How to Play Tech Earnings Season

The big guns of tech are coming up to the plate for earnings and they could use a strong showing as big tech’s narrative is on the ropes.

They are still the apex warriors of the stock market, and that position is hardly under threat, but there are whispers of a slowdown.

A recipe of high expectations mixed with cruddy forecasts could give us a dip to buy into.

This is what our portfolio would love to be gifted.

Don’t forget we have already seen some misses from tech companies like Snap (SNAP) which plunged 27% after warning that customers are cutting back on digital advertising spending.

The fallout sent other ad tech companies like Twitter and Google significantly lower.

This never used to happen to these companies and that’s important to point out because we just exited an era where ad tech companies could do no wrong.

Now it almost seems like they can’t do no right.

Readers got spoilt, earnings after earnings, these tech companies used to knock it out of the park and much of that high expectation is still leftover, perhaps a legacy concept from the bull market from 2008 to 2021.

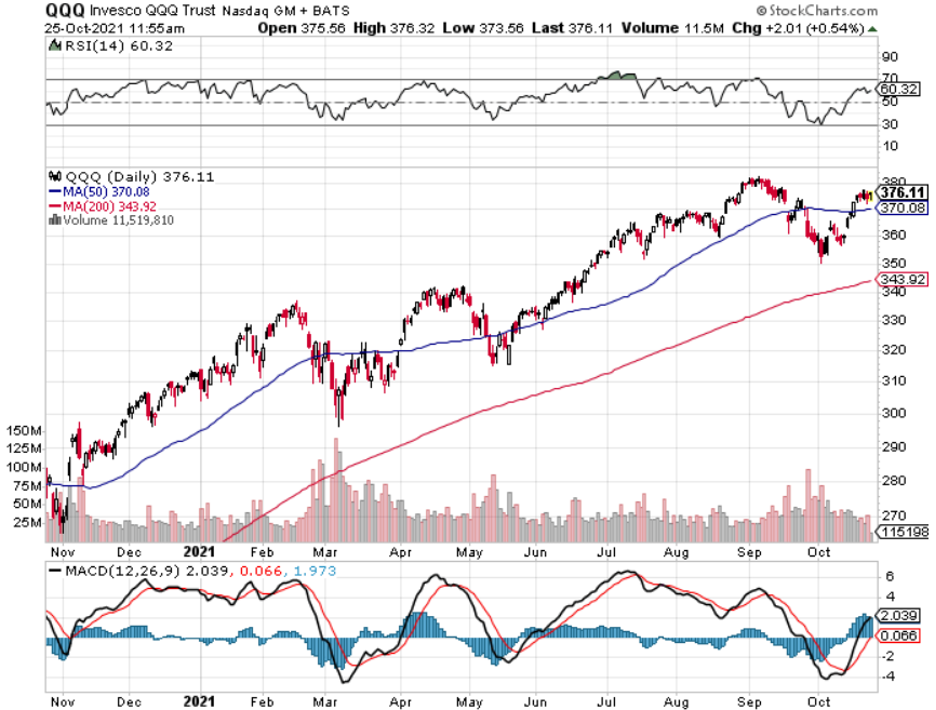

These are the bellwether stocks of the broader market that have single-handedly put the rest of their market on their back and carried it higher.

Everyone wants to know if they can still hack it?

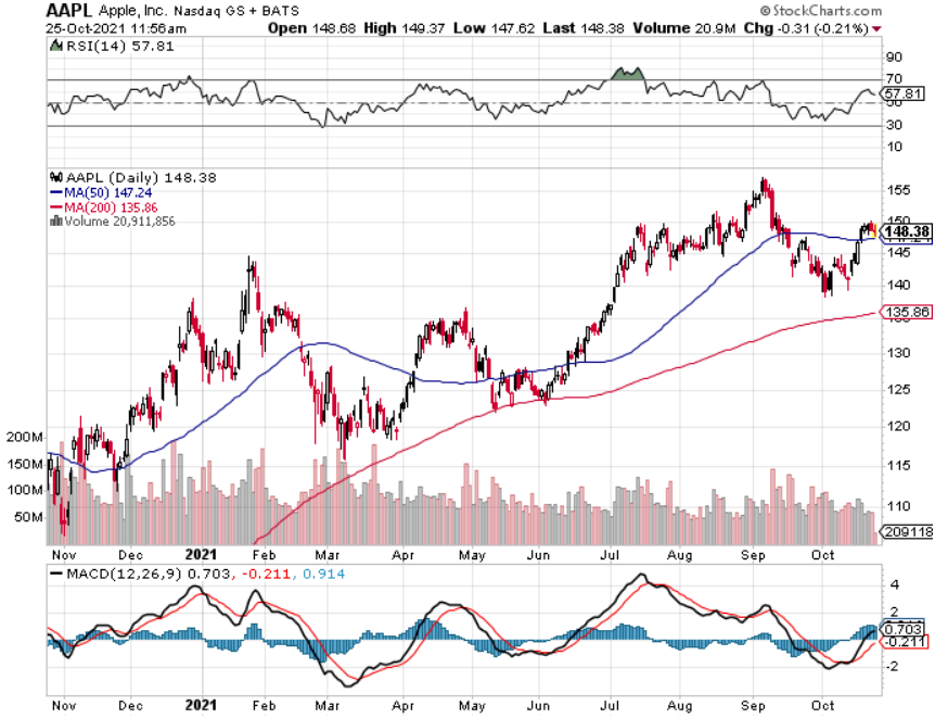

Technology companies in the S&P 500 Index are projected to report revenue growth of roughly 19% for the third quarter such as Alphabet at 38% growth, followed by Facebook at 37% and Apple (AAPL) at 31%.

I do believe that they will achieve these lofty estimates but they won’t overperform to the point where buyers line up in spades.

We aren’t in that type of environment now.

These companies have pricing power, and combined with underlying growth drivers, they generate high returns and reinvest in the business and perpetuate that strength.

The price action backs up my concerns with 85% of tech companies having beaten profit estimates, but the stocks have fallen an average of 2.4% the following day.

The lack of response means we are long in the tooth.

If this does become a “buy the rumor, sell the news” type of event, this will give us plenty of discounts to cherry-pick the next day.

The challenge of justifying their valuations means these companies aren’t getting their “free pass” that they used to pocket and manipulate.

They aren’t the darlings of the business world anymore — that title goes to cryptocurrency and bitcoin.

Facebook will tell us how badly Apple’s privacy changes are affecting its ad revenue model.

Consensus is looking for revenue growth of nearly 40% this quarter in Alphabet which in a normal year wouldn’t be that hard to beat but it’s a new normal now.

Ongoing monetization improvements in search advertising through product/AI-driven updates, along with greater-than-expected contributions from businesses like YouTube and Google Cloud can seem them meet their forecasts.

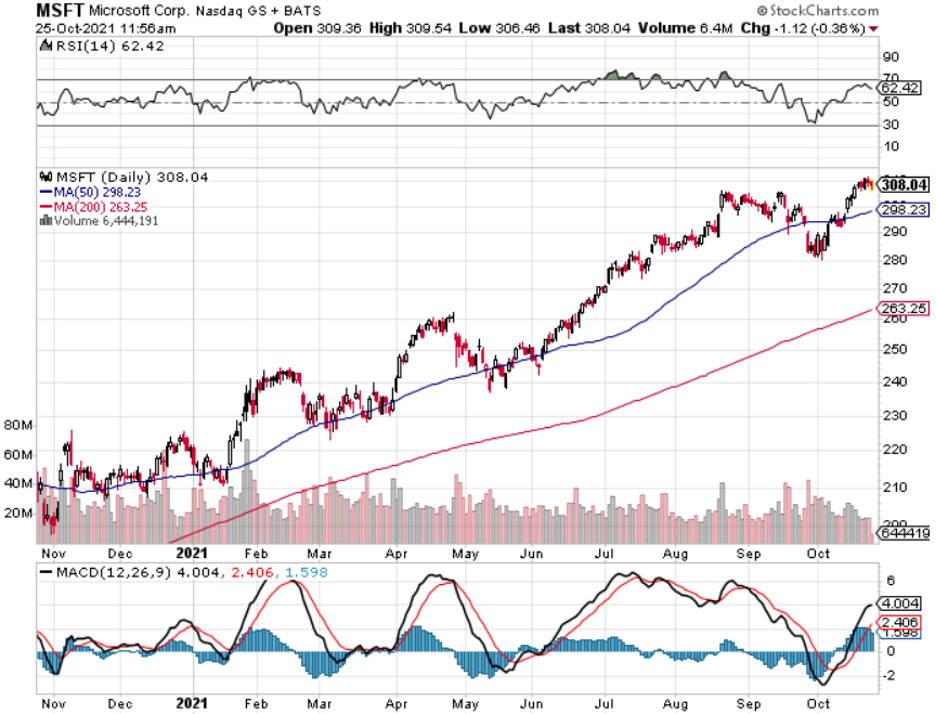

Microsoft (MSFT) expects revenue to grow around 20% in the quarter and we need to look out for if their cloud-computing business maintains strong demand.

Year-over-year comparisons get progressively tougher throughout the year which is an obstacle for MSFT’s durable growth portfolio of Azure/Security/Teams.

Apple could deliver great iPhone sales, but semiconductor shortages are a limiting factor, and the China risk is another big quagmire.

At what point will the Chinese Communist Party stop giving Apple such an easy go of it in China?

Regulatory uncertainty is an overhang — implications of the App Store ruling remain a wild variable.

Amazon is dealing with supply-chain challenges and labor shortages.

Last quarter, revenue missed expectations for the first time since 2018, and the company warned of the reverse of the pandemic-related tailwind for online retail.

Revenue is expected to grow a little more than 16%, the slowest pace since 2015.

The stock has been dead weight this year, which is unlike Amazon.

I do believe we will get a sprinkling of fairy dust that includes margin expansion, but some of these companies will experience a pullback and I will be waiting to aggressively take advantage of these deals.