Below please find subscribers’ Q&A for the Mad Hedge Fund Trader September 5 Global Strategy Webinar with my guest and co-host Bill Davis of the Mad Day Trader.

As usual, every asset class long and short was covered. You are certainly an inquisitive lot, and keep those questions coming!

Q: Do you think the collapse of commodity prices in the U.S. will affect the U.S. election?

A: Absolutely, it will if you count agricultural products as commodities, which they are. We have thousands of subscribers in the Midwest and many are farmers up to their eyeballs in corn, wheat, and soybeans. It won’t swing the entire farm vote to the Democratic party because a lot of farmers are simply lifetime Republicans, but it will chip away at the edges. So, instead of winning some of these states by 15 points, they may win by 5 or 3 or 1, or not at all. That’s what all of the by-elections have told us so far.

Q: What will be the first company to go to 2 trillion?

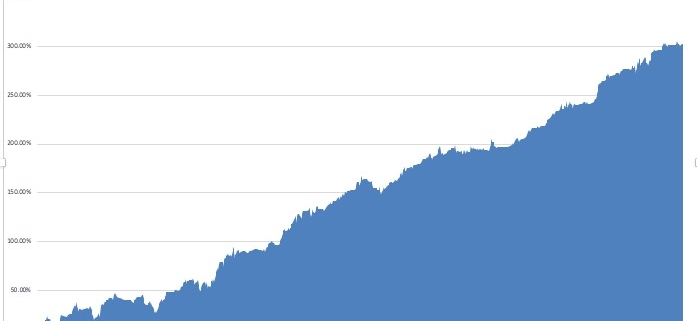

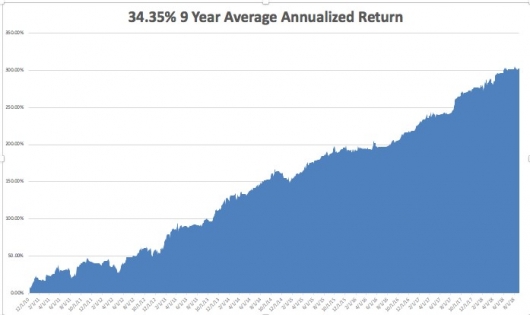

A: Amazon, for sure (AMZN). They have so many major business lines that are now growing gangbusters; I think they will be the first to double again from here. After having doubled twice within the last three years, it would really just be a continuation of the existing trend, except now we can see the business lines that will actually take Amazon to a much bigger company.

Q: Is this a good entry point for Micron Technology (MU)?

A: No, the good entry point was in the middle of August. We are at an absolute double bottom here. Wait for the tech washout to burn out before considering a re-entry. Also, you want to buy Micron the day before the trade war with China ends, since it is far and away its largest customer.

Q: Is Micron Technology a value trap?

A: Absolutely not, this is a high growth stock. A value trap is a term that typically applies to low price, low book to value, low earning or money losing companies in the hope of a turnaround.

Q: I didn’t get the Microsoft (MSFT) call spread when the alert went out — should I add it on here?

A: No, I am generally risk-averse this month; let’s wait for that 4% correction in the main market before we consider putting any kind of longs on, especially in technology stocks which have had great runs.

Q: How do you see Lam Research (LRCX)?

A: Long term it’s another double. The demand from China to build out their own semiconductor industry is exponential. Short term, it’s a victim of the China trade war. So, I would hold back for now, or take short-term profits.

Q: Is this a good entry point for Google (GOOGL)?

A: No, wait for a better sell-off. Again, it’s the main market influencing my risk aversion, not the activity of individual stocks. It also may not be a bad idea to wait for talk of a government investigation over censorship to die down.

Q: Would you buy Tesla (TSLA)?

A: No, buy the car, not the stock. There are just too many black swans out there circling around Tesla. It seems to be a disaster a week, but then every time you sell off it runs right back up again. Eventually, on a 10-year view I would be buying Tesla here as I believe they will eventually become the world’s largest car company. That is the view of the big long-term value players, like T. Rowe Price and Fidelity, who are sticking with it. But regarding short term, it’s almost untradable because of the constant titanic battle between the shorts and the longs. At 26% Tesla has the largest short interest in the market.

Q: I’m long Microsoft; is it time to buy more?

A: No, I would wait for a bit more of a sell-off unless you’re a very short-term trader.

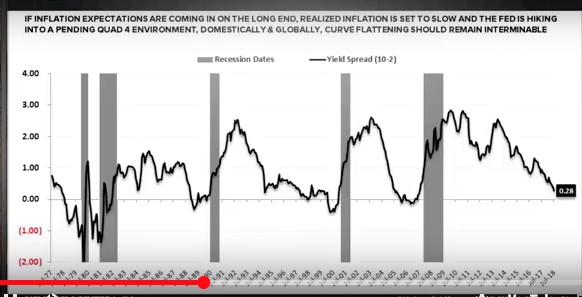

Q: What would you do with the TBT (TBT) calls?

A: I would buy more, actually; preferably at the next revisit by the ProShares Ultra Short 20 Year Plus Treasury ETF (TBT) to $33. If we don’t get there, I would just wait.

Q: What’s your suggestion on our existing (TLT) 9/$123-$126 vertical bear put spread?

A: It expires in 12 days, so I would run it into expiration. That way the spread you bought at $2.60 will expire worth $3.00. We’re 80% cash now, so there is no opportunity cost of missing out with other positions.

Q: Do you like emerging markets (EEM)?

A: Only for the very long term; it’s too early to get in there now. (EEM) really needs a weak dollar and strong commodities to really get going, and right now we have the opposite. However, once they turn there will be a screaming “BUY” because historically emerging nations have double the growth rate of developed ones.

Q: Do you like the Invesco India ETF (PIN)?

A: Yes, I do; India is the leading emerging market ETF right now and I would stick with it. India is the next China. It has the next major infrastructure build-out to do, once they get politics, regulation, and corruption out of the way.

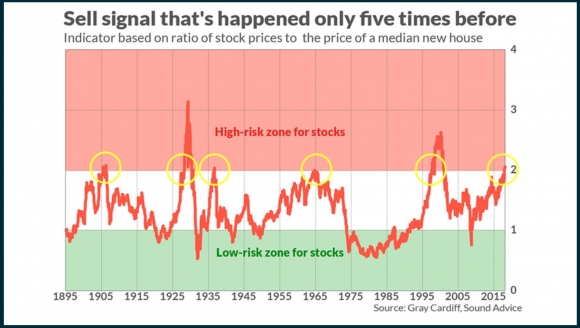

Q: Do you trade junk bonds (JNK), (HYG)?

A: Only at market tops and market bottoms, and we are at neither point. When the markets top out, a great short-selling opportunity will present itself. But I am hiding my research on this for now because I don’t want subscribers to sell short too early.

Q: With the (VXX), I bought the ETF outright instead of the options, what should I do here?

A: Sell for the short term. The iPath S&P 500 VIX Short-Term Futures ETN (VXX) has a huge contango that runs against it, which makes long-term holds a terrible idea. In this respect it is similar to oil and natural gas ETFs. Contango is when long-term futures sell at a big premium to short-term ones.

Q: How much higher for Apple (AAPL)?

A: It’s already unbelievably high, we hit $228 yesterday. Today it’s $228.73, a new all-time high. When it was at $150, my 2018 target was initially $200. Then I raised it to $220. I think it is now overbought territory, and you would be crazy to initiate a new entry here. We could be setting up for another situation where the day they bring out all their new phones in September, the stock peaks for the year and sells off shortly after.