For those of you who heeded my expert advice to buy the ProShares Ultra Short Euro ETF (EUO) last July, well done!

You are up a massive 48%! This is on a move in the underlying European currency of only 18.5%.

My browsing of the Galleria in Milan, the strolls through Spanish shopping malls, and my dickering with an assortment of dubious Greek merchants, all paid off big time. It turns out that everything I predicted for this beleaguered currency came true.

The European economy did collapse. Cantankerous governments made the problem worse by squabbling, delaying and obfuscating, as usual.

The European Central Bank finally threw in the towel and did everything they could to collapse the value of the Euro and reinvigorate their comatose economies. This they did by imitating America?s wildly successful quantitative easing, which they announced with local variations last Thursday.

And now for the good news: The best is yet to come!

Europe is now six days into a strategy of aggressive monetary easing which may take as long as five years until it delivers tangible, sustainable results. That?s how long it took for the Federal Reserve?s QE to restore satisfactory levels of confidence in the US economy.

The net net is that we have almost certainly only seen the first act of a weakening of the Euro which may last for years. A short Euro could be the trade that keeps on giving.

The ECB?s own target now is obviously parity against the greenback, which you will find predicted in my own 2015 Annual Asset Class Review released at the beginning of January (click here).

Once they hit that target, 87 cents to the Euro will become the new goal, and that could be achieved sooner than later.

However, you will not find me short the Euro up the wazoo this minute. I think we have just stumbled into a classic ?Buy the Rumor, Sell the News? situation with the Euro.

The next act will involve the ECB sitting on its hands for a year, realizing that their first pass at QE was inadequate, superficial, and flaccid, and that it is time to pull the bazooka out of their pockets once again.

This is a problem when the entire investment world is short the Euro. That paves the way for countless, rip your face off short covering rallies in the months ahead. Any smidgeon or blip of positive European economic data could spark one of these.

Trading the Euro for the past eight months has been like falling off a log. It is about to get dull, mean and brutish. So for the moment, my currency play has morphed into selling short the Japanese yen, which has its own unique set of problems.

As for the unintended consequences of the Euro crash, the Q4 earnings reports announced so far by corporate America tells the whole story.

Companies with a heavy dependence on foreign (read Euro and yen) denominated earnings are almost universally coming up short. On this list you can include Caterpillar (CAT), Procter and Gamble (PG), and Microsoft (MSFT).

Who are the winners in the strong dollar, weak Euro contest? US companies that see a high proportion of their costs denominated in flagging foreign currencies, but see their incomes arrive totally in the form of robust, virile dollars.

You may not realize it, but you are playing the global currency arbitrage game every time you go shopping. The standout names here are US retailers, which manufacture abroad virtually all of the junk they sell you here, especially in low waged China.

The stars here are Macy?s (M), Family Dollar Stores (FDO), Costco (COST), Target (TGT), and Wal-Mart (WMT).

You can see this divergence crystal clear in examining the behavior of the major stock indexes. The chart for the Guggenheim S&P 500 Equal Weight ETF (RSP), which has the greatest share of currency sensitive multinationals, looks positively dire, and may be about to put in a fatal ?Head and Shoulders? top (see the following story).

The chart for the NASDAQ (QQQ), where constituent companies have less, but still a substantial foreign currency exposure, appears to be putting in a sideways pennant formation before eventually breaking out to new highs once again.

The small cap Russell 2000, which is composed of almost entirely domestic, dollar based, ?Made in America? type companies, is by far the strongest index of the trio, and looks like it is just biding time before it blasts through to new highs.

If you are a follower of my Trade Alert Service, then you already know that I have a long position in the (IWM), which has already chipped in 2.12% to my 2015 performance.

You see, there is a method to my Madness.

Never Underestimate the Value of Research

Never Underestimate the Value of Research

Global Market Comments

January 27, 2015

Fiat Lux

Featured Trade:

(MORE PAIN TO COME IN OIL)

(USO), (XOM), (OXY), (COP), (DAL)

(THE SERVICE JOB IN YOUR FUTURE), (MCD)

United States Oil ETF (USO)

Exxon Mobil Corporation (XOM)

Occidental Petroleum Corporation (OXY)

ConocoPhillips (COP)

Delta Air Lines, Inc. (DAL)

McDonald's Corp. (MCD)

There are very few people I will drop everything to listen to. One of the handful is Daniel Yergin, the bookish founder and CEO of Cambridge Energy Research Associates, the must-go-to source for all things energy.

Daniel received a Pulitzer Prize for The Prize: The Epic Quest for Oil, Money, and Power, a rare feat for a non-fiction book (I?ve never been able to get one).

Suffice it to say that every professional in the oil industry, and not a few hedge fund traders, have devoured this riveting book and based their investment decisions upon it.

Yergin thinks that the fracking and horizontal drilling revolutions have made the United States the new swing producer of oil. There is so much money in the investment pipeline that American oil production will continue to increase for the next six months, by some 500,000 barrels a day.

This new supply will run head on into the seasonal drop in demand for energy, when spring ritually reduces heating bills, but the need for air-conditioning has not yet kicked in.

The net net could be a further drop in the price for Texas tea from the present $45 a barrel, possibly a dramatic one.

Yergin isn?t predicting any specific oil price as a potential floor, as it is an impossible task. While OPEC was a monolithic cartel, the US fracking industry is made up of thousands of mom and pop operators, and no one knows what anyone else is doing. However, he is willing to bet that the price of oil will be higher in a year.

Currently, the 91 million barrel global market for oil is oversupplied with 1 million barrels a day. That includes the 2 million b/d that has been lost from disruptions in Libya, Syria and Iraq.

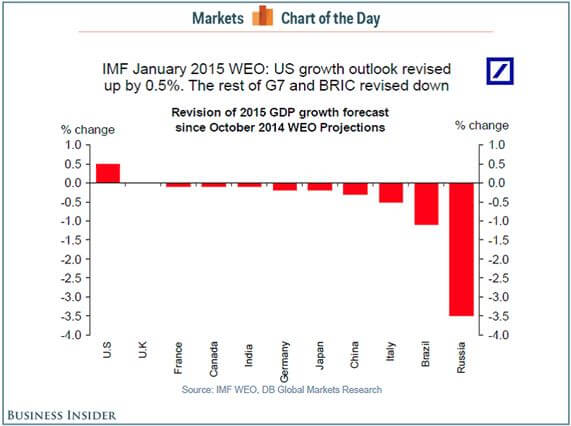

If the International Monetary Fund is right, and the world adds 3.8% in economic growth this year, we will soak up 1.1 million b/d of that with new demand. In the end, the oil price collapse is a self-solving problem. The new economic growth engendered by ultra low fuel prices eventually drives prices higher.

Where we reach the tipping point, and the oil market comes back into balance, is anyone?s guess. But when it does, prices will go substantially higher. The cure for low prices is low prices.

The bottom line is that there will be a great time to buy oil companies, but it is not yet.

What we are witnessing now is the worst energy crash since the 1980?s, when new supplies from the North Sea, Mexico and Alaska all hit at the same time. The price of oil eventually crashed from $42 to $8.

I remember it well, because Morgan Stanley then set up a private partnership that bought commercial real estate in Houston for ten cents on the dollar. The eventual return on this fund was over 1,000%.

This time it is more complicated. Prices lived over $100 for so long that it sucked in an unprecedented amount of capital into new drilling, some $100 billion worth. As a result, sources were brought online from parts of the world as diverse as Russia, the Arctic, Central Asia, Africa, the Canadian tar sands and remote and very expensive offshore platforms.

Yergin believes that Saudi Arabia can survive for three years with prices at current levels. After that, it will burn through its $150 billion of foreign exchange reserves, and could face a crisis. Clearly, the Kingdom is betting that prices will recover with its market share based strategy before then. They are playing for the long haul.

The transition of power to the new King Salman was engineered by a committee of senior family members, and has been very orderly. However, King Salman, a Sunni, will have his hands full. The current takeover of Yemen by a hostile Shiite minority, the Houthis, is a major concern. Yemen shares a 1,100 mile border with Saudi Arabia.

Daniel says that a year ago, there was a lot of geopolitical risk priced into oil, with multiple crises in the Ukraine, Syria, Libya and Iraq frightening consumers, so trading levitated over $100 for years. Delta Airlines Inc. (DAL) even went to the length of buying its own refiner to keep fuel prices from rising further.

US oil producers have a unique advantage over competitors in that they can cut costs faster than any other competitors in the world. On the other hand, they are eventually going head to head against the Saudis, whose average cost of production is a mere $5/barrel.

A native of my own hometown of Los Angeles, Yergin started his professional career as a lecturer at Harvard University. He founded Cambridge Energy in 1982 with a $7.00 investment in a file cabinet at the Good Will. He later sold Cambridge Energy to the consulting group IHS Inc. for a small fortune.

To buy The Prize at discount Amazon pricing, please click here.

Global Market Comments

January 26, 2015

Fiat Lux

SPECIAL RAILROAD ISSUE

Featured Trade:

(WILL THE OIL BUST KILL THE RAILROADS?),

(UNP), (CSX), (NSC), (CP), (ACI),

(TESTIMONIAL)

Union Pacific Corporation (UNP)

CSX Corp. (CSX)

Norfolk Southern Corporation (NSC)

Canadian Pacific Railway Limited (CP)

Arch Coal Inc. (ACI)

No, not really.

I was fascinated by the recent comments made by Union Pacific (UNP) CEO, Jack Koraleski, about the current robust health of his company.

Fourth quarter profits rocketed by an amazing 22% and those stellar numbers look set to continue.

I love railroads, not because they used to belch smoke and steam and have these incredibly loud, romantic, wailing whistles. In fact, my first career goal in life (when I was 5) was to become a train engineer.

It turns out that the railroads are also a great proxy for the health of the entire US economy. They are, in effect, our canary in the coalmine.

Jack sees moderate economic growth in the US continuing. Demand for the heavy products the company shifts is booming. Construction products like stone, gravel, cement and lumber, are up 10%.

The dramatic plunge in oil prices brings positives and negatives. The boom in oil shipments from North Dakota has been a windfall for the railroads that may now ebb.

But if prices stay low enough for long enough, it will boost demand for everything else that the Union Pacific ships, including houses, furniture, cars and every other sweet spot for their franchise. (UNP), in effect, has a great internal hedge for its many businesses. When one product line weakens, another strengthens. This has been going on forever.

The company is watching carefully the construction of a second Panama Canal across Nicaragua (the subject of a future article, when I get some time).

If completed by its Chinese promoters within the next decade, it could bring a tiny incremental shift of traffic from the US west coast to the Gulf ports. Even this is a mixed bag, as this will move some business away from strike plagued ports that are currently causing so much trouble.

When I rode Amtrak?s California Zephyr service from Chicago to San Francisco last year, I passed countless trains heading west, hauling hoppers full of coal for shipment to China.

This year I took the same trip. The coal trains were gone. Instead I saw 100 car long tanker trains transporting crude oil from North Dakota south to the Gulf Coast. I thought, ?There?s got to be a trade here?. It turns out I was right.

Take a look at the charts below, and you will see that the shares of virtually the entire railroad industry are breaking out to the upside.

In two short years, the big railroads have completely changed their spots, magically morphing from coal plays to natural gas ones. You?ve heard of ?fast fashion?? This is ?fast railroading?.

Today the big business is coming from the fracking boom, shipping oil from North Dakota?s Bakken field to destinations south. In fact, the first trainload of Texas tea arrived here in the San Francisco Bay area only a year ago, displacing crude that formerly came from Alaska.

Look at the share prices of the major listed railroads, and it is clear they have been chugging right along to produce one of the best performances of 2013. These include Union Pacific (UNP), CSX Corp (CSX), Norfolk Southern (NSC), and Canadian Pacific (CP). In the meantime, competing coal shares, like Arch Coal (ACI) have been one of the worst performing this year.

Those of a certain age, such as myself, remember railroads as one of the great black holes of American industry. During the sixties, they were constantly on strike, always late, and delivered terrible service.

A friend of mine taking a passenger train from New Mexico to Los Angeles found his car abandoned on a siding for 24 hours, where he froze and starved until discovered.

New airlines and the trucking industry were eating their lunch. They also hemorrhaged money like crazy. The industry finally hit bottom in 1970, when the then dominant Penn Central Railroad went bankrupt, freight was spun off, and the government owned Amtrak passenger service was created out of the ashes. I know all of this because my late uncle was the treasurer of Penn Central.

Fast forward nearly half a century and what you find is not your father?s railroad. While no one was looking, they quietly became one of the best run and most efficient industries in America. Unions were tamed, costs slashed, and roads were reorganized and consolidated.

The government provided a major assist with a sweeping deregulation. It became tremendously concentrated, with just four roads dominating the country, down from hundreds a century ago, giving you a great oligopoly play. The quality of management improved dramatically.

Then the business started to catch a few lucky breaks from globalization. The China boom that started in the nineties created enormous demand for shipment inland of manufactured goods from west coast ports.

A huge trade also developed moving western coal out to the Middle Kingdom, which now accounts for 70% of all traffic. The ?fracking? boom is having the same impact on the North/South oil by rail business.

All of this has ushered in a second ?golden age? for the railroad industry. This year, the industry is expected to pour $14 billion into new capital investment. The US Department of Transportation expects gross revenues to rise by 50% to $27.5 billion by 2040. The net net of all of this is that freight rates are rising right when costs are falling, sending railroad profitability through the roof.

Union Pacific is investing a breathtaking $3.6 billion to build a gigantic transnational freight terminal in Santa Teresa, NM. It is also spending $500 million building a new bridge across the Mississippi River at Canton, Iowa. Lines everywhere are getting double tracked or upgraded. Mountain tunnels are getting rebored to accommodate double-stacked sea containers.

Indeed, the lines have become so efficient, that overnight couriers, like FedEx (FDX) and UPS (UPS), are diverting a growing share of their own traffic. Their on time record is better than that of competing truckers, who face delays from traffic jams and crumbling roads, and are still hobbled by antiquated regulation.

I have some firsthand knowledge of this expansion. Every October 1, I volunteer as a docent at the Truckee, California Historical Society on the anniversary of the fateful day in 1846 when the ill-fated Donner Party was snowed in.

There, I guide groups of tourists over the same pass my ancestors crossed during the 1849 gold rush. The scars on enormous ancient pines made by passing wagon wheels are still visible.

During 1866-1869, thousands of Chinese laborers blasted a tunnel through a mile of solid granite to complete the Transcontinental Railroad. I can guide my guests through that tunnel today with flashlights because (UNP) moved the line to a new tunnel a mile south to improve the grade. The ceiling is still covered with soot from the old wood and coal-fired engines.

While the rebirth of this industry has been impressive, conditions look like they will get better still. Massive international investment in Mexico (low end manufacturing and another energy renaissance) and Canada (natural resources) promise to boost rail traffic with the US.

The rapidly accelerating ?onshoring? trend, whereby American companies relocate manufacturing facilities from overseas back home, creates new rail traffic as well. It turns out that factories that produce the biggest and heaviest products are coming home first, all great cargo for railroads.

And who knew? Railroads are also a ?green? play. As Burlington Northern Railroad owner, Warren Buffett never tires of pointing out, it requires only one gallon of diesel fuel to move a ton of freight 500 miles. That makes it four times more energy efficient than competing trucks.

In fact, many companies are now looking to railroads to reduce their overall carbon footprints. Warren doesn?t need any convincing himself. The $34 billion he invested in the Burlington Northern Railroad two years ago has probably

doubled in value since then.

You have probably all figured out by now that I am a serious train nut, beyond the industry?s investment possibilities. My past letters have chronicled adventures riding the Orient Express from London to Venice, and Amtrak from New York to San Francisco.

I even once considered buying my own steam railroad; the fabled ?Skunk? train in Mendocino, California, until I figured out that it was a bottomless money pit. Some 50 years of deferred maintenance is not a pretty sight.

It gets worse. Union Pacific still maintains in running condition some of the largest steam engines every built, for historical and public relations purposes. One, the ?Old 844? once steamed its way over the High Sierras to San Francisco on a nostalgia tour.

The 120-ton behemoth was built during WWII to haul heavy loads of steel, ammunition and armaments to California ports to fight the war against Japan. The 4-8-4-class engine could pull 26 passenger cars at 100 mph.

When the engine passed, I felt the blast of heat of the boiler singe my face. No wonder people love these things! To watch the video, please click here and hit the ?PLAY? arrow in the lower left hand corner. Please excuse the shaky picture.

I shot this with one hand, while using my other hand to restrain my over excited kids from running on to the tracks to touch the laboring beast.

Global Market Comments

January 23, 2015

Fiat Lux

Featured Trade:

(STOCKS TO BUY AT THE BOTTOM),

(CRASH TESTING THE TESLA), (TSLA)

Tesla Motors, Inc. (TSLA)

My friend and esteemed colleague, Mad Day Trader Jim Parker, spent the weekend perusing hundreds of long term charts. He was assembling a short list of attractive names to buy after the next major sell off.

I am not talking about a modest 4% decline. Even a textbook 10% won?t get his attention. I?m talking about the kind of gut churning, rip your face off, time to change the shorts panic that you only see in your worst nightmares.

Keep in mind that Jim is a technical and momentum analyst. He doesn?t know the CEO?s, hasn?t done the channel checks, nor has he gone through the balance sheets and income statements with a fine tooth comb. That is my job.

These are picks that are simply interesting on a chart basis only. Here they are, with ticker symbols included. For specific upside targets, please contact Jim directly.

BUY (KITE) Kite Pharmaceuticals

BUY (PCYC) Pharmacyclics, Inc.

BUY (AGN) Allergan

BUY (ACT) Actavis

BUY (PANW) Palo Alto Networks

BUY (GS) Goldman Sachs

BUY?(BRKA) Berkshire Hathaway

BUY?(SMH) Market Vectors Semiconductors Index

BUY?(MMM) 3M Co.

BUY?(DIS) Walt Disney Co.

BUY?(SWKS) Skyworks Solutions

BUY?(LNG) Cheniere Energy

Keep in mind that companies with great fundamentals often have fantastic charts as well. This is why you often have researchers and technicians frequently making identical recommendations.

One approach might be to trade around these over time, but only from the long side. Another might be to enter deep out-of-the-money limit orders to buy in case we get a mini flash crash in your favorite name.

While the Diary of a Mad Hedge Fund Trader focuses on investments over a one week to six-month time frame, Mad Day Trader will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

The Diary of a Mad Hedge Fund Trader is written by me, John Thomas, who you may have met during my recent series of conferences in the southern hemisphere.

I use a combination of deep, long term fundamental research, technical analysis and a global network of contacts to generate great investment ideas. The target holding period can be anywhere from three days to six months, although if something fortuitously doubles in a day, I don?t need to be told twice to take a profit (yes, this happens sometimes).

Last year, I issued some 200 Trade Alerts, of which 80% were profitable.

The Mad Day Trader is a separate, but complimentary service run by my Chicago based friend, Jim Parker. He uses a dozen proprietary short-term technical and momentum indicators he developed himself to generate buy and sell signals.

These will be sent to you by email for immediate execution. During normal trading conditions, you should receive three to five alerts and updates a day. The target holding period can be anywhere from a few minutes to three days.

Jim issues far more alerts and updates than I, possibly as many as 1,000 a year. He also uses far tighter stop loss limits, given the short-term nature of his strategy. The goal is to keep losses miniscule so you can always live to fight another day.

You will receive the same instructions for order execution, like ticker symbols, entry and exit points, targets, stop losses, and regular real time updates, as you do from the Mad Hedge Fund Trader. At the end of each day, a separate short-term model portfolio will be posted on the website for both strategies.

Jim Parker is a 40-year veteran of the wild and wooly trading pits in Chicago. Suffice it to say, Jim knows which end of a stock to hold up. I have followed his work for yonks, and can?t imagine a better partner in the serious business of making money for you, the reader.

Together, the?Mad Hedge Fund Trader?and the?May Day Trader?comprise?Mad Hedge Fund Trader PRO, which is for sale on my website for $4,500 a year.

You can upgrade your existing Global Trading Dispatch service, to include the Mad Day Trader. For more information, please call my loyal assistant, Nancy, in Florida at 888-716-1115 or 813-388-2904, or email her directly at?support@madhedgefundtrader.com.

Global Market Comments

January 22, 2015

Fiat Lux

SPECIAL GOLD ISSUE

Featured Trade:

(IS THE BULL MARKET IN GOLD BACK?),

(GLD), (GDX), (SIL), (ABX), (REMX), (SLV),

(ANOTHER NAIL IN THE NUCLEAR COFFIN),

(NLR), (CCJ)

SPDR Gold Shares (GLD)

Market Vectors Gold Miners ETF (GDX)

Global X Silver Miners ETF (SIL)

Barrick Gold Corporation (ABX)

Market Vectors Rare EarthStrat Mtls ETF (REMX)

iShares Silver Trust (SLV)

Market Vectors Uranium+Nuclear Engy ETF (NLR)

Cameco Corporation (CCJ)

After a prolonged, four year hibernation, it appears that the gold bulls are at long last back.

Long considered nut cases, crackpots and the wearers of tin hats, lovers of the barbarous relic have just enjoyed the first decent trading month in a very long time.

The question for the rest of us is whether there is something real and sustainable going on here, or whether the current rally will end with yet another whimper, to be sold into.

To find the answer, you?ll have to read until the end of this story.

Let me recite all the reasons that perma bulls used to buy the yellow metal.

1) Obama is a socialist and is going to nationalize everything in sight, prompting a massive flight of capital that will send the US dollar crashing.

2) Hyperinflation is imminent and the return of ruinous double digit price hikes will send investors fleeing into the precious metals and other hard assets, the last true store of value.

3) The Federal Reserve?s aggressive monetary expansion through quantitative easing will destroy the economy and the dollar, triggering an endless bid for gold, the only true currency.

4) To protect a collapsing greenback, the Fed will ratchet up interest rates, causing foreigners to dump the half of our national debt they own, causing the bond market to crash.

5) Taxes will skyrocket to pay for the new entitlement state, the government?s budget deficit will explode, and burying a sack of gold coins in your backyard is the only safe way to protect your assets.

6) A wholesale flight out of paper assets of all kind will cause the stock market to crash. Remember those Dow 3,000 forecasts?

7) Misguided government policies and oppressive regulation will bring the Armageddon, and you will need gold coins to bribe the border guards to get out of the country. You can also sew them into the lining of your jacket to start a new life abroad, presumably under an assumed name.

Needless to say, it didn?t exactly pan out that way. The end-of-the-world scenarios that one regularly heard at Money Shows, Hard Asset Conferences, and other dubious sources of investment advice all proved to be so much bunk.

I know, because I was a regular speaker on this circuit. I alone, a voice in the darkness, begged people to buy stocks at the beginning of the greatest bull markets of all time, which was then, only just getting started.

Eventually, I ruffled too many feathers with my politically incorrect views, and they stopped inviting me back. I think it was my call that rare earths (REMX) were a bubble that was going to collapse was the weighty stick that finally broke the camel?s back.

So, here we are, five years later. The Dow Average has gone from 7,000 to 18,000. The dollar has blasted through to a 12 year high against the Euro (FXE). The deficit has fallen by 75%. Gold has plummeted from $1,920 to $1,100. And no one has apologized to me, telling me that I was right all along, despite the fact that I am from California.

Welcome to the investment business.

Except that now, gold is worth another look. It has rallied a robust $200 off the bottom in a mere two months. Some of the most frenetic action was seen in the gold miners (GDX), where shares soared by as much as 50%. Even mainstay Barrick Gold (ABX) managed a 30% revival.

The gold bulls are now looking for their last clean shirt, sending suits out to the dry cleaners, and polishing their shoes for the first time in ages, about to hit the road to deliver almost forgotten sales pitches once again.

The news flow has certainly been gold friendly in recent weeks. Technical analysts were the first to raise the clarion call, noting that a string of bad news failed to push gold to new lows. Charts started putting in the rounding, triple bottoms that these folks love to see.

The New Year stampede into bonds gave it another healthy push. One of the long time arguments against the barbarous relic is that it pays no yield or dividend, and therefore has an opportunity cost.

Well guess what? With ten year paper now paying a scant 0.40% in Germany, 0.19% in Japan, and an eye popping -0.04% in Switzerland, nothing else pays a yield anymore either. That means the opportunity cost of owning precious metals has disappeared.

Then a genuine black swan appeared out of nowhere, improving gold?s prospects. The Swiss National Bank?s doffing of its cap against the Euro (FXE) ignited an instant 20% revaluation of the Swiss franc (FXF).

In addition to wiping out a number of hedge funds and foreign exchange brokers around the world, they shattered confidence in the central bank. And if you can?t hide in the Swiss franc, where can you?

This all accounts for the $200 move we have just witnessed.

So now what?

From here, the picture gets a little murky.

Certainly, none of the traditional arguments in favor of gold ownership are anywhere to be seen. There is no inflation. In fact, deflation is accelerating.

The dollar seems destined to get stronger, not weaker. There is no capital flight from the US taking place. Rather, foreigners are throwing money at the US with both hands, escaping their own collapsing economies and currencies.

And once global bond markets top out, which has to be soon, the opportunity cost of gold ownership returns with a vengeance. You would think that with bond yields near zero we are close to the bottom, but I have been wrong on this so far.

All of which adds up to the likelihood that the present gold rally is getting long in the tooth, and probably only has another $50-$100 to go, from which it will return to the dustbin of history, and possibly new lows.

I am not a perma bear on gold. There is no need to dig up your remaining coins and dump them on the market, especially now that the IRS has a mandatory withholding tax on all gold sales. I do believe that when inflation returns in the 2020?s, the bull market for gold will return for real.

You can expect newly enriched emerging market central banks to raise their gold ownership to western levels, a goal that will require them to buy thousands of tons on the open market.

Gold still earns a permanent bid in countries with untradeable currencies, weak banks, and acquisitive governments, like China and India, still the world?s largest buyers.

Remember, too, that they are not making gold anymore, and that all of the world?s easily accessible deposits have already been mined. The breakeven cost of opening new mines is thought to be around $1,400 an ounce, so don?t expect any new sources of supply anytime soon.

These are the factors which I think will take gold to the $3,000 handle by the end of the 2020?s, which means there is quite an attractive annualized return to be had jumping in at these levels. Clearly, that?s what many of today?s institutional buyers are thinking.

Sure, you could hold back and try to buy the next bottom. Oh, really? How good were you at calling the last low, and the one before that?

Certainly, incrementally scaling in around this neighborhood makes imminent sense for those with a long-term horizon, deep pockets and a big backyard.