I will be departing for my Mad Hedge Fund Trader?s 2014 Australia and New Zealand tour as soon as I finish writing today?s letter. During the next 18 days, I will fly 22,000 miles, dining with my abundance of readers in the southern hemisphere.

I am leaving you in good hands with a clean conscience. The markets graciously allowed me to exit my three remaining positions with nice profits, placing readers in the enviable position of being up +5.42% for the month of February, 8.46% year to date, and up +130.96% since inception. This was during a period when the Dow Average dove a ferocious 7.6%.

All 13 new Trade Alerts issued so far in 2014 have been profitable. The one loser we realized, in Softbank (SFTBY) shares, was carried over from 2013.

Hard earned experience has taught me that reaching for more than this in these troubled, volatile, and unpredictable times could result in my hand getting chopped off. Better to continue on the year with all ten digits intact, so as to type the Trade Alerts faster.

I will be meeting the CEO?s of major multinationals, the heads of sovereign wealth funds, senior officials at ministries of finance and central banks, and, of course, lots of hedge fund managers.

These meetings are extremely helpful in updating my view on all asset classes, as well as getting a real time read on the state of the global economy. You will be the direct beneficiaries of any insights I may glean, as they will directly translate into new, profitable trades upon my return to America.

Until then, I will be rerunning my favorite pieces from past letters, which have been updated for market relevance and accuracy. Thousands of new subscribers have recently joined the Mad Hedge Fund Trader community and will be reading them for the first time. Many of the rest of you were either too busy to catch them the first time, or completely forgot them.

I doubt that I will be issuing any new Trade Alerts during my trip. With these incredibly volatile market conditions, you have to be glued to your screen at all times, or you are toast. In Australia the New York market opens at 1:30 AM and closes at 8:00 AM local time. Given my packed schedule of strategies luncheons and speaking engagements, I really need a full night of sleep to carry it off.

Quite honestly, I am also getting kind of tired and can use a rest. Over the past two months, not only did I keep up my 1,500 word a day torrent of ideas and opinion, I also managed to pump out 44 trade alerts, nearly all of which made money.

This workload would crush most 30 year olds, and I just turned 62. Maybe I can catch some shuteye during the 45 hours that I will be spending on planes over the blue Pacific.

During my off hours, I will be mountain climbing on New Zealand?s North Island, where the Lord of the Rings trilogy was filmed, surfing on the western beaches, going wave hopping while piloting a small plane along the coast of New South Wales, and diving off a small coral island on the Great Barrier Reef.

My business strategy towards life has always been to under promise and over deliver. I believe that I have done this in spades with the Trade Alert mentoring program.

Not a day goes by without an email from a satisfied subscriber telling me that I have paid for a college education, a loved one?s chemotherapy, or given new meaning to long, but tired careers. Coming at a time in my life when there are clearly more years behind me than ahead, when the hike has fewer miles ahead than behind, they make it all worth it. Please keep them, coming.

Well, I?ve got to finish my packing, as the limo will arrive shortly. New Zealand and Australia are 220-volt countries, but don?t use the same plugs as England. So I dove into my voluminous bag of international power adapters and think I found the right ones. I?ve turned off the heat and the hot water, plugged in the Tesla, and took the battery out of the Toyota. I put the mail on old and gave all of my perishable food to my kids. It?s time to go.

If you wish to join me at any of the lunches, there are still tickets available for sale for all. Just go to my store. Here is the schedule:

Auckland, New Zealand - Wednesday, February 12

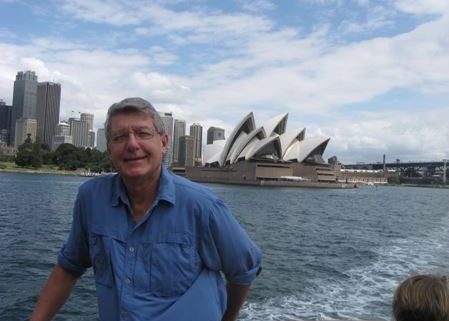

Sydney, Australia - Friday, February 14

Melbourne, Australia - Thursday, February 20

Brisbane, Australia - Monday, February 22

See you there

John Thomas

The Mad Hedge Fund Trader