSLA) rallies.

Budget Bill Kills Effort to Restore Strategic Petroleum Reserve, cutting the funding by 90%. Former President Joe Biden conducted several sales from the SPR, including 180 million barrels at $100 a barrel, the most ever, after Russia invaded Ukraine. The sales left the SPR at its lowest level in 40 years when the U.S. was far more dependent on oil imports. This explains why the Iran War rally faded so quickly.

Constellation Wiped out by Tariffs on Aluminum. The stock has shed more than 20% of its value this year, fueled by concerns about how the higher duties would affect demand for its beer. Did you know that their Modelo is the number one-selling beer in the US? At least Mexican beer is getting in.

Q1 GDP is Revised Down, shrinking from 0.2% to -0.5%. It’s further proof that we are in a recession that is accelerating. That’s why bonds (TLT) have enjoyed a five-week, $6.0 rally.

My Ten-Year View – A Reassessment

We have to substantially downsize our expectations of equity returns in view of the election outcome. My new American Golden Age, or the next Roaring Twenties, is now looking at multiple gale-force headwinds. The economy will completely stop decarbonizing. Technology innovation will slow. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old. My Dow 240,000 target has been pushed back to 2035.

On Monday, July 7, nothing of note takes place.

On Tuesday, July 8, at 7:30 AM EST, the Consumer Price Index is announced.

On Wednesday, July 9, at 8:30 AM, we get the Producer Price Index.

On Thursday, July 10, we get Weekly Jobless Claims. We also get US Retail Sales.

On Friday, July 11, at 8:30 AM, we get Housing Starts and Building Permits.

As for me, as you may imagine, the most interesting man in the world is impossible to shop for when it comes to Christmas and birthdays.

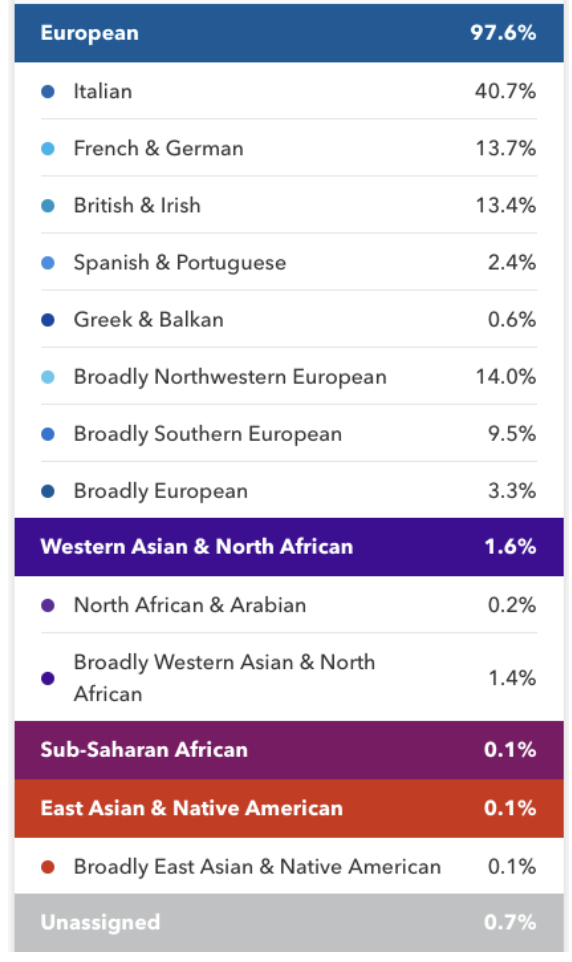

So, it was no surprise when I opened a box last December 25 and found a DNA testing kit from 23 and Me. I spat into a small test tube to humor the kids, mailed it off and forgot about it.

I have long been a keeper of the Thomas family history and legends, so it would be interesting to learn which were true and which were myths.

A month later, what I discovered was amazing.

For a start, I am related to Louis the 16th, the last Bourbon king of France, who was beheaded after the 1789 revolution.

I am a direct descendant of Otzi the Iceman, who is 5,000 years old and was recently discovered frozen high in an Alpine glacier. He currently resides in mummified form in a museum in Bolzano, Italy. So my love of the mountains and hiking is in my genes.

Oh, one more thing. The reason I don’t have any hair on my back is that I carry 346 gene fragments that I inherited directly from a Neanderthal. Yes, I am part caveman, although past wives and girlfriends suspected as much.

There were other conclusions.

I have a higher-than-average probability of getting prostate cancer, advanced macular degeneration (my mother had it), celiac disease, and melanoma. I immediately booked a physical with my doctor.

The service also offered to introduce me to 1,107 close relatives around the world whom I didn’t know about, mostly in New York, California, and Florida.

The French connection, I already knew about. During the 16th century, my ancestors rebelled against the French kings over the non-payment of taxes and were exiled to Louisiana.

Fleeing a malaria epidemic, they moved up the Mississippi River to St. Louis and stayed there for 200 years. When gold was discovered in California in 1849, they joined a wagon train headed west. It only got as far as Kansas, where it was massacred by Cherokee Indians.

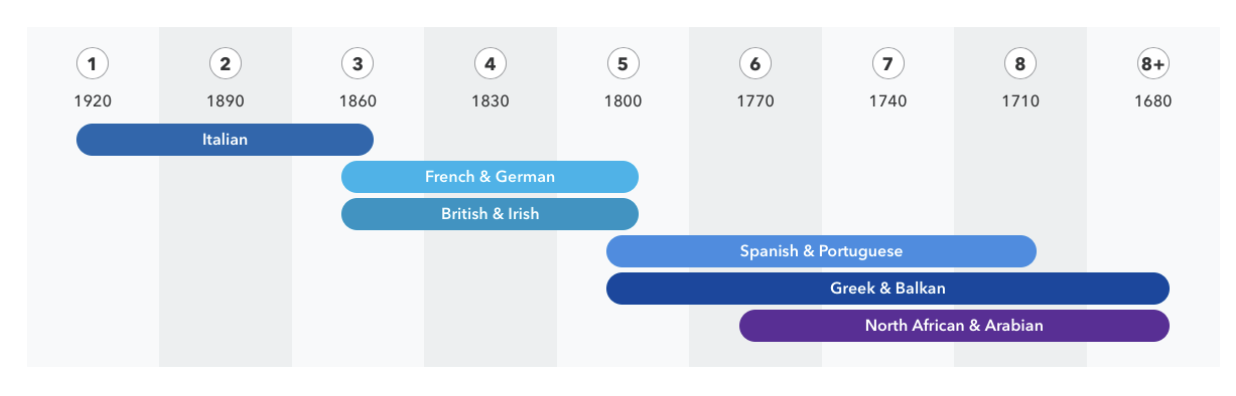

I am half-Italian and have birth certificates going back to 1800 to prove it. But 23 and Me says that I am only 40.7% Italian (see table below). It turns out that your genes show not only where you came from, but also who invaded your home country since the beginning of time.

In Italy’s case, that would include the ancient Greeks, Vikings, Arabs, the Normans, French, Germans, and the Spanish, thus making up my other 9.3%. Your genes also reflect the slaves your ancestors owned, for obvious reasons, as well as many of the servants who may have worked for them.

It gets better.

All modern humans are descended from a single primordial “Eve” who lived in Eastern Africa 180,000 years ago. Of the thousands of homo sapiens who probably lived at that time, the genes of no other human-made it into the modern age. We are also all descended from a single “Adam” who lived 275,000 years ago. Obviously, the two never met, debunking some modern conventions. Living 95,000 apart must have made dating difficult.

Around 53,000 years ago, my intrepid ancestors crossed the Red Sea to a lush jungle in the Sinai Peninsula, probably pursuing abundant game. 11,000 years ago, they moved onto the vast grasslands of the Central Asian Steppes. As the last Ice Age retreated, they moved into the warmer climes of South Europe. We have been there ever since.

23 and Me was founded in 2006 by Anne Wojcicki, wife of Google founder Sergei Brin. It is owned today by her and a few other partners. Its name is based on the fact that humans’ entire DNA code is found on 23 pairs of chromosomes.

23 and Me and other competitors like Ancestry.com, MyHeritage, and Living DNA have sparked a DNA boom that has led to once-unimagined economic and social consequences. DNA promises to be for the 21st century what electricity was to the 20th century. The investment consequences are amazing.

Talk about unintended consequences with a turbocharger.

A common ancestor going back to the early 1800s enabled Sacramento police to capture the Golden State Killer. Unsolved for 40 years, it took a week for them to find him after a DNA sample was sent to a database.

Thirty and 40-year-old cold cases are now being solved on a weekly basis. Long ago, kidnapped children were being reunited with their parents after decades of separation.

California froze all executions. That’s because DNA evidence showed that approximately 30% of all capital case convictions were of innocent men. That was enough for me to change my own view on the death penalty. The error rate was just too high. Dozens of men around the country have been freed after new DNA evidence surfaced, some after serving 30 years or more in prison.

23 and Me had some medical advice for me as well. They strongly recommended that I get tested for diabetes and high blood pressure, as these maladies are rife among my ancestors. They even name the specific guilty gene and haploid group.

This explains why major technology companies, like Amazon (AMZN) and Apple (AAPL) are pouring billions of dollars into genetic research.

I have long had a personal connection with DNA research. I worked on the team that sequenced the first-ever string of DNA at UCLA in 1974. It was groundbreaking work. We obtained our raw DNA from Dr. James Watson of Harvard, who, along with Francis Crick, was the first to discover its three-dimensional structure. As for my UCLA professor, Dr. Winston Salser, he went on to found Amgen (AMGN) in 1980 and became a billionaire.

The developments that are taking place today seem to us like science fiction that was set hundreds of years into the future. To see the paper created by this work, please click here.

As research into DNA advances, it is about to pervade every aspect of our lives. Do you have a high probability of getting a disease that costs a million dollars to cure, and are you counting on getting health insurance? Think again. That may well bring forward single-payer national health care for the US, as only the government could absorb that kind of liability.

And if you can only hang on a few years, you might live forever. That’s when DNA-based monoclonal antibodies and gene editing are about to cure all major human diseases. DNA is about to become central to your physical health and your financial health as well.

To learn more about 23 and Me, please click here to visit their website.

Maybe the next time I visit the Versailles Palace outside of Paris, I should ask for a set of keys, now that I’m a relative? Unfortunately, it’s much more likely that I’ll get the keys to my Neanderthal ancestor’s cave.

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

My Ancestor

“Send us your freaks,” said an Amazon human resources executive to a temp agency during its early days.

Mad Hedge Biotech and Healthcare Letter

July 3, 2025

Fiat Lux

Featured Trade:

(STEADY AS SHE COMPOUNDS)

(ABT)

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

My diabetic neighbor Frank swears by his Abbott FreeStyle Libre glucose monitor, checking his blood sugar with the ease of someone scrolling through their phone on a lazy Sunday morning.

“No more finger pricks,” he told me over the fence last week, tapping the discreet sensor on his arm like it was a badge of honor. “This little gadget changed my life.”

And just like that, Frank reminded me why Abbott Laboratories (ABT) deserves far more love from Wall Street than it gets.

While most are tripping over themselves to chase miracle drugs and moonshot biotech plays, Abbott is doing something radical: delivering consistent, boring excellence.

And in a market that’s feeling more like a seesaw than a rocket ship, boring might just be beautiful.

Abbott’s latest Q1 numbers were classic ABT: quiet competence wrapped in diversified strength.

The stock hovered around $137, barely moving the needle since its $136 print, but context matters. The S&P 500 slipped 0.43% in the same stretch, making Abbott’s small gain feel like a fortress.

This isn’t the kind of stock that makes Reddit (RDDT) traders salivate, but it’s exactly the kind that portfolio managers lean on when the macro turns messy. Defensive resilience isn’t sexy, but it sure helps you sleep at night.

CEO Robert Ford’s earnings call was a case study in calm under pressure. Instead of ducking tough questions or hiding behind macro gobbledygook, he acknowledged the looming $200 million tariff headwind for 2025 with refreshing candor.

Most of the pain hits in Q3, and Ford didn’t sugarcoat it. But he also laid out a real plan: optimizing a 90-facility global manufacturing network to absorb the blow.

Each of Abbott’s four segments tells its own steady success story.

Nutrition posted solid growth, with Similac leading the charge in pediatric nutrition. Medical devices jumped 12.5%, thanks in no small part to the continuous glucose monitors that Frank and millions like him can’t live without. Global CGM sales climbed over 20%.

Electrophysiology clocked in a 10% gain, buoyed by aging demographics and Abbott’s strong cardiac portfolio.

Meanwhile, diagnostics dipped 5% — largely a return to pre-COVID normalcy. It’s hard to be mad at fewer people needing tests.

The real speed bump came from China, where procurement issues dinged lab diagnostics. Not ideal, but hardly a deal-breaker.

If Abbott were a portfolio, it’d be a masterclass in diversification. Blood screening, resorbable stents, molecular diagnostics. They’re quietly taking over every profitable healthcare niche that isn’t grabbing headlines. This is a classic from Warren Buffett’s playbook.

What really earns my respect is Abbott’s refusal to play short-term games. When experts prodded Ford on tariffs, he didn’t promise quick fixes or creative accounting.

He acknowledged the drag and emphasized structural solutions. That’s a company playing the long game, and it’s a trait that’s increasingly rare and disproportionately valuable.

Financially, Abbott delivers the kind of metrics that make even the most conservative investors smile. Healthy profitability, disciplined debt levels, and a dividend that rises like clockwork.

Earnings quality got a few side-eyes from analysts, but there’s no question about the cash flow or the company’s ability to keep paying shareholders.

Valuation-wise, Abbott isn’t a bargain-bin gem, but it’s not overpriced either. It’s actually a fair premium for a defensive compounder in turbulent times.

With steady EPS growth projected through 2026, this looks like the kind of stock you buy when others are distracted by shinier toys.

No, Abbott won’t mint you a Lambo next quarter. But it just might keep your portfolio alive (and thriving) through the next crisis. And in the end, that’s what smart investing is all about.

Frank’s arm isn’t just wearing a glucose sensor. It’s wearing proof that steady innovation beats flashy promises every time.

And that’s exactly why ABT deserves a spot in your portfolio…right next to your aspirin and TUMS.

Global Market Comments

July 3, 2025

Fiat Lux

Featured Trade:

(JULY 2 BIWEEKLY STRATEGY WEBINAR Q&A)

(SPY), (NVDA), (MSFT), (META), (SNOW), (GOOGL), (DHI), (LEN), (KBH), (FXE), (FXA), (FXY), (FXY), (GLD), (SLV), (PPLT), (ALB), (SQM), (NEM), (ABX)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.