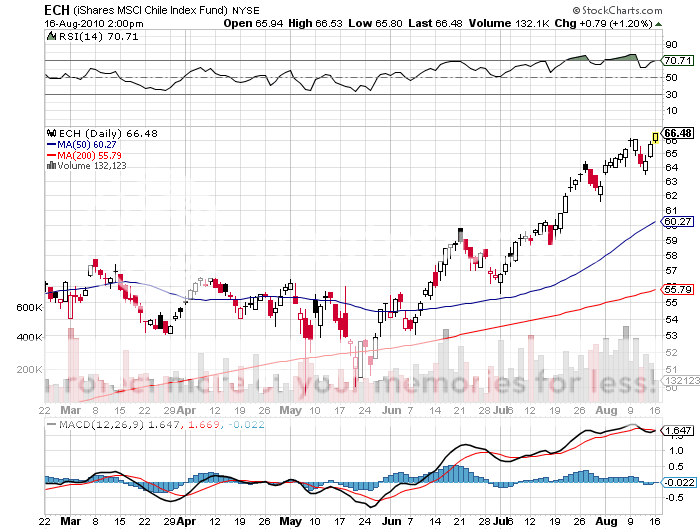

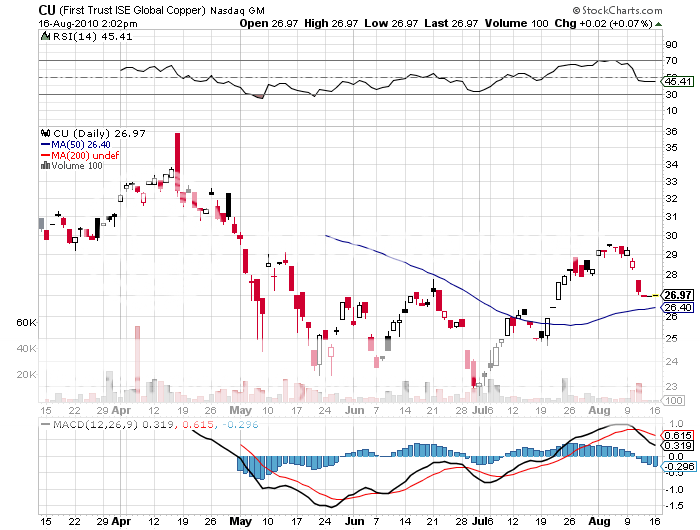

Featured Trades: (CHILE), (ECH), (CU)

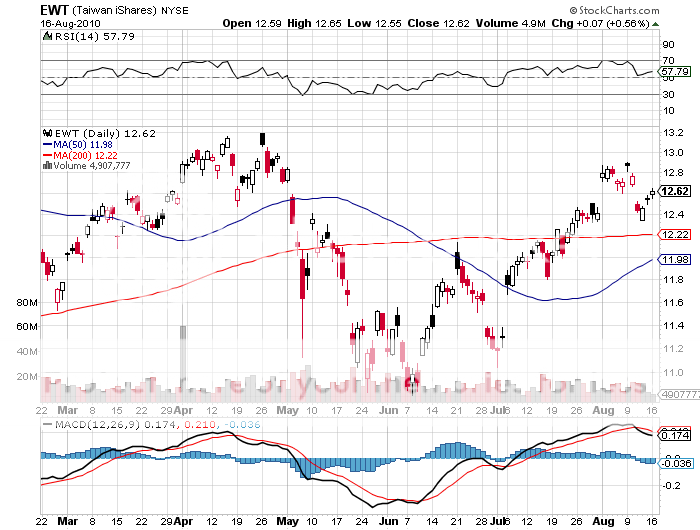

iShares MSCI Chile Index Fund ETF

First Trust ISE Global Copper ETF

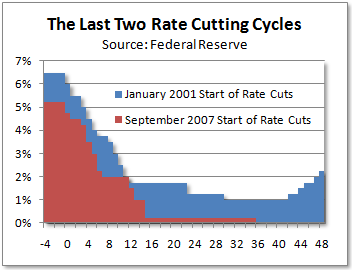

2) Why Can't We Be More Like Chile? I just want to pass on some data forwarded to me from my extensive band of Chilean readers in response to my recent piece, 'Chile is Looking Hot' (click here for the piece). In 2007, the government dissolved the old Copper Stabilization Fund and rolled windfall profits from sales of the red metal into a sovereign wealth fund called the Economic and Social Stabilization Fund. Today that fund has $11.7 billion, a lot for a small country like Chile, which only has a GDP of $161 billion and a population of 17 million. The fund will be used to increase government spending during economic downturns, thus eliminating the need for any borrowing during times of distress. This is one of the reasons why the Chilean ETF (ECH) never sold off in the wake of the massive 8.8 magnitude earthquake that struck in February. I had hoped to use the natural disaster to gain a good entry point to the country, to no avail. Imagine that! Counter cyclical Keynesian spending financed out of savings, instead of debt. Too bad they didn't think about that here! If I've piqued your fancy, another way to play Chile is to buy the copper industry ETF (CU), which has extensive holdings in this incredible well managed country. Since I recommended Chile only two weeks ago, the ETF has risen by 5% during otherwise dismal global trading conditions. And my American Chilean readers, who thank the heavens the day they decided to retire there, also recommend long positions in the country's outstanding wines, including a mature Viva Almaviva, a Carmin de Peumo, and a Viva Concha y Toro.