Global Market Comments

April 6, 2016

Fiat Lux

Featured Trade:

(APRIL 19 ATLANTA GLOBAL STRATEGY LUNCHEON),

(SEEING RED FLAGS EVERYWHERE),

(FXY), (YCS), (TLT), (USO), (T), (PCG), (FCX)

(THE TWO CENTURY DOLLAR SHORT),

(UUP)

CurrencyShares Japanese Yen ETF (FXY)

ProShares UltraShort Yen (YCS)

iShares 20+ Year Treasury Bond (TLT)

United States Oil (USO)

AT&T, Inc. (T)

PG&E Corporation (PCG)

Freeport-McMoRan Inc. (FCX)

PowerShares DB US Dollar Bullish ETF (UUP)

During Operation Desert Storm in 1991, Central Command asked me to fly a top secret mission to Lebanon in my twin engine Cessna 340.

Mission accomplished, I flew home on a 270-degree heading over the Eastern Mediterranean at an altitude of 200 feet, in order to stay under the radar.

It was a warm, hazy day, and I had the plane on autopilot, enjoying myself passing the time looking out for fishing boats, private yachts with bathing beauties, and cargo ships.

Suddenly, I saw an F-18 fighter jet come straight at me, pass a few feet overhead, do a 180, then come up right alongside my port wingtip. A minute later a second F-18 joined me on my starboard wingtip, and a third followed directly behind me at a safe distance.

I thought, ?This is not good.?

The planes had US markings. So I reached into my pilot?s case and pulled out a small American flag and held it up against the cockpit window.

They ignored me, stonily staring straight ahead.

Then I took off my New York Yankees baseball cap, held it up to the window and pointed at it.

Still no response.

Then they gradually started edging towards me, eventually holding course TEN FEET off each wingtip at 220 MPH. I was unable to change course.

I put out a Mayday call.

Five minutes later I received a call from a listening station at a British Army base in Cyprus. He said he was relaying a message from a US Navy helicopter from an undisclosed location.

Right at that moment the cause of my predicament became clear.

An American aircraft carrier loomed out of the haze, surrounded by 25 grey support ships. As I passed overhead, the cockney accent informed me ?Don?t worry, they only think you?re a suicide bomber.?

The second I passed over the enormous ship, it's deck chock a block with waiting aircraft and hustling sailors, the F-18?s suddenly peeled away.

Observing the disjointed market action over the past few days, that queasy feeling that I was about to be shot down in flames has returned.

Let me list the red flags I am seeing for this market.

1) The yen is appreciating. With a weak economy, exploding national debt, tottering government, demographic nightmare, and a 10-year JGB yielding negative -10 basis points, it should be falling. The yen (FXY), (YCS) only goes up for one reason: hedge funds around the world are covering their short positions because they plan to dump long positions in all other asset classes, especially stocks.

2) The bond market is remarkably healthy. Ten-year US Treasuries (TLT) hit a 1.70% yield today. Investors are not buying bonds because they love these fabulous 170 basis point yields. They are soaking them up because they want to hide their cash from the greater harm they could suffer elsewhere.

3) Defensive stocks have been roaring. Utilities (PGE) and telephone companies (T) have some of the best performing stocks of 2016. This is despite the fact that they are burdened by ancient business models and literally rusting assets. But they have high dividend payouts and low stock volatility that is attracting investors. This means said investors believe the rest of the market is going to suck for the foreseeable future. Not good, not good.

4) Oil is going down again. Remember that perfect correlation between oil and stocks (USO)? It will return with a vengeance, and oil now has a head start. The world is still drowning in surplus oil, and a wave of bankruptcies is about to hit us big time.

5) You know those monster moves in oil and commodities (FCX) we saw since January? 100% of it was short covering. There was almost no new net cash pouring into the sector. And what is all that cash waiting to do again? Sell short the next momentum driven market breakdown.

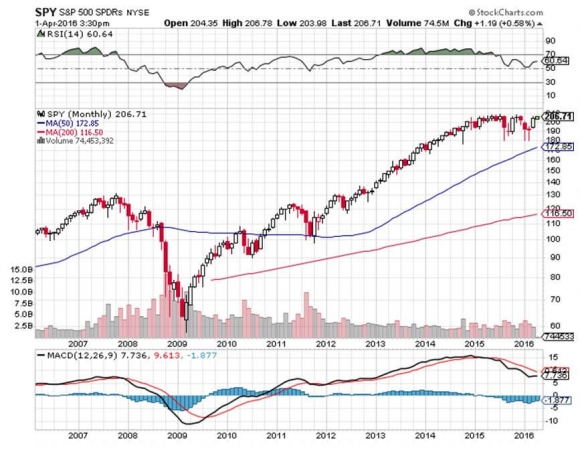

6) The calendar is about to turn savagely against us. Heard of ?Sell in May and Go Away?? It?s April. What follows April? May. We are about to enter a period of historic stock market weakness (SPY) which is really tough to beat, unless you are short or hedged.

7) The Republican Convention in July could be a nightmare. Remember the Democratic Convention in 1968, when the police were found to have rioted? The upcoming brawl in Cleveland could make that affair look like a cakewalk. Anyone with a predilection for civil disobedience has already made their travel plans for the summer. Markets everywhere will shudder.

Don?t get me wrong here. I am convinced that the bull market in stocks still has several years to run. I just think that the last rally was too much, too fast, and that we could be in for another hickey. This is why I am running one of my smallest trading books in years, with just a small long in gold.

By the way, parachutes don?t work at 200 feet. I doubt that would have been a concern of mine, as sidewinder missiles rarely have a problem hitting their target at 100 feet.

I?m still pissed at the squids in the Navy.

?Why Insurance Companies Hate Me

Global Market Comments

April 5, 2016

Fiat Lux

Featured Trade:

(APRIL 18 MIAMI GLOBAL STRATEGY LUNCHEON),

(GUESS WHO?S BEEN BUYING GOLD?),

(GLD), (GDX), ($SSEC),

(MY BRIEFING FROM THE JOINT CHIEFS OF STAFF),

(PANW), (PHO), (HACK), (FXI), (RSX),

(TESTIMONIAL)

SPDR Gold Shares (GLD)

Market Vectors Gold Miners ETF (GDX)

Palo Alto Networks, Inc. (PANW)

PowerShares Water Resources ETF (PHO)

PureFunds ISE Cyber Security ETF (HACK)

iShares China Large-Cap (FXI)

Market Vectors Russia ETF (RSX)

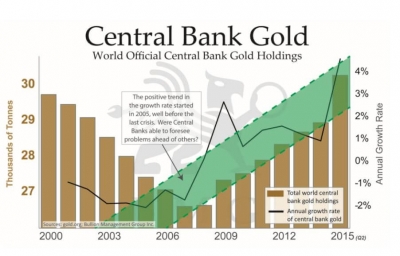

Gold bugs, conspiracy theorists, and perma bears had some unfamiliar company last year.

While traders, individuals, and ETF?s have been unloading gold for the past five years, central banks have been steady buyers.

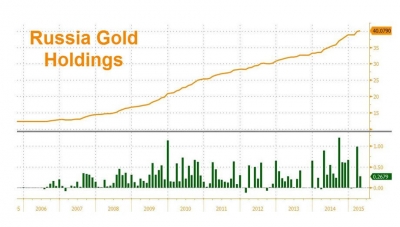

Who had the biggest appetite for the barbarous relic? Russia, which has been accumulating the yellow metal to avoid economic sanctions imposed by the United States in the wake of their invasion of the Ukraine.

Hot on their heals was China, which has flipped to a large net importer of gold to meet insatiable demand from domestic investors.

It seems the Chinese stocks markets ($SSEC) were not the great trading opportunity they were hyped to be, which plunged 30% during the first two months of 2016, and is now 60% off its all time high. That?s a big deal in a country that has no social safety net.

Many Chinese now prefer to buy gold instead of stocks, which are now considered too risky for a personal nest egg. They are facilitated by the ubiquitous precious metal coin stores, which have recently sprung up like mushrooms in every city.

Only a few years ago, private ownership of gold resulted in China having your organs harvested by the government.

Central bank sellers have been few and far between. Venezuela has dumped about half its reserve to head off a recurring liquidity crisis. Middle Eastern sovereign wealth funds cashed in some chips to deal with the oil price crash.

Canada has also been selling for reasons unknown to us south of the border.

All of this poses a really interesting question. Gold fell for the four consecutive years that central banks were buying, and the rest of the world was selling.

What happens when the rest of the world flips to the buy side?

My guess is that it goes up, which is why I have issued long side trade Alerts on gold every month this year.

Depending on who you talk to, the magical support level were you get back in for another visit to the trough is $1,199 or, $1,200.

In the meantime, I think I?ll run my (GLD) April 15 $$109-$112 vertical bull call spread into expiration in eight trading days.

I retired eight years ago, and my broker told me to hang in there with my stocks before the recession, so I saved myself a lot of money and closed the account.? In 2009 I started paying for advice and investing on line.?

A blind chicken could have made a fortune in 2009, and I did well.?But it got harder, so I added advisers.? John Thomas was one I added in 2010.?

Since then, my TAX FREE profits have been greatly improved.? Last year I made more than 80% on the information that I received from the Mad Hedge Fund Trader.?

I am not a day trader (I belong to a country club and play golf daily) but I also subscribe to Mad Day Trader service.? Now I have John's in-depth experience combined with Jim's analytical timing.?

I spend about ten to fifteen hours a week on my investments, and played 120 rounds of golf last year.? Year-to-date, my investments are up 50% with Mad Hedge Fund Trader advice, I just completed my 40th round of golf, and my wife thinks she is the sole sustainer of our local plant nursery.?

Thanks John and Jim.? I could not live like this without your VALUABLE effort.

Gratefully,

Kurt

Sacramento, CA

Global Market Comments

April 4, 2016

Fiat Lux

Featured Trade:

(COME JOIN ME FOR A MARKET PANEL DISCUSSION),

(APRIL 15 HOUSTON STRATEGY LUNCHEON INVITATION),

(REVISITING THE BIG PICTURE ON THE ECONOMY),

(TSLA)

Tesla Motors, Inc. (TSLA)

Come join me, John Thomas, the Mad Hedge Fund Trader, for a wide ranging discussion of the near term direction of the stock market with a group of top market professionals on Monday, April 4th at 1 PM (ET).

The meeting is being organized by the boutique research firm Timing Research. It will be hosted by my friend, Matt "Whiz" Buckley of TopGunOptions.com, another former combat pilot who actively trades the market.

We will be joined by

- Lance Ippolito of AlphaShark.com

- Sam Bourgi of TradingGods.net

- Sang Lucci of SangLucci.com

Together we will attempt to discern the most important drivers of stock prices in the coming weeks and the overall net direction.

I always have a lot of fun with these things since it is interesting to learn new approaches to trading the market. I am also usually the one who turns out to be right.

In order to participate for free please click here.

See you there!

I Usually End Up Doing the Heavy Lifting

I Usually End Up Doing the Heavy Lifting

As you all know, I call readers everyday looking for fresh market intelligence and new ways to improve my service. Yesterday, I spoke to a seven-year follower who inspired me to write this piece.

She was thinking of quitting the stock market and not renewing my newsletter. A 50 year market veteran who grew up with a QUOTRON in her house, she was getting discouraged not just by the recent market action, but the public discussion in America as a whole.

I?ve seen this happen to a lot of people this year. The negative advertising is so ferocious that people are literally going insane. They are being driven to the edge of despair.

I said that for a start she had to turn off the TV.

Some $8 billion will be spent on media by political candidates this year who want to convince you how terrible things are so you can vote for them to fix them.

Turn off the TV and all of that suddenly goes away, and the world becomes a better place.

My response to all of this is to only look at numbers and the US instantly becomes a mighty fine place. A 5.0% unemployment rate. Interest rates are near zero. Energy prices at multi decade lows. Inflation is nowhere to be seen. Did I mention that the stock market is 4% short of an all time high.

Look at the world, and America is the only place you would want to keep your money. Every Chinese and Russian billionaire wants to park their money here as a safe haven. Here they get taxed. At home they get shot.

People are flocking here by the millions to take advantage of our economic opportunities, as they always have done.

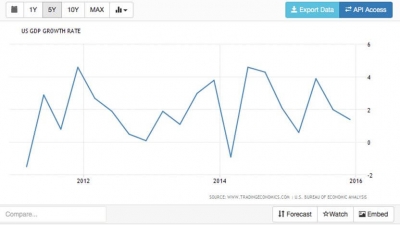

Sure, there is an issue with our 2.5% GDP growth rate, a shadow of the 4% rate we saw during the go go 1990?s. I have a couple of theories about that.

1) Demographics

This has largely to do with the retirement of 80 million baby boomers. When our senior citizens pass from the economic scene, they stop spending and increase saving, switch from equity to fixed income investment, and downsize their homes.

The drag created on economic growth is at least 1% a year and maybe more, and there is nothing anyone can do about it. This ends in 2022. We are more than half way through the hard decade now. The next decade will be a replay of the roaring twenties, as 85 million Millennials become big spenders.

2) Out-of-Date Government Data

I think the GDP figures are inaccurate because they are too heavily focused on antiquated measures of the US economy, understating the true growth rate. Why place such a heavy emphasis on manufacturing, when services, where we dominate, account for 80% of the economy?

Much of online commerce, which is generating much of the new growth, is invisible to the green eyeshades in Washington, including my own business. The stock market sees this growth, which is why shares are up 300% from the 2009 bottom, while GDP has added only 19.41%, rising to $17.41 trillion.

When it comes to your investments, you are better off picking up the remote and changing channels from Fox News to CNBC.

3) Hyper Accelerating Technology

Remember when a few days ago I predicted that the first day orders for the new Tesla (TSLA) Model 3 would come in at 10,000 ( click here for ?How Tesla Takes Over the World on Thursday?)? I lied. They are over 200,000 and the day still isn?t over.

In one day, Tesla has completely blown up a 100-year-old business model, as I expected. It has already happened with music, airlines, cell phones, computers, and yes, even the newsletter business. Tesla is now so far ahead of its German, Japanese, Korean, British, and Chinese competitors that they will never catch up.

Where it is most important, the United States is spectacularly ahead of the rest of the world in virtually every important technology, and that lead is increasing.

I was at a dinner party the other night and one of the guests told me that America was angry. I piped up and said ?I?m not angry. In fact things are pretty good for me.? Someone else chimed in, ?Yes, I?m not angry either.?

I discovered the big truth in yesterday?s Quote of the Day. ?Economists say we?re having 2.5% growth. That?s a lie. The reality is that we have 5% growth for the top 20% of the economy, and 0% growth for the bottom 80% of the economy,? said Arthur Brooks, president of the American Enterprise Institute.

I?m in the top 20%, and life is good. I bet you are too.

The message here is that you have to ignore all the noise and keep your eye on the big picture. If you can?t do that you better get out of the market and keep all your money in cash before you lose it.

What all of this means is that the bull market in stocks has at least another three or four years to run.

After 30 minutes of listening, my subscriber was stunned into utter silence. She said what I just told here was alone worth the $3,000 cost of my newsletter.

She would be renewing after all.