Below please find subscribers’ Q&A for the Mad Hedge Fund Trader September 4 Global Strategy Webinar broadcast from Silicon Valley with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: If Trump figures out the trade war will lose him the election; will he stop it?

A: Yes, and that is a risk that hovers over all short positions in the market at all times these days because stocks will soar (INDU) when the trade war ends. We now have 18 months of share appreciation that has been frustrated or deferred by the dispute with China. The problem is that the US economy is already sliding into recession and it may already be too late to turn it around.

Q: Do you see the British pound (FXB) dropping more on the Brexit turmoil? Do you think the UK will stay in the EU?

A: If the UK ends Brexit through an election, then the pound should recover from $1.19 all the way back up to $1.65 where it was before Brexit happened four years ago. If that does happen, it will be one of the biggest trades of the year anywhere in the world, going long the British pound. This is how I always anticipated it would end. I was in England for the Brexit vote and I was convinced that if they held the election the next day, it would have lost. The only reason it won was because nobody thought it would— a lot like our own 2016 election. That brings Britain back into the EEC, saves Europe, and has a positive impact on markets globally. So, this is a big deal. Not to do so would be economic suicide for Britain, and I think wiser heads will prevail.

Q: Do you think it’s a good idea for Saudi ARAMCO to go public in Japan as reports suggest?

A: When the Arabs want to get out of the oil business (USO), (XLE), you want to also. That’s what the sale of ARAMCO is all about. They’re going to get a $1 trillion or more valuation, raising $100 billion in cash. And guess who the biggest investors in alternative energy in California are? It’s Saudi Arabia. They see no future in oil, nor should you. This is why we’ve been negative on the sector all year. By the way, bankruptcies by frackers in the U.S. are at an all-time high, another indicator that low oil prices can’t be tolerated by the US industry for long.

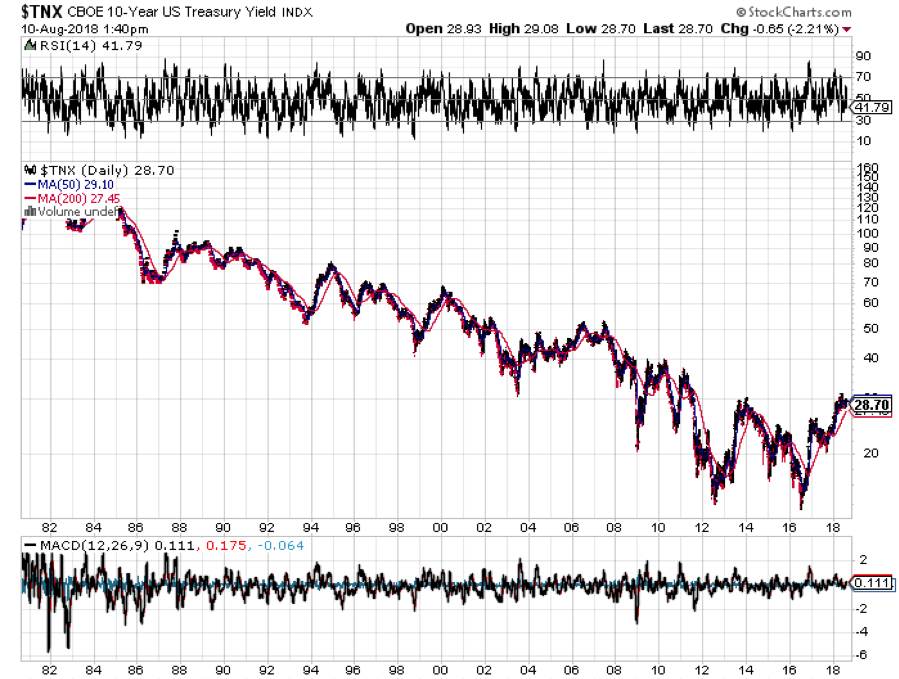

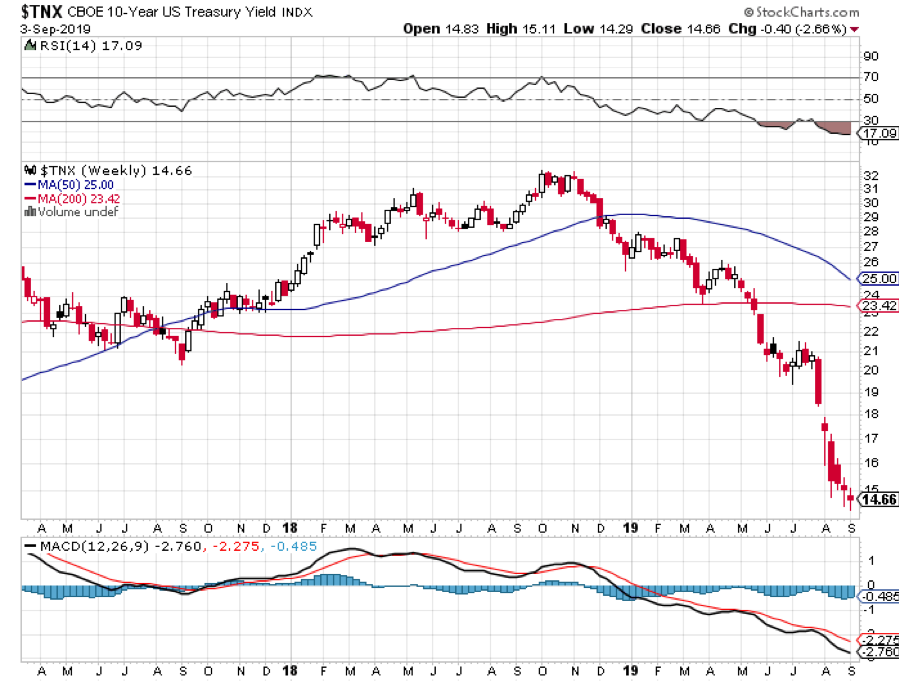

Q: Is it time to buy the ProShares Ultra Short 20 year Plus Treasury Bond Fund (TBT)?

A: No, not yet; I think we’re going to break 1.33% — the all-time low yield for the (TLT) will probably be somewhere just below 1.00%. We probably won’t go to absolute zero because we still have a growing economy. The countries that already have negative interest rates have shrinking economies or are already in recession, like Germany or Great Britain can justify zero rates.

Q: Are you going to run all your existing positions into expiration?

A: I’m going to try to—it’s only 12 days to expiration, and we get to keep the full profit if we do. As long as the market is dead in the middle here, there are no other positions to put on, no extreme low to buy into or extreme high to sell into. It’s a question of letting this sort of nowhere-trend play out, but also there's nothing else to buy, so there is no need to raise cash. So, we’re 60% invested now and we’re going to try running as many of those into expiration as we can. Looks like all the long technology positions are safe (FB), (AMZN), (MSFT), (DIS). The only thing we’re pressing here are the shorts in Walmart (WMT) and Russell 2000 (IWM).

Q: Do you think it’s a good idea for Tesla (TSLA) to build another Gigafactory in Shanghai, China during a trade war? Will this blow up in Elon’s face?

A: I don’t think so because the Chinese are desperate for the Tesla technology and they just gave Tesla an exemption on import duties on all parts that need to go there to build the cars. So, that’s a very positive development for Tesla and I believe the stock is up about $10 since that news came out.

Q: Will Roku (ROKU) ever pull back? Would you buy it up here?

A: No, we recommended this thing last year at $40; it’s now up to $165, and up here it’s just wildly overbought, in chase territory. Of course, the reason that’s happening is that the big concern last year was Amazon wiping out Roku, yet they ultimately ended up partnering with Roku, and that’s worth about a 400% gain in the stock. You know the second you get into this, it’s over. There are just too many better fish to fry in the technology area.

Q: What happens if our existing Russell 2000 (IWM) September 2019 $153-$156 in-the-money vertical BEAR PUT spread Russell 2000 position closes between $156 and $153?

A: You lose money. You will get the Russell 2000 shares put to you, or sold to you at $153.00, which means you now own them, and you’ll get a big margin call from your broker for owning the extra shares. If ever it looks like we’re getting close to the strike price going into expiration, I come out precisely because of that risk. You don’t want random chance dictating whether you’re going to make money in your position or not going into expiration. If you’re worried about that, I would get out now and you can still come out with a nice profit. Or, you can always wait for another down day tomorrow.

Q: Is it time to get super aggressive shorting Lyft (LYFT) or Uber (UBER) when they openly admit that they won’t make a profit anytime in the near future?

A: The time to short Uber (UBER) and Lyft was at the IPO when the shares became available to sell. Down here I don’t really want to do very much. It’s late in the game and Uber’s down about one third from its IPO price. We begged people to stay away from this. It’s another example where they waited for the company to go ex-growth before it went public, but it didn’t leave anything for the public. It was a very badly mishandled IPO—it’s now at $31 against a $45 IPO price and was at a new all-time low just 2 days ago. You knew when they offered the drivers shares, the thing was in trouble. Sometime this will be a buy, but not yet. Go take a long nap first.

Q: Is the fact that rich people are hoarding cash a good indicator that a recession is approaching?

A: Yes, absolutely. Bonds yielding 1.45% is also an indication that the wealthy are hoarding cash from other investment and parking it in US treasury bonds. I went to the Pebble Beach Concourse d’ Elegance vintage car show a few weeks ago and all of the $10 million plus cars didn’t sell, only those priced below $100,000. That is always a good indicator that the wealthy are bailing ahead of a recession. If you can’t get a premium price for your vintage Ferrari, trouble is coming.

Q: Argentina just implemented currency controls; is this the start of a rolling currency crisis among emerging nations?

A: No, I believe the problems are unique to Argentina. They’ve adopted what is known as Modern Momentary Theory—i.e. borrowing and printing money like crazy. Unfortunately, this is unsustainable and results in a devalued currency, general instability, and the eventual hanging of their leaders from the nearest lamppost. This is exactly the same monetary policy that the Trump administration has been pursuing since he came into office. Eventually, it will lead to tears, ours, not his.

Q: Is the new all-electric Porsche Taycan a threat to Tesla?

A: No, it’s not. Their cheapest car is $150,000 and it gets one third less range than Tesla does. It’s really aimed at Porsche fanatics, and I doubt they will get outside their core market. In the meantime, Tesla has taken over the middle part of the electric market with the Model 3 at $37,000 a car. That’s where the money is, and Porsche will never get there.

Q: How will the US pull out of recession if the interest rates are at or below zero?

A: It won’t—that’s what a lot of economists are concerned about these days. With interest rates below zero, the Fed has lost its primary means to stimulate the economy. The only thing left to do is use creative means like feeding the economy with currency, which Europe has been doing for 10 years, and Japan for 30, with no results. That’s another reason to not allow rates to get back to zero—so we have tools to use when we go into a recession 12-24 months from now.

Q: What’s the best way to buy silver?

A: The ETF iShares Silver Trust (SLV) and, if you want to be aggressive, the silver miners with the Global X Silver Miners ETF (SIL).

Q: Have global central banks ruined the western economic system as we know it for future generations?

A: They may have—mostly by printing too much money in the last 10 years in order to get us out of recession. This hasn’t really worked for Europe or Japan, mind you, though who knows how much worse off they would be if they hadn’t. What it did do here is head off a Great Depression. If we go back to money printing in a big way, however, and it doesn’t work, we will not have prevented a Great Depression so much as pushed it back 10 or 15 years. That’s the great debate ongoing among economists, and it will eventually be settled by the marketplace.

Global Market Comments

September 5, 2019

Fiat Lux

SPECIAL VOLATILITY ISSUE

Featured Trade:

(SHOPPING FOR FIRE INSURANCE IN A HURRICANE),

(VIX), (VXX), (XIV),

(THE ABCs OF THE VIX),

(VIX), (VXX), (SVXY),

I am one of those cheapskates who buy Christmas ornaments by the bucketload from Costco in January for ten cents on the dollar because my 11-month theoretical return on capital comes close to 1,000%.

I also like buying flood insurance in the middle of the summer drought when the forecast in California is for endless days of sunshine. That is what we had at the end of July when the (VIX) was plumbing the depths of $12.

Get this one right, and the profits you can realize are spectacular.

It gets better.

If the bottom in volatility exactly coincides with the peak in the stock market that it measures, volatility could be headed back up to the 30% handle, and maybe more.

I double dare you to look at the charts below and tell me this isn’t happening.

Watch carefully for other confirming trends to affirm this trade is unfolding. Those would include a strong dollar, and a weak Japanese yen, Euro, and rising fixed income instruments of any kind.

Notice that every one of these is happening this week!

Reversion to the mean, anyone?

You may know of this from the many clueless talking heads, beginners, and newbies who call (VIX) the “Fear Index”.

For those of you who have a Ph.D. in higher mathematics from MIT, the (VIX) is simply a weighted blend of prices for a range of option contracts on the S&P 500 index (SPX).

The formula uses a kernel-smoothed estimator that takes as inputs the current market prices for all out-of-the-money calls and puts for the front-month and second-month expirations.

The (VIX) is the square root of the par variance swap rate for a 30-day term initiated today. To get into the pricing of the individual options, please go look up your handy dandy and ever-useful Black-Scholes equation.

You will recall that this is the equation that derives from the Brownian motion of heat transference in metals. Got all that?

For the rest of you who do not possess a Ph.D. in higher mathematics from MIT, and maybe scored a 450 on your math SAT test, or who don’t know what an SAT test is, this is what you need to know.

When the market goes up, the (VIX) goes down. When the market goes down, the (VIX) goes up. Period. End of story. Class dismissed.

The (VIX) is expressed in terms of the annualized monthly movement in the S&P 500 (SPX) which, with the (VIX) today at $10, is at $72.54.

So for example, a (VIX) of $10 means that the market expects the index to move 2.89%, or $72.54 S&P 500 points, over the next 30 days.

You get this by calculating $10/3.46 = 2.89%, where the square root of 12 months is 3.46.

The volatility index doesn’t really care which way the stock index moves. If the S&P 500 moves more than the projected 2.89% in ANY direction, you make a profit on your long (VIX) positions.

I am going into this detail because I always get a million questions whenever I raise this subject with volatility-deprived investors.

It gets better.

Futures contracts began trading on the (VIX) in 2004 and options on the futures since 2006.

Since then, these instruments have provided a vital means through which hedge funds control risk in their portfolios, thus providing the “hedge” in hedge fund.

Global Market Comments

September 4, 2019

Fiat Lux

Featured Trade:

(HOW FREE ENERGY WILL POWER THE COMING ROARING TWENTIES),

(SPWR), (TSLA)

(ARE YOU IN THE 1%?),

(SNE), (HMC), (TLT)

I have been in the much-talked-about and often despised 1% for most of my adult life.

I started my relentless march towards wealth and financial independence when I was 11 years old and landed a job delivering newspapers for the Los Angeles Herald Examiner, an old Hearst rag, earning $30 a month.

I’ll never forget the weight of 30 pounds of newsprint on my shoulders as I delivered them around my neighborhood in the dark on my Schwinn bicycle.

I eventually got fired because I found the stock pages so enthralling that I was always late delivering the papers. The Herald was run out of business by the Los Angeles Times in 1989.

My next step towards success came with a job in the snack bar at the May Company, a Los Angeles department store that also no longer exists, earning the untold sum of $1 an hour, then the minimum wage.

The really smart thing I did there was that whenever a customer paid for a hot dog with a 40% pure Kennedy silver half dollar, which in 1967 was still in widespread circulation, I would switch it for paper money.

Eventually, I accumulated 100 of these half dollars.

At age 15, I was willing to bet that someday the US would go off the gold standard and all precious metals would rise in value.

President Nixon did exactly that in 1971, and the value of my stash rose 100-fold to $5,000.

I still have those silver half dollars. I understand that Texas hedge fund manager Kyle Bass owns the rest.

I finally made it into the 1% when I was 33, after spending two years at Morgan Stanley. By then, my pay there had rocketed from an entry level $45,000 to $300,000 a year.

It helped that I won the betting pool for picking the best performing stock in the world two years running.

Back then, nobody had ever heard of an obscure electronics company in Japan called Sony (SNE) which rose in value 85-fold in dollar terms over the following seven years.

Nor had they heard of Honda Motors (HMC). When the other traders saw their little eggshell shaped cars for the first time, they laughed.

The pitiful vehicles had to make a high-speed run to make it to the top of an American freeway onramp. Its shares rose 45 times in dollar terms.

This was back when $300,000 could buy you a luxury two-bedroom condo on the 34th floor on the upper east side of Manhattan. That is exactly what I did, right next door to corporate raider Carl Icahn, and across the street from Henry Kissinger and Ginger Rogers.

A London mansion followed, located between other homes owned by Jacob Rothschild and Sir Richard Branson.

After a few more years at Morgan Stanley, and then founding the first-ever dedicated international hedge fund, I soon found myself in the much-vaunted 1/10th of the top 1% of American earners.

I stayed there for quite a while.

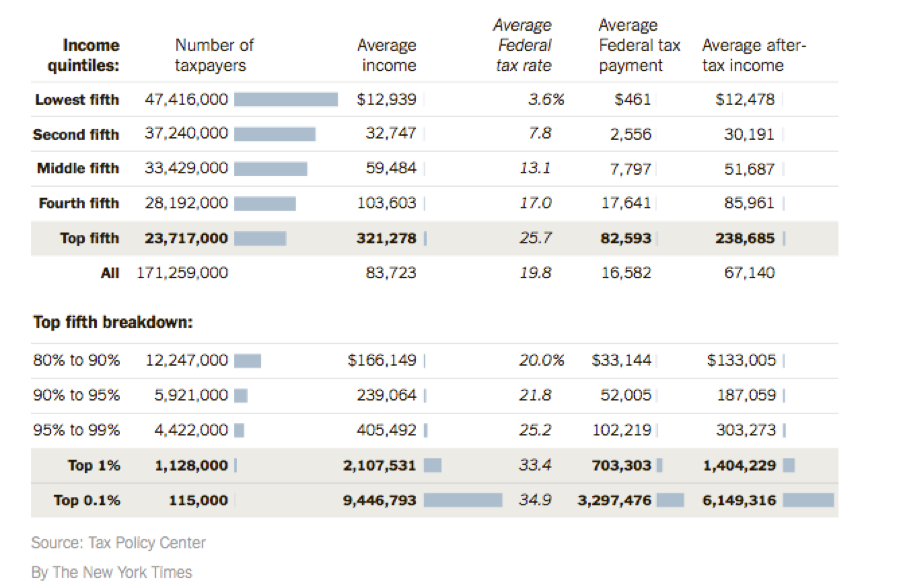

However, I recently got the bad news from the New York Times that I have been kicked out of the top tier.

According to their research, to prove I have grabbed the brass ring, I have to have an average annual income of $9,446,793. Only 115,000 taxpayers can meet this elevated standard.

I am still in the top 1%, where I only need to earn $2,107,531 to qualify and can remain with my 1,128,000 friends.

My Brioni suits, Turnbull & Asser Sea Island Silk shirts, and Bruno Magli shoes will not be found for sale on eBay anytime soon.

Which left me to ponder why I had lost my position at the apex of US earning power.

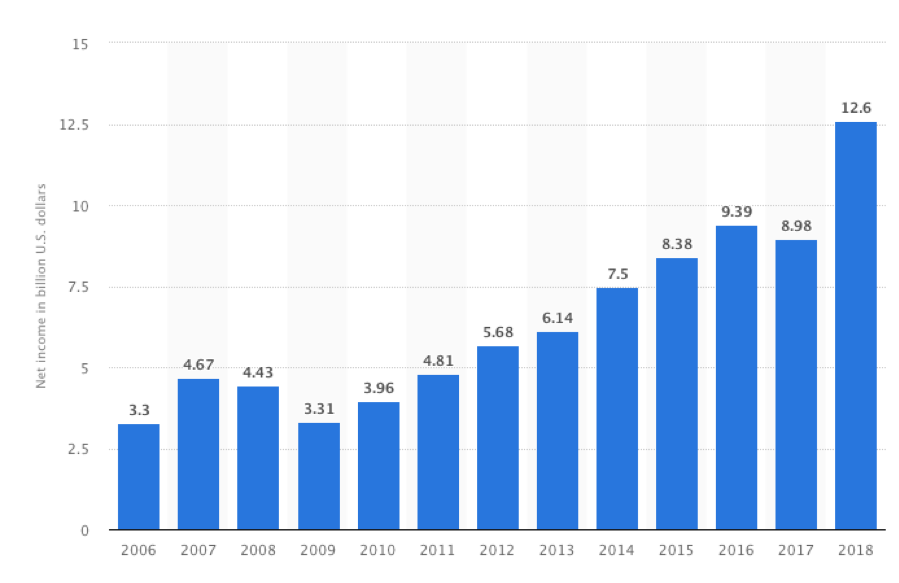

It turns out that the concentration of wealth at the top has vastly accelerated since the stock market bottomed in March 2009.

Risk takers, like those who owned stocks, bonds, and real estate, were tremendously rewarded by the recovery of asset prices.

Those who don’t own any assets, about 40% of the country, were left behind in the dust.

So, the low tax leveraged longs, like those running big hedge and private equity funds, started to greatly outpace my own earning power.

Concentrating so much wealth at the top is a problem for the United States. As any financial advisor can tell you, the richer people become, the more conservative they get with their investments.

Eventually, it all ends up in the bond market, where positions are never sold to avoid paying taxes. In other words, it stagnates and is one of the causes of our present low 2.5% GDP growth rate.

It is also where the 1.46% ten-year Treasury bond (TLT) comes from.

It is usually NOT placed with higher risk, job-creating, equity type investments. For more on this, click here for “The Bond Market and the 1%”.

This always happens when you have a big bulge generation retire all at once, like the 85 million baby boomers.

Another reason I lost my guarantee of the best table in every restaurant I walk into is that I am paying a lot more in taxes than I used to.

This is because I shifted careers from the hedge fund business, where I paid a bargain 15% tax rate on my realized carried interest, to the newsletter game where I am tagged for a heart-rending 43.4%, including the Obamacare add on.

As a result, I pay more in taxes in a single year than most people earn in a lifetime. In other words, for the first time in my life, I am paying taxes like everyone else.

Ouch, and double ouch!

Want to know why I am so interested in what happens in Washington? BECAUSE IT’S MY MONEY THEY’RE SPENDING!

It is also why I have come to learn so much about our arcane and abstruse tax system, and how I am able to periodically pass on insights to you.

I have to pay my accountants tens of thousands of dollars to ferret this stuff out, for your benefit.

When I had dinner with former Federal Reserve Chairman Ben Bernanke, he told me that “rising income inequality is the biggest structural problem we face.”

To find out where you stand in the country’s multi-tiered income structure, I have reproduced the New York Times data below.

Who has seen the greatest accumulation of wealth since the 2009 low? The Koch Brothers, whose combined net worth has soared from $26 billion to $90 billion since then.

Go Figure.

For one more piece on the 1%, please click here for “Mixing With the 1% at Pebble Beach”.

These days, I get to download my papers on my iPad every morning no matter where I am in the world, which then update themselves throughout the day.

I now get up even earlier than when I delivered the papers by bike.

Come to think of it, that “Horatio Alger Effect” that Ben Bernanke mentioned to me over dinner the other day applies to me as well.

I bet it has worked for a lot of you too.

Being a Hedge Fund Manager Did Have Its Advantages

Global Market Comments

September 3, 2019

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or VISIBILITY IS POOR),

(SPY), (TLT), (FXB), (WMT), (USO), (XLE)

I have a pretty good view from my home on a mountaintop in San Francisco.

To the west, I can see through the Golden Gate Bridge all the way out to the Farallon Islands 20 miles off the coast. To the south, there is Stanford’s Hoover Tower and all of Silicon Valley. In the winter I can look east and see the snow-covered High Sierras 200 miles away.

However, during last year’s wildfires, I couldn’t see a thing. Visibility ended at 100 yards, the cars parked outside were covered in ash, and I could barely breathe. We were all confined indoors.

I kind of feel that’s the way the stock market is right now. You can’t see a thing, so it’s better to stay indoors.

Not only are market gyrations subject to unpredictable and random, out-of-the-blue influences. The old playbook about cross market correlations and how asset classes respond at different points of the economic cycle doesn’t work either.

The good news is that August is over, the second worth trading month of the year. The bad news? September is the WORST trading month of the year!

So, what does a trader do on the first day of the worst investment month of the year?

Research.

That's what I’ll be doing, waiting for the next cataclysmic collapse to buy or the next euphoric bubble to sell short. Until then, I’ll be sitting tight. Just running my existing long/short trading book, I’ll be up 3.4% by the September 20 option expiration date in 15 trading days.

There is one BIG positive for the economy that no one is talking about. The home ATM is open for business, and open like it’s never been open before.

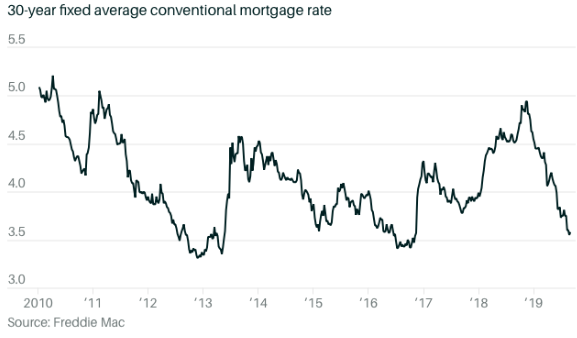

The thirty-year fixed rate mortgage rate is now at 3.56%, 10 basis points over a decade low and 20 basis points above an all-time low (see the chart below). There are currently $9.4 trillion of outstanding home mortgages in the US. Some $5 trillion is in Fannie Mae and Freddie Mac conforming loans, some 90% of which have interest rates higher than the current market.

If just ten million of these mortgages refinance obtaining an average of $4,560 in annual savings each, that will amount to a de facto tax cut of $456 billion per year, not an inconsequential amount. And Goldman Sachs thinks we could be in for as much as 37 million refis. It could be enough to offset the negative impact of the trade war.

As for the past week, it seemed like a disaster a day.

Trump ordered all US companies out of China. Like you can reverse 40 years’ worth of trillions of dollars of investment with a Tweet. If they did, an iPhone would cost $10,000 and your low-end laptop $15,000. An escalation of the trade war is the last thing your 401k wanted to hear. Kiss that early retirement goodbye.

Oil crashed (USO) on trade war escalation, with the industry now seeing a recession as a sure thing. Russian cheating on quotas is pouring the fat on the fire creating a massive supply glut in the face of shrinking demand. Take a long nap before considering any energy investment (XLE). The long-term charts show they are all going to zero.

Prime Minister Boris Johnson suspended Parliament, prompting a free fall in the pound. It’s to keep Parliament from blocking his hard Brexit, where it would certainly loose by a landslide. It’s all up to the Queen now, the monarch, not the rock group.

The yield inversion is deepening, with the US Treasury selling two-year notes today at a 1.56% yield, with ten-year yield closing at 1.45%. And that’s with the Treasury selling a total of a gob smacking $113 billion worth of bonds last week, which should have driven rates UP! US ten-year TIPS now showing negative interest rates.

Company stock buy backs are fading. That's a big deal as corporations retiring their own shares have been the biggest buyers in the market for the past two years. As if you needed another reason for downside risk.

US 15% tariffs hit on Sunday, and the Chinese paused in retaliation. Christmas is about to get more expensive. Many large retailers won’t make it until the new year. Keep selling short Macy’s (M) on rallies.

Bond yields hit new lows, at 1.44% for ten-year US Treasury bonds. The next stop is zero. Fixed income markets are saying that a recession is imminent. “Inversion” will be the world of the year for 2019. Go refi that home if you can get a banker on the phone!

There is no way out of the next recession, says hedge fund titan Ray Dalio. With global rates below zero, you can’t cut to stimulate business. You can’t do any more quantitative easing either, as the world is already glutted with paper. This is the trap Japan has been caught in for the last 30 years. It is all sobering food for thought.

US growth slowed with the second reading of the Q2 GDP marked down from 2.1% to 2.0%. The downturn has continued since the economy peaked 18 months ago. Q3 will be much worse when the trade war and earnings downgrades hit big time. And then there’s the soaring deficit. Sow the wind, reap the whirlwind.

US Consumer Sentiment took a dive from 98.4 to 89.8 in August. Has the spending boom just peaked? If so, we’re all toast. The "tariff cliff" is already taking its toll.

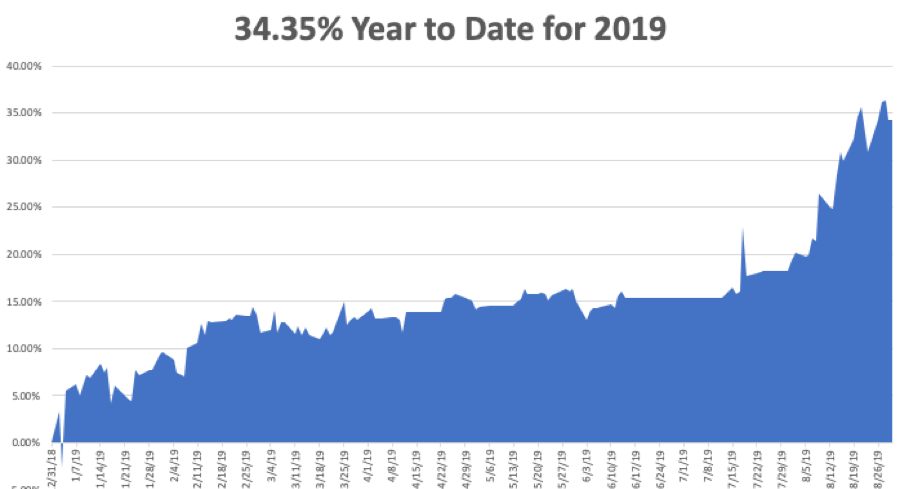

The Mad Hedge Trader Alert Service has posted its best month in two years. Some 22 or the last 23 round trips, or 95.6%, have been profitable, generating one of the biggest performance jumps in our 12-year history.

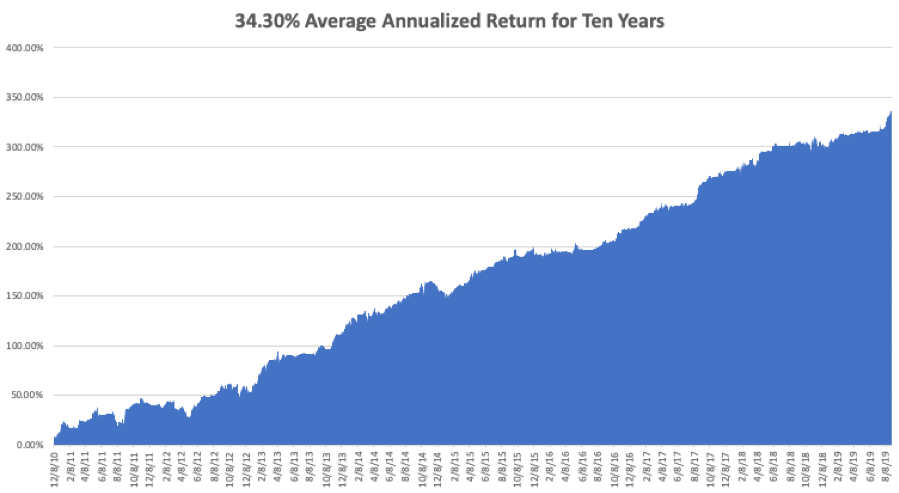

My Global Trading Dispatch has hit a new all-time high of 334.48% and my year-to-date shot up to +34.35%. My ten-year average annualized profit bobbed up to +34.30%.

I raked in an envious 16.01% in August. All of you people who just subscribed in June and July are looking like geniuses. My staff and I have been working to the point of exhaustion, but it’s worth it if I can print these kinds of numbers.

As long as the Volatility Index (VIX) stays above $20, deep in-the-money options spreads are offering free money. I am now 60% invested, 40% long big tech and 20% short Walmart (WMT) and the Russell 2000, with 20% in cash. It rarely gets this easy.

The coming week will be all about jobs, jobs, jobs.

Monday, September 2, markets were closed for the US Labor Day.

Today, Tuesday, September 3 at 10:00 AM, the August ISM Purchasing Manager’s Index is out.

On Wednesday, September 4, at 2:00 PM, the Fed Beige Book for July is published.

On Thursday, September 5 at 8:30 AM EST, the Weekly Jobless Claims are printed. At 10:30, we learn the ADP Report for private hiring.

On Friday, September 6 at 8:30 AM, the August Nonfarm Payroll Report is printed.

The Baker Hughes Rig Count follows at 2:00 PM.

As for me, I’ll be filling out the paperwork for my own home refi. JP Morgan Chase Bank (JPM) is offering the best deals, in my case a 30-year fixed rate no-cash-out jumbo loan for only 3.4%. Now where did I put that tax return?

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

August 30, 2019

Fiat Lux

Featured Trade:

(ALL IS WELL AT THE MOUSE HOUSE), (DIS), (NFLX),

(A VERY BRIGHT SPOT IN REAL ESTATE),

I’ll never forget the first time I met Walt Disney. There he was at the entrance on opening day of the first Disneyland in Anaheim, CA in 1955 on Main street shaking the hand of every visitor as they came in. My dad sold the company truck trailers and managed to score free tickets for the family.

At 100 degrees on that eventful day, it was so hot that the asphalt streets melted. Most of the drinking fountains and bathrooms didn’t work. And ticket counterfeiters made sure that 100,000 people jammed the relatively small park. But we loved it anyway. The band leader handed me his baton and I was allowed to direct the musicians in the most ill-tempoed fashion possible.

After Walt took a vacation to my home away from home in Zermatt, Switzerland, he decided to build a roller coaster based on bobsleds running down the Matterhorn on a 1:100 scale. In those days, each ride required its own ticket, and the Matterhorn needed an “E-ticket”, the most expensive. It was the first tubular steel roller coaster ever built.

And investment in Walt Disney was dead money for years.

The main reason has been the drain on the company presented by the sports cable channel ESPN. Once the most valuable cable franchise, the company is now suffering from multiple fronts, including the acceleration of cord-cutting, the demise of traditional cable, the move to online streaming, and the demographic abandonment of traditional sports like football.

However, ESPN’s contribution to Walt Disney earnings is now so small that it is no longer a factor.

All that changed in March when Wall Street got the first whiff of Disney plans to enter the online streaming business. In quick order, it ended its contract with Netflix (NFLX) to stream its movies and announced plans to launch Disney Plus to compete directly with Netflix.

Since then, the shares have risen by an eye-popping 40% and every institutional investor out there is struggling to double up their position. Personally, I think the stock could hit $200 in the next couple of years. That’s why I am trying to run a recurring long in the stock going forward.

In the meantime, a lot has gone right with Walt Disney. The parks are going gangbusters. With two teenage girls in tow, I have hit three in the past two years (Anaheim, Orlando, and Paris, where they serve wine with their $20 cheeseburgers).

The movie franchise is going from strength to strength. Frozen 2 and Toy Story 4 were blockbusters. A new Star Wars films is due in December, Star Wars: Episode IX – The Rise of Skywalker. Its online strategy is one of the best in the business. And it’s just a matter of time before they hit us with another princess. How many is it now? Nine?

It is about to expand its presence in media networks with the acquisition of 21st Century Fox (FOX) assets, already its largest source of earnings. It will join the ABC Television Group, the Disney Channel, and the aforementioned ESPN.

As for old Walt, he died of lung cancer in 1966, just when he was in the planning stages for the Orlando Disney World. All that chain-smoking finally got to him. Despite that grandfatherly appearance on the Wonderful World of Color weekly TV show, friends tell me he was a complete bastard to work for.

Global Market Comments

August 29, 2019

Fiat Lux

Featured Trade:

(HOW THE MARKETS WILL PLAY OUT FOR THE REST OF 2019),

(SPY), ($INDU), (USO), (TLT), (UUP), (COPX), (GLD),

(HOW THE MAD HEDGE MARKET TIMING ALGORITHM WORKS)