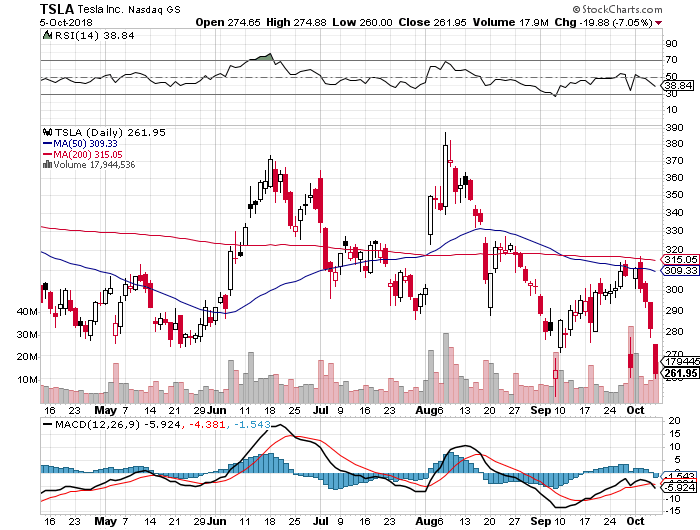

Talk about a bad news factory.

A short interest of 26% in Tesla (TSLA) stock has the tendency to manufacture bad news on a daily basis, whether it is true or not. It really has been a black swan a day.

This really is the most despised stock in the market. But you have to expect that when you are simultaneously disputing the auto, oil, dealer, and advertising industries, and doing it all union-free.

It also doesn’t help that Tesla is on the Department of Justice speed dial, undergoing no less than three investigations since the advent of the new administration. I can’t imagine why this is happening, given that the White House is now packed with oil industry executives.

That’s why I have been advising investors to buy the car and not the stock.

That is until now.

The truth is that all of this negativity is generating the best entry point for Tesla shares in two years.

In the meantime, the San Francisco Bay Area has become flooded with new Tesla 3’s. These are suddenly everywhere and soon will outnumber the ubiquitous Toyota Prius, until now the favorite of technology employees.

Q3 production of Tesla 3’s reached an eye-popping 55,840, up from 18,440 the previous quarter, taking Tesla’s total output to 80,000 including the model X.

That puts the company on target to reach 250,000 units in 2019. Tesla may be about to see something it has not witnessed in the company’s 15-year history: a real profit.

When I picked up my first Tesla 1 in 2010, chassis no. 125, I was all alone and treated like I was visiting royalty. The sales staff fawned all over me, offering me free hats, coffee mugs, and other tchotchke. Today, a staggering 200 people a day are gleefully driving their new wheels away from the Fremont factory, and another 200 getting them home-delivered by semis. Take a number and wait in line.

I have pinned down several of these drivers in parking lots, shopping malls, and trailheads to quiz them about their new ride and the answer is always the same. It’s a car from 20 years in the future, the best they have ever driven, and they will never buy another marque again.

Sounds pretty good, doesn’t it?

So I perked up the other day when I heard my old pal, legendary value investor Ron Baron, make the bull case for Tesla.

Ron has never done things by halves. He expects Tesla’s market capitalization to soar from $43 billion today to $1 trillion by 2030, a mere 12 years away. By then, Tesla should be generating $150 billion a year in profits. That implies that a 23-fold increase in the share price to $5,570 is ahead of us.

Half of this will be generated by the auto sales, while the other half will be produced by a burgeoning battery business. Tesla will easily become the largest auto manufacturer in the world within a few years.

Tesla will sell 10-15 million cars a year by 2030, compared to the current 300,000 annual rate.

It already is the one American auto maker with the highest US parts content, nearly 100%. It has also been one of the largest creators of new jobs over the past decade, right behind Amazon (AMZN), at some 46,000.

It’s really all about the math. Today, Tesla is building its Tesla 3’s at a cost of $28,000 apiece and selling them for $62,000. That’s the high price they have been realizing with extra options like four-wheel drive, 300-mile extended range batteries, painted wheels, and all the other bells and whistles. That gives you a $34,000 profit per vehicle.

Tesla’s “cheap” cars, the stripped-down rear wheel drive Tesla 3’s that will sell for a modest but world-beating $35,000 won’t be available until early 2019.

At this rate, the entire company will become profitable when it hits a production rate of 10,000 units a week compared to the current 6,000 units. They should achieve that sometime in early 2019.

Much has been made of drone video footage showing vast parking lots in Fremont, CA chock-a-block with shiny new Tesla 3’s. This creates a false sense of poor sales.

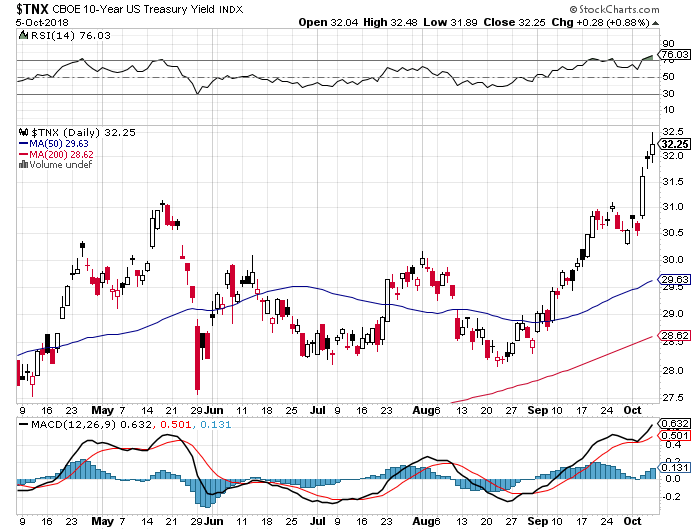

The actual fact is that Tesla has no dealer network. All of those parked cars have been sold and are awaiting owners to pick them up. The months it takes from payment to actual delivery gives Tesla a free float on billions of dollars. That’s worth a lot in a world of steadily rising interest rates.

Oh, and those notorious tents? They could withstand a category 5 hurricane. However, like everything else the company does, they’re revolutionary. They enable bypassed permitting procedures and can be built very quickly and cheaply.

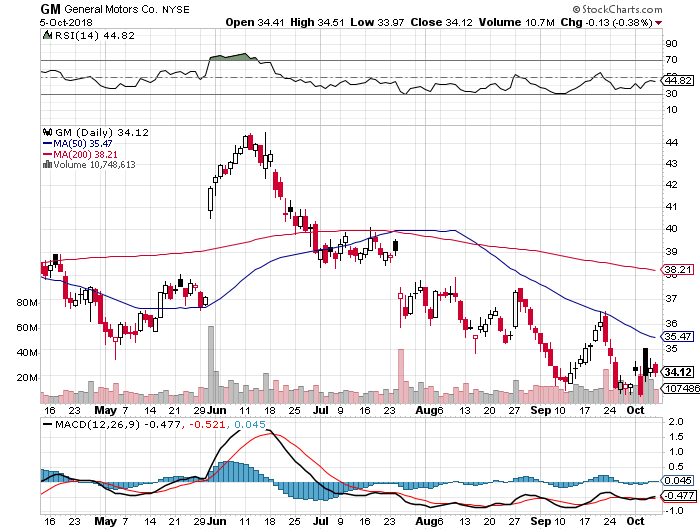

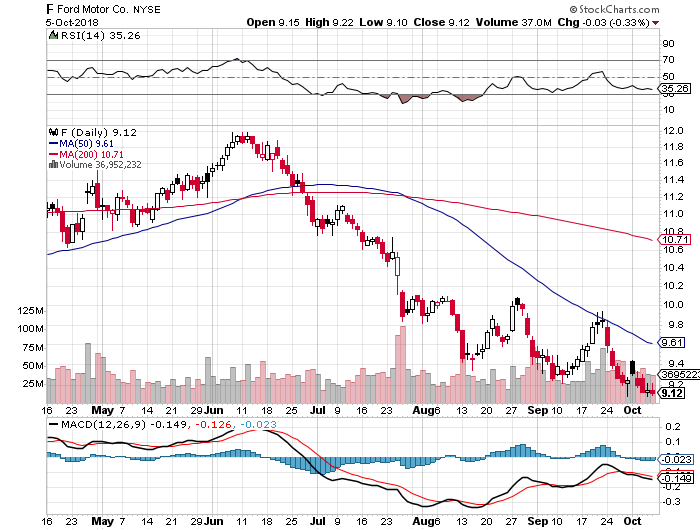

How are things going with the competition? Not so good. The traditional internal combustion car industry has hundreds of billions of dollars tied up in engine factories that will eventually become worthless. They really are the 21st century equivalent of buggy whip makers.

General Motors (GM), Ford (F), and Chrysler are executing slow motion roll out of electric cars in order to squeeze a few more years of use out of these legacy plants. Electric cars don’t use engines. That is putting them ever further behind.

This is what the poor share performance of auto shares has been screaming at you all year despite one of the strongest economies and stock markets in history. Yes, “peak Auto” is at hand.

The high-end brands like Mercedes, BMW, Audi, and Porsche that just entered the all-electric market are a decade behind Tesla in autonomous software and manufacturing processes. They all have huge, expensive dealer networks.

Let’s see how sales go after they suffer their first fatal crash. In the meantime, Tesla has run up 200 million miles worth of driving data.

Factory insiders say a speed-up of new Tesla orders is in the works. Orders placed before December 31, 2018 are entitled to a $7,500 federal tax credit. That drops to $3,750 in the first half of 2019, only $1,750 in the second half, and zero in 2020.

In the meantime, the oil industry is still collecting $55 billion a year of federal oil depletion allowances. Go figure.

At the same time, many states like California, far and away Tesla’s largest market (Texas is no. 2), are either maintaining or expanding their own electric car subsidies or gas guzzler penalties. It is $2,500 per car in California.

Ron Baron is not alone in his admiration of Tesla. Macquarie Research has just initiated coverage with a strong “BUY” and a target of $430 a share, up 70% from today’s close.

Next in the works will be a Tesla Model Y, a small four-wheel drive based on the Tesla 3 chassis. A Roadster relaunch comes next in 2022, a $250,000 super car that will be doubtless aimed at Arab sheiks and billionaire car collectors.

By then the entire product line will spell SEXY. See! Elon Musk does have a sense of humor after all!

My First S-1

RIP

My New Wheels