“The French have more fun in one year than the English do in 10,” said John Adams, America’s second president, and one-time ambassador to Paris and London.

“The French have more fun in one year than the English do in 10,” said John Adams, America’s second president, and one-time ambassador to Paris and London.

Global Market Comments

August 23, 2018

Fiat Lux

Featured Trade:

(WHY THE DOW IS GOING TO 120,000),

(X), (IBM), (GM), (MSFT), (INTC), (DELL),

($INDU), (NFLX), (AMZN), (AAPL), (GOOGL),

(THE MAD HEDGE CONCIERGE SERVICE HAS AN OPENING),

(TESTIMONIAL)

For years, I have been predicting that a new Golden Age was setting up for America, a repeat of the Roaring Twenties. The response I received was that I was a permabull, a nut job, or a conman simply trying to sell more newsletters.

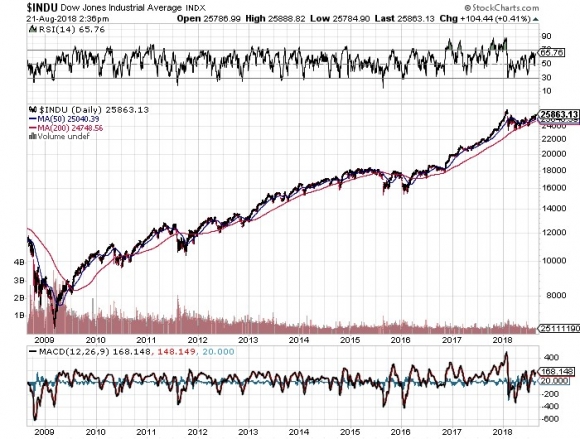

Now some strategists are finally starting to agree with me. They too are recognizing that a ganging up of three generations of investment preferences will combine to drive markets higher during the 2020s, much higher.

How high are we talking? How about a Dow Average of 120,000 by 2030, up another 465% from here? That is a 20-fold gain from the March 2009 bottom.

It’s all about demographics, which are creating an epic structural shortage of stocks. I’m talking about the 80 million Baby Boomers, 65 million from Generation X, and now 85 million Millennials. Add the three generations together and you end up with a staggering 230 million investors chasing stocks, the most in history, perhaps by a factor of two.

Oh, and by the way, the number of shares out there to buy is actually shrinking, thanks to a record $1 trillion in corporate stock buybacks.

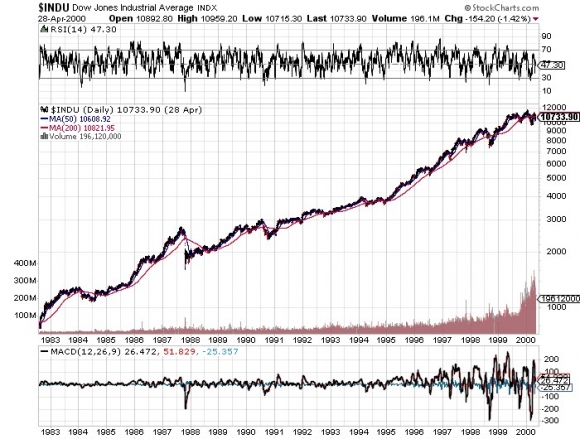

I’m not talking pie in the sky stuff here. Such ballistic moves have happened many times in history. And I am not talking about the 17th century tulip bubble. They have happened in my lifetime. From August 1982 until April 2000 the Dow Average rose, you guessed it, exactly 20 times, from 600 to 12,000, when the Dotcom bubble popped.

What have the Millennials been buying? I know many, like my kids, their friends, and the many new Millennials who have recently been subscribing to the Diary of a Mad Hedge Fund Trader. Yes, it seems you can learn new tricks from an old dog. But they are a different kind of investor.

Like all of us, they buy companies they know, work for, and are comfortable with. During my Dad’s generation that meant loading your portfolio with U.S. Steel (X), IBM (IBM), and General Motors (GM).

For my generation that meant buying Microsoft (MSFT), Intel (INTC), and Dell Computer (DELL).

For Millennials that means focusing on Netflix (NFLX), Amazon (AMZN), Apple (AAPL), and Alphabet (GOOGL).

That’s why these four stocks account for some 40% of this year’s 7% gain. Oh yes, and they bought a few Bitcoin along the way too, to their eternal grief.

There is one catch to this hyper-bullish scenario. Somewhere on the way to the next market apex at Dow 120,000 in 2030 we need to squeeze in a recession. That is increasingly becoming a topic of market discussion.

The consensus now is that an impending inverted yield curve will force a recession sometime between August 2019 to August 2020. Throwing fat on the fire will be a one-time only tax break and deficit spending that burns out sometime in 2019. These will be a major factor in U.S. corporate earnings growth dramatically slowing down from 26% today to 5% next year.

Bear markets in stocks historically precede recessions by an average of seven months so that puts the next peak in top prices taking place between February 2019 to February 2020.

When I get a better read on precise dates and market levels, you’ll be the first to know.

To read my full research piece on the topic please click here to read “Get Ready for the Coming Golden Age.”

I am pleased to announce that I have a rare opening for the Mad Hedge Fund Trader Executive Concierge Service, a program that is aimed at our most valued clients.

This is the first time an opening has become available since the service was initiated in November.

The goal is to provide high net worth individuals with the extra degree of assistance they may require in managing diversified portfolios. Tax, political, and economic issues will all be covered.

The service comes at $10,000 a year.

It is also the ideal service for the small- and medium-sized hedge fund that lacks the resources to support their own in-house global strategist full time.

The service includes the following:

1) A risk analysis of your own personal portfolio with the goal of focusing your investment in the highest return sectors for the long term.

2) A monthly phone call from John Thomas to update you on the current state of play in the global financial markets.

3) Personal meetings with John Thomas anywhere in the world once a year to continue your in-depth discussions.

4) A subscription to all Mad Hedge Fund Trader products and services. The cost for this highly personalized, bespoke service is $10,000 a year.

5) Think of it as an investment 911. If you require an instant read on the markets or a possible business venture, you will always have my personal cell phone number.

To best take advantage of Mad Hedge Fund Trader Executive Service, you should possess the following:

1) Be an existing subscriber to the Mad Hedge Fund Trader PRO who is already well aware of our strengths and limitations.

2) Have a liquid net worth of more than $5 million.

3) Possess a degree of knowledge and sophistication of financial markets. This is NOT for beginners.

It is my intention to limit the number of Concierge subscribers to 10. When a black swan comes out of the blue, I have to be able to call all of you within the hour and tell you the immediate impact on your portfolio, as I did last night in the wake of the Washington convictions.

A short note to thank John for great information and insight. Listening to John’s ideas is awesome, and I have committed to myself to keep following his research and trade ideas because the performance has been outstanding.

Regards

Dallas,

Melbourne, Australia

Global Market Comments

August 22, 2018

Fiat Lux

Featured Trade:

(WHY DOCTOR COPPER IS WAVING A RED FLAG),

($COPPER), (FCX), (USO),

(HANGING OUT WITH THE WOZ),

(AAPL)

One of my responsibilities as a global strategist is to talk about how cheap stocks are at market bottoms, and how expensive they are at market tops. In all honesty I have to tell you that 9 ½ years into a bull market, we are now much closer to a top than a bottom.

If Dr. Copper has anything to say about it the global economy is already in a recession. Since the June peak, trade wars have taken the red metal down a gut-punching 22.7%. The world’s largest copper producer Freeport-McMoRan (FCX), a Carl Icahn favorite, is off an eye-popping 30.6% during the same period.

Should we be running around with our hair on fire? Is it time to throw up on our shoes? I don’t think so…not yet anyway.

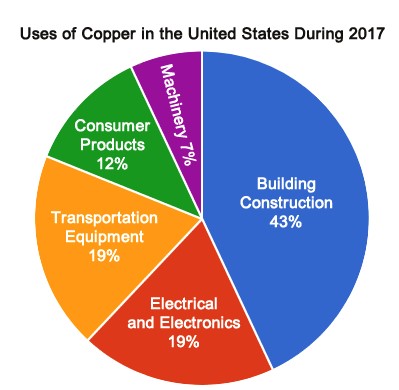

Dr. Copper achieved its vaunted status as a leading indicator of economic cycles for the simple reason that everyone uses copper. Building and construction took up 43% of the supply in 2017, followed by electronics (19%) and transportation equipment (17%).

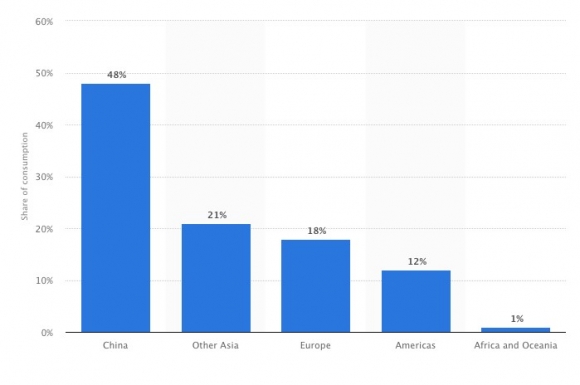

China is far and away the world’s largest consumer of copper. In 2017, it bought 48% of total world output. However, red flags there are flying everywhere.

Back in the 2000s, when China was building a “Rome a Day,” demand for copper seemed limitless. Since then, Chinese construction has fallen to a low ebb as the greatest infrastructure build-out in history came to completion.

China has steadily moved from an export-oriented to a services-driven economy, further eroding the need for copper. I warned investors of this seven years ago. That is why the Mad Hedge Fund Trader has issued virtually NO commodities-based Trade Alerts since then.

Before the last financial crisis Chinese banks accepted copper ingots as collateral for business loans. That practice is now banned.

In the second quarter, nonperforming loans at Chinese banks notched their biggest rise in more than a decade, according to research from Capital Economics. Corporate bond defaults are on the rise, and earlier this week, official reports showed Chinese investment growth, which has long been a driver of the economy, fell to its lowest level since the late 1990s.

The pressure on the Chinese economy is beginning to take its toll in other places, too. China’s currency, the renminbi, has fallen more than 9% against the dollar in the past six months, and China’s CSI 300 index of blue chip stocks is off 19% this year.

The net effect of all of this has been to dilute the predictive power of copper. Copper may no longer deserve its PhD in economics, perhaps only a master’s degree or an associate of arts.

Copper is not alone in predicting imminent economic disaster. Oil (USO) has also been shouting the same. Texas tea has fallen by 15.8% since copper began its swan dive two months ago.

For sure, oil has been falling for its own reasons. Iran has sidestepped American sanctions by selling its oil directly to China, and there is nothing the U.S. can do about it. Every year, global GDP growth needs less oil to grow than before thanks to alternative energy sources and conservation. A recent bout of OPEC quota cheating hasn’t helped either.

As any market strategist will tell you, falling copper and oil prices are not what sustainable bull markets in stocks are made of. I’m not saying a crash will happen tomorrow.

Personally, I believe that the bull market should spill into 2019. But when corporate earnings growth downshifts from 26% to 5% YOY, as it will in Q1 2019, watch out below!

I first spoke to Steve Wozniak via HAM radio when I was 12 years old and he was the 14-year-old president of the Homestead High School Radio Club in Cupertino, California.

With seven children, my dad was pretty stingy with allowance money. But when it came to electronic parts, I had an unlimited budget, as that is where he saw the future.

So, while other kids collected baseball cards, I stocked up on tubes, resistors, capacitors, and rheostats. This was back when you could buy WWII surplus parts from Radio Shack for pennies a pound.

Then the transistor came out, and building projects, like simple computers programmed with basic '1's' and '0's' suddenly became possible.

By junior high school, I had gained my radio license, learning Morse code at the required five words per minute, and a path opened that eventually led me to Woz.

Whenever I had a design problem, Woz always had a solution. He seemed to know everything about electronics.

I planned to attend De Anza College in the San Francisco Bay Area to collaborate with Woz, but then the State of California dropped a big fat scholarship to the University of Southern California in my lap, and we parted ways.

That's government for you. The state thought I was smarter than Woz. Ha!

The last thing he taught me was this really cool way to make long distance phone calls for free with something called a 'blue box.'

I later heard that Woz went to work for some kind of fruit company designing computers, which sounded stupid to me at the time, but Woz was always a guy who marched to a different drummer.

A decade later, I was an ambitious young vice president at Morgan Stanley, and ran into Woz again while escorting Steve Jobs around to big institutional investors hawking an Apple (AAPL) shares back when they were $1 on a split adjusted basis.

By then he had gained a lot of weight. He fascinated me with stories about how he had gone from scrounging around for a bootleg $12 chip, to making $100 million on the Apple IPO in just three years.

The phrase "only in America" has to come to mind.

We bought our planes at the same time, me a Cessna 340 twin, and he a Beechcraft Bonanza. When I heard he totaled his in a crash in Santa Cruz a few years later, I sent flowers to his hospital room, even though he was in a coma and wasn't expected to live.

In later years we moved into the same philanthropic circles at the San Francisco Ballet, the Computer Museum, and local art museums. To me, Woz always stood out at the social events as the only one who was not an inveterate social climber, the kind of which I tired of long ago.

That was vintage Woz. He just didn't care.

When I finally stumbled across his autobiography, iWoz, I grabbed it and devoured the pages in a couple of days.

The tome filled in the holes about what I knew about the man: the wives, the rock concerts, his universal remote-control idea, and the early days at Apple.

You also learn a lot about electronics and basic computer hardware and software design.

While there are a lot of fifth-grade science teachers who wish they were billionaires, there is only one billionaire who aspired to teach fifth-grade science. That is what Woz did for 10 years after he left Apple.

Despite the billions, Steve is still an all-right guy. With Apple stock having touched $218 last week he must be worth an unimaginable amount. He won’t tell anyone how much he still owns, and he doesn’t even have his own rocket program. To buy the book of his engaging and entertaining story, please click here at click here.

Global Market Comments

August 21, 2018

Fiat Lux

Featured Trade:

(DON’T MISS THE AUGUST 22 GLOBAL STRATEGY WEBINAR),

(PROFITING FROM AMERICA’S DEMOGRAPHIC COLLAPSE)

My next global strategy webinar will be held on Wednesday, August 22 at 12:00 PM EST, which I will be broadcasting live from Silicon Valley in California.

Mad Day Trader Bill Davis will be my willing co-conspirator.

I'll be giving you my updated outlook on stocks, bonds, commodities, currencies, precious metals, energy, and real estate.

The goal is to find the cheapest assets in the world to buy, the most expensive to sell short, and the appropriate securities with which to take positions.

I will also be opining on recent political events around the world and the investment implications therein.

I usually include some charts to highlight the most interesting new developments in the capital markets. There will be a live chat window with which you can pose your own questions.

The webinar will last 45 minutes to an hour. International readers and new subscribers who are unable to participate in the webinar live will find it posted on my website within a few hours. I look forward to hearing from you.

To log into the webinar, please click on the link we emailed you entitled, "Next Bi-Weekly Webinar - August 22, 2018" or click here.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.