Featured Trades: (THE HEALTH CARE BILL)

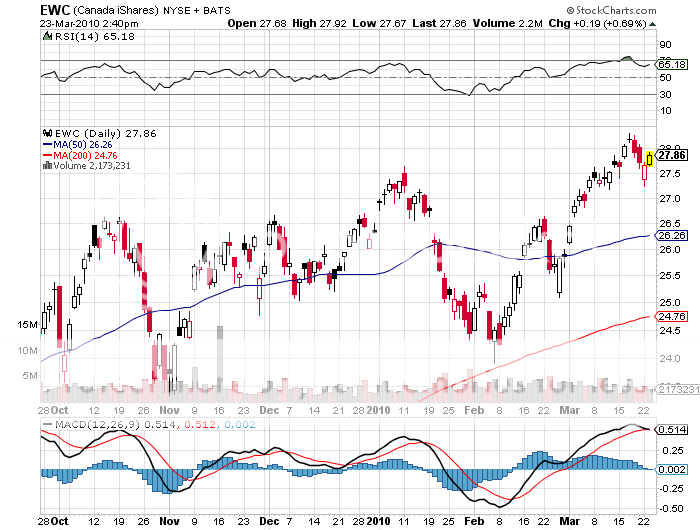

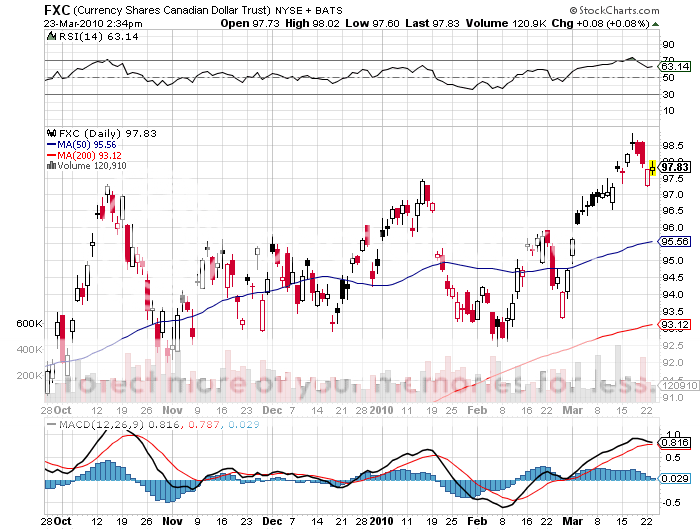

1) Here Comes Health Care. Well, the sun rose this morning. After driving around Washington State listening to talk radio while the health care vote was counting down, I wasn't so sure I would see it again. With this single vote, Obama has torn up the constitution, deprived America of freedom, and signaled the end of our country as a power on the world stage. The Democrats will lose control of the House and the Senate in seven months, and impeachment proceedings will begin against our 44th president immediately. A tectonic shift has broadened the gap between the two parties wider than the chasm of the Grand Canyon, and 30 states are planning to secede to keep socialized medicine outside their borders, sparking a second civil war. So I thought it would be timely to invite my friend Pat from across the border in Vancouver to lunch, where national health care has been in force in some form since the fifties. Pat and I survived the 1968 Paris student riots together. He managed to keep his front teeth. I didn't. He managed to get the girl and take off for Greece. I didn't get that either. Pat thought the people south of the border were mad. For $125 a month he gets outstanding health care for himself and his wife. When his significant other broke her leg skiing at Whistler a few years ago, they couldn't helicopter her off the slopes fast enough. The doctors did a fabulous job taking care of her, and it was all free. Sure, there are plenty of Canadians heading to the US for medical care, but they are mostly for face lifts and boob jobs not covered by the Canadian plan, or for procedures so advanced that the technology doesn't yet exist in the Frozen Wasteland of the North. There are far greater numbers of Americans flocking North to buy subsidized prescription drugs. Nor has the plan taken Canada to hell in a hand basket, with the Canadian dollar (FXC) among the world's strongest currencies, and the Toronto Stock Exchange (EWC) one of the most bullish. After the harangues from the car radio became redundant, I switched to a golden oldies station and had a much more enjoyable drive. Maybe the country that gave birth to Buddy Holly, Patsy Cline, and Chubby Checker will survive this after all.

Featured Trades: (LUMBER), (SUGAR), (PALL), (PPLT)

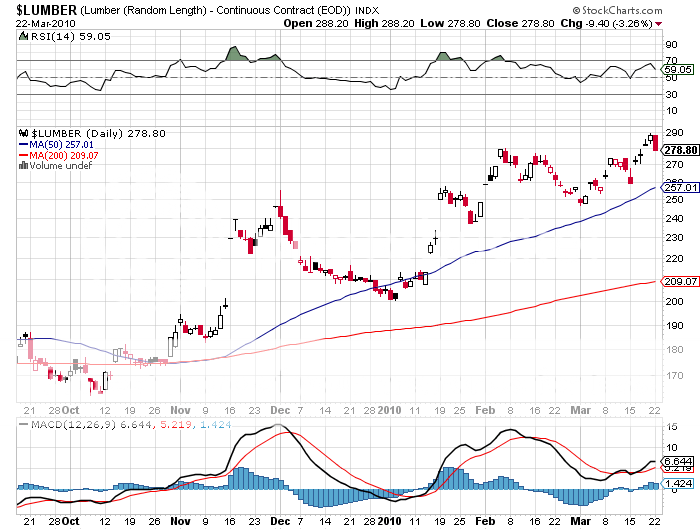

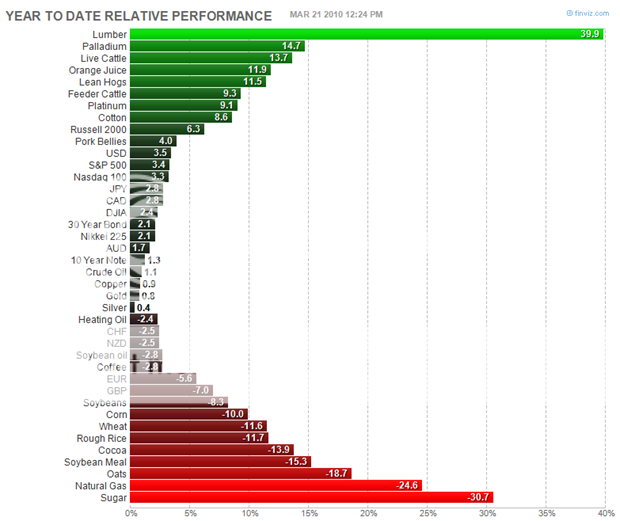

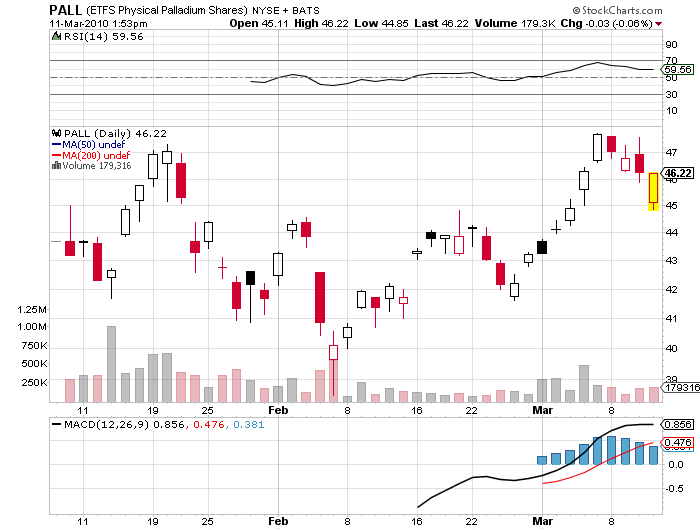

2) Lumber Futures Are On Fire. When I recommended that you take profits on lumber in my February 25 piece (click here ), after pleading with you to buy it for the past year, I hope you were all in a coma in intensive care, spending a weekend in Paris with your mistress, or on a long distance hike on the Appalachian trail (Is that redundant?). Lumber futures have been far and away the top performing asset class of 2010, bringing in a blistering 39.9% year to date, and a healthy 16% gain since my call to take the money and run. Please check out the chart below of asset class returns this year, which I lifted off of Paul Kedrosky?s Infectious Greed website. All of the reasons to own the aromatic commodity kept coming through by the rail car, including decades of production downsizing, huge Chinese buying, and waning competition from Canada because of a strong loonie. No one ever got fired for taking a profit, but they do get sacked for being an idiot, or worse these days, being too conservative. At least I avoided the temptation to buy sugar, now down 31.7% YTD, the year?s worst performing investment. And I did catch palladium (PALL), the year?s number two performer, with a 14.7% gain, and platinum (PPLT) (Remember that killer pair of lowriders?), up 9.1%.

Featured Trades: (THE US EDUCATION SURPLUS)

3) The Huge US Balance of Payments Surplus in Education. I spent the weekend attending? a graduation in? Washington state, a stone?s throw from where the 2010 Winter Olympics were recently held. While sitting through the tedious reading of 550 names, and listening to the wailing bagpipes, I did several calculations on the back of the commencement program. I came to some startling conclusions. Higher education has grown into a gigantic industry, with a massively positive impact on America?s balance of payments, generating an impact on the world far beyond the dollar amounts involved. There are 671,616 foreign students in the US (90,000 from China alone) paying an average out-of-state tuition of $25,000 each, creating a staggering $16.8 billion of payments a year. On a pro rata basis, that amounts to a serious part of our total receipts in services in Q4 2009 of $131.6 billion, not far behind financial services (click here for the Bureau of Economic Analysis site ) . A fortunate few, backed by endowed chairs and buildings built by wealthy and eager parents, land places at prestigious Universities like Harvard, Princeton, Yale, and UC Berkeley. The overwhelming majority, however, enroll in the provinces in a thousand rural state universities and junior colleges that most of us have never heard of. The windfall has enabled once sleepy little schools to build themselves into world class institutions of higher learning with 30,000 or more students, boasting state of the art facilities, much to the joy of local residents and state education officials. Furthermore, this dominance of education industry is steadily Americanizing the global establishment. I can?t tell you how many times over the decades I have run into the Persian Gulf sovereign fund manager who went to Florida State, the Asian CEO who attended Cal State Hayward, or the African finance minister who fondly recalled rooting for the Kansas State Wildcats. Those who constantly bemoan the impending fall of the Great American Empire can take heart by merely looking inland at these impressive degree factories. It also might give them an explanation of why the dollar is so strong in the face of absolute gigantic and perennial trade deficits.

'Inflation steals from savers, and inflation is the logical consequence of printing too much money,' said Oracle of Omaha, Warren Buffett.

Global Market Comments

March 23, 2010

Featured Trades: (JOHN MAULDIN), (SPX),

(XEU), (EEM), (GLD), (CMGTX), (TBT),

(JAMES BAKER, III)

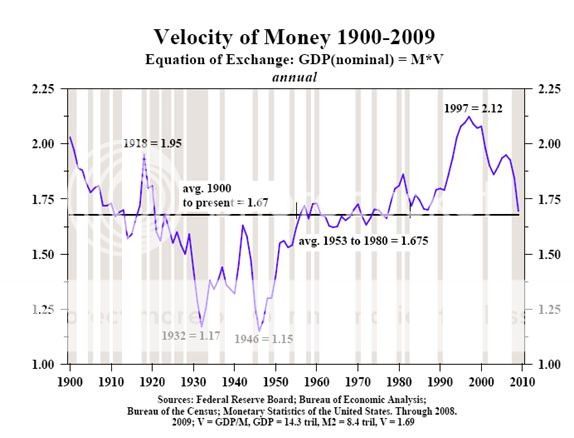

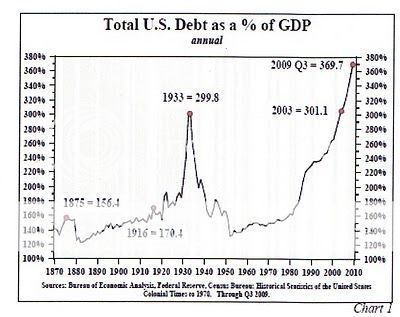

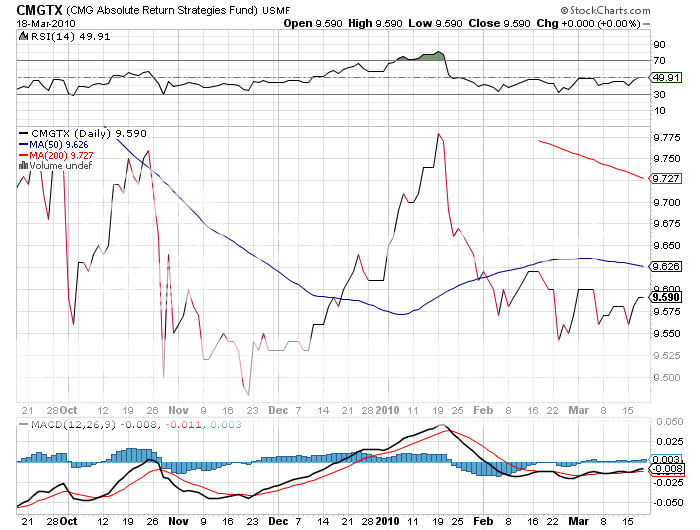

1) Son of Texas and financial seer, John Mauldin, believes the stock market could shed 40% in the near future (SPX). John is the president of Millennium Wave Advisors, LLC, a Dallas, Texas based investment advisor, with $600 million in assets under management. John worries that the velocity of money, an indicator of how many times a dollar is reused in the economy, is collapsing. This ratio, which is defined by the GDP divided by the money supply, bottomed at 1.15 in 1946. It peaked at a breathtaking 2.2 times in 1997, near the top of the Dotcom bubble. The ratio has been retreating ever since, has recently accelerated down to the 100 year mean, but still has much farther to fall to get to the bottom of the 100 year range. The collapse of velocity signals the end of a 50 year super cycle in lending. For you and I, this means lower economic growth for perhaps another decade. It is partly the result of banks getting generous funding from the Treasury, and then sitting on it. The bucks simply stop there. It suggests that no matter how much money the government pumps into the economy, it might as well be pushing on a wet noodle. The gold bugs have got it all wrong, simply focusing on money supply growth and expecting hyperinflation. A lot of money can sit and go nowhere. The inflation will come back with a vengeance when the economy revives and banks finally resume lending. With so much new money being created in the last two years, the chances of the Fed being able to head this off are close to nil. Similarly, the bond vigilantes may have to wait a couple of years for their big move down in the 30 year Treasury bond (TBT). When the bond markets call ?times up,? the US will be forced to embark on some highly deflationary spending cuts. If this happens during a recession, it could be a disaster. John thinks there will be a substantial slowdown in growth in Q3 and Q4. With anticipated federal tax increases of 2% of GDP in 2011 added to a further 1% in state tax hikes, the recovery will be strangled in its crib. That?s when the risk of a double dip recession explodes. Over 3-4 years higher taxes could add up to a burdensome 9% drag on GDP. John says that emerging markets (EEM) will decouple from the US and keep powering up, as this is where the real economic growth is (EEM). He has been a gold bull since 2002 (GLD), when it was below $300/ounce, and isn?t backing off from that position, but prefers to own it against Euros at this point. He thinks the entire premise for the existence of the European currency (XEU) is questionable, and sees it eventually moving to parity against the dollar. John doesn?t manage money directly himself, but outsources assets with market timers employing a number of different models. One firm he has particular success with is CMG in Philadelphia (CMGTX). He really only selects individual stocks in the biotech area, which he thinks have the potential to develop into a bubble, and has a variety of small cap and microcap holdings. Not pulling any punches, John said that the Republican leadership of the last congress was ?criminally incompetent? in the way they unnecessarily squandered surpluses and spent their way into oblivion, leaving us without dry powder to fight the current crisis. John has an incredibly diverse past, which includes a degree from Rice University, a stint at divinity school, and time spent running a check printing company which led him into newsletters. Today, his two letters, Outside the Box and Thoughts From the Frontline, go out on the Internet to 1.5 million readers a week. John is the publisher of three investment books, The Millennium Wave, Just One Thing, and Bulls Eye Investing. To learn more about John?s many activities in the markets, please visit his website at http://johnmauldin.com/ . To catch my entire insightful interview with John Mauldin on Hedge Fund Radio, please go to www.madhedgefundtrader.com/ and click on the ?Today?s Radio Show? menu tab on the left.

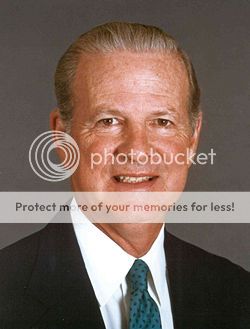

2) ?We have 3,500 nuclear weapons left over from the cold war we don?t need, they take 20 seconds to re-aim, we?re not afraid to use them, and by the way, they?re already aimed at you.? That is the approach James Baker III thinks America should take with Iran, Ronald Reagan?s Chief of Staff and Secretary of the Treasury and George H.W. Bush?s Secretary of State. At the same time we should be talking to the regime in Tehran, while doing everything we can to support the reformers, tighten sanctions, and enlist Europe?s help. Baker does not see a military solution in Iran, even though their potential to create instability in the region is enormous. This was one of dozens of amazing insights I gained spending an evening chatting with the wily Texas lawyer during an evening in San Francisco. Baker is happy to take on the ?America Bashers?, pointing out that the US still plays a dominant role in the UN, NATO, the IMF, and the World Bank. It still accounts for 25% of GDP, and its military is unmatched. The US spread globalization, and the spectacular growth of China and India is largely the result of open American trade policies, raising standards of living globally.? But the US can?t take its leadership role for granted. The biggest threats to American dominance are the runaway borrowing and entitlements. US debt to GDP will soar from 93% to 100% in three years, the highest level since WWII. This is unsustainable, is certain to bring a return of inflation, and unless dealt with, will lead to a long term American decline on the world stage. Massive trade and capital flow imbalances also have to be addressed. The 80 year old ex-Marine, who confesses to being the only Treasury Secretary in history who never took an economics class, believes that the advantageous rates that the government now borrows at are not set in stone. Baker is the man who engineered an end to the cold war with a whimper, and not a bang. He thinks that ?even our power has its limits,? and that there is a risk of strategic overreach.?? While conditions in Iraq still look dicey, there is a good chance that we can pull out combat troops by August, and all troops by 2011, and leave a stable country. With the US politically evenly divided, Congress has degenerated from debating teams into execution squads, and consensus is impossible. The media are partly to blame, especially bloggers who propagate wild conspiracy theories, as confrontation sells better than accommodation. Regarding the financial crisis, we need to end ?too big to fail? and embark on re-regulation, not strangulation. All in all, it was a fascinating few hours spent with a piece of living history who still maintains his excellent contacts in the diplomatic and intelligence communities.

QUOTE OF THE DAY

Early in the political career of James Baker, III, when he was campaigning in the Texas panhandle, a voter approached him with a question. ?Does anyone ever tell you that you look a lot like James Baker, III?? he asked. Baker answered, yes, I get that a lot.? The man responded, ?that must really piss you off.?

Global Market Comments

March 17, 2010

(TRES AMIGAS TRANSMISSION PLANT),

(SPX), (DOLLAR BILL)

2) A few years ago, I went to a charity fund raiser at San Francisco?s priciest jewelry store, Shreve & Co., where the well heeled men bid for dinner with the local high society beauties, dripping in diamonds and Channel No. 5. Well fueled with champagne, I jumped into a spirited bidding war over one of the Bay Area?s premier hotties, who shall remain nameless. Suffice to say, she has a sports stadium named after her. The bids soared to $6,000, $7,000, $8,000. After all, it was for a good cause. But when it hit $10,000, I suddenly developed lockjaw. Later, the sheepish winner with a severe case of buyer?s remorse came to me and offered his new date back to me for $9,000.? I said ?no thanks.? $8,000, $7,000, $6,000? I passed. It was embarrassing. The current altitude of the stock market reminds me of that evening. If you rode gold from $800 to $1,220, oil from $35 to $80, and the FXI from $20 to $40, why sweat trying to eke out a few more basis points, especially when the risk/reward ratio sucks so badly, as it does now? I realize that many of you are not hedge fund managers, and that running a prop desk, mutual fund, 401k, pension fund, or day trading account has its own demands. But let me quote what my favorite Chinese general, Deng Xiaoping, once told me: ?There is a time to fish, and a time to hang your nets out to dry.? At least then I?ll have plenty of dry powder for when the window of opportunity reopens for business. One of the headaches in writing a letter like this is that while I publish 1,500 words a day for 250 days a year, generating about half the length of War and Peace annually, you really need to tinker with your portfolio on only a dozen or so of those days. So while I?m mending my nets, I?ll be building new lists of trades for you to strap on when the sun, moon, and stars align once again. And no, I never did find out what happened to that date.

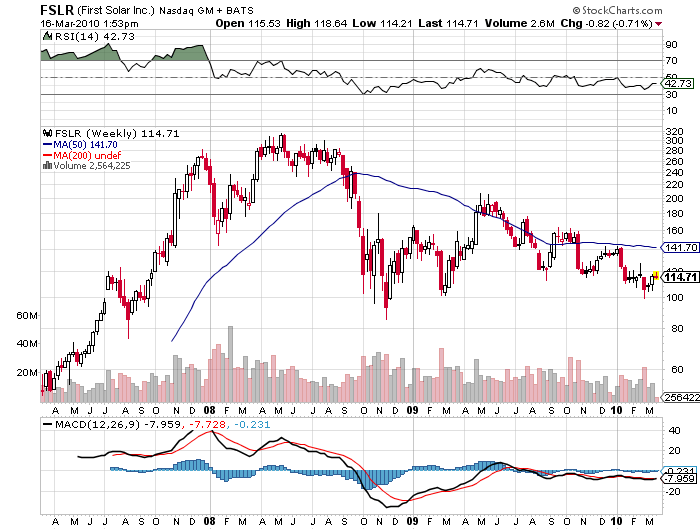

3) Until now, the country?s power grid has been divided into three unconnected chunks, making transnational transmission impossible, leading to huge regional mispricing. While California and New York suffered from brown outs and sky high prices, electricity was given away virtually for free in Texas. A group of power companies is now proposing to build the $1 billion Tres Amigas superstation in Clovis, New Mexico that would connect all three grids. The plant would use advanced superconducting technology that will send five gigawatts of power down cables cooled at 300 degrees below zero. The facility would solve a major headache of alternative energy planners, and will no doubt accelerate development. It would allow the enormous wind farms on the drawing board in the Midwest to ship energy to the power hungry coasts. Ditto for the mega solar projects proposed in the Southwest deserts, and the big geothermal plants being built in Nevada. With Obama sending tidal waves of government cash towards the sector, the timing couldn?t be better. It is also great news for major alternative suppliers like First Solar (FSLR). Some of these projects might now actually make some sense.

4) If you want to impress your friends with your vast knowledge of financial matters, then here are the Latin translations of the script on the backside of a US dollar bill. ?ANNUIT COEPTIS? means ?God has favored our undertaking.? ?NOVUS ORDO SECLORUM? translates into ?A new order has begun.? The Roman numerals at the base of the pyramid are ?1776.? The better known ?E PLURIBUS UNUM? is ?One nation from many people.? The basic design for the cotton and linen currency with red and blue silk fibers, which has been in circulation since 1957, carries enough symbolism to drive conspiracy theorists to distraction. An all seeing eye? The darkened Western face of the pyramid? And of course, the number ?13? abounds. Thank freemason Benjamin Franklin for these cryptic symbols, and watch Nicholas Cage?s historical adventure movie National Treasure. The balanced scales in the seal are certainly wishful thinking and a bit quaint. Study the buck closely, because there are going to be a lot more of them around.

QUOTE OF THE DAY

?When it? raining gold, reach for a bucket, not a thimble,? said Oracle of Omaha Warren Buffet.

March 15, 2010

Featured Trades: (CHARLES NENNER), (SPX), (DOW), (YEN), (PALLADIUM), (PALL), (DEMOGRAPHICS)

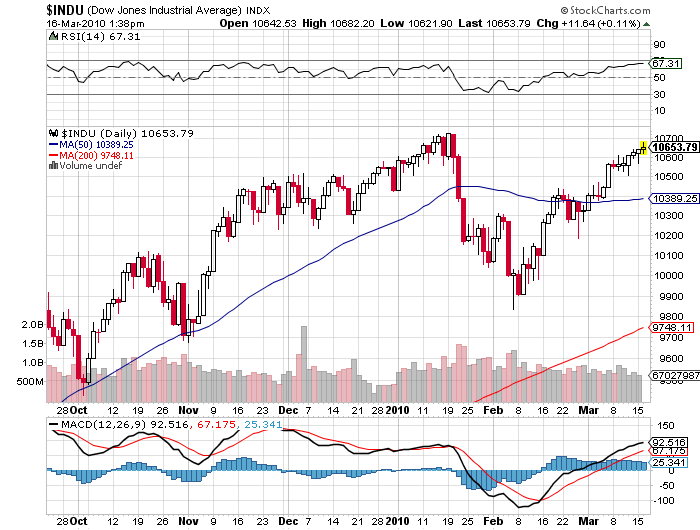

1) After much pleading and cajoling, I managed to get a no holds barred, no stone unturned 40 minute interview with technical analyst to the stars, Charles Nenner of Charles Nenner Research in Amsterdam, for Hedge Fund Radio. Bottom line: A? second deflationary tidal wave could hit the US as early as April. If it does, the Dow is going to crash, possibly heading for a double bottom at 6,000, and bonds are going up for the rest of the year. Oh, and by the way, crude oil futures are discounting war with Iran by 2013. Charles has a long career that includes stints at medical school, Merrill Lynch, Rabobank, and 12 years at Goldman Sachs. He has spent three decades developing his proprietary Cycle Analysis System, which generates calls of tops and bottoms for every major market in the world. Charles developed a huge following after 2007, when he accurately nailed the top in the Dow at 14,500 and urged his clients to put on short positions when everyone else was predicting that the market would keep grinding higher. I have been following Charles? daily research reports myself for two years, and found them to be uncannily accurate. Today, Charles counts major hedge funds, banks, brokerage houses, and high net worth individuals among his clients. You can find out more about Charles? work by clicking here to get to his website at his website at www.charlesnenner.com. This will no doubt be the hottest show of the year. Listen in before listeners blow up my server, melt my fiber optic pipes, and bring the entire Internet to a screeching halt, as they did last time. To catch the entire sizzling interview, please click here to get to Hedge Fund Radio.

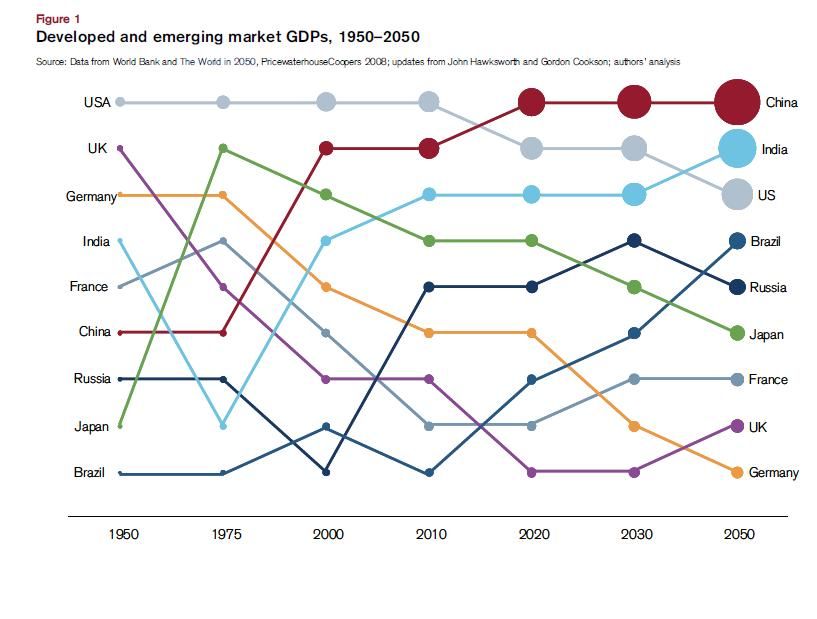

2) I love making very long term forecasts, because they give tremendous insights into the future of the global economy, and because at my advanced age, I won?t live long enough to see if I am right or wrong. I pulled this chart off of Paul Kedrosky?s Infectious Greed website which shows GDP growth rates for a 100 year period from 1950 to 2050. It shows why you should be infatuated with emerging markets (EEM) like Brazil (EWZ), China (FXI), and India (PIN), lukewarm about the US (SPX), and avoiding Europe and Japan like the plague. It also gives the underlying argument behind my long term currency calls to stay short the yen. The basic trade is to be long countries and currencies with high growth rates, and be short, or at least stay out of, countries and currencies with low growth rates. As exciting as this chart is, I really don?t see myself living another 40 years to 2050. But who knows? Maybe if I take some of those pills they sell late at night on CNBC? What are they called? Extenze?

3) My editor in charge of the ?I Told You So Department? is having a busy year. Not only did we catch the dead market in equities, the collapse of volatility, the selloff in the Euro and the yen, the rallies in the Ausie/Euro and Ausie/Yen crosses, and the bounce in Toyota, we now have Palladium (PALL) to crow about. Palladium hit a two year high of $477 an ounce last week and speculative longs in the market have hit an all time high. I discussed the potential of the ?poor man?s platinum? in January (click here for the piece). My sources at the London Metals Exchange tell me that investment demand from big hedge funds is clearly overwhelming traditional demand from the auto industry, who use it to build catalytic convertors. The ETF (PALL) has popped 17% since my initial call. Watch this space.

4) Since I am in the long term forecasting business, it was with some fascination that I caught the Associated Press report that minority children born this year may exceed white children for the first time. Whites lost their majority in San Francisco many years ago, and will do so in California as a whole in the near future. The report said that the US will have a ?minority? majority by 2050. Whites now account for 2/3 of the population. While minorities now dominate only 10% of counties, they account for 40% of new births. Demographers say the trend will be reinforced by a large number of Hispanic women entering their prime child bearing years, who historically have more children than other races. More white women are delaying childbearing, reducing fertility. As demographics is destiny, this is bound to have huge political and economic ramifications for the country going forward. It is also going to influence the marketing priorities of corporations. A decade ago Betty Crocker anticipated this trend by using shorter, darker skinned models on the boxes of its cake mix boxes. Companies that target specific ethnic groups are going to gain a competitive advantage. Furthermore, the rate of interracial mixing is accelerating at a tremendous rate. In California, 50% of all Chinese woman and 60% of Japanese women marry whites. This is amazing, given that this was illegal until the Civil Rights Act was passed as recently as 1962. Millennials are virtually color blind. Personally, I think genetically recessive blonde haired, blue eyed people, who sprang out of a mutation in the Caucuses 7,000 years ago, may completely disappear in 200 years. Pure Caucasians themselves may eventually go too, as they only account for 15% of the world?s population, and that number is falling.

?If you can?t make yourself loved, make yourself feared,? said Meyer Amschel Rothschild, founder of the banking dynasty.

Global Market Comments

March 11, 2010

Featured Trades: (PCY), (TBF), (TM), (THE PACIFIC)

NOTE TO SUBSCRIBERS: There will be no letter tomorrow, as I am taking a research day.

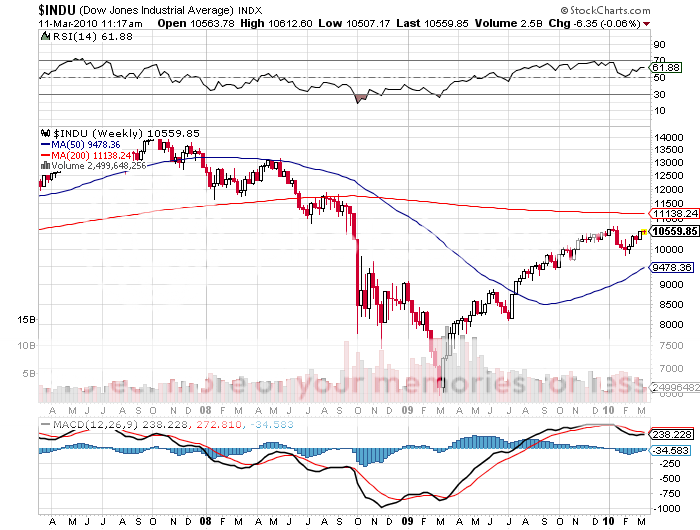

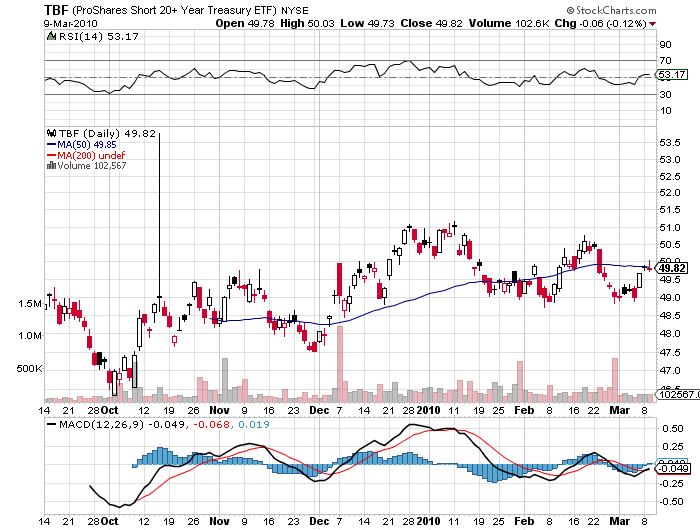

1) Get Ready for the April Surprise. I have a feeling that the markets are on a final countdown, but don?t know it yet. No, I am not talking about the next issue of the TV show 24. On April Fool?s Day, the Fed brings to a close its $1.25 trillion program to prop up the mortgage market in which essentially all home mortgages are ending up, either directly or indirectly, on the books of our esteemed central bank. As we approach this rendezvous with destiny, a growing number of hedge funds are piling on the short side of the bond market, betting that nobody will be there when the purely commercial market is reborn. It harks back to an old Wall Street saw that ?Success has many fathers, but failure is an orphan?. I expect stocks to rally until then, bonds to grind down, and yields possibly climbing as high a 4.00% on the ten year Treasury bond. This pessimism will drag mortgage rates up 15-25 basis points. The government will help the process along with increasingly bloated new issuance. This is a good reason why the credit markets have become ultra sensitive to developments in Japan, California, Dubai, Greece and other PIIGS (oink!). Seasonally, we are in a period of weak bond prices. To really throw the fat on the fire, the highly anticipated March nonfarm payroll, the number of the month, will be released the next day. When everybody and his dog is positioning for something to happen at a certain time, you can count on either the opposite to happen, or for nothing to happen. I vote for the former. After all, who is overweight mortgage backed securities these days? The market has been closed for 18 months, and everything institutions still own is probably down by a third in value. Look for an upside surprise in the nonfarm payroll report to produce a peak in equities and bond yields, an intermediate bottom in bond prices, and a reversal of everything from there. My bet is that the drastic jump in home mortgage rates that many are forecasting for April is going to do a no show. This is just a humble trader?s musings.

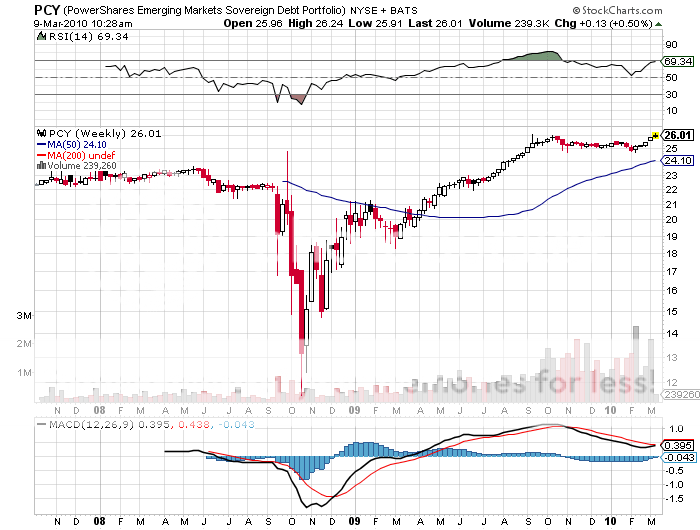

2) Where to Hide. I am constantly asked where to find safe places to park cash by investors understandably unhappy with the risk/reward currently offered by the markets. Any reach for yield now carries substantial principal risk, the kind we saw, oh say, in the summer of 2007. I have had great luck steering people in the Invesco PowerShares Emerging Market Sovereign Debt ETF (PCY) for the last seven months, which is invested primarily in the debt of Asian and Latin American government entities, and sports a generous 6.44% yield. This beats the daylights out of the one basis point you currently earn for cash and the 3.66% yield on 10 year Treasuries. The big difference here is that PCY has a much rosier future of credit upgrades to look forward to than other alternatives. It turns out that many emerging markets have little or no debt, because until recently, investors thought their credit quality was too poor. No doubt a history of defaults in Brazil and Argentina in the seventies and eighties is at the back of their minds. With US government bond issuance going through the roof, the shoe is now on the other foot. A price appreciation of 120% off one year lows tells you this is not exactly an undiscovered concept. Still, it is something to keep on your ?buy on dips? list.

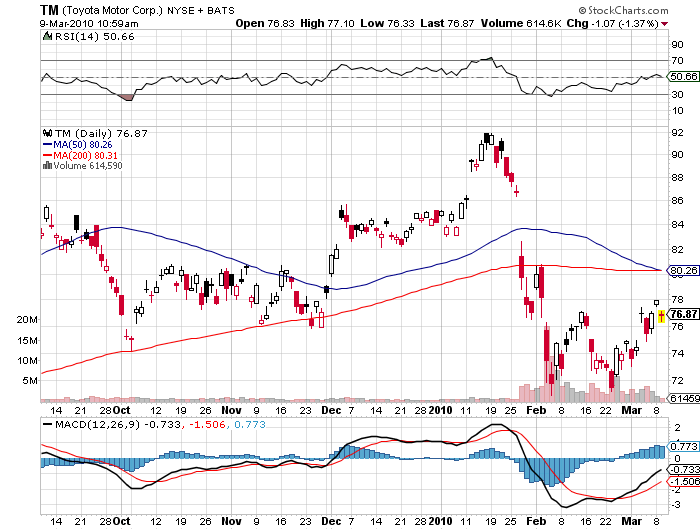

3) Those of you who wisely bought Toyota (TM) when there was literally blood in the street a month ago are now sitting on a healthy 10% profit (click here for the link at https://madhedgefundtrader.com/February_3__2010.html ). Those of the short term trading persuasion may want to book some profits here. Only this morning there was yet another dramatic report about a Highway Patrol officer who bravely placed his vehicle ahead of a runaway Prius racing down a San Diego freeway at 94 miles an hour in order to stop it. I thought a Prius could only go this fast if you dumped it out the back of an airplane, or parked on San Francisco?s Kearney Street. Another recall on brake pedals was triggered. I have no doubt that many of these stories are true. I also have no doubt that many of them are hoaxes in search of a class action law suit hungry, ambulance chasing lawyer. The odor of the US car makers and the unions is also in the room, who have lost market share to Toyota for 40 years and are looking for payback. We rue the day that lawyers were first allowed to advertise on TV. Toyota is now the butt of jokes from David Letterman, Jay Leno, and even the Academy Awards. I have no doubt this incredibly well run company will resurrect. Their dominant share of the global car market isn?t going away. If my scenario of a yen collapse to ?120 to the dollar in a year comes true, their foreign earnings will absolutely go through the roof. But they may have to pay more penance and cry a little more in public before they return to greatness in the minds of consumers.

4) TV Review. I highly recommend the HBO miniseries that premiers this Sunday night called The Pacific, which dramatizes the history of the First Marine Division during WWII. This is the Pacific version of the Band of Brothers and is made by many of the same people. My uncle, Col. Mitchell Paige (click here for the link to his site at http://www.homeofheroes.com/mitch/index.html ), who won the first Medal of Honor of the war, was a technical consultant to the project before he passed away in 2003. In one night, he managed to single handedly mow down 2,000 suicide attacking Japanese with three Browning 30 caliber, water cooled machine guns, thus saving Henderson Field, and shortening the war by a year. I still have the samurai sword that he retrieved from the battlefield the next morning. My father was with the First Marines at Guadalcanal, I flew for them during Desert Shield and Desert Storm, and my nephew joined to fight in Afghanistan and Iraq. Maybe I?ll find out why dad never spoke a single word about what went on there.

< p style="text-align: center;">?The American public has a whole new mindset about buying things than they had a couple of years ago,? said Oracle of Omaha, Warren Buffett.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.