It seems like another day, another analyst downgrade for technology. The latest report came from Japan's Nihon Keizai Shimbun, which reported that Apple has asked parts suppliers throughout Asia to cut back parts shipments for its iPhones by 20%. Apple shares responded by falling by $5 to $190.

Granted, the global cell phone market has been flat for the past two years. What is new is that Apple has been extracting an ever-larger share of the global smart phone profit stream, now at a heady 92%, thanks to more expensive products with better functionality. That's what I'm focusing on.

We saw a similar downgrade for the chip sector days early, which cut $9 off the high beta play there, Micron technology (MU).

The bad news was enough to trigger a long overdue rotation from perennial leaders in technology toward laggard banks, retailers, materials, and consumer discretionary.

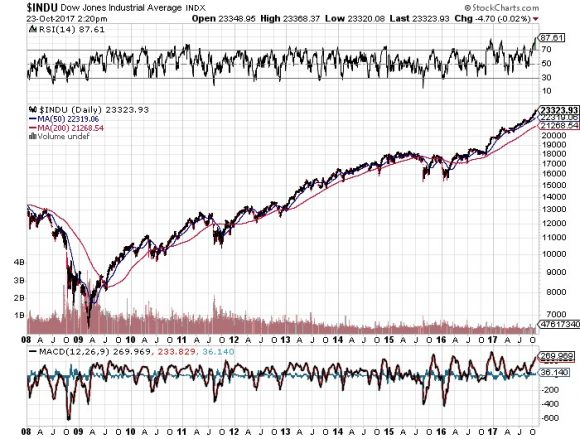

Remember, as long as no new net cash is coming into equities beyond share buybacks, the main indexes can't break out to new all-time highs. My 10-month range for the (SPY) lives!

It is normal to hear a rising tide of wailing from Cassandras decrying impending doom as we reach the end of an economic and stock market cycle. At nine years, this one is already the second longest in history. But we have six more years to run to top the market performance from 1949 to 1961.

Personally, I believe the current technology cycle has a minimum of one to two years to go, so there is more than ample time to make money in the sector.

Much media was focused last week on the G7 Meeting in Quebec City Canada, which appears to soon become the G6, ex the United States. Here we see the unfolding of another aspect of Trump's global strategy.

He wants to break up the American led post WWII order, which made us all wealthy and abandon Europe, Japan, and Australia as allies. This is what all the new trade wars against our friends are all about.

Instead, the NEW world order has us allied with Russia, Saudi Arabia, and a handful of Gulf sheikdoms. If carried out, it should shrink U.S. GDP growth by 1% to 2% a year, caused the mother of all stock market crashes, and greatly undermine the security of the United States.

My prediction is that it won't last. The market risk is zero for the short term, but enormous for the long term. I am not alone in these predictions.

There was another new world order emerging this week, and that the addition of Twitter (TWTR) this week to the S&P 500, replacing old line chemical company Monsanto (MON). I have to confess that I totally missed the Twitter turnaround, which has rocked from $14 to $45 in a year.

Maybe meeting Twitter employees during my nightly hikes on Grizzly Peak and meeting despairing Twitter employees who went up there to commit suicide had something to do with it. This kind of experience kind of puts one off a stock for life.

As for the Mad Hedge Trade Alert Service we are having another blockbuster month. I caught the upside breakout by the lapels and shook it for all it was worth with aggressive long positions in Microsoft (MSFT), Amazon (AMZN), Salesforce (CRM), Apple (AAPL), and the Biotechnology Index (IBB).

The result was to take the performance of the Mad Hedge Trade Alert Service to yet another all-time high. Those who signed up at any time in the past 12 months have to be extremely happy.

After one trading day, my June return is +6.24%, my year-to-date return stands at a robust 26.75%, my trailing one-year returns have risen to 62.14%, and my eight-year profit sits at a 303.65% apex.

This coming week will be all about the big Fed decision on interest rates on Wednesday.

On Monday, June 11, no data of note is released.

On Tuesday, June 12, the Federal Open Market Committee Meeting begins. At 8:30 AM EST, the May Consumer Price Index is released, the most important indicator of inflation.

On Wednesday, June 13, at 7:00 AM, the MBA Mortgage Applications come out. At 2:00 PM EST, the Fed is expected to raise interest rates by 25 basis points. At 2:30 Fed Chair Jerome Powell holds a press conference.

Thursday, June 14, leads with the Weekly Jobless Claims at 8:30 AM EST, which saw a fall of 13,000 last week to 222,000. Also announced are May Retail Sales.

On Friday, June 15 at 9:15 AM EST, we get May Industrial Production. Then the Baker Hughes Rig Count is announced at 1:00 PM EST.

As for me, I will be taking off on my 2018 Mad Hedge U.S. Road Show. See you at lunch.

Good Luck and Good Trading.