I am writing this to you from Terminal 3 at San Francisco airport, awaiting my flight to Honolulu, Hawaii.

The pilot strides by quickly and purposefully, and I?m wondering if I should stop him for a brief pilot to pilot chat.

How are you feeling? Are you satisfied with your life?

Are you feeling depressed at all?

Hey, did you hear the one about the chicken that crossed the road...?

Two guys walk into a bar, and there?s a duck sitting on a barstool...?

Did you know that the three most often told lies are ?the check is in the mail?, ?I?ll get back to you? and ??

A Protestant, a Catholic and a Jew are sitting next to each other when the engine fails?

My kids quickly talk me out of the idea. They convince me that if I did make it to Hawaii, I probably would only get as far as the Federal Detention Facility in Honolulu. This must be the only family in the world where the kids have to ask the dad to exercise discretion.

But I digress.

No, this is not some kind of April Fool.

You would think that homebuilders would be the worst place in the world to invest right after the biggest bond bull market in history is ending, and interest rates are going to rise.

Not so.

In fact, homebuilders are the current number one pick of Bill Miller, the legendary stock picker at fund manager Legg Mason. He argues strongly that it will be the easiest place to make money in the market for the rest of the decade, with the stocks doubling or more from current levels.

I like the sound of this.

Bill argues that there is a 500,000-unit deficit in homebuilding industry capacity compared to market demand. It trades at a 25% discount to the S&P 500 earnings multiple of 17X. He expects profit growth to run at a 20% annual rate for the next 3-5 years.

And let?s face it. The data out of the real estate industry in February was nothing less that blockbuster. February new home sales were up a red hot 7.8% and January was revised up to a smoking 4%. February pending home sales clocked 6.1% and 12% year on year.

When you see an entire data range catch fire like this, it becomes highly convincing.

This rocketing demand is occurring in the face of shrinking supply. There are now only 1.8 million existing homes on the market in the United States, a 4.6 month supply, close to an historic low. Real estate agents are clamoring for new supply, but the builders are taking their own sweet time.

After a quiescent 2014, home prices in America have started to rise once again.

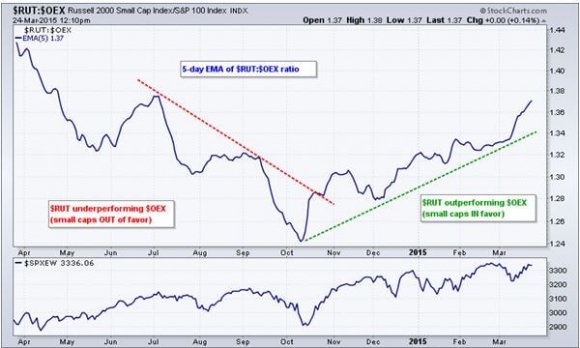

You would think that anyone going into the homebuilders just as interest rates are starting to increase has a hole in their head. But look at the correlation between rates and homebuilder share prices, and the opposite is true.

When prices began their meteoric rise last year, culminating in an eye popping 1.62% yield on ten year Treasury bonds (TLT) in January, homebuilder stocks looked liked they had Montezuma?s revenge.

Now that rates have backed off, and the Fed has been rattling its saber for more interest rate rises (goodbye ?patience?), the sector has been on fire.

The reason is that the Fed will raise rates only if they see inflation coming. This would be fantastic news for the entire real estate industry, the most reliable inflation hedge out there for the individual investor.

Having your inventory appreciate in value through no effort of your own is also about the best thing that can happen to any developer.

The key to understanding these stocks is that this is not you father?s real estate industry.

Absolutely no one competes for market share anymore. Companies are constructing only enough homes they are certain to sell at high margins. They?re also getting cagier on land acquisition costs.

Hence the shortage.

Look no further than Lennar (LEN). At the top of the last housing cycle in 2005, they built 53,000 houses. In 2015, they will construct only 25,000, but will earn a far greater profit margin on them.

Those firms that reached for market share with leverage were wiped out by the great cleansing of the 2008 crash, or were taken over for pennies on the dollar.

Mind you, the industry still has major challenges. The entry-level buyer is missing in action, as millions of students buckle under crushing debt loads. Some 10% of all homeowners representing 5.4 million units are still underwater on their mortgages, blocking trade ups.

These factors alone explained the market?s and the homebuilder shares lack of sizzle in 2014.

But longer term, the outlook is fantastic.

My ?Golden Age? scenario for the 2020?s makes the homebuilders an absolute sweet spot to be in. A demographic shortfall will make workers scarce, lead to rising wages, and at long last bring a return of inflation. It is a perfect storm for rising home prices.

Could the market already be starting to discount the great things to come in the next decade?

In addition to (LEN), the usual suspects in this sector include Pulte Homes (PHM), KB Homes (KBH), the old Kaufman & Broad (who sold out right at the top) and DR Horton (DHI). You can also contemplate the Real Estate iShares ETF (IYR).