For the second time in four years, the Republican Party has blown a presidential election through the choice of a running mate. What little chance the GOP had in winning the election has gone up in smoke with the selection of Wisconsin congressman Paul Ryan to join the ticket. Think of him as a Sarah Palin with pants.

Of course, there was great celebration by the Tea Party wing that sees Ryan as a standard bearer. And don?t get me wrong. With an economics background, Ryan brings far more intellectual weight to the game than the former governor of Alaska.

The problem is that Ryan doesn?t bring a single new vote to Romney. He had a lock on the Tea Party vote, no matter who the vice presidential candidate is. It?s not like they were going to vote for Obama because they didn?t like his pick.

What Ryan does do is dash any hopes the Republicans had of capturing moderates, independents, and undecideds. Romney can?t win without these. As I write this, Obama is already winning every battleground state, except Virginia, which is a dead heat.

Since Ryan has been the poster boy for the replacement of Medicare with a voucher system, he brings this crucial issue for seniors to the forefront. Most people have already figured out that this would freeze benefits at current levels while medical care inflation continues at a 10%-20% annual rate unabated. This is why it never made it into law, even when the Republicans controlled all branches of government. You could not imagine an issue better designed to alienate voters, and the Ryan pick focuses a giant, great spotlight on it.

Just take a look at the three states with the highest percentage of seniors, who are understandably gun shy over the matter. Those are Florida, with 29 electoral votes, Pennsylvania with 20 votes, and Iowa with 6. A Republican loss of the first two alone is enough to decisively swing the election to Obama. If you live outside of Wisconsin and are unaware of the Ryan Medicare plan, just wait. The videos of him pushing granny in a wheelchair over a cliff are already running online.

At least Romney and Obama finally agree on something. They both wanted Ryan as the vice presidential candidate. One Democratic strategist said they are now going to gather up what campaign money they have left, buy a margarita machine, and party until November.

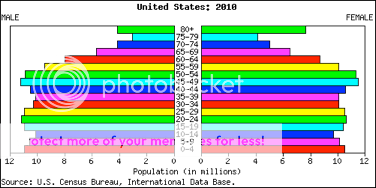

What all of this does mean is that traders and investors can now build a second Obama term into their strategic and asset allocation assumptions. It means that when Ben Bernanke?s term is up in 18 months, he will either be reappointed or replaced with a clone with an identical philosophy. That means QE3, QE4, and QE5 until the economy returns to a more robust 3%-4% growth rate, which for demographic reasons is probably ten years off.

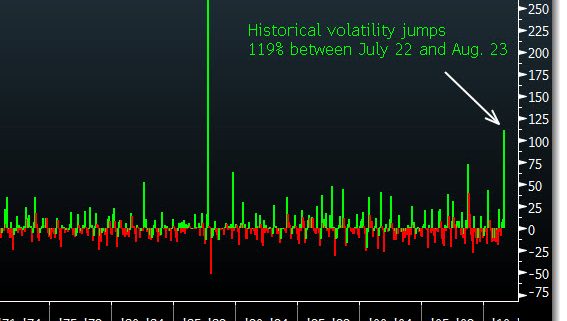

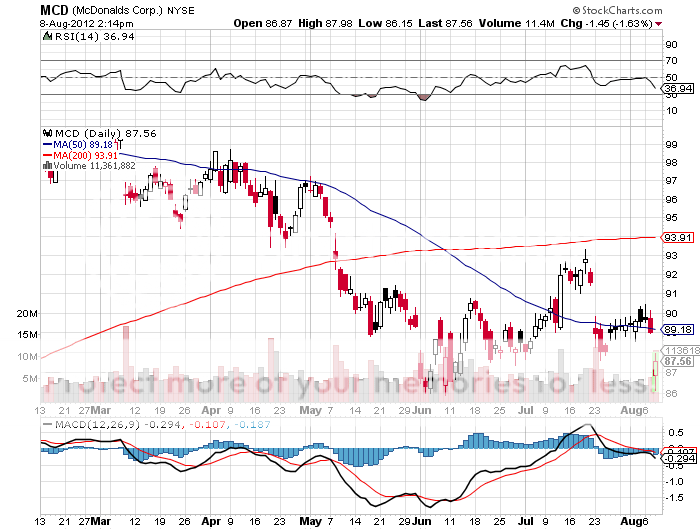

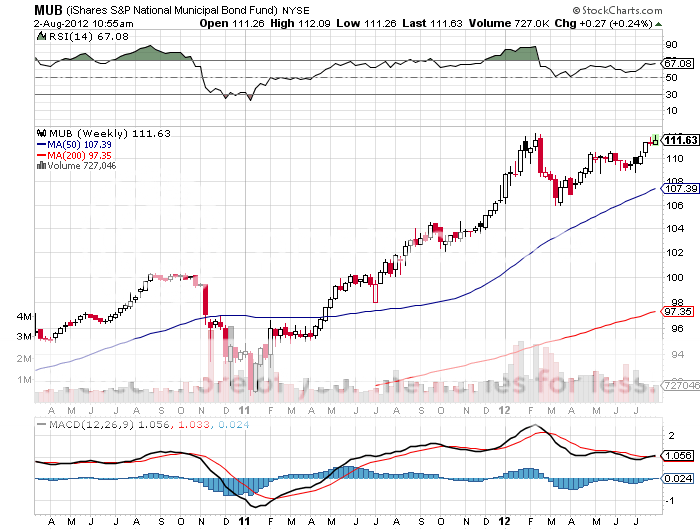

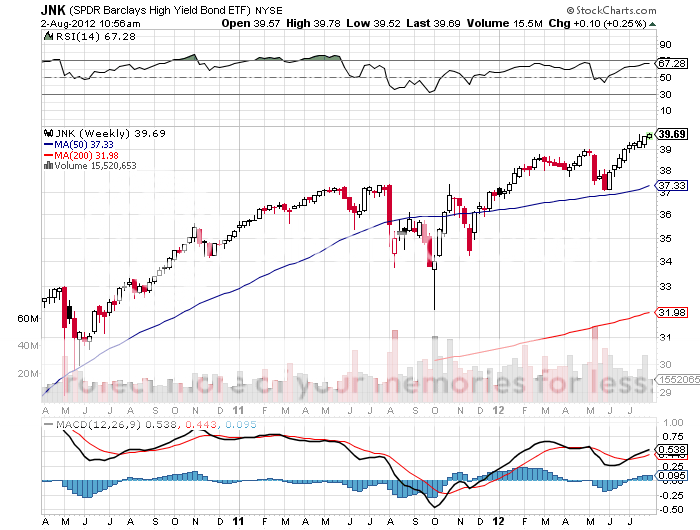

This means that financial markets could continue to bounce along in narrow ranges for four more years. Every bout of weakness will be met with more Fed action, or the implied threat of it. But the economy never reaches the escape velocity for the markets to bust out to the upside either. We all end up dying of boredom instead of Armageddon.

Romney and Ryan?s antipathy towards Bernanke and the Fed are well known. So a Republican win would have brought quantitative easing to a screeching halt, and possibly a quick unwind of the central bank?s massive $2.8 trillion balance. Such a policy would be highly recessionary. Remember, no Bernanke means no Bernanke put. You could halve asset prices everywhere pretty quickly in such a scenario.

This is all frustrating for me because I much prefer crashes to slow grinds. I can make a bundle in a good market meltdown, and outperforming conventional long only competitors by a huge margin is a piece of cake. Basically, crises are good for my business. Give me a good 500 point down day in the Dow, and traffic on my website soars as the desperate seek guidance from wherever they can find it.

I know this piece will probably ignite a firestorm of controversy. These political pieces usually do. However, in election years an accurate call on outcomes can be crucial to your performance. If you have something to say, send me data, not opinions. I live in the world of facts and hard numbers, not beliefs or religions. I?m always looking for someone to prove me wrong so I can readjust my global view, but I need evidence to do this, not a new chant from a Yaqui Indian.

By the way, if you want to watch a fascinating insider account of the Palin vice presidential run, watch the movie ?Game Changer?, which is now out on HBO. It really gives you an inside look at how campaigns are run, warts and all. I saw several of these during my days in the White House Press Corps three decades ago, and what goes on behind the green curtains is truly amazing, if not unbelievable. For you, it might be an eye opener.

Is This a BUY Signal?