While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points. Read more

Global Market Comments

June 28, 2011

Fiat Lux

(NOTICE TO SUBSCRIBERS

TAKING OFF FOR EUROPE)

My tux and white dinner jacket are packed, the hotels are booked, and the limo is waiting outside. The Cessna is fully fueled and the flight plan filed. I am taking off for my annual European Strategy Luncheon Tour.

Along the way I will be meeting with other hedge fund managers, senior government officials, CEO?s at major banks and Fortune 500 companies, large institutional investors, and a Nobel Prize winner or two. Getting out into the real world and soaking up new data and opinions in invaluable in shaping my own global view, and your performance benefits from it. Since I don?t stumble across these people in my living room, I have to seek them out.

After pit stops in Chicago and New York, I?ll board the Cunard Line?s Queen May II at the Brooklyn Cruise Terminal to take residence in the owner?s suite. As we pass over the wreck of the Titanic on the second day out, we?ll throw a bouquet of flowers as a mark of respect.

In London I?ll catch William Shakespeare?s A Midsummer Night?s Dream at the Globe Theater, spend an evening at the Royal Ballet, and visit the Royal Academy of Arts Summer Exhibition. At least one morning will find me catching an old-fashioned straight razor shave at the Jermyn Street Barbers, and topping up my supply of business shirts at Turnbull & Asser.

The cheese trolley at the Michelin restaurant is to die for. For accommodations I?ll be staying at the ever reliable, if not Spartan, British Navy Officers Club. You know, the place where Horatio Nelson used to drink with his junior officers?

I?ll then board the Orient Express for Venice, where the dinner is black tie only. Hopefully, there won?t be any murders this time. If a new Brioni suit and pair of Gucci shoes throw themselves upon me while I stroll through the Galleria in Milan I may be unable to resist.

In Geneva I?ll be consulting with the representatives of several Middle Eastern royal families while they vacation in the Alps. One afternoon will be devoted to taking the paddle wheel steamer on Lake Geneva to the Chateau de Chillon in Montreux where Lord Byron used to live, sipping fine Swiss white wines along the way.

The grand finale will be my annual assault on the Matterhorn at Zermatt, which at 14,692 feet, is higher than anything we have in the continental US. After training all year for this, it?s now or never. I spend my evenings there at public steam baths where, afterwards, I roll around in the snow and beat myself with birch branches. It is invigorating, to say the least.

I will be traveling with my laptop and keeping touch with the markets. While 18th century Internet service is passable, the bandwidth can be snail like. So unless I see something extraordinary, I will cut back on new Trade Alerts. After running up a 36% return in six months, and beating 99% of the hedge funds in the industry, I deserve a break. I need to spend some time alone on a mountaintop, communing with the spirits, attempting to discover the new long-term market trends through the mist.

While on the road, I will continue writing my newsletter, giving you my daily dose of market insight. I will also be re-running some of my favorite research pieces from the past. This is to expose my thousands on new subscribers to the golden oldies, and to remind the legacy readers who have since forgotten them. I will be back in San Francisco in mid August, glued to my screens once again for another year of toil. In the meantime, please feel free to email me.

Mad Day Trader, Jim Parker, will be putting the pedal to the metal to get his new product off the ground, and will be working straight through the summer.

In the meantime, I shall be raising a glass to all of you at dinner, the loyal readers of The Diary of a Mad Hedge Fund Trader. Salute! Prost! And Cheers! Thanks for making this letter a huge success!

If you want to take the opportunity to meet me in person, please find my strategy luncheon schedule below. To purchase tickets for the luncheons, please go to my online store at http://madhedgefundradio.com/ and click on ?STRATEGY LUNCHEONS?, and the city of your choice.

New York City - July 2

London, England - July 8

Amsterdam, Netherlands - July 12

Berlin, Germany - July 16

Frankfurt, Germany - July 19

Portofino, Italy - July 25

Mykonos, Greece - August 1

Zermatt, Switzerland - August 9

I?ll Meet You on Top

Global Market Comments

June 27, 2013

Fiat Lux

Featured Trade:

(UPDATED 2013 STRATEGY LUNCHEON SCHEDULE),

(THE BITTER MEDICINE FOR THE STATES),

(THE FALLING MARKET FOR KIDS),

(HOLLYWOOD CASHES IN ON WALL STREET TROUBLES)

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Updates, which I will be conducting throughout Europe during the summer of 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store at http://madhedgefundradio.com/ and click on ?STRATEGY LUNCHEONS?.

New York City - July 2

London, England - July 8

Amsterdam, Netherlands - July 12

Berlin, Germany - July 16

Frankfurt, Germany - July 19

Portofino, Italy - July 25

Mykonos, Greece - August 1

Zermatt, Switzerland - August 9

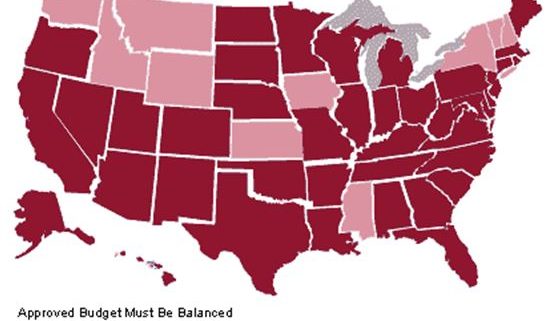

On a map, it appears that the United States is made up of 50 states. The fiscal reality is that we have 20 Portugal?s, 15 Italy?s, 10 Ireland?s, 3 Greece?s, and 2 Spain?s.

In the aftermath of the Great Recession, state GDP?s saw the sharpest drop since 1981. States shoveled money out of the economy nearly as fast as the Obama administration shoveled it in. During the bubble, the states wildly overestimated revenues, thought they were richer than they really were, and bulked up on social services as if the party would go on forever.

As a result, spending grew faster than the economy for many years, especially when it came to building new prisons. Because of the ephemeral nature of property and stock gains, that movie now has to run in reverse, and state services have to shrink down to what they can afford.

During the last two recessions, state and local governments hired, easing some of the pain at the local level. Not this time. Teachers, policemen, and firemen have been laid off with reckless abandon, the oldest and most expensive usually targeted to go first.

Entitlements, primarily state employee pension payments, are going to have to be the top priority, which in many cases now exceed those in the private sector. The headache is so huge that it is mathematically impossible for any tax increase to address the shortfall alone. No action at all brings slower economic growth and fewer jobs. This is all one reason why I am pounding the table for a long-term growth rate of 2%-2.5% which the financial markets have only recently started to embrace.

Until the 19th century, children used to provide income and security for their parents as they worked on the family farm. That dynamic continued when industrialization brought families into the cities and kids into the factories.

Since then, children have been a great short. A hundred years of state mandated education and child labor laws increased the cost of raising children while reducing their income potential. Today many offspring stay in increasingly expensive schools until their mid-twenties without earning a dime of income.

A century ago, 10 children were a godsend. Today they would be ruinous. Spending on children has flipped from an investment to conspicuous consumption. I count myself in the latter category, as I have five kids of my own. The cost of children is proving to be the most effective form of birth control. The problem is that it is working too well, as fertility rates are collapsing in all parts of the globe, except in the Islamic world.

Many nations have fertility rates that during 2005-2010 plunged far below the 2.1 replacement rate, like Taiwan (1.14) Italy (1.18), Japan (1.27), and Russia (1.34). The US is nearly at breakeven at 2.05, versus a world average of 2.55, and an amazing 7.19 in the sub Saharan nation of Niger. This is partially being offset by lifespans that have doubled since 1800 in the industrialized world from 40 to 80, and are now quickly ratcheting up in emerging nations.

The World Bank expects the global population to jump by 2 billion to 9 billion by 2050, and then flatten out. The big question for all of us: what does a zero population growth mean for the economy, which until now has always been driven on an endlessly rising number of consumers? How soon will financial markets start to discount its implications, whatever they are? Expect to hear a lot more about this issue.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.