Global Market Comments

May 29, 2014

Fiat Lux

Featured Trade:

(JUNE 23 LONDON STRATEGY LUNCHEON)

(JOHN THOMAS AND ALAN PATCHING ON HEDGE FUND RADIO),

(UUP), (FXI), (FXA), (EWA), (AAPL), (GOOG),

(GLD), (SLV), (MON), (POT), (MOS),

(AND MY PREDICTION IS?.),

(TESTIMONIAL)

PowerShares DB US Dollar Index Bullish (UUP)

iShares China Large-Cap (FXI)

CurrencyShares Australian Dollar Trust (FXA)

iShares MSCI Australia (EWA)

Apple Inc. (AAPL)

Google Inc. (GOOG)

SPDR Gold Shares (GLD)

iShares Silver Trust (SLV)

Monsanto Company (MON)

Potash Corp. of Saskatchewan, Inc. (POT)

The Mosaic Company (MOS)

During my recent trip to Australia, I had the privilege to be interviewed by Alan Patching, one of the leaders of the country?s vibrant business community, on his show, Transforming Business Minds.

Alan was the chief organizer of the 2000 Sydney Olympics. He is the author of several business books. He is also a professor at Bond University on Queensland?s Gold Coast in Australia. Patching is one of the top entrepreneurs in Australia, arranging tens of billions of dollars worth of transactions over the past decade.

During the interview, we covered about every asset class under the sun, looking for long and short opportunities. I discussed the ongoing global synchronized economic recovery and the implications for the market. I also covered the global geopolitical scene in depth.

I go into why the US dollar will remain a reserve currency. I explain how wars of the last 50 years were all about oil, and in the next 50 years they will revolve around food and water supplies. I analyze Apple?s (AAPL) prospects in depth.

Chinese money will continue to pour into Australia. I even reminisce about flying the best Russian fighters in the early nineties. There was that time when the CIA helped get my late wife out of a Russian jail. And, oh yes, I explain why the Dow Average is going to 200,000 by 2030!

I have broken up the extensive hour and a half interview into three 30-minute segments. You can purchase each one for $4.95 on Hedge Fund Radio by clicking: ?http://madhedgefundradio.com/radio-show/.

Global Market Comments

May 28, 2014

Fiat Lux

Featured Trade:

(JULY 25 ZERMATT, SWITZERLAND GLOBAL STRATEGY SEMINAR)

(THE 60-40 CORRECTION),

(SPY), (QQQ), (IWM), (TLT), (FXY), (GLD), (IBB),

(COME TO THE JUNE 13-14 INVEST LIKE A MONSTER LAS VEGAS CONFERENCE)

SPDR S&P 500 (SPY)

PowerShares QQQ (QQQ)

iShares Russell 2000 (IWM)

iShares 20+ Year Treasury Bond (TLT)

CurrencyShares Japanese Yen Trust (FXY)

SPDR Gold Shares (GLD)

iShares Nasdaq Biotechnology (IBB)

Please come to hear me, Mad Hedge Fund Trader John Thomas, as the keynote speaker at the Invest Like a Monster Las Vegas Conference on June 13-14.

I will be joined by many old friends from across the investment spectrum. Jon and Pete Najarian will teach you the tricks of the trade for navigating the ever complex options markets.

Fellow former combat pilot, Chuck Hughes, will go into depth on his own highly successful approach to trading the market. To listen to my in depth interview with him on Hedge Fund Radio, please click here.

Well known market commentator Guy Adami, the Prince of New Jersey, will be there to give his trading insights. So will former hedge fund manager and Yahoo Finance guru Jeff Macke.

The first day will be devoted to three educational sessions that get into the nitty gritty of trading options. The day winds up with a cocktail party with the Najarian Brothers and myself.

I will kick off the Saturday session with and extended presentation on the long-term future of the financial markets, to be followed by an extensive question and answer session. I will be followed by an impressive lineup of market veterans.

The event will be held at the Bellagio Hotel on the Strip, my favorite Las Vegas haunt, best known for its spectacular water fountains out front. You may recognize it in the hit movies The Hangover and Ocean?s Eleven.

General admission costs $499 for the two full days. You can buy a VIP ticket for $699, which includes social events with the high and the mighty. It is all great value for money, given the quality and quantity of the information you will obtain. Just click here at http://www.optionmonster.com/events/?refId=186 to buy tickets.

Trademonster?s proprietary program, called Heat Seeker ?, monitors no less than 180,000 trades a second to give an early warning of large trades that are about to hit the stock, options, and futures markets. To give you an idea of how much data this is, think of downloading the entire contents of the Library of Congress, about 20 terabytes, every 33 minutes.

The firm maintains a 10 gigabyte per second conduit that transfers data at 6,000 times the speed of a T-1 line, the fastest such pipe in the civilian world. The firm then distills this ocean of data into the top movers of the day, which he puts up for free on its website, and offers much more detailed analysis through a premium subscription product.

?As with the NFL,? says Jon, ?you can?t defend against speed.?

The system catches big hedge funds, pension funds, and mutual funds shifting large positions, giving subscribers a peak at the bullish or bearish tilt of the market. It also offers accurate predictions of imminent moves in single stock and index volatility.

Jon started his career as a linebacker for the Chicago Bears, and I can personally attest that he still has a handshake that?s like a steel vice grip. Maybe it was his brute strength that enabled him to work as pit trader on the Chicago Board of Options Exchange for 22 years, where he was known by his floor call letters of ?DRJ.? He formed Mercury Trading in 1989 and then sold it to the mega hedge fund, Citadel, in 2004.

Jon developed his patented algorithms for Heat Seeker? with his brother Pete, another NFL player (Tampa Bay Buccaneers and the Minnesota Vikings), who like Jon, is a regular face in the financial media.

June is a great time to visit Sin City, as the crowds are largely gone and the sun is a wonderfully baking hot. You can ride the neck-breaking roller coaster at the New York New York Hotel, catch one of eight Cirque du Soleil shows, and ride a gondola at the Venetian Hotel.

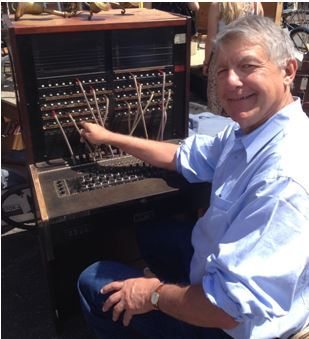

Or you can try to get a great deal on a luxury item from my buddy, Rick Harrison, at the famous Gold and Silver Pawn, of Pawn Stars fame (good luck with that!).

Just be sure to bring extra sun tan lotion!

Hanging With the Big Dogs in Vegas

Hanging With the Big Dogs in Vegas

Global Market Comments

May 27, 2014

Fiat Lux

Featured Trade:

(JUNE 17 NEW YORK STRATEGY LUNCHEON)

(INTRODUCING ?THE OPENING BELL WITH JIM PARKER?),

(BUY NOW TO BEAT THE PRICE INCREASE),

(ORDER EXECUTION 101)

Come join Mad Day Trader Jim Parker and me for lunch at the Mad Hedge Fund Trader?s Global Strategy Luncheon, which we will be conducting in New York, NY on Tuesday, June 17, 2014. An excellent three course lunch will be provided. A PowerPoint presentation will be followed by an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $248.

The formal luncheon will run from 12:00 to 2:00 PM. I?ll be arriving an hour early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The event will be held at a prestigious private club on Central Park South, the details of which will be emailed to you with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

In 2013, the Mad Hedge Fund Trader Trade Alert Service delivered a blowout return of 68% for followers. As I present my Global Strategy luncheons around the world, I am learning that many made much more.

I am therefore raising the price for our flagship product, Mad Hedge Fund Trader Pro, by $500 to $4,500 a year and Mad Day Trader to $2,500 a year or $859 per quarter. We have not seen a price increase in two years and are overdue, given the red hot numbers that I have been delivering.

The service includes my daily newsletter, the Trade Alert service, biweekly Global Strategy Webinars, invitations to strategy luncheons, and search ability for my 3 million word research data base. It also includes Jim Parker?s Mad Day Trader running market commentary, his Trade Alert service, and brand new The Opening Bell with Jim Parker.

To show how much we appreciate our most loyal and long-term customers, we are going to make a special one time only offer. If you upgrade now, we will honor our old prices until June 1. You can still purchase Mad Hedge Fund Trader Pro for a bargain $4,000 for another year of outstanding service, or Mad Day Trader as a stand alone product for $2,000 or $699 for 3 months.

Place your order online which will add an additional year to your existing subscription.? If you need assistance just email Nancy at customer support at support@madhedgefundtrader.com, or call her directly at 888-716-1115 east coast time.

Because of overwhelming demand, I am taking my hard-earned profits to reinvest in the business to improve the quantity and quality even more. My goal is to advance your education about the markets, raise your level of financial sophistication, and to level the playing field with Wall Street.

This will give you the ability to place your own trades with confidence. In other words, I am teaching you how to fish, instead of relying on the aged product they sell at Safeway.

Your Emails Will Be Answered Promptly

Your Emails Will Be Answered Promptly

Global Market Comments

May 23, 2014

Fiat Lux

SPECIAL MEMORIAL DAY ISSUE

Featured Trade:

(JULY 7 ROME, ITALY STRATEGY LUNCHEON)

(A TRIBUTE TO A TRUE VETERAN)

Global Market Comments

May 22, 2014

Fiat Lux

SPECIAL INDIA ISSUE

Featured Trade:

(JUNE 26 ISTANBUL, TURKEY STRATEGY LUNCHEON)

(THE GAME CHANGER IN INDIA),

(INP), (PIN), (EPI), (EEM), (CEW), (ELD),

(USO), (KOL), (CU), (GLD),

(INDIA IS CATCHING UP WITH CHINA)

iPath MSCI India Index ETN (INP)

PowerShares India (PIN)

WisdomTree India Earnings (EPI)

iShares MSCI Emerging Markets (EEM)

WisdomTree Emerging Currency Strategy (CEW)

WisdomTree Emerging Markets Local Debt (ELD)

United States Oil (USO)

Market Vectors Coal ETF (KOL)

First Trust ISE Global Copper Index (CU)

SPDR Gold Shares (GLD)

Global Market Comments

May 21, 2014

Fiat Lux

Featured Trade:

(JUNE 23 LONDON STRATEGY LUNCHEON),

(BACK AT THE RANCH),

(GILD), (PFE), (IBB), (HCA)

Gilead Sciences Inc. (GILD)

Pfizer Inc. (PFE)

iShares Nasdaq Biotechnology (IBB)

HCA Holdings, Inc. (HCA)