"Have a seat at the table, or you'll end up on the menu," said a confidential friend of mine in the Trump administration.

Global Market Comments

January 25, 2018

Fiat Lux

Featured Trade:

(GOLD IS BREAK OUT ALL OVER),

(GLD), (GDX), (NEM),

(THE 13 NEW TRADING RULES FOR 2018)

I'm sitting here at my Lake Tahoe lakefront mansion watching the Dow Average meander and go nowhere.

It is one of those perfect, picture postcard days, with a blue sky and cobalt lake. The fields outside are covered with snow crystals sparkling in the sunshine.

After the close, I'm going to have to shovel off my outside decks to keep the weight of the ice from collapsing them.

Those (TLT) puts are looking pretty good this morning, and are approaching the maximum profit point with only a few weeks to expiration.

In these tedious trading conditions it is more important for me to teach you how to avoid doing the wrong thing than pursuing the right thing.

I am therefore going to fill you in on my 13 Rules for Trading in 2018. Tape them to the top of your computer monitor, commit them to memory, and maintain iron discipline.

They will save your wealth, if not your health. Here they are:

1) Dump all hubris, pretentions, and stubbornness. It will only cost you money.

2) The market is always right, even if all the prices appear wrong.

3) Only buy the puke outs and sell the euphoria. Do anything in the middle, and you will get whipsawed.

4) With option implied volatilities so low, outright calls and puts are offering a far better risk/reward right now than vertical bull and bear vertical call and put spreads. It is also better to buy stocks and ETF's outright with a tight stop loss. This won't last forever.

5) If you do trade spreads, you can no longer run them into expiration the collect the last few pennies. If you have a nice profit take it, don't hang on to the last 30 basis points, even if it means paying more commission. The world could end three times, and then recover three times, before the monthly expiration date rolls around.

6) Tighten up your stop loss limits. Not losing money is the key to winning in this market. There is nothing worse than having to dig yourself out of a hole. Don't run hemorrhaging losses, like the (VXX) from $55 down to $25. It will get easy again someday.

7) Buy every foreign crisis and sell every recovery. It really makes no difference to assets here in the US.

8) Several asset classes are becoming untradeable for long periods (retail, the ags). Stay away and stick to the asset classes that are working (technology stocks and short bonds). This is not the time to get greedy and bet the ranch.

10) Turn off the TV and just look at your screens and data. Public entertainers have no idea what the market is going to do, especially if their last job was sports reporting. Their job is to get you to watch the ads for General Motors and TD Ameritrade.

11) As the bull market in stocks enters its ninth year, too many traders, analysts, and strategists have become complacent. You are going to have to work for your crust of bread this year. This is an earnings, technology, and cash flow driven bull, not a QE or tax cut driven one.

12) It is clear that more money was allocated to high frequency traders this year. That is driving the new, breakneck volatility, increasing stop outs.

13) Ignore Washington at all costs. The market doesn't give a fig what's going on there, to quote The Queen.

The hackers are getting better. Better change your password too, from 12345 to DKFGGIDKFOKBJGELXPEVJBKDLKFBBJFCJCKVLBKGTY69!, and hope that the 69 doesn't give you away.

Only The Real Gunslingers are Prospering in This Market

Global Market Comments

January 24, 2018

Fiat Lux

Featured Trade:

(WHY CHINA'S US TREASURY DUMP WILL CRUSH THE BOND MARKET),

(TLT), (TBT), ($TNX), (FCX), (FXE), (FXY), (FXA),

(USO), (OXY), (ITB), (LEN), (HD), (GLD), (SLV), (CU),

(THE NEW OFFSHORE CENTER: AMERICA)

Years ago, if you asked traders what one event would destroy financial markets the answer was always the same: China dumping it's $1 trillion US treasury bond hoard.

It looks like Armageddon is finally here.

Chinese sellers were a major factor in the recent break of ten-year US Treasury bond yields above 2.60%. They recently tickled 2.68% a new four-year high. With a breakdown like this you could be printing a 2.90% yield in a couple of months.

You may read the president's punitive duties on Chinese solar panels as yet another attempt to crush California's burgeoning solar installation industry. I took it for what it really was: a signal to double up my short in the US Treasury bond market.

For it looks like the Chinese finally got the memo. Exploding American deficits have become the number one driver of all assets classes, perhaps for the next decade.

Not only are American bonds falling in value, so is the US dollar (UUP) in which they are denominated. This creates a double negative hockey stick effect on their value for any foreign investor.

In fact, you can draw up an all assets class portfolio based on the assumption that the US government is now the new debt hog:

Stocks -Buy inflation plays like Freeport McMoRan (FCX) and US Steel (X)

Emerging Markets - Buy asset producers like Chile (ECH)

Bonds - run a double short position in the (TLT)

Foreign Exchange - Buy the Euro (FXE), Yen (FXY), and Aussie (FXA)

Commodities - Buy copper (CU) as an inflation hedge

Energy - another inflation beneficiary (USO), (OXY)

Precious Metals -Entering a new bull market for gold (GLD) and silver (SLV)

Real Estate - The ultimate hard asset with a massive demographic tailwind (ITB), (HD), (LEN)

Yes, all of sudden everything has become so simple, as if the fog has suddenly been lifted.

Focus on the US budget deficit, which has soared from $450 billion a year ago to $700 billion today on its way to $1.2 trillion later this year, and every investment decision becomes a piece of cake.

This exponential growth of US government borrowing should take the US National Debt from $20 to $30 trillion over the next decade.

I have been dealing with the Chinese government for 45 years and have come to know them well. They never forget anything. They are still trying to get the West to atone for three Opium Wars that started 179 years ago.

Imagine how long it will take them to forget about washing machine duties?

By the way, if I look uncommonly thin in the photo below it's because there was a famine raging in China during the Cultural Revolution in which 50 million died. The Chinese government never owned up to it.

Don't See Any Bond Buyers Here

Global Market Comments

January 23, 2018

Fiat Lux

Featured Trade:

(KEEP A CLOSE EYE ON FREEPORT MCMORAN),

(FCX), (COPPER), ($SSEC), (BHP), (RIO), (ECH), (CU),

(WILL BITCOINS REPLACE THE $10,000 BILL), (GLD),

(THE SERVICE JOB IN YOUR FUTURE), (MCD)

It is clear from the improving economic data from China that the hard landing scenario is off the table. It is all part of the synchronized global economic recovery that is powering financial markets everywhere.

This is great news for the producers of everything that the Middle Kingdom buys in bulk, especially copper.

If you like copper, you've got to love Freeport-McMoRan (FCX), one of the world's largest producers for the red metal. These factors explain the sizeable insider buying that has been taking place in the shares over the past months.

The technical picture is looking pretty positive as well. The chart is showing that a strong upside breakout took place in the fall, supported by a sharp turn up in the 50-day moving average. This is universally positive for share prices.

This commodity is known in the investment industry as Dr. Copper, the only metal that has a PhD in economics. That's because of its uncanny ability to predict the future of the global economy.

Copper is now screaming of better things to come, along with the stock market, like a 3.5% GDP growth rate in the US this year, and stronger growth elsewhere.

The recent strength further is confirmed by longer-term charts for the Shanghai index ($SSEC), which is showing that a double bottom may well be in place.

Copper was the first metal used by man in any quantity. The earliest workers in the red metal found that it could be easily hammered into sheets and worked into shapes, like swords, which became more complex and artistic as their skill increased.

The ability to resist corrosion ensured that copper, bronze and brass remained as functional as well as decorative materials during the Middle Ages and through the Industrial Revolution to the present day.

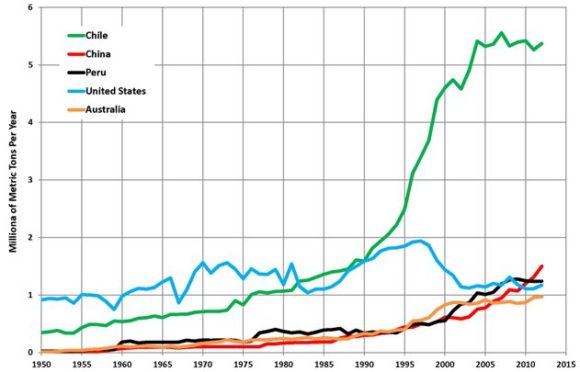

Of the 19.1 million metric tonnes of copper produced in 2015, the latest year for which figures are available, Chile was far and away the leader, with 5.76 million metric tonnes. It was followed by China at 1.71 million tonnes, Peru at 1.7 million tonnes, and the US at 1.38 million tonnes.

This makes the Chile ETF (ECH) another great backdoor play in copper, which is up a ballistic 178% in two years.

As copper is a great electrical conductor, it is primarily used for electrical wiring, followed by the construction industry and shipbuilding, and the auto industry, especially in the rapidly growing electric vehicle space.

It's true that copper is no longer the dominant metal it once was, due to a structural global oversupply in shipping and the ongoing transition of the Chinese economy from a manufacturing to a services economy. Their copper intensive infrastructure is already largely built out.

Because of the lack of a consumer banking system in the Middle Kingdom, individuals have been hoarding 100-pound copper bars and posting them as collateral for loans. Get any weakness of the kind we saw in 2015, and lenders panic, dumping their collateral for cash. That's what made the early 2016 bottom.

The high frequency traders are now also in there in force, whipping around prices and creating unprecedented volatility. You can see this also in gold, silver, oil, coal, platinum, and palladium.

This is why I am spurring readers into the shares of Freeport McMoRan. The gearing in the company is such that a 50% rise in the price of copper triggers a 100% rise in (FCX).

More conservative and less leveraged investors can buy the First Trust ISE Global Copper ETF (CU).

Where to Find Copper

The conspiracy theorists will love this one.

The IRS has long despised the barbaric relic (GLD) as an ideal medium to make invisible large transactions. Did you ever wonder what happened to $500, $1,000, $5,000, and $10,000 bills?

Although the Federal Reserve claims on their website that they were withdrawn because of lack of use, the word at the time was that they disappeared to clamp down on money laundering operations by the mafia.

In fact, the goal was to flush out income from the rest of us.

Currency trivia question of the day: whose picture was engraved on the $10,000 bill? You guessed it, Salmon P. Chase, Abraham Lincoln's Secretary of the Treasury.

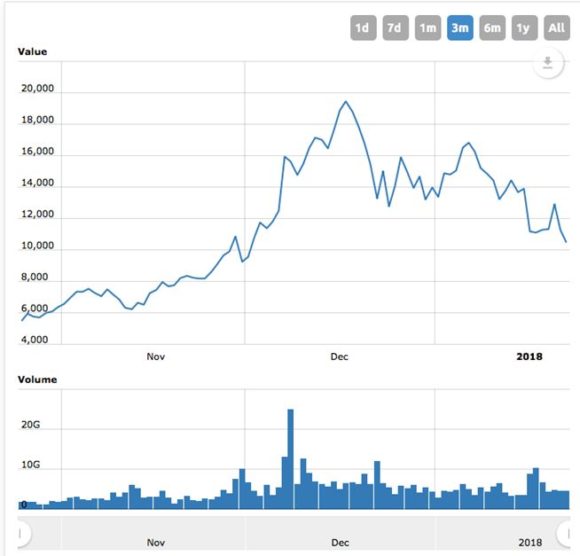

Now organized crime, terrorists, and tax cheats have another means with which to sidestep the IRS: Bitcoin.

When India dumped its high denomination banknotes in 2016, to where did everyone flee? To Bitcoins.

When China clamped down on individuals desperate to get their savings out of the country, what means did they use? Bitcoin.

As a result, the price of Bitcoins exploded some 110% to $1,100 over the past six months, and then crashed.

It is an old nostrum that if you block one means to avoid taxes, new ones will spring up to replace them.

This is a classic case.

Out With the Old

In With the New

Anyone wondering about the long term future of the US economy is amazed at how fast it is evolving.

There has been an unrelenting growth of services' share of American GDP, from 25% to 45% over the last sixty years.

Far and away the fastest growth area for the past eight years has been health care, thanks to Obamacare. With that program now headed for the dustbin of history, those job gains are about to be quickly unwound.

It takes one health care professional to take care of 14 Americans. If you eliminate health care for 20 million, that eliminates 1.42 million jobs.

That's what will happen if our national health care is eliminated without a replacement.

This is not necessarily a bad thing. Would you rather be mining coal or designing a website? Do you want to earn $12 an hour, or $150?

These statistics make us the envy of the world, as services are where the future lies. By creating so many key technologies, our country has been the most successful in the world in climbing up the value chain.

China can have all the $3 an hour jobs it wants.

Services largely comprise pure intellectual content, require no raw materials, and the end product can be transmitted over the Internet.

There is a reason why nearly a million foreign students have flocked to the US for an education.

Emerging nations like China and South Korea, which only see services generating 10%-15% of their GDP, are wracking their brains trying to figure out how to play catch up.

Global Market Comments

January 22, 2018

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or CLOSED FOR BUSINESS),

(SPY), (TLT), (TBT), (GLD), (AAPL), (FB),

(BUSINESS IS BOOMING AT THE MONEY PRINTERS)

(TESTIMONIAL)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.