High-Risk Lyft

Lyft (LYFT) has the wind at its back but that doesn’t mean you should bet the ranch on it.

In Silicon Valley, “peak losses” are two words that can deliver a great earnings report.

That is where we are at with tech’s risk tolerance.

It’s no surprise some of these outfits burn money like no other, Lyft rejigged guidance from EBITDA losses of $1.15 billion to $1.175 billion down to $850 million to $875 million.

The main reason Uber (UBER), Lyft, and I’ll lump Netflix (NFLX) into the mix too, lose money is because they intentionally underprice their services allowing consumers to take advantage of a great deal in relative terms stoking outperforming revenue growth.

All those years of losses can be shouldered by the venture capitalists if revenue growth outweighs the pain of short-term losses.

But when a company takes that step to go public, everything changes.

No longer can they sweep the mountain of losses under the carpet to the deep-pocketed VCs, but they are penalized for it by a lower share price under the control of panicky shareholders.

Lyft started to raise prices in June and since Uber went public as well, the duopoly is in the same boat.

This means that your rideshare route home from the bar after the last call is about to get more expensive.

Since Lyft and Uber have a boatload of data, they will surgically pick and identify the routes and distance that do the least damage to end demand.

This will clearly be the routes and distances that have such an overwhelming and pent up demand that they can nudge up prices an extra 5% or more if they can get away with it.

In my head, these routes mean downtowns in metros with high paying jobs with poor public transportation links such as Los Angeles or Seattle.

Another route that I believe will get a bump in price is late-night surcharges often when partygoers are inebriated or out on the town.

Lyft has pockets of opportunities to exploit.

The cost inflation won’t stop there because even though Lyft “beat expectations” due to this pricing change, there is the long-term fixation on profitability that haunts management.

The pricing trick made Lyft rejig its annual targets expecting revenue of between $3.47 billion and $3.5 billion this year, up from a previously stated range of $3.275 billion to $3.3 billion.

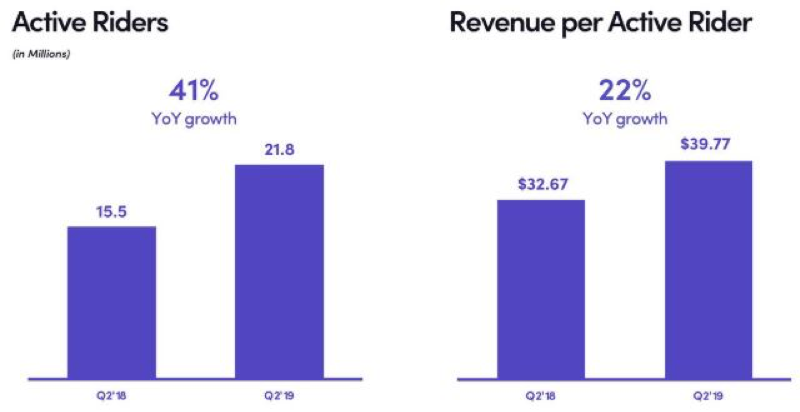

The one metric that bodes well for the service is the 21.8 million “active riders” on its platform beating expectations by about 0.7 million year-over-year.

Lyft’s services are scalable and the growth will help mitigate losses and even though it’s in the public market, that doesn’t mean that it can’t stop growing.

Both ride-sharing services going public at almost the same time has meant that the price war that resulted in massive discounts to riders is no more.

Each service has incentives to raise prices in the most pain-reductive way possible for riders.

This particular tech category is certainly high risk - high reward as Lyft and Uber still face ongoing litigation in California courts concerning the job status of its drivers about whether they are classified as employees or independent contractors.

The more imminent issue is how much can they price hike before consumers balk.

Riders certainly have a price threshold that they aren’t willing to accommodate.

Luckily, Uber and Lyft have a treasure trove of data and can manipulate it to their interests by floating out trial balloons to test bold initiatives.

These two tech companies will not be able to shake off the volatility disease for the foreseeable future as the laundry list of predicaments spell turbulence.

Long term, they must show more to investors than “peak losses” but for the time being, they have survived the gauntlet.

I would not buy shares short-term, the most recent spike has snatched away an accommodative entry point.