I have been through 11 bear markets in my lifetime, and I can tell you that the most ferocious rallies always take place in bear markets. This one is no exception. Short sellers always have a limited ability to take pain.

This rally took the Dow Average up 14.4% during the month of October, the biggest such monthly gain since 1976 (hmmm, just out of college and working for The Economist magazine in Tokyo, and dodging bullets in Cambodia).

The Dow outperformed NASDAQ by 9% in October, the most in 20 years. That is a pretty rare event. During the pandemic, the was a tremendous “pull forward” of technology stocks, as only commerce was possible. Now it is time for their earnings to catch up with pandemic valuations, which may take another year.

But first, let me tell you about my performance.

With some of the greatest market volatility in market history, my October month-to-date performance ballooned to +4.87%.

That leaves me with only one short in the (SPY) and 90% cash.

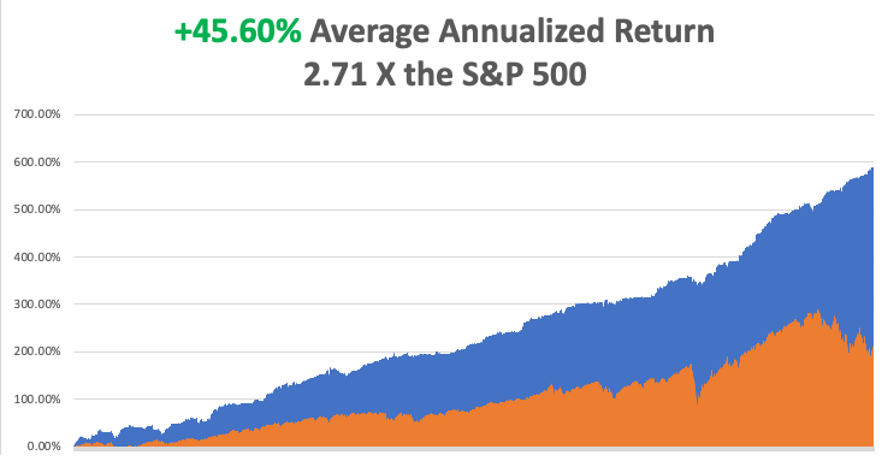

My 2022 year-to-date performance ballooned to +74.55%, a new high. The Dow Average is down -9.47% so far in 2022.

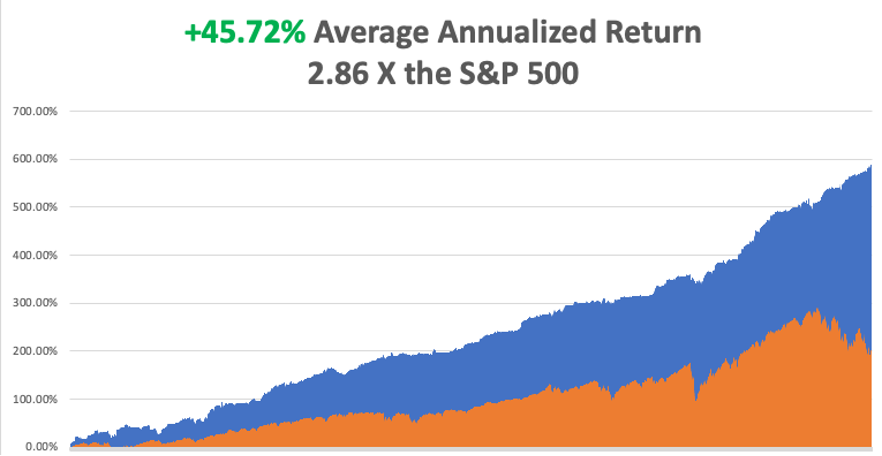

It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high +77.95%.

That brings my 14-year total return to +587.88%, some 2.86 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to +45.60%, easily the highest in the industry.

And of course, there is no better indicator of the market strength than the Mad Hedge Market Timing Index, which broke above 50 for the first time in six months, all the way to 61.

It's no surprise that investors sold what was expensive (tech) and what was bought that was cheap (banks). It’s basic investing 101. Tech is still trading at a big premium to the market and double the price earnings of banks

The prospect of an end to Fed tightening has ignited a weaker dollar, prompting a stronger stock market that generated the rocket fuel for this month’s move.

All the negatives have gone, the seasonals, earnings reports, a strong dollar, and in 8 days, the election. Don’t forget that the (SPX) has delivered an eye-popping 16.3% return for every midterm election since 1961, all 15 of them.

The put/call spread is the biggest in history, about 1:4, showing that investors are piling in, or at least covering shorts, as fast as they can. Individual stock call options are trading at the biggest premiums ever.

Suffice it to say that I expected all of this, told you about it daily, and we are both mightily prospering as a result.

Much of the selling this year hasn’t been of individual stocks but of S&P 500 Index plays to hedge existing institutional portfolios. The exception is with tax loss selling to harvest losses to offset other gains. That means indiscriminate index selling begets throwing babies out with the bathwater on an industrial scale. And here is your advantage as an individual investor.

A classic example is Visa (V) which I’m’ liking more than ever right now, which I aggressively bought on the last two market downturns. The company has ample cash flow, carries no net debt, and with high inflation, is a guaranteed double-digit sales and earnings compounder.

It clears a staggering $10 trillion worth of transactions a year. With $29.3 billion in revenues in 2022 and $16 billion in net income, it has a technology-like 55% profit margin. Visa is also an aggressive buyer of its own shares, about 3% a year. That’s because it trades at a discount to other credit card processors, like Master Car (MA) and American Express (AXP).

The only negative for Visa is that it gets 55% of its earnings from aboard, which have been shrunken by the strong dollar. That is about to reverse.

It turns out that digital finance never made a dent in Visa’s prospects, as the dreadful performance of PayPal (PYPL) and Square (SQ) shares amply demonstrate.

Remember, however, that the Fed is raising interest rates by 0.75% to a 3.75%-4.00% range on Wednesday, November 2, and may do so again in December. It has been the fastest rate rise of my long and illustrious career, and also the best telegraphed.

That may give us one more dip in the stock market that will enable us to buy in on the coming Roaring Twenties.

We’ll see.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With the economy decarbonizing and technology hyper-accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side will be far more efficient and profitable than the old. Dow 240,000 here we come!

On Monday, October 31 at 6.45 AM, the Chicago PMI for October is released.

On Tuesday, November 1 at 7:00 AM, the JOLTS job opening report for September is out.

On Wednesday, November 2 at 8:30 AM, ADP Private Employment Report for October is published. The Fed raises interest rates at 11:00 AM and follows with a press conference at 11:30.

On Thursday, November 3 at 8:30 AM, Weekly Jobless Claims are announced.

On Friday, November 4 at 8:30 AM the Nonfarm Payroll Report for October is printed. At 2:00, the Baker Hughes Oil Rig Count is out.

As for me, during the late 1980s, the demand for Japanese bonds with attached equity warrants was absolutely exploding.

Japan was Number One, the engine of technological innovation. Everyone in the world owned a Sony Walkman. They were trouncing the United States with 45% of its car market.

The most conservative estimate for the Nikkei Average for the end of 1990 was 50,000, or up 27%. The high end was at 100,000. Why not? After all, the Nikkei had just risen tenfold in ten years and the Japanese yen had tripled in value.

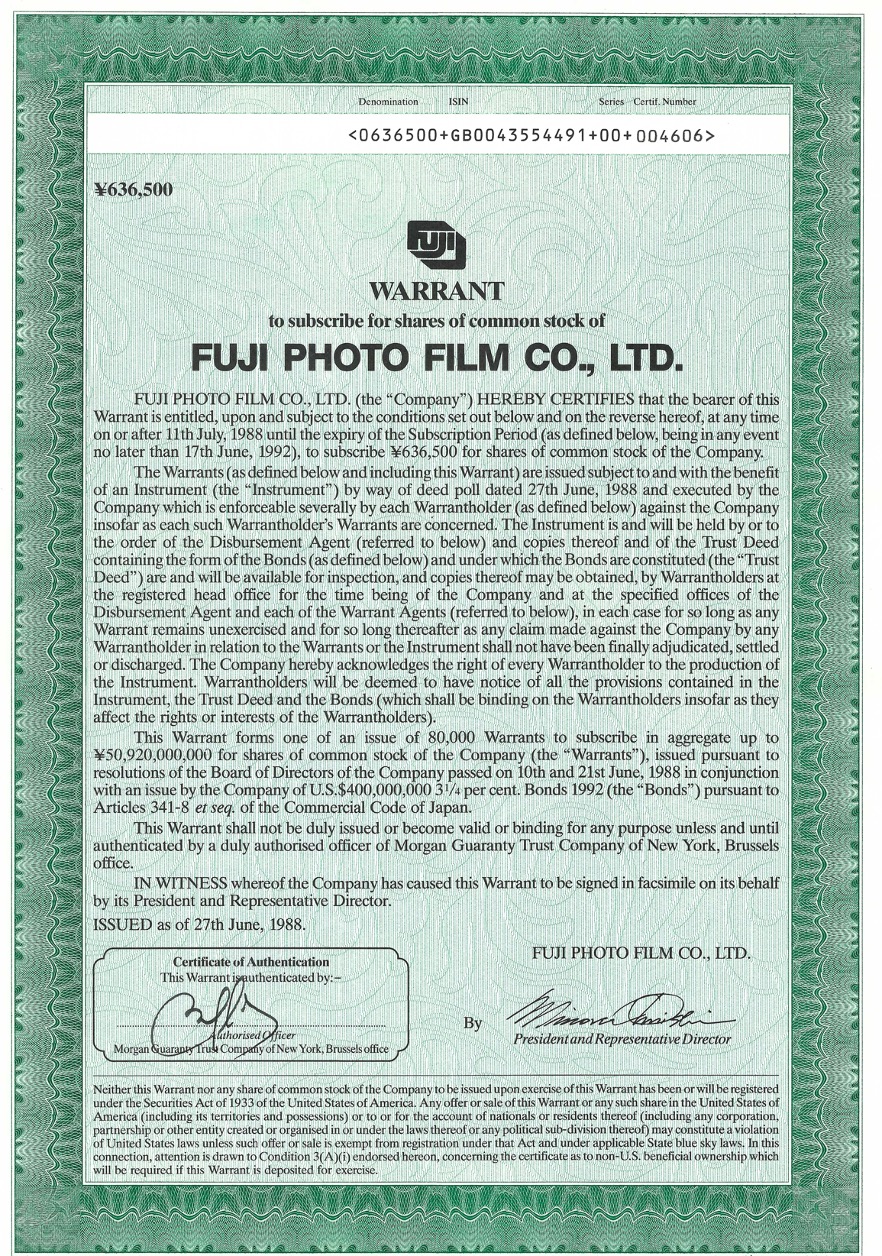

In 1989, my last full year at Morgan Stanley, the Japanese warrant trading desk accounted for 80% of the firm’s total equity division profits.

The deals were coming hot and heavy. Since Morgan Stanley had the largest Japanese warrant trading operation in London, a creation of my own, we were invited to join so many deals that the firm ran out of staff to attend the signings.

Since I was the head of trading, I thought it odd that the head of investment banking wanted to speak to me. It turned out that Morgan Stanley was co-managing two monster $3 billion bond deals on the same day. Could I handle the second one? Our commission for the underwritings was $10 million for each deal!

I thought, why not, better to see how the other half lived. So, I said “yes.”

The attorneys showed up minutes later. I was given a power of attorney to sign on behalf of the entire firm and commit our capital to the underwriting $3 billion five-year bond issue for the Industrial Bank of Japan. The deal was especially attractive as the bonds carried attached put options on the Nikkei which institutional investors could buy to hedge their Japanese stock portfolios.

Since the Industrial Bank of Japan thought the stock market would never see a substantial fall, they happily sold short the put options. Only the Industrial Bank of Japan could have pulled this off as it was one of the largest and highest-rated banks in Japan. I knew the CEO well.

It turned out that there was a lot more to a deal signing than I thought, as it was done in the traditional British style. We met at the lead manager’s office in the City of London in an elegant wood-paneled private dining room filled with classic 18th century furniture.

First, there was a strong gin and tonic which you could have lit with a match. A five-course meal accompanied with a 1977 deep Pouilly Fuse white and a 1952 Bordeaux red with authority. I had my choice of elegant desserts. Sherry and a 50-year-old port followed, along with Cuban cigars, which was a problem since I had just quit smoking (my wife recently bore twins).

The British were used to these practices. Any American banker would have been left staggering, as drinking during business hours back then was illegal in New York.

Then out came the paperwork. I signed with my usual flourish and the rest of the managers followed. The Industrial Bank of Japan provided the Dom Perignon as they were about to receive $3 billion in cash the following week.

Then an unpleasant thought arose in the back of my mind. Morgan Stanley assumed the complete liability for their share of the deal. But did I just incur a massive personal liability as well?

Then I thought, naw, why pee on someone’s parade. Morgan Stanley’s been doing this for 50 years. Certainly, they knew what they were doing.

Besides, the Japanese stock market is going up forever, right? No harm, no foul. In any case, I left Morgan Stanley to start my own hedge fund a few months later.

Some seven months later, one of the greatest stock market crashes of all time began. The Nikkei fell 50% in six months and 85% in 20 years. Some 32 years later the Nikkei still hasn’t recovered its old high.

For a few years, that little voice in the back of my mind recurred. The bonds issued by the Industrial Bank of Japan fell by half in months on rocketing credit concerns. The IBJ’s naked short position in the Nikkei puts completely blew up, costing the bank $10 billion. The Bank almost went bankrupt. It was one of the worst timed deals in the history of finance. The investors were burned bigtime.

Did I ever hear about the deal I signed on again? Did process servers show up and my front door in London with a giant lawsuit? Did Scotland Yard chase me down with an arrest warrant?

Nope, nothing, nada, bupkis. I never heard a peep from anyone. It turns out you CAN lose $12 billion worth of other people’s money and face absolutely no consequences whatsoever.

Welcome to Wall Street.

Still, when the five-year maturity of the bonds passed, I breathed a sigh of relief.

My hedge fund got involved in buying Japanese equity warrants, selling short the underlying stock, thus creating massive short positions with a risk-free 40% guaranteed return. My investors loved the 1,000% profit I eventually brought in doing this.

Unlike most managers, I insisted on physical delivery of the warrant certificates, as the creditworthiness of anyone still left in the business was highly suspect. Others who took delivery used warrants to wallpaper their bathrooms (really).

They all expired worthless, I made fortunes on the short positions, and still have them by the thousands (see below).

In September 2000, the Industrial Bank of Japan, its shares down 90%, merged with the Dai-Ichi Kangyō Bank and Fuji Bank to form the Mizuho Financial Group. It was a last-ditch effort to save the Japanese financial system after ten years of recession engineered by the government.

Morgan Stanley shut down their worldwide Japanese equity warrant trading desk, losing about $20 million and laying off 200. Some staff were outright abandoned as far away as Hong Kong. Morgan Stanley was not a good firm for running large losses, as I expected.

I learned a valuable trading lesson. The greater the certainty that people have that an investment will succeed, the more likely its failure. Think of it as Chaos Theory with a turbocharger.

But we sure had a good time while the Japanese equity warrant boom lasted.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader