Global Market Comments

March 9, 2018

Fiat Lux

Featured Trade:

(HERE'S ANOTHER CHANCE TO MAKE YOUR EMERGING MARKET PLAY),

(EEM), (SPY), (PIN),

(TRADING DEVOID OF THE THOUGHT PROCESS),

(SPY), (QQQ), (IWM)

Global Market Comments

March 9, 2018

Fiat Lux

Featured Trade:

(HERE'S ANOTHER CHANCE TO MAKE YOUR EMERGING MARKET PLAY),

(EEM), (SPY), (PIN),

(TRADING DEVOID OF THE THOUGHT PROCESS),

(SPY), (QQQ), (IWM)

I have been pounding the table for years about a global synchronized recovery, and there is no better way to play it than emerging markets (EEM).

That play it not over.

After suffering volatility that was a multiple of what we saw here in the US during the February meltdown, Emerging markets ae getting ready for an upside move.

The fundamental case is there.

During a period of global growth, emerging nations see growth rates that are double or more those seen here in the US and Europe.

Emerging companies tend to be more highly leveraged than western competitors, giving an upside hockey stick effect on profit growth.

And much of the emerging world is tied to commodities, a legacy of the investments made in their countries by former colonial masters during the last century.

Commodity prices usually outperform those of stocks as we approach the tag ends of a prolonged economic cycle because additional supply can't be created with a printing press.

Emerging countries are also getting a strong tailwind from a weak US dollar, as it increasing the purchasing power of their earnings on the world stage.

Companies that financed their debt in US dollars, a common occurrence abroad, effectively see their loans paying themselves off.

With exploding US budget deficits and a ballooning national debt, a continuation of a weak dollar is a sure thing for the foreseeable future.

This has heralded a dramatic improvement in the credit quality of emerging companies.

Even the technical set up is looking attractive on the charts. You see a narrowing triangle formation to the right which should break out to the upside once the growth data comes in.

The is just a continuation of a trend that has been in place for years.

Since they bottomed at the beginning of 2016, the (EEM) has tacked on an impressive 100%. This is in sharp contrast to the S&P 500 (SPY), which has gained by only 63.42% during the same period. Owning technology was the only way you could beat emerging market returns.

China is the mainstay of emerging markets, with far and away the largest weighting in the (EEM). Last week, the government confirmed that it was targeting a 6.5% growth rate for 2018, the same that was achieved last year.

China only accounts for 3% of US steel imports, so the imposition of a punitive 25% tariff will have a minimal impact on the countries growth prospects.

However, don't look and emerging markets as a one-way bet. After a two-year bull run, it happens to be one of the most over owned sectors in the markets.

There are also major elections coming up in several emerging nations, like Brazil and Mexico. A backlash against Trumps nationalist, protectionist, "America First" policies are a sure thing. That would be market negative.

One way to sidestep this is to take a rifle shot at a single country that has no imminent election. India is the hedge fund community's favorite right now, which has the additional attraction that its steel and trade exposure to the US is minimal.

Take a look at the PowerShares India Portfolio ETF (PIN) if you are so inclined.

??

??

??

??

With every major index rolling around like a BB in a boxcar (SPY), (QQQ), (IWM), the day to day call has become almost impossible.

The Mad Hedge Market Timing Index is now showing “Extreme Fear” with a reading of 20, never a good time to initiate a new short.

What’s a trader to do here?

Invest purely on the basis of momentum?

That risks buying the top tick in the entire move and looking like a complete mug to your clients, your boss, your coworkers, and your wife.

Maybe it’s time to take a long cruise at let your performance flat line at an all-time high?

But then, mid-March is a little early to call it a year, even though you may be up double digits.

The exit of institutional money to trading in in-house dark pools, the concentration of trading into single sector exchange traded funds (ETF’s), and the departure of the traditional individual investor, are all exaggerating these moves.

It doesn’t help that stock markets are sitting just short of all-time highs.

You could run off and trade something else besides stocks. That’s easier said than done, as virtually all other asset classes have become untradeable.

Bonds (TLT) have just entered a new 30-year bear market.

Some commodities (COPX) are now trading at double their fall lows.

Precious metals (GLD), (SLV) seem to be hesitating here.

What’s a poor trader to do?

Take up the action in collectable Beanie Babies? Rare French postage stamps? Crypto-currencies? Rare vintage Madeira’s?

There are only two ways to deal with a market like this. Turn off the TV, cancel your newswire feeds, quit reading research, and just look at your screens.

Buy the low numbers and sell the high ones.

It is no more complicated than that.

Don’t confuse matters with the thought process. The markets are now so illogical you will only muddy the waters. A brilliant move in one hour may look like a disaster in the next.

The other method is to become boring. Just find the cheapest, low fee index fund you can find, like one of Vanguard’s, buy it, and stuff it under your mattress.

I’m pretty confident that it will be up 10% by the end of the year.

That means you will probably beat most hedge managers out there, as you would have done for the past nine consecutive years.

Try to earn more than 10% trading in these choppy markets, and you could end up losing 10%, or 100%.

As for me, I am going to stick with trading. At least I’ll be there when it turns easy again, which has to be soon, and I’ll make a hell of a lot more than 10%.

And was never very good at the “boring” thing.

Global Market Comments

March 8, 2018

Fiat Lux

Featured Trade:

(SO, WHERE'S THE CRASH?),

(GS), (INTC), (CSCO), (VXX), (TLT),

(DON'T GET SCAMMED BY THE MUTUAL FUNDS)

When I heard that White House economic advisor and former Goldman Sachs (GS) CEO Gary Cohen resigned, I thought the Dow Average would crash 1,000 points.

Sure enough, the overnight futures markets was already reflecting down 450.

So, I spent last night writing up Trade Alerts to execute at the market opening. Laid out neatly on my desk in the proper order were alerts to BUY Intel (INTC), sell short US Treasury bonds (TLT), Buy Cisco Systems (CSCO), and sell short the IPath S&P 500 VIX Short-Term Futures ETN (VXX).

When the bell rang, the Dow instantly cratered 350 points and I got the (INTC) Alert off to the Mad Hedge Technology Letter subscribers. And that was it. The market turned around so fast that it was impossible to get anything else off.

So where's the crash?

Surely Gary Cohen has to be disappointed, who almost certainly believed the end of his government employment was worth 1,000 Dow points, instead of the paltry 350 points we saw.

What a come down.

The hard truth is that investors have been instilled with a Pavlovian reaction to buy stocks on any Washington inspired sell off because at the end of the day, they all amount to precisely nothing.

This has worked like a finely tuned Swiss watch, and will continue working, until it doesn't.

Here is the harsh reality.

At a 16X price earnings multiple at a Dow OF 23,800, and overnight rates at 1.50%, US stocks are still A SCREAMING BUY!

It doesn't get any easier than that. And here is another harsh reality. With earnings growing at a 15% annual rate, thanks to the tax cuts, the 23,800 PE multiple floor at 23,800 is rising by 3,570 points a year.

So this year's 23,800 16X multiple bottom becomes next year's 27,370 bottom. That means on any kind of pull back you buy with both hands. If it falls some more, you buy more. Period, end of story.

Normally, I dismiss purely academic valuation arguments out there. But the brutal fact is that there is still $50 trillion in cash sitting on the sidelines held by individuals, intuitions, mutual funds, hedge funds, and foreign investors trying to get into SOMETHING.

US technology stocks are their first choice by miles. That's why I started the new Mad Hedge Technology Letter five weeks ago, and it has been the smartest thing that I have done in a decade.

I expect this to remain the case until US interest rates rise too high, causing the yield curve to invert, eventually triggering a bear market and a recession. But I don't expect this scenario to unfold for another year.

Until then, make hay while the sun shines, and I'll try to get those Trade Alerts out a little faster. After all, I don't expect another major market meltdown until this afternoon, or tomorrow at the latest.

For new subscribers, and the old ones who have already forgotten, let me list below the ten reasons why there will be no stock market crash in 2018:

1) US stocks are still one of the highest yielding asset classes in the world

2) Oil prices are still less than half of where they were 5 years ago.

3) Stronger Japanese and European economies are enabling them to buy more of our exports.

4) While US interest rates are rising, they are doing so at a snail's pace.

5) Delayed US interest rate hikes will keep the US dollar cheaper for longer so more foreigners can buy our stuff.

6) Technology everywhere is hyper accelerating, sending profits through the roof.

7) Stock buy backs and M&A are shrinking the supply of equities.

8) Corporate earnings growth at the fastest in history, some 15% YOY.

9) The hurricanes created a big de facto infrastructure bill.

10) Trade war is more bark than bite.

??

??

??

??

Global Market Comments

March 7, 2018

Fiat Lux

Featured Trade:

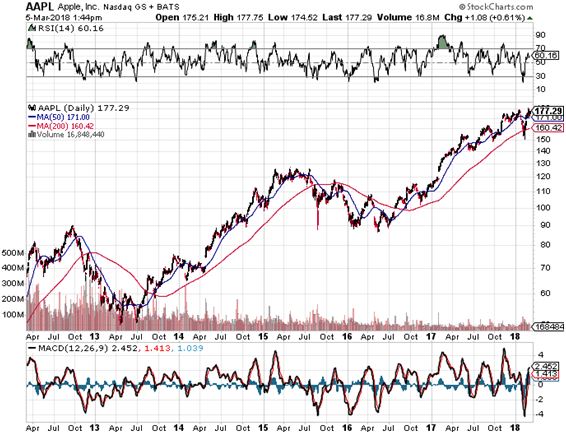

(TAKE A LEAP INTO LEAPS), (AAPL),

(TESTIMONIAL),

(OPTIONS FOR THE BEGINNER)

Global Market Comments

March 6, 2018

Fiat Lux

Featured Trade:

(GETTING AHEAD OF THE TECHNOLOGY CURVE),

(SQM), (GOOGL), (FB), (AAPL)

(ANOTHER REASON FOR APPLE TO GO TO NEW HIGHS, or

THE INCREDIBLE DISAPPEARING US STOCK MARKET),

(NOC), (CSX), (MMM), (UTX), (MSFT), (INTC), (CSCO), (TRV), (GPS), (BBBY), (MCD)

Stay ahead of the curve. That has been my seminal lesson after 50 years of trading the global financial markets.

Stay ahead of the curve, and riches will shower down upon you. Fall behind the curve, and life will become dull, mean, and brutish, and very poorly compensated.

Fortunately, I learned that crucial lesson early on in life. In 1972, when the US left the gold standard, I thought gold had a very bright future, then trading at $34 an ounce. It soared to $900 in seven years. I nailed that peak waiting in a line in Johannesburg to sell the last of my krugerrands.

In 1999, I saw a major crash coming in the Great Dotcom Bubble. I not only turned bearish, I sold my entire hedge fund management company at an enormous premium. Stocks then fell by 80%. Hedge funds died by the thousands.

I am now starting to get an inkling of another major market move.

But first, let me tell you to what extent the most devious, hardest core hedge fund managers are now going to get ahead of the curve.

Want to get a lead on the copper market? How about leasing time on a geostationary satellite to park over the storage facilities of Sociedad Qimica Y Minera (SQM) in Chile, one of the world’s largest producers.

Ore in the pipeline is a fabulous predictor of prices. By the way, (SQM) has risen by 400% in three years.

Stories like this are legion in the hedge fund community. Researchers pick up guys in bars outside of Foxconn factories in China to get a head start on iPhone production.

Another satellite counts ships laid up in Singapore Harbor to predict shipping rates.

I even once relied on a retired KGB officer in Russia to give me the heads up on wheat production there.

Long time readers will remember that I put out a Trade Alert based on this information to buy wheat (WEAT), right after the Mad Hedge Fund Trader was blessed with 50 new subscribers from Italy (I spoke at a conference there).

They made so much money that I received a lifetime’s worth of invitations to pasta dinners in Rome and Milan, which are made out of wheat. Some eight years later and I’m still collecting.

So having established the value of TRULY granular, on-the-ground research, let me tell you what I learned lately.

I was having lunch with a major San Francisco real estate investor the other day, and what I heard blew my mind.

Alphabet (GOOGL) is soaking up office space like there is no tomorrow. In 2017 it was the top lessor of space in the area, taking more than any other private or government entity.

The creation of Sergei Brin and Larry page currently owns or leases 20 million square feet of office space in the entire San Francisco Bay Area, housing some 34,000 workers.

To give you some idea of the scale of these holdings, that is DOUBLE the square footage of the pre-9/11 Twin Towers in New York.

What’s more, Alphabet is looking to DOUBLE this figure within the next five years.

Google already dominates the skyline of its hometown of Mountain View, California, where it already has 20,000 workers. It is negotiating with the City of San Jose for the purchase of a full city block large enough to build a new tower for a further 20,000 workers.

Various Alphabet divisions are spilling throughout the region, as far north as Marin County and as far east as Oakland and Alameda. What’s more interesting is that many of these leases contain options to buy. These are definitely long-term plays.

Other tech titans are similarly expanding, although not at the frenetic rate seen at Alphabet. Apple has 25,000 Bay area employees and is just in the process of moving into its brand new, flying saucer shaped “Donut” headquarters (the vanity address is One Infinite Loop, Cupertino, CA). Fly over it on a clear day in a small plane and you can’t miss it.

Facebook is also enjoying a growth spurt. Half of its 25,000 employees work at its Mountain View headquarters (address: One Hacker Way, Mountain View, CA). It is scouring the landscape for more.

The influx of so many highly paid tech workers in such a confined space has far reaching implications.

Residential real estate prices are through the roof, up 13% YOY, and more than 100% in five years. The local real estate pages have shrunk to nothingness, as everyone is afraid to sell for fear of not being able to get back in.

Traffic is now worse than in Los Angeles. And good luck hiring a cleaning lady, gardener, or housekeeper. You can only hire an experienced nanny if you throw in a free BMW. Every contractor is booked beyond infinity.

And good luck getting your kids into a private school at $40,000 a year each. Applications are outrunning places by 5:1.

The implications for technology share investors is nothing less that mind boggling.

If Alphabet thinks it will more than double its business, it’s safe to assume that the share price will double as well. What is more likely is that the stock will appreciate even more, given the economies of scale and their dominance of the current advertising industry by Alphabet.

It isn’t just the ad people and their programmers who are demanding more space. YouTube, the autonomous driving subsidiary Waymo, and their life sciences spinoff Verily are also growing by leaps and bounds.

I think the conclusion of all of this is pretty obvious. Buy Alphabet and any dip, and then go out and buy some more.

Now you see it, now you don't.

If you think this was some kind of magic show, you'd be right. For what has been disappearing is the US stock market.

American companies have been buying their own shares back at a frenetic pace, some $5 trillion worth in the last six years. And since the beginning of 2018, that buy back rate has doubled, thanks to the machination of the new tax bill.

If you own stocks, you should feel like you just landed in Heaven.

Mergers and acquisitions have vaporized another $2 trillion of equity.

Some 35% of the American equity markets have gone poof, gonzo, and bye-bye in a mere half a decade

This all compares to a total remain stock marketing capitalization today of $25 billion.

The laws of supply and demand are really quite simple. The fewer shares that are out there, the more valuable the remaining ones become.

It's not like shares go to money heaven when they are bought back.

Companies are not allowed to keep them. Instead, they retire them, increasing the relative ownership of the company for the remaining shareholders, like you and me.

This means there are fewer claims on earnings, and a greater say in the future of the company through increased voting power at shareholder meetings and proxy fights.

The net effect is to improve the firm's financial ratios and boost return on equity and the return on assets. These are all excellent reasons for the shares to trade at higher price earnings multiples and rise in value.

You can't blame corporate America for falling into a narcissistic love affair with its own shares.

For a start, because the S&P 500 (SPY) up 400% from its March, 2009 bottom, they have been fantastic investments.

Take a look at Apple (AAPL), with the largest buyback program in absolute dollar terms by miles. Since it announced its share repurchase plan in late 2012 the value of its stock has skyrocketed some 262%.

According to their latest announcement, the firm is committed to buying back another $170 billion worth of stock, or 68% of its current $250 billion cash hoard.

Anyone who thinks this money is coming home to create new jobs is smoking California largest export crop.

The same is true for most other big names.

The bottom line here, ironically, is that companies can make more money buying back their own shares than investing in their own core businesses, even with technology firms.

Expect this to continue. Looking in the only in the rear-view mirror with your foot firmly on the accelerator has proved a successful management strategy for decades.

It not like senior management solely have the interests of shareholders at heart either. The bulk of their personal compensation is usually tied to stock options in their own firms' stocks.

More aggressive corporate share buybacks pave the path to high prices and personal enrichment beyond the dreams of Croesus.

That has enabled a continuously rising stock market to mint more billionaires than you can count, even though the beneficiaries had no idea what markets were going to do.

It's like the cock taking credit for the rising sun.

No wonder I have such a tough time chartering a personal jet these days!

Take a look at the share prices of some of the most ambitious buyers of their own stock.

Bed Bath & Beyond (BBBY) has purchased 50% of its outstanding float, at one point delivering a 400% gain in its shares, even though its core retail business sucked.

The Travelers Company (TRV) has removed a mind boggling 60% of its shares from the market, delivering another 400% gain in the shares.

Gap, Inc., a member of another dying industry, which bought back some 55% of its shares, saw prices jump some 800% at the top.

Wasn't it Calvin Coolidge who, our 30th president, who said that, "The business of America is business."

The reality is that the business of America is buying shares.

You can also blame interest rates, which have stayed at ultra-low levels for the past nine years, thanks to the Federal Reserve's aggressive quantitative easing programs.

Back in the day, when overnight interest rates were at 6%, large companies maintained substantial cash management divisions to administer their excess funds.

No more. It doesn't take a lot of talent to bring in a zero return. And cutting a few green eyeshades was always a popular cost cutting measure.

It's not like shares go to money heaven when they are retired.

Largest Share Repurchase Programs 2010-2017

Industrials

Northrop Grumman (NOC) - 50%

CSX Corp. (CSX) - 29%

3M Co. (MMM) - 25%

United Technologies (UTX) - 25%

Technology

Microsoft (MSFT) - 30%

Intel (INTC) - 30%

Cisco (CSCO) - 32%

Consumers

Travelers (TRV) - 60%

Gap (GPS) - 55% (GPS)

Bed Bath & Beyond (BBBY) - 50%

McDonald's (MCD) - 36%

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.