He did just enough.

He did 5% enough, but it should have been 10%.

That was the performance of the highly controversial data company Facebook (FB) in the wake of Mark Zuckerberg's (the aforementioned "he") testimony in front of politicians who failed to correctly pronounce his name let alone understand his business model.

But Zuckerberg did well.

Well enough that investors approved in droves.

Facebook shares tanked after the Cambridge Analytica scandal was disclosed, and the stock traded 16% below its February high.

The FANG stocks lost more than $200 billion in market value at one point when the headlines went viral.

Amazon (AMZN) and Netflix (NFLX) accounted for more than 30% of the S&P 500's 2018 gains in February, and their contribution has dipped to about 24% as of early April.

The leadership burden for large-cap tech is a resilient pillar propping up the equity market.

Let's get this straight - there has been no regulation as of yet but this moves forward any regulation that eventually was going to happen.

However, it could be a highly diluted version of any worst-case scenarios of which one could think.

The big question: Will earnings and guidance be sideswiped because of higher data costs?

And how many of the 2.2 billion MAU (Monthly Active Users) permanently deleted their Facebook accounts?

Facebook profile removals surged to 4,000 to 5,000 the first few days after the news hit and decreased to 2,000 per day in late March. The numbers further subsided to 1,000 at the start of April.

Deletions around the political testimony were clocking in between 1,000 to 2,000 per day.

To put this into perspective, the extirpation of accounts was only about 30% of the Snapchat rebellion where users quit in hoards because of a sub-optimal design refresh.

The media has done its best to sensationalize events and avoid the fact that hyper-targeting ad models has been around for years and has been used by various companies.

Facebook is not the only one.

Bottom line, there has been no material damage to user volume, and the testimony will empower tech because of Washington's botched question session.

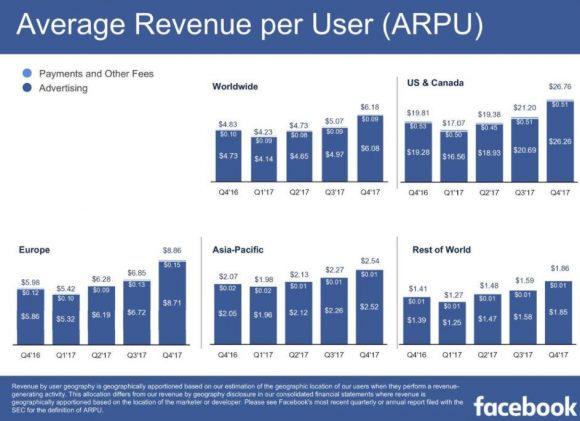

Most of Facebook's profits come from less than 10% of user accounts.

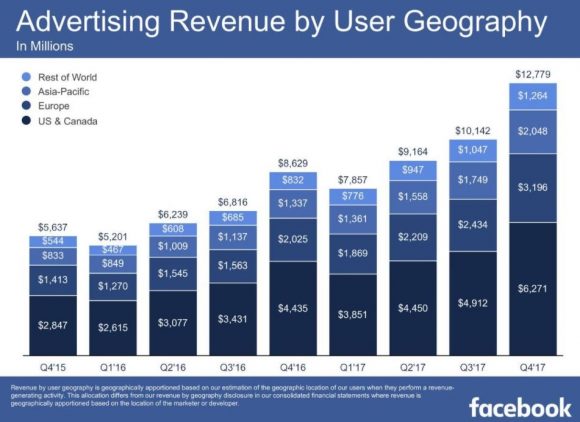

Facebook is a one-trick pony with 98% of profits coming from ad revenue.

To add granularity, the bulk of revenue derives from developed nations mainly from North America, which make up more than 50%, and Europe at about 30% of total revenue.

Falling user engagement from the developed English speaking world would be a canary in the coal mine.

I am not talking about a few thousand profile deletions. However, a mass removal of 50,000 profiles or 100,000 profiles per day would throw Mark Zuckerberg into a tizzy.

If Facebook can convince users to stick around then Mark Zuckerberg is the ultimate winner.

With all the fearmongering, some facts get swept under the carpet. And it could be the case that many users are fine with Facebook possessing large swaths of their personal data.

In reality, users might prefer Facebook to Washington when it comes to possessing their personal information.

The performance of politicians lined up to interrogate Mark Zuckerberg was an unmitigated disaster for the political elite.

It is clear there is a competency issue with politicians. The generation bias has given us a fleet of politicians who have almost zero grasp of technology and its pervasive use in America's economy.

Many politicians showed a weak grasp of Facebook's profit engine.

Some politicians were more focused on Facebook's diversity policy than the real issue at hand.

Let's not forget Zuckerberg also controls 60% of voting rights through his accumulation of Facebook Class B shares and has an iron grip on any direction where the company traverses.

Any meaningful regulation costs will be passed onto the advertisers as a cost of doing business.

This is the key lever investors don't fully understand.

Facebook currently uses an auction-based system for ad pricing but could easily slip in stand-alone regulatory fees to compensate the extra costs.

The industries move from CPC (cost per click) to CPM (cost per impression) including duopoly playmate Alphabet (GOOGL) is a great strategy to pad profits.

The only real incurred cost to Facebook is the in-house DevOps team responsible for platform enhancement.

Facebook tried to experiment in 2016 by charging Facebook-owned smartphone messaging service WhatsApp users a $1 per year fee to use the messaging service.

It has done the groundwork to roll out a mass paid service.

Facebook later decided against this move as many users of WhatsApp are from undeveloped countries with no access to credit card payment services.

Zuckerberg is awkward. However, he has come a long way since his hoody days, even using smoke and mirrors to wriggle out of probing questions.

Half the "grilling" he received in Washington was met with the same vanilla answer saying that his team will get back to them.

The peak of evasiveness was Zuckerberg's response to a question about the willingness to change the business model in the interest of protecting individual privacy.

Zuckerberg stated he was "not sure what that means."

The hammering in Facebook shares was overdone.

It is obvious Washington is no match for large cap tech.

Facebook's upside trajectory has been sacrificed in the short term, but one could argue regulation was on the way - regardless of this data breach.

Regulation is a natural progression for an industry with almost no meaningful regulation.

Therefore, a little regulation for tech does not mean the end of tech.

Facebook is not going out of business. Not anytime soon.

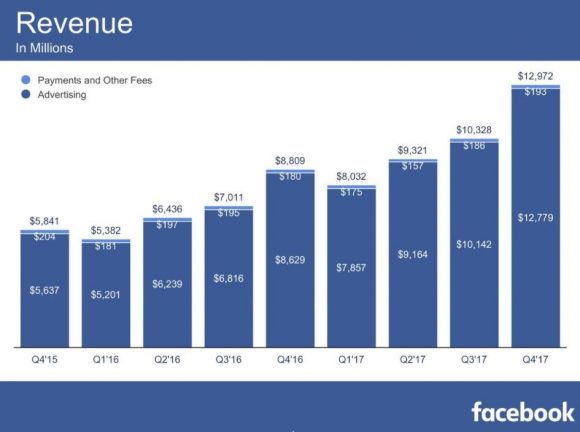

Facebook earned revenue of $27.64 billion in 2016, on the back of $40.65 billion in 2017.

Facebook does not need to be "fixed" - it just needs a few bandages in place before it goes back onto the field.

These bandages will damage operating margins that are currently at 57% in Q4 2017, but their long-term fundamentals are still intact.

The wall of worry is unfounded and ad engagement is still solid.

Facebook is in store for record bottom- and top-line numbers when earnings come out. Ad revenue numbers and the guidance will be the key metric to digest.

Investors might want Zuckerberg to kitchen sink the quarter because most of the bad news is already priced into the stock and might as well dig out all the skeletons in the closet.

Regulation is positive for Facebook because Facebook and the rest of the FANGs are in the best position to confront the regulations. The worst case scenario is finding a backdoor way to navigate through the new rules just as the backdoor way of profiting through ad distribution.

The headline hysteria makes it seem like Facebook is about to go under and file Chapter 11.

The bar has been set so low for upcoming earnings that any reasonable guidance will be seen as a victory.

Advertisers have no choice but to pay for Facebook ads if they want to grow business - that has not changed.

Facebook is growing so fast that the CEO could not name the competition when he was asked at the hearing.

There is a huge short squeeze setting up for the next earnings report due out on April 25, 2018.

Lastly, WhatsApp recently surpassed 1.5 billion MAU with users sending more than 60 billion messages every day.

Remember that Mark Zuckerberg purchased WhatsApp when it had around 500 million MAU back in February 2014.

This service hasn't even started to monetize yet and was a genius piece of business for $19.3 billion in 2014.

The valuation is at least double to triple the price of purchase now but seemed ludicrously expensive when Facebook snapped it up at the time.

Facebook has bottomed out, and the added bonus is it is quite insulated from all the tariff chaos whipsawing the equity markets.

__________________________________________________________________________________________________

Quote of the Day

"I'm on the Facebook board now. Little did they know that I thought Facebook was really stupid when I first heard about it back in 2005."- said founder and CEO of Netflix Reed Hastings