Apple Just Gave You a Gift

Steve Jobs? creation dropped a real bombshell on the market Tuesday when it announced Q2, 2012 earnings that were rotten to the core. The timing could not have been worse for a market that was on the verge of complete nervous breakdown. Of the 53 brokers who provided research coverage of the Mountain View, California firm, 27 rated it a ?buy?, 21 ?outperform?, and precisely zero ?underperform?. And you wonder why retail has bailed on Wall Street.

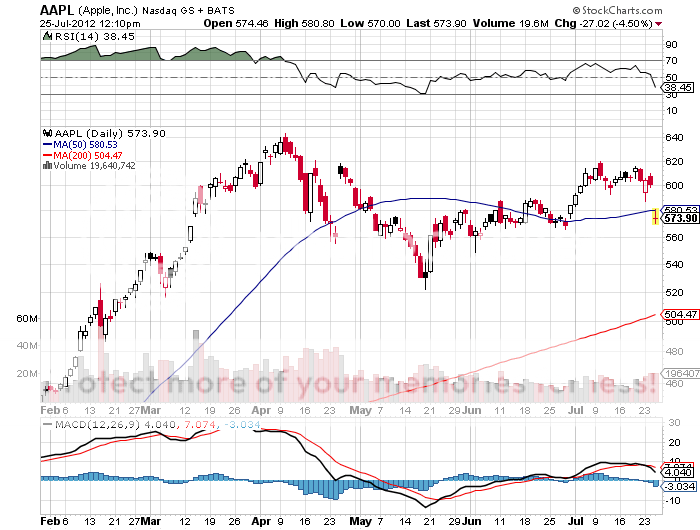

The numbers made grim reading. Sales, which had been targeted at $37 billion came in at only $35 billion. Profits amount to $8.82 billion, taking earnings per share to $9.32, well down from the $10.37 expected. Estimates for iPhone sales had run as high as the low 30 millions. The actual figure was 26 million. In overnight trading, the shares opened down a gob smacking $40, instantly vaporizing $37 billion in market capitalization.

Apple is suffering from the mother of all delayed consumption headaches. Consumers love their products so much they have gone on strike until the vastly upgraded and better performing iPhone 5 is launched in the fall, yours truly included. So the dip in profits will reappear as a spike in profits in the next one or two quarters. This means that if you missed the 50% run up since the beginning of the year, you may have a chance to take another bite at, well, the apple.

Apple is not just an iPhone story. The mini iPad is expected out soon. Apple TV is expected to be huge next year. Apple has only just scratched China?s market of 600 million cell phone users. Its six stores are regularly the scene of long lines, and occasional riots by consumers desperate to buy their products. Droves are crossing the border by train from Shensen to Hong Kong, where Apple products are more easily available.

In the spring I lead readers into the August $400-$450 call spread which became one of our most profitable trades of the year. I took them out a month ago because we had already squeezed out most of the profit, and because I thought that exactly this kind of disappointment might occur.

The intelligent thing to do here is to wait for the current shock to work its way through the system. You also want the present melt down in the broader market to exhaust itself. That could take us well into August. The best-case scenario here is that you get back in when the stock falls all the way down to its June low at $525. If it then drops below $500, double up. This would be a once in a lifetime gift.

If you are cautious, you will then want to put the $400-$450 (AAPL) call spread back on with a January 2013 expiration. The more aggressive could roll up to the $450-$500 call spread. Or you could just buy the stock outright for longer-term accounts. All of the arguments that I made two years ago that the shares were headed for $1,000 are still valid (click here for the link).