Global Market Comments

April 9, 2015

Fiat Lux

Featured Trade:

(FRIDAY, APRIL 17 INCLINE VILLAGE, NEVADA STRATEGY LUNCHEON),

(MY UPDATED VIEW OF THE STOCK MARKET),

(SPY), (TLT), (IWM), (DXJ), (FXE),

?(PANW), (GS), (AAPL), (FB), (BABA)

SPDR S&P 500 ETF (SPY)

iShares 20+ Year Treasury Bond (TLT)

iShares Russell 2000 (IWM)

WisdomTree Japan Hedged Equity ETF (DXJ)

CurrencyShares Euro ETF (FXE)

Palo Alto Networks, Inc. (PANW)

The Goldman Sachs Group, Inc. (GS)

Apple Inc. (AAPL)

Facebook, Inc. (FB)

Alibaba Group Holding Limited (BABA)

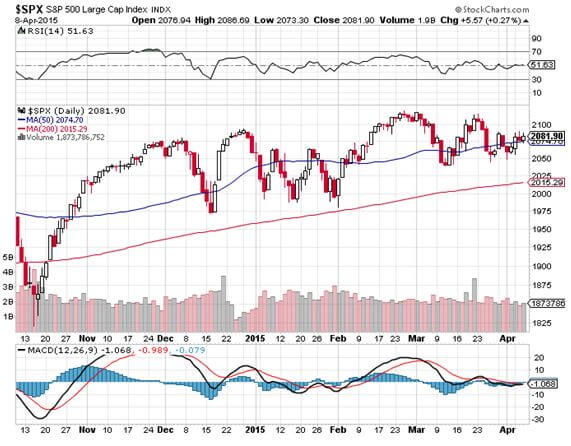

Sooner, and not as high. Those are the adjustments that I am making to my forecast this year for the performance of the US stock markets for the year.

You may recall that in my 2015 Annual Asset Class Review (click here), that I thought the S&P 500 might appreciate from 2,060 to 2,350 by the end of 2015, a gain of 14%, and that stocks might reach an average multiple of 18.5 times earnings.

I am now cutting that expectation by two thirds. My top end target is now a much more modest 2,150, or 4.4% increase. Add in 2% for dividends, and you will earn a paltry 6.4% on you indexed stock investments.

Shares may still achieve 18.5 earnings, but from here, that is looking like a stretch, as euphoria is in short supply.

My aggressive expectations for stocks this year were based on the business and economic conditions that existed a short three months ago.

But oh, how the world has changed since then.

For a start, the euro (FXE), (EUO) reached my yearend downside target in a mere three weeks. In all, the beleaguered continental currency has plunged an awesome 25% since the summer high, a Titanic move in the foreign exchange markets (sorry, reading Dead Wake by Erik Larson now).

The speed of the descent has many consequences. It means currency translation losses will occur much sooner, and be far larger than even the most wild-eyed pessimist was expecting. It also shut out companies from hedging against future losses in the currency markets.

This will affect the Dow Average and the S&P 500 (SPX) the most. It will have almost no impact on the Russell 2000 (IWM), which is composed of small caps. This is why my long US equity positions are focused in the (IWM) along with a few rifle shots in cyber security (PANW) and financials (GS).

A big chunk of my stock risk is also in Japan (DXJ), which benefits from a strong greenback.

You can also expect technology to continue to do well, which obtains some 80% of sales from domestic sources, and will therefore miss much of the dollar?s damage.

Any sector that trades at a 10% discount to market multiple, but enjoys 10% better earnings growth than rest of market has my vote. Think Apple (AAPL), Alibaba (BABA), and Facebook (FB).

The other big factor toning down my US stock hopes is that oil (USO) looks like it is going to stay down lower for longer. The approaching storage Armageddon, now only weeks away, is ominous in the extreme.

The Iran peace deal also tosses in one million barrels of supply on the global markets, right when producers need it the least.

Energy companies? earnings, which account for a hefty 10% of the (SPX), are already down by 60% in the recent quarter, and more pain is to follow.

As a result, the Q1, 2015 earnings reports, which started yesterday with Alcoa?s (AA) sickly $120 million revenue miss, are expected to be the worst in years.

However, don?t go slit your wrists yet. The growth we lost to a strong dollar, the west coast port strike and a horrendous winter in Q1 will roll over into Q2, setting up April as a stock great buyers month.

Don?t forget also that several hundred billion dollars worth of refund checks start appearing in the mail after April 15, much of which ends up in the stock market.

The markets will also slowly come around to the view that the Mad Hedge Fund Trader has been right all along, and that there will be no interest rate rise from the Federal Reserve until 2016.

This factor will co-conspire to drive stocks up to 2,150 or a little more by midyear.

After that, watch out below!

Did I hear ?Sell in May and go away??

The flip side of my interest rate view is that interest rates will increase early in the New Year. And that will be a lot to worry about. The worst-case scenario is that the US stock markets then give up all their gains to end up with a flat year.

That is, unless you read this newsletter and, as a result, carried a heavy overweight position in Japanese and European equities. Whatever the US loses in the second half, Europe and Japan may well pick up.

Don?t worry yourself over the prospect of a stock market crash. Corporate earnings now highest in history, boasting 9% margins, thanks to lower tax rates, ultra low interest rates, bargain energy costs, offshoring and just in time inventories.

The scenario I am painting here calls for no more than a 10% correction this year.

Then GDP growth will return to a heady 3% rate by the end of the year, and it will be off to the races once again.

And one more thing: The Mad Hedge Fund Trader?s model trading portfolio performance hit a new all time high today, up an eye popping 15.03% so far in 2015, and up an unbelievable 167.84% over the past four and a half years.

Urahh!

Global Market Comments

April 8, 2015

Fiat Lux

Featured Trade:

(FRIDAY, MAY 8 LAS VEGAS STRATEGY LUNCHEON)

(CYBER SECURITY IS ONLY JUST GETTING STARTED),

(PANW), (SNE), (GOOG), (CSCO), (FEYE), (FTNT), (CHKP), (JNPR),

(A TRIBUTE TO A GIANT OF JOURNALISM, ROY ESSOYAN)

Palo Alto Networks, Inc. (PANW)

Sony Corporation (SNE)

Google Inc. (GOOG)

Cisco Systems, Inc. (CSCO)

FireEye, Inc. (FEYE)

Fortinet Inc. (FTNT)

Check Point Software Technologies Ltd. (CHKP)

Juniper Networks, Inc. (JNPR)

Global Market Comments

April 7, 2015

Fiat Lux

SPECIAL IRAN ISSUE

Featured Trade:

(CHICAGO FRIDAY, APRIL 30 GLOBAL STRAGEGY LUNCHEON),

(IRAN PEACE DEAL BRINGS ON THE PAX AMERICANA),

(USO)

United States Oil ETF (USO)

The peace deal with Iran is worth a stock market double and maybe more.

Add that to the double we already deserve from a cheap long-term price of energy, and it is clear that stock prices have a long ways to go on the upside from here.

The Iranian peace deal is a hugely pro global growth, pro risk development, which I have been forecasting for years.

Bring on the Pax Americana, whereby the United States no longer faces any industrial strength adversary anywhere in the world for decades to come.

That is why I have been adding to what is already a precariously bullish position in the Mad Hedge Fund Trader?s model trading portfolio, which by the way, us up an impressive 12.67% so far in 2015. Hold on to your hats, because there are still more Trade Alerts in the works to come.

New all time highs for the service are a hair?s breadth away.

After discussing the finer print of the agreement with my many friends at the State Department, the Joint Chiefs, the CIA, and Israeli Intelligence, it is a miracle that this deal got done at all.

Pouring molasses in the works were direct communications between the Republican Party and the far right in Iran, both of which have absolutely no interest in a peace deal getting done.

This led to an event almost ludicrous in the annals of international diplomacy, where moderate Iranians lectured American conservatives on the finer points of US constitutional law, and the Persians were proffering the correct view.

Christian and Islamic Fundamentalists working hand in hand? Go figure!

I?ll break down the major talking points, and their consequences. I will also draw where I can from my own knowledge of nuclear weapon construction, which I picked up while working at the Atomic Energy Commission?s nuclear test site in Nevada 45 years ago. Not much has changed since then, although it has been a while since I have heard ?nuke them till they die!?

Sanctions

Iran won?t see positive economic consequences from the deal until well into 2016. That?s because they first have to destroy 14,000 centrifuges in full public view, from 19,000 down to 5,000. The Iranians see this as a big win because the US initially demanded only 1,000 centrifuges.

Iran also has to cut its uranium stockpiles to a fraction of its current inventory, another big job. The US has offered to purchase the excess uranium at market prices to fuel its own power plants.

Not until then will only the economic and financial sanctions be lifted, not the military ones. Remember Iran still possesses a ton of US military hardware purchased by the late Shah at inflated prices (to account for the bribes), which is in desperate need of spare parts.

Those waiting anxiously for another crash in the price of oil may have to sit on their hands for a while, as it will take this long for the new Iranian crude to hit the market.

Uranium Enrichment

Iran is permitted to enrich uranium to only 3.67%, enough to run an electric power plant, but far below bomb grade 90% purity.

This deal has a ten-year maturity on enrichment. What happens after that will be subject to the next round of negotiations. The future of the deep underground research facility at Fordow is still up in the air.

However, if Iran falls out of compliance for any reason, the US could destroy this facility at any time with a single, recently upgraded bunker buster bomb. The Iranians know this.

Plutonium

This element is crucial for the development of any large atomic bombs. Iran has agreed to destroy its reactor at Arak used to produce it, setting them back several years. All heavy water (2H2O) used to run the reactor will be sold on the open market.

Inspections

They are going to get the full proctological level of international inspection. The hot stuff is not hard to find. You can see it from a satellite that is already permanently stationed overhead.

Third party international inspectors will get unrestricted access to the entire nuclear supply chain, from the uranium mines to the storage of the enriched end product. These intrusive inspections will continue for 25 years.

What Could Go Wrong?

Many things.

Domestic backlashes in either the US or Iran could easily torpedo the deal. In that case, the financial markets would quickly give back any rallies achieved so far.

Goodbye Dow 20,000!

Representatives from both sides are already making conflicting representations to their own people on what exactly has been agreed to in Geneva.

Iran has the tougher sell, to the powerful Revolutionary Guards, which are currently making a fortune from the black market that the sanctions created. No sanctions means no pay, and therefore, no play.

The Republican Party will do whatever they can to demolish an agreement, and all 16 presidential candidates have already come out strongly against it. The Republican controlled congress will certain refuse to lift sanctions, even if a final agreement is signed.

This is meaningless, as the European sanctions will be gone, where Iran conducts most of its international trade anyway. In the end, US big business will force congress to cave, lest they lose out on the immense profits about to be made in Iran.

The country has suffered from 40 years of woeful underinvestment in its oil and gas industry, and guess who the most competitive provider of that is (think yellow roses, Astros).

If the US doesn?t agree to the deal, it is likely that Europe would make the move without us, leaving America twisting in the wind. In any case, the US has the most aggressive weapons monitoring infrastructure, run by old friends of mine out of Los Alamos, New Mexico. (Hey John, call me!). So, our participation is crucial.

Also, if there is no deal, Iran would probably have a bomb in a year anyway. After all, sanctions didn?t prevent them from boosting their number of centrifuges from 300 to 19,000 over the last 15 years.

The reality is that the government in Tehran has probably done the math and found that a weapon they would probably never use anyway was not worth keeping the country in a permanent depression with dramatically falling standards of living.

The lesson here is that economic sanctions work, if you are willing to wait long enough.

For More depth on the long term global economic and financial implications of the peace deal with Iran, please read my recent piece ?Here Comes the Next Peace Dividend? by clicking here.

By the way, in this piece I predicted years ago that such an earth shaking development would crash the price from $100 to $30 a barrel and it looks like that is exactly what we are going to get.

Global Market Comments

April 6, 2015

Fiat Lux

Featured Trade:

(FRIDAY, MAY 15 SAN FRANCISCO STRATEGY LUNCHEON)

(THE BIG MILESTONE FOR SOLAR),

(TAN), (SCTY), (SPWR), (FSLR),

(THE CHINA VIEW FROM 30,000 FEET),

(FXI), (BABA), (DBC), (DYY), (DBA), (PHO),

(TESTIMONIAL)

Guggenheim Solar ETF (TAN)

SolarCity Corporation (SCTY)

SunPower Corporation (SPWR)

First Solar, Inc. (FSLR)

iShares China Large-Cap (FXI)

Alibaba Group Holding Limited (BABA)

PowerShares DB Commodity Tracking ETF (DBC)

DB Commodity Double Long ETN (DYY)

PowerShares DB Agriculture ETF (DBA)

PowerShares Water Resources ETF (PHO)

I am writing this to you from a dive boat headed for the Molokini Crater off the coast of Maui in Hawaii. The rolling of the boat makes typing challenging, so please excuse me for more than the usual number of typos.

In the distance farmers are burning off their harvested cane fields, creating giant plumes of smoke, a practice banned in the continental US decades ago.

A pod of dolphins are racing the bow of the boat and humpback whales are blowing their spouts on the horizon. Periodically, the boat scares up a school of flying fish going airborne to find safety.

Life is good.

Another thing I have noticed cruising off the Maui leeward coast is that almost every building has solar roof panels. Of course, the incentive here is huge, as costly imported fuel for power plants makes electricity in Hawaii 20%-50% more expensive than it is on the mainland.

By now, you probably are sick to death of my banging on about the fantastic investment opportunities in the solar industry. But I am not recommending the sector because I wear Birkenstocks, eat organic bean sprouts and recycle even my vegetable waste. Putting money into solar now also makes solid business sense.

Did I also mention that it prevents millions of tons of carbon from entering the atmosphere, or about 5 tons per household per year?

With the stocks expected to rise by ten times over the next decade, you better get ready for more abuse. The solar industry is about to cross an epochal, sea changing benchmark.

Thanks in part to heavy competition from China, South Korea and Japan, the cost of solar panels has collapsed by 75% over the past four years.

Indeed, Chinese flooding of the US market with cheap imported panels almost wiped out every American producer. If you don?t believe me, then check out the long-term stock charts.

More importantly, the cost of industrial, utility sized solar power plants has fallen by 50%.

Only four years ago, large solar power plants made economic sense only after heavy government subsidies were included. They were all part of a ?stimulate the economy and save the world? philosophy demanded by the global economic collapse.

Now we are about to attain the Holy Grail: solar that is profitable on a stand-alone basis.

Don?t get me wrong. Subsidies are nice, as the oil and gas industry well know. I have been sidling up to the trough myself lately with my own solar projects (more on that in a future research piece). But subsidies are no longer the lifeblood of the business.

The economics of solar roof installations are now so compelling, that they are going up everywhere across the country. In fact, everyone on my street has one except me.

That is because the technology, which I keep close track of, is evolving so quickly that it has paid to wait. I did the same when I skipped six track tapes and waited for eight tracks ones, ignored Betamax in favor of VHS, and passed on Windows 1 (which always froze), but soaked up Windows 2.

A solar installation now also protects you from the hefty price increases that will be demanded by your local utility to pay for long overdue infrastructure upgrades.

I am also holding out for the best possible deal (you know me). With one Tesla Model S in the garage, and a Model X on order, I also happen to be one of the largest residential electric power consumers in the state. So, we?re not talking small beer here.

This is starting to have a sizeable impact on the American electricity market. A reader who works for Southern California Edison (SCE/PF) has told me that the cumulative effect of millions of home silicon roof panels is now so great that the traditional daily afternoon power demand spike is starting to disappear.

Even Saudi Arabia is building solar plants now, and they have access to nearly unlimited crude at a mere $5 a barrel.

The Spanish engineering company TSK has just signed a contract with Dubai to build a sizeable, state of the art 100-megawatt photovoltaic plant. The production costs there will work out to just $5.85 a kilowatt hour.

For oil to be competitive with this capital cost, the price would have to stay under $50 a barrel for the next 20 years. Technological advances on stream will make solar competitive at $20 a barrel in a year or two. This explains why some $2.7 billion worth of solar contracts with the Middle East are currently in negotiation.

Oil poor states are rushing even faster to the solar panacea. Jordan is planning to obtain 20% of its power from alternative sources by 2020, while Egypt has set a more ambitious 20% target. Morocco, which I will be visiting this summer, is the most aggressive, with an impressive 42% goal.

All of the means dramatically falling costs and soaring revenue for the solar companies. That sounds like a great business plan to me.

The usual suspects here include First Solar (FSLR), at $11 billion, the largest capitalized behemoth in the industry, and the master of thin film technology. Their power plant near Las Vegas is a sight to behold from the air.

There is Solar City (SCTY), Elon Musk?s highly competitive entry in the field, which will be able to draw from Tesla?s massive $6 billion giga factory in Reno, Nevada.

Sunpower (SPWR) is the Rolls Royce of the solar industry, producing the highest efficiency rated 340-watt panels (thanks to the pure copper substrate), which I will soon be installing in my own home. Love that biochemistry degree!

You could also go risk averse and buy all of them through the Guggenheim Solar ETF (TAN).

The key here is the price of oil, which has unnecessarily dragged down the shares of solar companies over the past nine months. Once it bottoms, if it has not already done so, it will be off to the races.

While your big cap oil majors might add on 40% in value in any recovery, the solars could be in for a tenfold return.

Back to me whale watching. Thar she blows!

Busy Thinking Great Thoughts

Busy Thinking Great Thoughts

Global Market Comments

April 2, 2015

Fiat Lux

Featured Trade:

(FRIDAY, APRIL 17 INCLINE VILLAGE, NEVADA STRATEGY LUNCHEON)

(AN UPGRADE FOR THE TESLA SUPERCHARGER NETWORK),

(TSLA),

(NOTICE TO MILITARY SUBSCRIBERS)

Tesla Motors, Inc. (TSLA)

I am writing this to you from the veranda of my penthouse suite at the Maui Hyatt Hotel.

I am sipping my fifth cup of Kona coffee for the morning. You see, the New York market opens at 3:30 AM here. On the other hand, Tokyo hours run from 3:00 ? 8:00 pm, ideal working hours if surfing every morning is your priority.

That explains why so many Asian oriented hedge funds are based here. You can tell by all the BMW?s and Ferrari?s parked at the prime surfing beaches.

The channel in front of me between the islands of Maui and Lanai is a veritable freeway for whales. I can see pods of humpbacks blowing and breaching every few minutes, chased by a flotilla of tourist bearing whale-watching boats. It is truly one of the greatest sights in nature.

I received an email from Tesla (TSLA) this morning informing me of the latest additions to the Tesla National Supercharger Network. Drivers of the Tesla Model S-1 and soon the Model X SUV will be ecstatic.

Should holders of the shares be similarly ebullient? I?ll get to this last point later.

The new station in Truckee, California now makes it possible to drive to Salt Lake City, and then on to Chicago and New York.

An addition in Petaluma, California now makes possible a round trip for a romantic weekend in Mendocino. Before, you had to spend at least three days there while a lowly 110-volt charge got you enough juice to get home, excuses in hand.

There is also another supercharger in remote Inyokern, California, on US Highway 395 in the Owens Valley. This puts ski weekends at Mammoth Mountains for Los Angeles Tesla drivers on the calendar (if they ever get any snow).

It is all exciting news for me, who has been following the construction of the National Supercharger Network since it consisted of only two stations. Over the years, readers have been faithfully emailing me photos of stations as they were built from locations as far away as North Dakota (thanks Susanna!).

By the end of next year, no point in the continental United States will be more than 200 miles from a station.

Superchargers allow a full charge for a depleted battery in 45 minutes, giving you a 270 miles range, and it is free. They are usually located in big shopping malls where one can pick up a Starbucks or catch a meal while your car is getting juiced up. Many support vast arrays of solar panels.

This is a big deal.

It is not just a luxury toy for the rich and famous. It is all part of an infrastructure build out for when Tesla takes over the global car market in three years. That?s when the Tesla 3 model comes out at a cost of $35,000 with a 300-mile range. Initial production is slated for 400,000 units a year.

As for the stock, it is a ?no touch? here. How do you value a company that will be producing 15 million units annually in 15 years, and is miles ahead of the competitors on the technology front, but is losing money now after the tax breaks are stripped out?

It beats me.

Apparently, other investors are having the same problem, as a position in the stock has been dead money for the past year. Now, we have the technical picture starting to roll over and play dead.

All I know is that it was a screaming ?BUY? at $16 when I first recommended to readers after a disastrous IPO years ago.

In the meantime, it is best to wait for Tesla to announce new drivers for the share price until we dive back in. An announcement of a launch date for the Model X would be a big help.

Until then, buy the car and not the stock.

Back to whale watching.