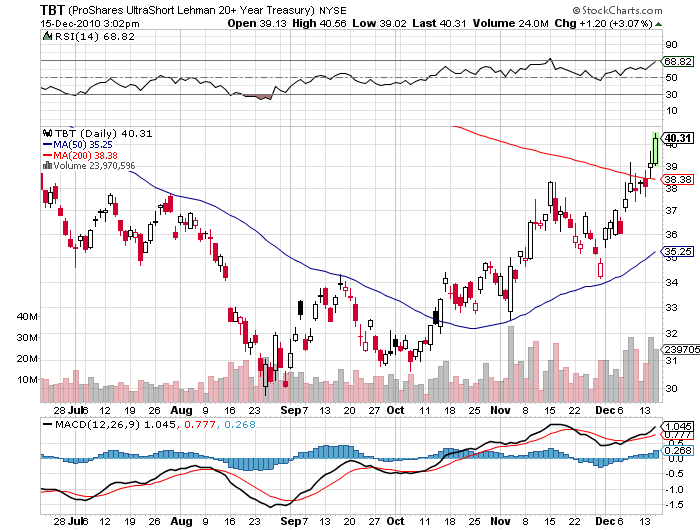

Featured Trades: (PANIC BUYING OF THE TBT), (TBT)

2) Panic Buying Hits the (TBT). Buy the rumor, sell the news. That is one of the oldest adages one hears on trading desks, and it was never more true than today. Yesterday we learned that the ratings agency, Moody's, is considering a downgrade of US government debt in the wake of the tax compromise, as it should, the first time ever. The Producer Price Index came in at a healthy 0.8%, much better than expected, suggesting that the economy is far more robust than people realize. Retail sales popped 0.8% as well, telling us that people are falling back into their old habits of Christmas shopping with reckless abandon. You could not image more bond negative news hitting the tape, or more positive developments for the (TBT). And of course, the tax compromise was the gasoline that hit the fire.

We've had a great run here for the (TBT), tacking on and impressive 35% since the August bottom. The yield on the 30 Year Treasury bond has soared from 3% to 4.6% during this time. Those lucky few who signed up with Macro Millionaire immediately and executed every trade that I suggested are now up 10.25% in two weeks in their initial position. In a zero return world, that is much better than a poke in the eye with a sharp stick. Don't count on every one of my trades to deliver such stellar returns so quickly.

I am taking a quick profit here and selling my entire position. That will enable me to duck the carrying costs for the (TBT) over the holidays, which are now running at nearly a very heavy 1% a month, one of the highest in ETF land. It will allow more time for this ETF to grind through the 200 day moving average, which has clearly presented a short term ceiling on prices. And it gives me some dry powder I can use to take advantage of any dips in the New Year. My long term target for the (TBT) is still $200, but you have to allow the market to breathe along the way. And no one ever got fired for taking a profit.

-

-

Give Me My TBT!

SPECIAL COPPER ISSUE

Featured Trades: (COPPER), (CU), (JJC), (ECH), (FCX)

FOR PAID SUBSCRIBERS ONLY

1) Copper Turns Into Gold.

-

-

Want to Race for Pink Slips?

-

Featured Trades: (ECONOMY UPGRADE FEVER),

($SSEC), (SSO), (X), (CU), (COPPER)

1) The Upgrade Fever Pandemic. I knew it, I knew it, I knew it. As soon as Bill Gross at bond giant, PIMCO, announced that it was off to the races with a 1% mark up in his GDP forecast for 2011, upgrade fever would break out all over.

I look no further than my alma mater, Morgan Stanley, which followed suit with their revision for economic growth from 2.9% to 4.0%. David Greenlaw thinks that the tax deal Obama cut with the Republicans, to the chagrin of his own party, is great for exports, consumer spending, and capital spending. A sudden fall in weekly jobless claims by 17,000 to only 421,000 suggests he may be right. A sleigh full of more economic releases arrives this week, and I expect them all to surprise to the upside, leading to a further surge in corporate profits. Needless to say, this is all hugely bullish for equities.

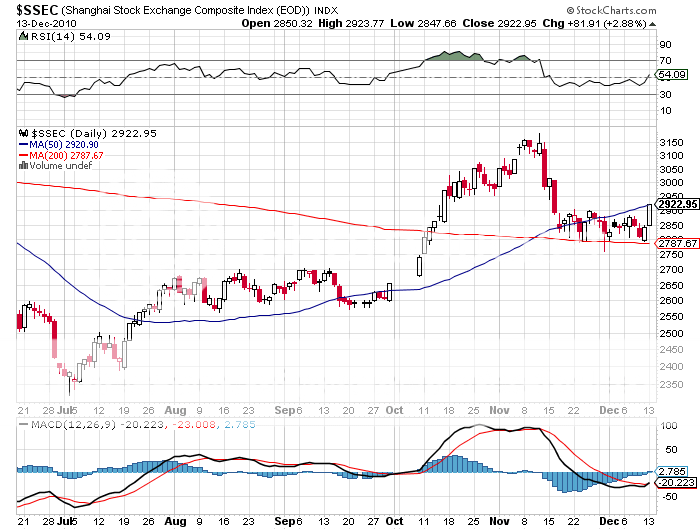

The other big development is that China (FXI) postponed its next interest rate rise by a few weeks, delivering a nice pop for the Shanghai market ($SSEC), and triggering a global melt up in commodities. Copper (CU) hit a new all time high today, and steel names, like US Steel (X) were on fire. I have a very heavy weighting in the sector in my long term portfolio, but my short term trading book is out for the moment, as the overheating is starting to scare me.

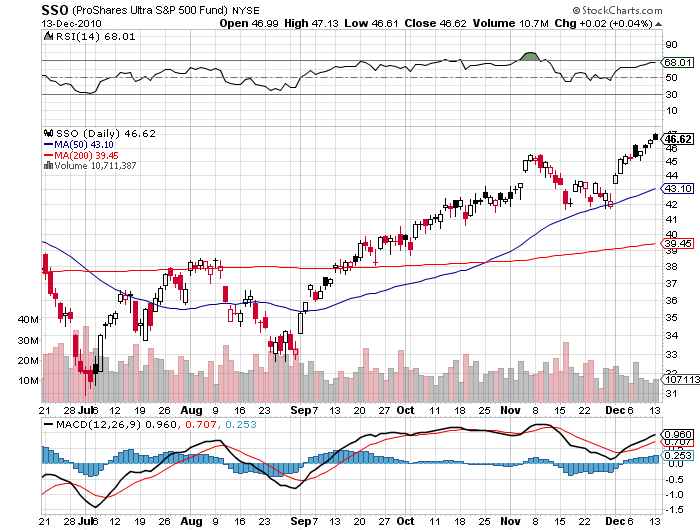

The 'FEAR' to 'CONFIDENCE' trade is on, and Santa Claus is mixing steroids into the reindeer feed as we speak to deliver a continued rally. Did I mention this is all hugely bullish for equities? It all makes my (SSO) position, the 200% leveraged bet that the S&P 500 is going up, smell like roses.

Optimism is Breaking Out All Over

-

-

My (SSO) Position is Smelling Like Roses

Featured Trades: (NISSAN LEAF), (NSANY)

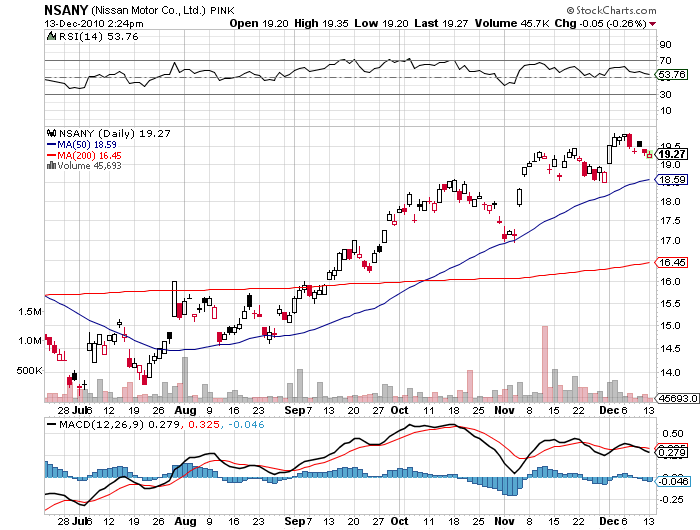

2) The Nissan Leaf Roll Out. With great fanfare and celebration, Nissan Motors (NSANY) at long last delivered its first all electric, 100 mile range Leaf to an ecstatic customer at San Francisco city hall today. Long time readers of this letter know that I have been banging the table on this technology for some time, starting with my now ancient recommendation to buy Sociedad Quimica Y Minera (SQM), Chile's largest producer of lithium (click here for the piece).

Offering a car which effectively uses no fuel, requires no maintenance, at a heavily government subsidized price could only be a blow out success. One of the most aggressive and ambitious adverting campaigns in history assured that even Neolithic consumers living in caves in Borneo would know about it. Nissan is confidently betting the company that the project will be a blow out success, ramping global production up to 500,000 annually by the end of next year. My local utility, PG&E, (PGE) has since upped the ante by cutting prices for electric vehicle recharges between 12:00 midnight at 7:00 am from their peak rate of 40 cents per kilowatt hour to only 3 cents, a 92.5% discount. That works out to buying all the gasoline equivalent I want at 14 cents a gallon.

I predicted that these developments would conspire to drive the shares of Nissan Motors ever Northward. Nissan has been in my model portfolio for a while as a play on the recovery of the global auto industry. Those who piled into my initial recommendation to buy the stock last July are now up a handy 30% (click here for the 'Making a New Home for My Nissan Leaf').

For those of us who have been involved in the alternative energy space, this has been a very long time in coming, some 40 years in my case. Since I am neither a movie star nor a lucky lottery winner, I will not get delivery of my own Leaf until March, 2011. But the dealer has already called, asking which options I wanted. Fully loaded with all the bells and whistles, even with the $1,200 solar cell roof that looks cool more than it is functional, it will cost me $38,000. When I do get what will undoubtedly be the most enviable wheels on the block, you'll be the first to hear about it. Buy a new two year subscription to my letter, and I might even give you a ride.

-

'This is the ultimate Keynesian stimulus. We debated all summer and Keynes won. This is $800-$900 billion of stimulus over the next two years. This guarantees that the economy will surprise to the upside,' said Greg Valliere, chief research strategist at the Potomac Group.

Featured Trades: (SOARING WITH THE EAGLES),

(SLV), (AGQ), (GLD), (TBF), (TBT), (XLF), (BAC), (YCS)

1) Soaring With the Eagles. I was sleeping like a rock last night, having one of those great flying dreams. I dove, rolled, and looped through the clouds, and soared with the eagles, my arms stretched out like wings. The phone rang. I looked at the clock. It was 2:00 am. What else was new? After 40 years in the business, I seemed to have developed a supercharged internal adrenaline pump that jolts me into full combat mode in seconds, firing on all 16 cylinders. Such is the life of a global macro long/short hedge fund manager.

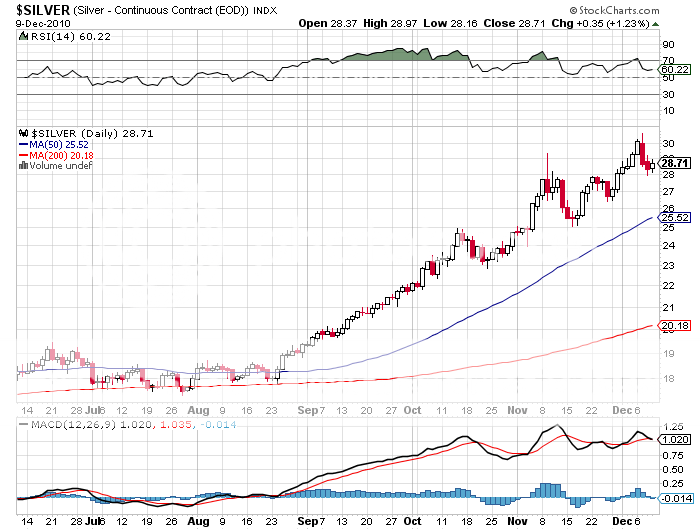

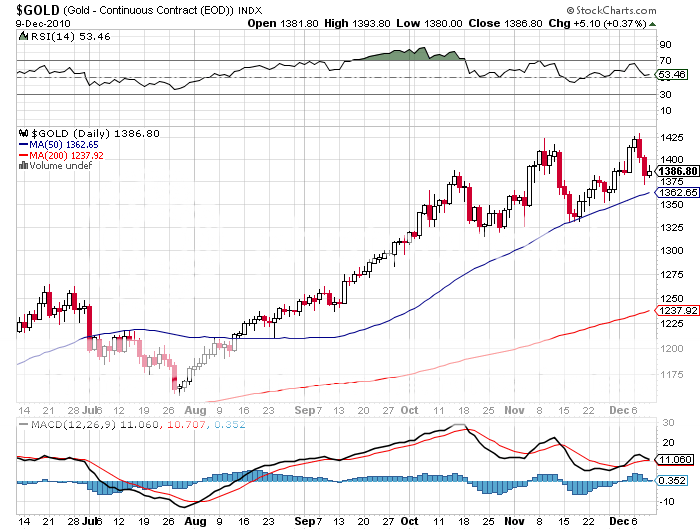

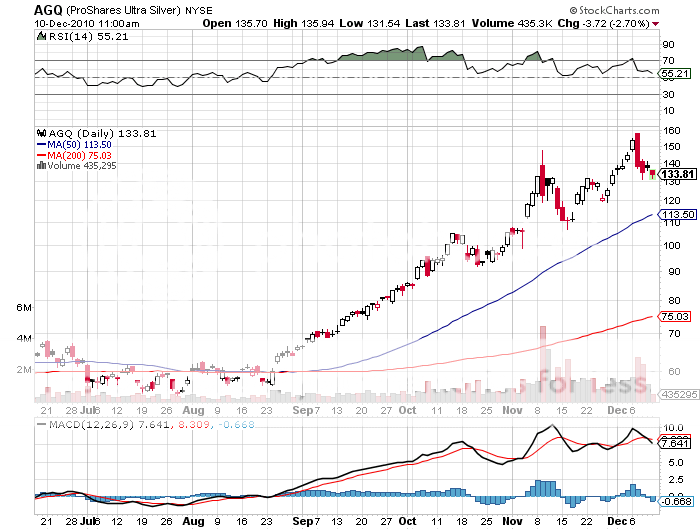

It was my friend, Ming, at the People's Bank of China in Beijing. They had just raised reserve bank requirements by 50 basis points, and another interest rate hike was in the works. Leaks of the impending move had prompted traders to dump holdings of commodities, energy, and precious metals, expecting the move to cool economic growth by the Chinese economic juggernaut. This is why silver (SLV), (AGQ) dove from $30.60 to $28 in recent days, and gold (GLD) backtracked from $1,430 to $1,374.

The wheels whirred away in my mind, calculating how this news would impact my trading book, which was long US stocks (SSO) and financials (BAC), (XLF), and short Treasury bonds (TBF), (TBT) and the yen (YCS). I concluded that I was perfectly positioned, and that my longs should go up and my shorts would go down. Back to soaring with the eagles.

I was just coming out of a white fluffy cloud when the phone rang again. It was 4:00 am. A friend at bond investment giant, PIMCO, in San Diego, CA was calling to tell me that they were upgrading their growth forecast for 2011 from an anemic 2.0%-2.5% range to a more virile 3.0%-3.5%. The rerating was off the back of the tax compromise between the President and the Republican leadership, and the massive, short term government stimulus that was working far better than imagined or publicized.

If there is one guy who's every word I hang on, it is PIMCO's eclectic managing director Bill Gross. This is not just because he was an ex-hippy, former Vietnam War swift boat veteran, who worked his way through college counting cards at blackjack in Las Vegas at the same time I did. We may well have sat at the same tables (play the videotape!). I think Bill and his cohorts, Mohamed El-Erian and Paul McCulley, are one of a tiny handful of people who have nailed it with their understanding of the global economy and the consequences for financial markets and asset classes. So we are usually reading from the same sheet of music.

I could see this easily leading to a round of competitive upgrades of forecasts by other financial institutions as we run into year end. Needless to say, this is a hugely positive backdrop for stocks. The wheels whirred again, popping out the same conclusion. If anything, my trading book looked even better. It was too late to soar with anymore damn eagles, so I staggered out of bed to do some flying of a different sort. I checked prices, and was reassured that the markets agreed with my analysis. It wasn't until noon that I realized that in the dark I had put on my boxer shorts backwards.

-

-

-

-

Come Fly With Me

Featured Trades: (SLV), (BAL), (PALL), (JO), (JJG), (CORN), (UNG), (FXE)

(WHAT A YEAR!)

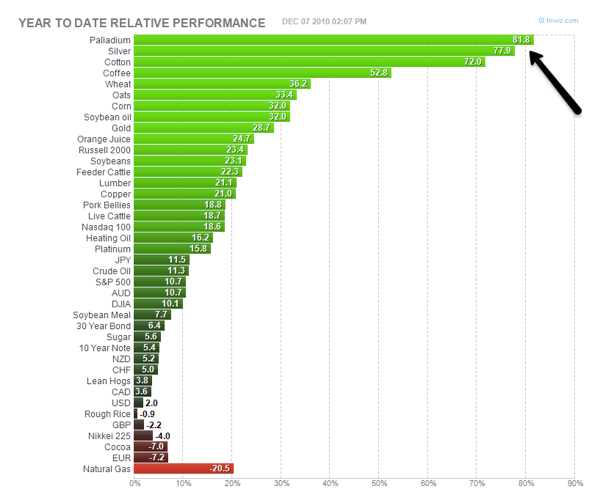

3) And What a Year It's Been! Look at the year to date performance of ??the asset classes below, and it almost looks like my buy and sell recommendations I put out at the beginning of 2010. I had strong buy recommendations on the top nine performers, including palladium (PALL) (81.8%), silver (SLV) (77.9%), cotton (77%) (BAL), (72%), coffee (JO) (52.8%), wheat (JJG) (36.2%), oats (33.4%), corn (CORN) (32%), and soybean oil (JJG) (32%). Perhaps this explains why I have so many readers that are farmers, and gold and silver coins are showing up in the mail as Christmas presents from newly enriched subscribers.

I told followers to avoid natural gas (UNG) (-20.5%), like the plague, and go short the Euro (FXE) (-7.2%). Maybe this explains why I have 30 outstanding dinner invitations in Rome (pasta is made of wheat), and why I have signed 8 X 10 glossy portraits of George W. Bush coming out of my ears, all sent from the oil patch in Texas.

At this point I have to say that past is not prologue, and it's only a matter of time before the markets serve me up with a healthy, and sobering dose of humility. All I know is that the harder I work, the luckier I get.

-

'When you fly from Shanghai airport to New York airport, you're flying from the Jetsons to the Flintstone's,' said Hot, Flat, and Crowded author Tom Friedman.

Featured Trades: (A TECHNICAL UPDATE ON YOUR POSITIONS), (BAC)

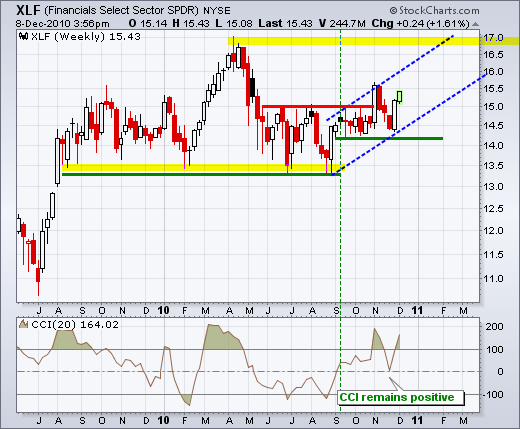

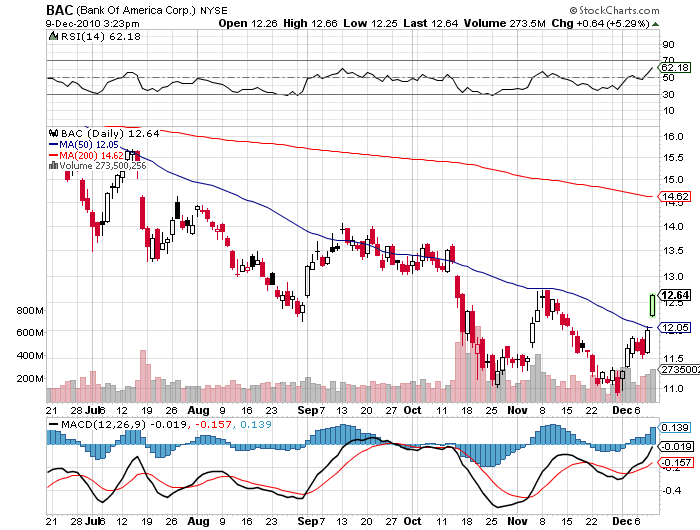

2) The Lost Decade For Bonds Has Begun! In order to enjoy your coming weekend, I thought you'd like a technical update of your positions, so feast your eyes on the two charts below. They say that a picture is worth a thousand words, so here is 2,000 words worth. If you have piled on the positions that I recommended over the last two weeks, these charts should enable you to sleep much better.

I believe these charts show that we are entering a major uptrend for financials, which are asserting themselves to become the lead sector for the market for the next several months. Watch the financial press this weekend, and you will hear a parade of technicians screaming that there has been a major trend reversal, a breakout, or a sea change. This alone could trigger a new wave of cash moving into the sector. The best case scenario has these things going up right into year end. Take a look at my Bank of America (BAC) trades, where the stock has popped 10% in two days. The low risk option play is up 57%, while the high risk one has soared by 325%. The fact that this is going on against a backdrop of a broader market that is doing diddly squat makes the moves even more convincing.

The exact reverse is true for bonds, where virtually every fixed income product broke down through their 200 day moving averages. Let me draw a simple picture ??for you laymen out there. That means you should sell every rally for the next ten years. The technical set up is now so dire, that bonds are going to have a really tough time rallying from here. The momentum players now smell blood in the water, and they'll be jumping in with both feet at every opportunity. The lost decade for bonds has begun!

Of course, you knew this was coming. It is the ultimate irony that the first action of the party that campaigned hard and won the House of Representatives on promises to cut the deficit was to engineer a dramatic increase in the deficit with yesterday's package of tax cuts. The bond market is not laughing.

-

-

-

Momentum Players Are Smelling Blood

in the Water in the Bond Market

-

While Mad Hedge Fund Trader Readers Are Sleeping Well

4) Testimonial. Signing up for your service was the easiest decision that I have ever made knowing the value that I am getting in return. Thanks for making the world of capital markets profitable for non-Wall Street guys that are busy working in other professions. Until now, I have been forced to deal with money managers or 'Company Men' that only push the products their higher ups want to sell. Finally, I have an alternative route to go. Thanks a 'Million'.

Steve

Boynton Beach, Florida