Global Market Comments February 12, 2019 Fiat Lux Featured Trade: (HOW TO HANDLE THE FRIDAY, APRIL 20 OPTIONS EXPIRATION), (TLT), (PLEASE SIGN UP NOW FOR MY FREE TEXT ALERT SERVICE NOW), (BRING BACK THE UPTICK RULE!),

Global Market Comments February 11, 2019 Fiat Lux Featured Trade: (THE MARKET FOR THE WEEK AHEAD, or DON’T STAND NEXT TO THE DUMMY), (AAPL), (MSFT), (TSLA), (VIX), (TLT), (TBT), (FXI)

When I was a war correspondent (Cambodia, Laos, Iraq, Kuwait, Indonesia), my seniors gave me a sage piece of advice that saved my life many times. “Don’t stand next to the dummy.” Don’t go near the guy wearing the Hawaiian shirt, NY Yankees baseball cap, and aviator sunglasses. You want to be dressed in the

Global Market Comments February 8, 2019 Fiat Lux Featured Trade: (FEBRUARY 6 BIWEEKLY STRATEGY WEBINAR Q&A), (TLT), (FXA), (NVDA), (SPY), (IEUR), (VIX), (UUP), (FXE), (AMD), (MU), (SOYB)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader February 6 Global Strategy Webinar with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming! Q: Why are you so convinced bonds (TLT) are going to drop in 2019? A: I think the Fed will regain the confidence to start raising rates again

Global Market Comments February 7, 2019 Fiat Lux Featured Trade: (WHAT TO BUY AT MARKET TOPS?), (CAT), ($COPPER), (FCX), (BHP), (RIO), (EUROPEAN STYLE HOMELAND SECURITY), (TESTIMONIAL)

Hey John and the MAD Team, here's a late Happy New Years! You really nailed and keep nailing great reversals and trends that are just beginning to deserve a watchful eye. I'm still a bit stuck on futures, but I realize the safety in your spreads is a lot smarter...Thx for all you know

Global Market Comments February 6, 2019 Fiat Lux Featured Trade: (MY 20 RULES FOR TRADING IN 2019)

Global Market Comments February 5, 2019 Fiat Lux Featured Trade: (A NOTE ON OPTIONS CALLED AWAY) (TLT), (AAPL), (THE GOVERNMENT’S COMING WAR ON MONEY)

I bought a tall caramel macchiato at Starbucks the other day. When I handed over a crisp $100 bill, the cashier’s response set me back. “Oh, dinosaur money.” I have to tell you that after speaking to US Treasury officials for a half-century, there is one thing I know for sure. The government absolutely hates

Global Market Comments February 4, 2019 Fiat Lux Featured Trade: (THE MARKET FOR THE WEEK AHEAD, or FROM PANIC TO EUPHORIA), (SPY), (TLT), (AAPL), (GLD),

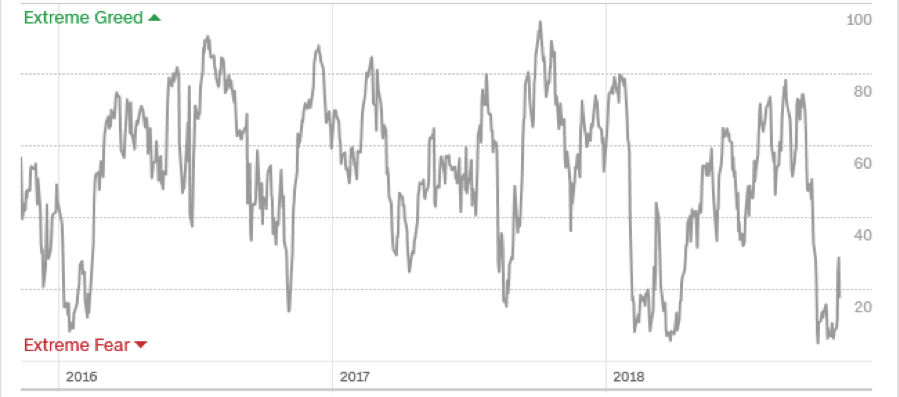

What a difference a month makes! In a mere 31 days, we lurched from the worst December in history to the best January in 30 years. Traders have gone from lining up to jump off the Golden Gate Bridge to ordering Dom Perignon Champaign on Market Street. However, not everything is as it appears. The

Global Market Comments February 1, 2019 Fiat Lux Featured Trade: (THE DEATH OF KING COAL), (KOL), (PEA), (THE BRAVE NEW WORLD OF ONLINE RETAILING), (SNAP), (GPRO), (APRN), (SFIX)

Global Market Comments January 31, 2019 Fiat Lux Featured Trade: (MARKET GETS A FREE PASS FROM THE FED), (SPY), ($INDU), (TLT), (GLD), (FXE), (UUP), (APPLE SEIZES VICTORY FROM THE JAWS OF DEFEAT), (AAPL)

When the Oxford English Dictionary considers the Word of the Year for 2019, I bet “PATIENCE” will be on the short list. That was the noun that Federal Reserve governor Jerome Powell had in mind when describing the central bank's current stance on interest rates. Not only did Powell say he was patient, he posited

After an almost 40% swan dive, Apple has found solid footing at these levels for the time being. 40% seems to be the magic number. Declines ALWAYS end at 40% with Apple. About time! It’s been an erratic last few months for the company that Steve Jobs built and this last earnings report will go

Global Market Comments January 30, 2019 Fiat Lux Featured Trade: (WHY WATER WILL SOON BE WORTH MORE THAN OIL), (CGW), (PHO), (FIW), (VE), (TTEK), (PNR), (WHY WARREN BUFFETT HATES GOLD), (GLD), (GDX), (ABX),

Global Market Comments January 29, 2019 Fiat Lux Featured Trade: (RISK CONTROL FOR DUMMIES), (SPY), (AMZN), (TLT), (CRM), (VXX)

There is a method to my madness, although I understand that some new subscribers may need some convincing. Whenever I change my positions, the market makes a major move or reaches a key crossroads, I look to stress test my portfolio by inflicting various extreme scenarios upon it and analyzing the outcome. This is second

Global Market Comments January 28, 2019 Fiat Lux Featured Trade: (THE MARKET FOR THE WEEK AHEAD, or IT’S FINALLY OVER) (SPY), (TLT), (FXE), (MSFT), (AAPL), (PG), (F), (LRCX), (AMD), (XLNX)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.