The US passed a single-day record of 70,000 new cases for Covid-19 over the weekend, with Florida bringing in an astounding 15,300.

We missed a chance to stop the epidemic in January because we were blind. Then we missed again in April because we were lazy, when New York City was losing nearly 1,000 souls a day and ignored the lessons therein.

So, we relentlessly continue our march towards herd immunity, when two-third of the population gets the disease, protecting the remaining one third. That’s about a year off.

That implies total American deaths will reach 2.2 million, more than we have lost from all our wars combined.

The faster people die, the closer we are to the end of the plague, which is good news for everyone.

And the stock market keeps going up every day, the worse the news, the faster. That may be happening because the more severe the shock to the system, the faster companies must evolve to survive, making them ever more profitable.

Out with the Old America, in with the new. The future is happening fast.

We here at Mad Hedge Fund Trader have just delivered the most astonishing quarter in our 13-year record, up some 41.98% from the March 16 low.

That makes me cautious. Things never stay that good for long. Just because I can’t see the next black swan doesn’t mean it isn’t going to happen.

If stocks rise when corona cases are exploding, what do they do when cases fall? Do they fall too, or do they rise even faster?

That’s above my pay grade. I’m only a captain, not a general.

So, I will be moving to a 100% cash position in coming days and then let the next black swan tell me what to do. If we suffer a severe dive, and 10%-20% is entirely possible, then I’ll jump back in with my “BUY” hat on. That means testing the lower up of my six-month (SPX) 2,700-$3,200 range.

If we suddenly surge to far greater heights and new all-time highs, then I will be selling short as fast as I can write the trade alerts.

In the meantime, we have Q2 earnings to look forward to in the coming week, which will certainly be one for the history books. The bullish view is that they will be down only 44% from a dismal Q1. The bearish view is far worse. Banks (JPM) kick off on Tuesday.

NASDAQ (QQQ) hit a new high at 10,622, with Apple (AAPL) and Microsoft (MSFT) leading the charge. Elon Musk is now looking at another $1.7 billion payday with his shares touching $1,500. I’m moving to 100% cash, peeling off one profitable position a day as each option play reaches its maximum profit. I just had the best quarter in a decade, up an eye-popping 40%, and I’m just not that smart to keep it going. Humility always wins in the long-term.

Goldman Sachs chopped its growth forecast in the face of soaring Covid-19 cases, paring their Q3 prediction from +33% to +25%. Political campaign rallies are spreading the disease faster than expected. Q1 most likely came in at negative -5%. Expect worse to come. If the stock market can’t break at 135,000 corona deaths, it will at 260,000 or 520,000, which is certainly coming.

NVIDIA topped Intel as most valuable chip company. No surprise here. High-end graphics cards are worth a lot more money than plain commodity processors. Keep buying dips on (NVDA) which we’ve been loading the boat with now for four years. There’s an easy double from here.

Warren Buffet bought Dominion Energy (DCUE), in one of the only distressed sales available this year, thanks so much to government support. With natural gas prices at all-time lows, the big boys are throwing in the towel. Immense public pressure is forcing public utilities to abandon fossil fuels. Warren will sell all of his newfound energy in the $10 billion deal to China. It’s the beginning of the end for carbon. Buy (TSLA) on dips.

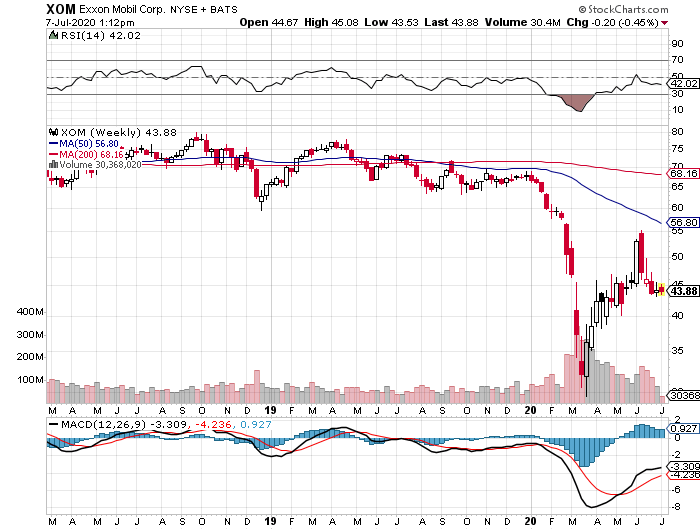

Dividend Cuts will drive stock trading in H2. Energy, airline, cruise lines, casinos, movie theaters, and hotels are most at risk, while big technology companies like Apple are the safest. Currently, the S&P 500 is yielding 2.0%, while the ten-year US Treasury bond is paying out 0.65%. Room for a cut?

Tesla to reach $100 billion in annual revenue by 2025, says San Francisco-based JMP Securities. The logic goes that if they can produce 90,000 vehicles a quarter during a pandemic, 140,000 a quarter should be no problem by yearend. The news delivered a move in the shares to a new all-time high of $1,549. Inclusion of (TSLA) in the S&P 500 would also deliver a lot of forced institutional buying, which might take the shares up 40% more. The future is happening fast. Keep buying (TSLA) on dips for a 2021 target of $2,500. If this keeps up, we may see it next week. Remember, I traded Tokyo in 1989. Nothing is impossible.

US student visas were canceled in ostensibly an administration coronavirus-fighting measure, but really in the umpteenth measure to shut foreigners out. “America first” is turning into “America only.” Midwestern schools in particular will be hurt by the loss of 400,000 full tuition-paying international students, especially when state education budgets are getting cut to the bone. That’s down from 800,000 three years ago. If they’re already here, how does this help us? Most colleges are moving to online-only models to limit infections.

When we come out the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade.

My Global Trading Dispatch enjoyed another blockbuster week, up an astounding +2.28. It was a week when everything worked in the extreme….again.

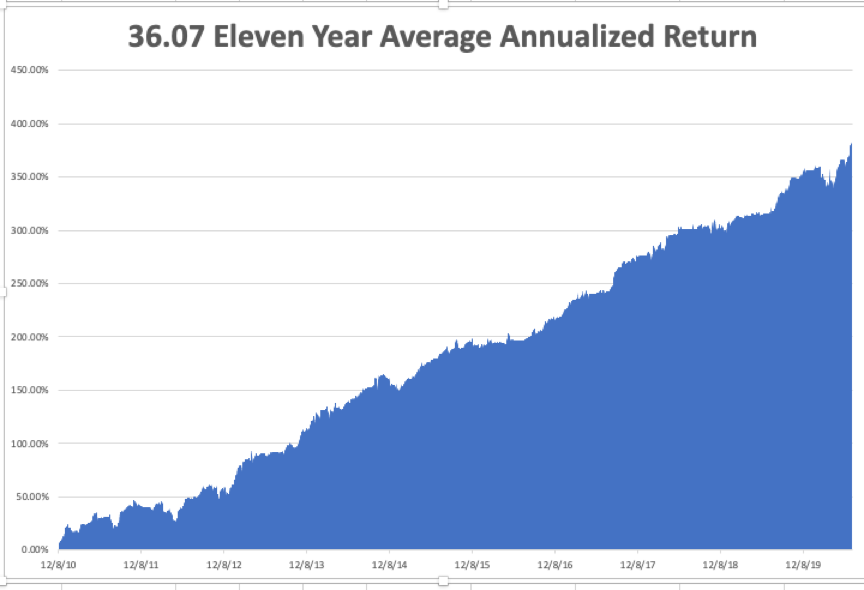

My eleven-year performance rocketed to a new all-time high of 381.74%. A triple weighting in biotech and a double weighting in gold were a big help. A foray into the banks proved immediately successful. I seem to have the Midas touch these days.

That takes my 2020 YTD return up to an industry-beating +25.83%. This compares to a loss for the Dow Average of -8.8%, up from -37% on March 23. My trailing one-year return popped back up to a record 66.22%, also THE HIGHEST IN THE 13-YEAR HISTORY of the Mad Hedge Fund Trader. My eleven-year average annualized profit recovered to a record +36.07%, another new high.

The only numbers that count for the market are the number of US Coronavirus cases and deaths, which you can find here. It’s jobs week and we should see an onslaught of truly awful numbers.

On Monday, July 13 at 10:00 AM EST, the June Inflation Expectations are out.

On Tuesday, July 14 at 7:30 AM EST, US Core Inflation for June is published

On Wednesday, July 15, at 7:30 AM EST, US Industrial Production for June is announced. At 10:30 AM EST, the EIA Cushing Crude Oil Stocks are out.

On Thursday, June 16 at 8:30 AM EST, Weekly Jobless Claims are announced. At 7:30 AM, US Retail Sales for June is printed.

On Friday, June 17, at 7:30 AM EST, the US Housing Starts for June are released.

The Baker Hughes Rig Count is out at 2:00 PM EST.

As for me, I am training hard for my upcoming 50-mile hike with the Boy Scouts, knocking off 10 miles a day at 9,000 feet on the Tahoe Rim Trail. I have to confess that I’m feeling the knees like never before.

As they used to say in the Marine Corps, “Pain is fear leaving the body.” More than knowledge comes with age. Pain is there as well.

Marine Corps to Boy Scout leader. It’s been a full life.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader