I used to begin my pieces about residential real estate talking about the broker I found hanging from the showerhead at an open house.

That didn?t really happen. But from 2008-2012 conditions were so dire that it could have.

That is clearly not the case any more. The market has been on fire for the past three years. Private equity firms put a floor under the markets by pouring in massive amounts of cash. Once they chewed through a backlog of foreclosed homes, it was off to the races.

The gains in the lead markets have been nothing less than stunning. San Francisco saw prices rocket by 33% last year, floated by a tidal wave of technology IPO money. A home in Fog City is now 40% more expensive than the last peak in 2007.

If you want to work for a startup, you better count on spending some time in a garage, to live, not to work, as rents are now so stratospheric. Even the basket case states of Florida, Arizona, and Nevada have bounced back, although they are still well off their highs.

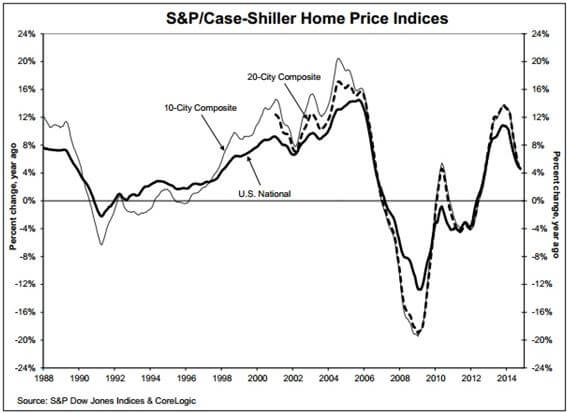

The S&P 500 Case Shiller Real Estate Index has been moving up in nearly a straight line since 2009. That is, until six months ago, when a noticeable softening began (it?s always published on a three month lag, as the market is so fragmented).

The most recent report said that homes were appreciating at a modest 4.7% year on year rate, a much slower rate than in the past. Given the onslaught of other negative data in recent months, you have to ask if the party is now over for homeowners.

It would be easy to blame the weather, last winter being one of the worst on record. My friends in Chicago threw empty beer cans at the TV sets whenever the weatherman appeared, for good reason. You can?t visit an open house if it is buried in snow and black ice has closed the roads.

However, you have to ask if there is more going on here. We also learned today that the national homeownership rate has fallen to 68.4%, a new 19 year low, according to the US Census Bureau. It would be easy to ascribe this as just one more effect of concentration of wealth at the top. But more thoughtful analysis is deserved here.

Talk to kids today, and it quickly becomes clear that homeownership is not the priority that it was for earlier generations. And who would blame them. For most of their lives, house prices have gone down, not up. For them, that cute little house with the white picket fence belies tales of financial distress, bankruptcy and foreclosure. So what?s the big rush?

A lot of twenty somethings would rather just spend their money and rent, not own. Many in the San Francisco Bay Area prefer to invest their savings in their own start-ups in the hope of making it big someday.

It?s not like banks want to lend to them anyway. In the aftermath of the Great Recession, banks now have far more stringent lending standards than in the past. You can blame both the new regulation in Dodd Frank and the banks? own desire to pare back risk.

Some 70% of graduating students today do so with outstanding student loan balances. Debts of $100,000 or more are common, and heaven help you if you want to go to graduate school. Needless to say, they don?t exactly make ideal mortgage candidates. We may b losing an entire generation of homebuyers.

I don?t think we are headed for another real estate crash. More likely, it will go to sleep for a while in a prolonged sideways move. Interest rates are still at ultra low levels and will remain so for a long time, providing a floor under current prices. The big killings are long gone. That was a 2012 trade.

The stock market has been telling us as much. The iShares Dow Jones US Home Construction ETF (ITB) has led the market retreat this year, paring back 12.7%. Banks have also taken it in the shorts, thanks to the drying up of new mortgage originations, the SPDR KBW Bank Index ETF (KBE), giving back 12% during the same time frame.

Happy days will return to housing once more. But we may have to wait until the 2020?s, when a gigantic demographic tail wind, returning inflation and rising wages all kick in at the same time.

Some of those nascent start-ups may also be going public by then, adding more fuel to the fire.

Is Housing Cooling Off?

Is Housing Cooling Off?

Global Market Comments

February 3, 2015

Fiat Lux

Featured Trade:

(FEBRUARY 4 GLOBAL STRATEGY WEBINAR),

(HOW TO LOSE MONEY),

(LINE), (USO),

(THE MARKET?S TECHNICAL OUTLOOK IS TERRIBLE),

(SPY), (QQQ), (IWM), (T), (AA), (FXY),

(TESTIMONIAL)

Linn Energy, LLC (LINE)

United States Oil ETF (USO)

SPDR S&P 500 ETF (SPY)

PowerShares QQQ Trust, Series 1 (QQQ)

iShares Russell 2000 (IWM)

AT&T, Inc. (T)

Alcoa Inc. (AA)

CurrencyShares Japanese Yen ETF (FXY)

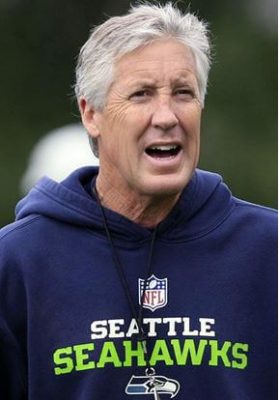

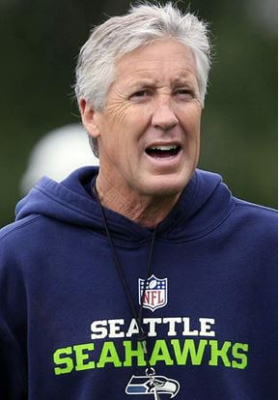

I?m really glad I watched the Super Bowl yesterday. Not only was it a great warm-up for next year?s championship game, which will be in my hometown of San Francisco. I also witnessed the worst coaching call in football history.

The Seattle Seahawks had the game in the bag. All they had to do was move the ball one foot over two tries at the goal line. Instead, they passed? Too bad I wasn?t able to find a bookie to take a last minute six-figure bet. I expected New England to win.

I have to tell you that I sympathize with Seahawks Coach Peter Carroll. For I sent out one of the worst recommendations in trading history with my BUY of master limited partnership Linn Energy (LINE) on December 1.

I then proceeded to break every rule in the trader?s handbook on how to manage this position. The errors were so many that I have to list them:

1) I scored the instant profit I was looking for, making 80 basis points within two days. I didn?t take it. Instead I got greedy, hanging on for more. It never showed.

2) I then ignored my own stop loss at $15, even though most of you bailed out then and there.

3) I then committed anther sin, waiting for the units to get back to my cost to get out, even though I constantly admonish followers never to do this. The market doesn?t care what your cost is. The market is the market. It has zero memory, and could care less who you are.

4) There were several substantial rallies that I could have sold into for a much smaller loss, to $14.80, $11.90 and $11.70. I didn?t. The ?getting out for even? syndrome strikes again.

5) I expected oil to bottom out in the low $60?s, which was much lower than most people?s targets. It didn?t. Instead, it dropped another $20 to the $43 handle. Once there is a glut of oil, there is no place to put it, as all storage is full, so it always plunges lower than you expect. With more oil industry experience than most traders, I already knew this. But I ignored the writing on the wall.

6) I waited for a yearend short covering rally to take me out of the position. It never showed. Instead, it went down faster, hitting a new five year low of $9.30.

7) I waited for a New Year rally to take me out. Ditto.

At this point, (LINN) is acting like a classic busted stock. Even though oil has bounced back by a hefty 15% in recent days, (LINN) has barely moved. If you throw good news on a stock and it doesn?t move, it is time to say hasta la vista baby.

For more depth on the grim outlook for Texas tea, please read my recent piece, ?More Pain to Come in Oil? by clicking here. Now is not the time to maintain an aggressive long in energy.

I?m sure (LINN) will come back some day, as it is well managed. In fact, it might even be the big trade of the year. But this could happen in months, or even years. And if you haven?t noticed, the name of this service is the Diary of a Mad Hedge Fund Trader, not the Diary of a Mad Long Term Investor.

Where I live, long-term is a long-winded way of saying "wrong".

Can I Interest You in Some Linn Energy?

Can I Interest You in Some Linn Energy?

At yesterday morning?s opening bell, we were greeted with the unmistakable evidence the stock market is technically breaking down.

The Dow Average has broken its three-year upward sloping trend line. Market leading sectors, like Consumer Discretionary and Financials have all put in eminently convincing ?Head and Shoulders? tops (click here). More distressingly, the head and shoulders for lead sector Technology has already broken down. Check out all the charts below.

I quickly ran my expiration P&L this morning. I figured out that if I sold all my longs for small profits (SPY), (IWM), and kept all my short positions (FXY), (T), (AA), I would be up 4.43% year to date by mid February, which in this environment is nothing less than heroic. The exception to the analysis is my sale of Linn Energy (LINE), which will be the subject of my next piece.

For more detail on why this is happening, read today?s letter, ?The Great American Rot is Ending? by clicking here).

Time to Bail

Time to Bail

Global Market Comments

February 2, 2015

Fiat Lux

Featured Trade:

(THE GREAT AMERICAN ROT IS ENDING),

(SPY), (TLT), (FXY), (FXE), (USO)

SPDR S&P 500 ETF (SPY)

iShares 20+ Year Treasury Bond (TLT)

CurrencyShares Japanese Yen ETF (FXY)

CurrencyShares Euro ETF (FXE)

United States Oil ETF (USO)

Global Market Comments

January 30, 2015

Fiat Lux

Featured Trade:

(FEBRUARY 4 GLOBAL STRATEGY WEBINAR),

(SIGN UP NOW FOR TEXT MESSAGING OF TRADE ALERTS),

(QCOM), (SPY),

(THE CHINA VIEW FROM 30,000 FEET)

(FXI), (DBC), (DYY), (DBA), (PHO)

QUALCOMM Incorporated (QCOM)

SPDR S&P 500 ETF (SPY)

iShares China Large-Cap (FXI)

PowerShares DB Commodity Tracking ETF (DBC)

PowerShares DB Commodity Double Long ETN (DYY)

PowerShares DB Agriculture ETF (DBA)

PowerShares Water Resources ETF (PHO)

Global Market Comments

January 29, 2015

Fiat Lux

Featured Trade:

(QUALCOMM GUIDANCE CRUSHES STOCK), (QCOM)

(BUSINESS IS BOOMING AT THE MONEY PRINTERS),

(TESTIMONIAL)

QUALCOMM Incorporated (QCOM)

It seems that the harder I work, the luckier I get.

Last week I made a bet that companies with a high share of international business would be punished severely during earnings season.

Specifically, I picked QUALCOMM (QCOM), the San Diego based maker of processors for cell phones, tablets, and laptops, because it had the highest percentage of foreign earnings among the S&P 500.

Three days later, after years of dawdling, the European Central Bank announced a particularly aggressive form of quantitative easing that sent the Euro crashing. You might as well have sent a torpedo directly into QUALCOMM?s bottom line.

The company?s Q4 earnings report, announced after the Tuesday close, confirmed my worst fears. While the earnings held up surprisingly well, the second half guidance was downright apocalyptic.

The stock immediately gapped down to $65 in the aftermarket, off some 8%, in a heartbeat.

Foreign earnings are a great place to hide when the greenback is soggy. It is a terrible place to be when the buck is moving from strength to strength, as it has for the past eight months.

It turns out that there is much more that is wrong under the hood at QUALCOMM than the recent collapse of the Euro and the Yen.

Much of the meteoric growth of Apple?s (AAPL) iPhone 6 sales in recent months has been at the expense of Samsung and other competitors. I hate to say ?I told you so? but I have been predicting this all along.

While QUALCOMM sells to both companies, particularly its Snapdragon 800 quadcore processor, it gets a lesser share of the profits on its sales to Apple. QUALCOMM is therefore, effectively, an indirect short position in Apple.

Oops!

I think you can take QUALCOMM?s woeful stock performance today as a warning that there is more suffering to come on the foreign earnings front by other companies yet to report.

For more depth on this, please read yesterday?s piece on ?The Unintended Consequences of the Euro Crash? by clicking here.

As for the happy holders of my recommended QUALCOMM (QCOM) February, 2015 $75-$80 in-the-money bear put spread, good for you! You have just made a nearly instant 2.25% profit on your total portfolio in a mere seven trading days. That works out to a gain of 22% on this single position.

There is no point in running this position the remaining three weeks into the February 20 expiration, as you have already reaped 95% of the potential profit. Better to free up the cash to roll into a new position, while simultaneously reducing your risk.

Or, you could simply take a long vacation from the miserable, unforgiving market.

There Goes QUALCOMM?s Earnings

There Goes QUALCOMM?s Earnings

Global Market Comments

January 28, 2015

Fiat Lux

Featured Trade:

(THE UNINTENDED CONSEQUENCES OF THE EURO CRASH),

(FXE), (EUO)

(CAT), (PG), (MSFT), (M), (FDO), (COST), (TGT), (WMT)

(RSP), (QQQ), (IWM)

(WATCH OUT FOR THE HEAD AND SHOULDERS)

(SPY), (QQQ), (TLT), (FXE), (FXY), (GLD), (SLV)

CurrencyShares Euro ETF (FXE)

ProShares UltraShort Euro (EUO)

Caterpillar Inc. (CAT)

The Procter & Gamble Company (PG)

Microsoft Corporation (MSFT)

Macy's, Inc. (M)

Family Dollar Stores Inc. (FDO)

Costco Wholesale Corporation (COST)

Target Corp. (TGT)

Wal-Mart Stores Inc. (WMT)

Guggenheim S&P 500 Equal Weight ETF (RSP)

PowerShares QQQ Trust, Series 1 (QQQ)

iShares Russell 2000 (IWM)

SPDR S&P 500 ETF (SPY)

iShares 20+ Year Treasury Bond (TLT)

CurrencyShares Japanese Yen ETF (FXY)

SPDR Gold Shares (GLD)

iShares Silver Trust (SLV)