When asked about the urban legend that the vaults at Fort Knox are empty, and that the Fed has no gold, former Federal Reserve Chairman Ben Bernanke responded,"I've been to the basement of the New York Fed. The gold is there. I've seen it."

When asked about the urban legend that the vaults at Fort Knox are empty, and that the Fed has no gold, former Federal Reserve Chairman Ben Bernanke responded,"I've been to the basement of the New York Fed. The gold is there. I've seen it."

Global Market Comments

November 6, 2017

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, OR

WHAT A WEEK THAT WAS!), (AAPL),

(DON'T GET SCAMMED BY THE MUTUAL FUNDS)

What a week that was!

Trump campaign criminal indictments, a controversial new tax bill, Apple earnings, a Fed governor appointment, and a blockbuster Nonfarm payroll report would have kept the hands full of any trader.

Yet, despite all of this, markets closed at new all-time highs on Friday.

Followers of the Mad Hedge Fund Trader also got to enjoy the Lake Tahoe Master Minds Conference on the weekend, one of the truly insightful events of the year.

But more on that another day.

I'll make a few brief comments on the the week's action, as I have to race over a High Sierra mountain pass before it is closed by snow.

The Big MO continues.

The market momentum is so overwhelming that to resist it would be like standing in front of a runaway locomotive.

Hedge funds have lost half their potential trades, the short side, and are getting hit with massive redemptions for poor performance.

All agree that it will end, and maybe soon, but NO ONE is willing to stick there neck out now.

As for me, I am committing to going 100% into cash in mid-December, now the de facto end of the year.

The risk/reward of initiating new positions is now so unfavorable, that no other choice is justified.

With mountains of tax deferred selling postponed until 2018, January has HURT written all over it.

Some 100% of the market gains in October were due to only the five FANG stocks.

Without their contribution, the S&P 500 would have been down for the month.

Talk about concentration!

Apple (AAPL) alone added $80 billion in market capitalization, the equivalent of the GDP of a small country, larger than Ethiopia, but smaller than Sri Lanka.

Apple earnings came out better than expected, pouring more fuel on the FANG fire, taking the share up 53.51% since January, creating an eye-popping $310 billion in new market capitalization.

The Federal Open Market Committee came and went with no action, as expected. The federal funds rate stands at a 1.25%-1.50% range.

Don't expect the same at the December meeting.

From January, the meeting will be held with a new boss in town.

Jerome Powell was the closest thing to an ultra-dove the Republicans could find in their party.

So expect Janet Yellen's policies will continue unchanged, with a focus on jobs, and interest rates lower for longer.

You don't want to appoint an interest rate hawk to the Fed just before you take on a mountain of new debt, which seems to be the plan.

Mueller fired the opening salvo in a long string of criminal indictments that will stretch out for years.

His strategy is clearly to arrest peripheral figures first, squeeze them for all they're worth to exchange damning testimony for a light plea bargain, then circle in on the final criminal mastermind, whoever that may be.

The markets proved how desensitized they have become to out-of-the-blue Washington shockers by engineering a mere 200 point correction, which was over in hours.

The FBI has been doing this for 100 years. It is all classic G-Man stuff. Expect it to continue.

What better way to finish the week than with a blockbuster October Nonfarm Payroll Report that showed the economy added 261,000 jobs.

The headline Unemployment Rate collapsed to a subterranean 4.1%.

It shows that the hurricane inspired dent to the economy snapped back smartly, as I expected.

A global synchronized economic recovery is a tough thing to bet against.

What is happening now is that Europe and Japan, once a drag on growth, are now beating the pants off the US.

That's because they implemented American style quantitative easing five year later, and it is only now starting to bear fruit.

As for the tax bill, don't even waste your time reading about it nor your accountant's.

There is absolutely NO chance that the bill will pass in the remaining eight working days congress still has in 2017.

The president believes as much by leaving the country for 14 days the day the plan was announced.

If he thought the bill had the remotest chance of passing he would be here working the phones like crazy trying to force it through.

Something greatly diluted will get through some time next year with minimal impact on the economy, but with a lot of new government debt.

The economy, and corporate America, are doing just fine, thank you, as this year's earnings reports confirm.

So don't downgrade your car, sell off the second home, or tell the kids they need to get minimum wage jobs to finish college just yet.

The coming week will be the slowest of the month from a data point of view.

On Monday, November 6, there is no economic data of any import.

On Tuesday, November 7 at 6:00 AM EST we get a new NFIB Small Business Optimism Index, which is based on a questionnaire of only 10 common business outlook questions.

On Wednesday, November 8, at 7:00 AM EST we obtain MBA Mortgage Applications, which should tail off, given the recent sharp rise in interest rates.

The weekly EIA Petroleum Status Report is out at 10:30 AM.

Thursday, November 9 at 8:30 AM EST we learn the Weekly Jobless Claims, which have been plunging to new 43 year lows.

On Friday, November 10 at 1:00 PM, we receive the Baker-Hughes Rig Count, which lately has been rolling over.

How many mutual funds would you guess outperformed the stock market since the bull run started almost nine years ago?

If you guessed 1,000, 100 or even 10, you would be dead wrong and even off by miles. In actual fact, not a single mutual fund has beaten the market since 2009.

Remember all those expensive, slickly produced TV ads boasting market beating ratings and top quartiles?

You know, the ones that show an incredibly good looking, but aging couple walking hand in hand into the sunset on a deserted beach?

They are all just so much bunk. The funds mentioned rarely quote performance beyond one or two years.

Like my college math professor used to tell me, "Statistics are like a bikini bathing suit. What they reveal is fascinating, but what they conceal is essential."

Recently, the New York Times studied the performance of 2,862 actively managed domestic stock mutual funds since 2009. It carried out a simple quantitative analysis, looking at how many managers stayed in the top performance quartile every year.

Their final conclusion: zero.

It gets worse.

It is very rare for a manager to stay in the top quartile for more than one year. All too often, last year's hero is this year's goat.

The harsh lesson here is that investing with your foot on the gas pedal and your eyes on the rear view mirror is certain to get you into a fatal crash.

The Times did uncover two funds that stayed at the top for an impressive five years. They turned out to be small cap energy funds that took inordinate amounts of risk to achieve these numbers and have since lost money.

The reasons for the woeful under performance are legion. Management fees are sky high and grasping. Hidden costs are everywhere. Read the fine print in the prospectus, as I do, and you would be shocked, truly shocked.

Real talent is in short supply in the mutual fund industry, with all the real brains decamping to start their own 2%/20% hedge funds. The inside joke among hedge fund managers is that employment at a mutual fund is proof positive that you are a lousy manager.

Let's go back to those glitzy TV ads, which cost millions to produce. If you are a mutual fund investor you are paying for all of those too. They are made at the expense of a lower return on investment on your money.

And those sexy performance numbers? They benefit from a huge survivor bias. As soon as fund performance starts to tank, the managers close it, lest it pollute the numbers of other funds in the same family.

The number of funds with good, honest 20-year records can almost be counted on one hand.

Now let me depress you even more.

An industry performance this poor under performs random chance. That means chimpanzees throwing darts at the stock pages of the Wall Street Journal would generate a higher investment return than the entire mutual fund industry combined.

So much for all of those Harvard MBAs!

Are you ready to throw your empty beer can at the TV set yet?

If you think all of this stuff should be illegal, you are probably right. But since you watch TV, then you have probably been trained like a barking seal to oppose the regulation that would reign these people in.

This is what the attempt to kill the Dodd-Frank financial regulation bill was all about. The mutual fund industry complains bitterly that they are over regulated and spend millions on lobbyists to get themselves off the hook. By the way, these expenses also come out of your fund performance.

These are all reasons why the Mad Hedge Fund Trader is able to generate such high performance numbers year in and year out.

I am not charging you with any of my overhead. I am not jacking up your commissions. Nor am I selling your order flow to high frequency traders for a tidy sum so they can front run you.

Being a small operation, I'll tell you what I don't have. I lack an investment banking department telling me I have to recommend a stock so we can get the management of their next stock issue or a sweet M&A deal.

I am absent a trading desk telling me I have to move this block of stock before the prices drop and my bonus gets cut.

And I am completely missing a boss screaming at me that if I don't get my orders up, my wife would have to become a prostitute to support our family (yes, some asshole sales manager actually told me that once. I later heard he died of a heart attack).

You just need to pay me a low, flat, annual fee, and I'm done. I don't need any more. It's up to you to search out the best deal you can get on executions.

Don't even think about trying to give me your money to manage. I don't want it.

This is why the overwhelming bulk of investors are better off investing in the cheapest Vanguard index fund they can find, diversifying holdings among a small number of major asset classes, and then rebalancing once a year (click here for my "Buy and Forget Portfolio").

Welcome to the brave new world.

Global Market Comments

November 3, 2017

Fiat Lux

Featured Trade:

(TRADING FOR THE NON-TRADER),

(ROM), (UXI), (UCC), (UYG),

(TEN TIPS FOR SURVIVING A DAY OFF WITH ME)

Global Market Comments

November 2, 2017

Fiat Lux

Featured Trade:

(CHICAGO WEDNESDAY, DECEMBER 27 GLOBAL STRATEGY LUNCHEON)

(THE WORST TRADE IN HISTORY), (AAPL)

(THE QUANTUM COMPUTER IN YOUR FUTURE),

(AMZN), (GOOG)

Come join me for lunch for the Mad Hedge Fund Trader's Global Strategy Update, which I will be conducting in Chicago on Wednesday, December 27.

A three-course lunch will be followed by an extended question and answer period.

I'll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, energy, and real estate. And to keep you in suspense, I'll be throwing a few surprises out there too.

Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $239.

I'll be arriving an hour early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a downtown Chicago venue on Monroe Street that will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

To purchase tickets for the luncheons, please go to my online store at www.madhedgefundtrader.com, click on the "STRATEGY LUNCH" tab in the second row, then the "USA" tab, and then click on the CHICAGO STRATEGY LUNCHEON link.

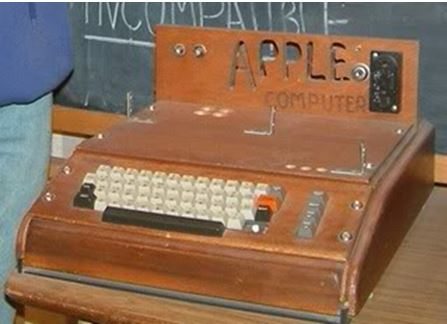

Say you owned 10% of Apple (AAPL) and you sold it for $800 in 1976.

What would that stake be worth today?

Try $75 billion.

That is the harsh reality that Ron Wayne, 83, faces every morning when he wakes up, one of the three original founders of the consumer electronics giant.

Ron first met Steve Jobs when he was a sprightly 21-year-old marketing guy at Atari, the inventor of the hugely successful Pong video arcade game. In those days, Steve never took a bath, as he believed they were unhealthy.

Ron dumped his shares when he became convinced that Steve Jobs' reckless spending was going to drive the nascent start up into the ground and he wanted to protect his assets in a future bankruptcy.

Co-founders Jobs and Steve Wozniak each kept their original 45% ownership. Today Jobs' widow owns 0.5% ownership is worth $4 billion, while the Woz shares remains undisclosed.

Ron designed the company's original logo and wrote the manual for the Apple 1 computer, which boasted all of 8,000 bytes of RAM (which is 0.008 megabytes to you non-techies).

Jobs tried on many occasions to get Wayne to return to Apple, to no avail.

Wayne worked at Atari into 1978, and later moved on to Lawrence Livermore Labs.

Today, Ron is living off of a meager monthly Social Security check in a mobile home park in remote Pahrump, Nevada, about as far out in the middle of nowhere as you can get, where he can occasionally be seen playing the penny slots.

He spends his time collecting rare coins and stamps.

Ron has never purchased an Apple product.

When asked how he manages the time to be chairman of Microsoft, run the world's largest charity, and raise three kids, Bill Gates answered, "I don't mow the lawn."

Global Market Comments

November 1, 2017

Fiat Lux

Featured Trade:

(THURSDAY DECEMBER 28 MINNEAPOLIS STRATEGY LUNCHEON),

(BATTERY BREAKTROUGH PROMISES BIG DIVIDENDS),

(TSLA),

(TESTIMONIAL)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.