Global Market Comments

June 26, 2013

Fiat Lux

Featured Trade:

(JULY 8 LONDON STRATEGY LUNCHEON),

(MEET MAD DAY TRADER JIM PARKER AT THE JULY 2 NEW YORK LUNCH),

(WHERE THE ECONOMIST "BIG MAC" INDEX FINDS CURRENCY VALUE),

(FXF), (FXE), (FXA), (CYB)

(ANOTHER MIRACLE FROM TESLA), (TSLA), (SCTY)

CurrencyShares Swiss Franc Trust (FXF)

CurrencyShares Euro Trust (FXE)

CurrencyShares Australian Dollar Trust (FXA)

WisdomTree Chinese Yuan (CYB)

Tesla Motors, Inc. (TSLA)

SolarCity Corporation (SCTY)

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in London on Monday, July 8, 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $249.

I?ll be arriving an hour early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a private club on St. James Street, the details of which will be emailed to you with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

Jim Parker, who runs our Mad Day Trader Service, will be making a last minute appearance at my New York strategy luncheon on July 2. There you can ask him any questions you want about his new short term trade mentoring program, which goes on sale on Monday. You can buy his service as a stand-alone product for $2,000 per year, or $1,000 as an upgrade to your existing Global Trading Dispatch package.

To buy tickets for the luncheon, please buy a ticket for $209 by clicking here. I just ordered the food, and I decided to go for the Big Apple menu with the New York style cheesecake for dessert. See you there, and don?t forget about the strict dress code.

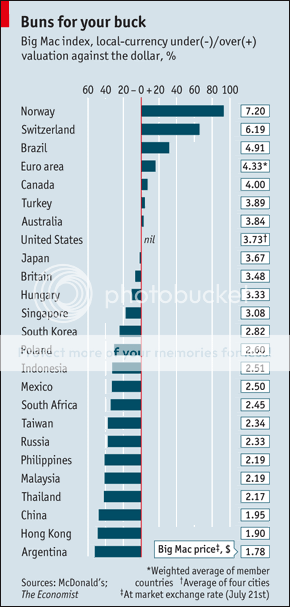

My former employer, The Economist, once the ever tolerant editor of my flabby, disjointed, and juvenile prose (Thanks Peter and Marjorie), has released its ?Big Mac? index of international currency valuations.

Although initially launched as a joke three decades ago, I have followed it religiously and found it an amazingly accurate predictor of future economic success. The index counts the cost of McDonald?s (MCD) premium sandwich around the world, ranging from $7.20 in Norway to $1.78 in Argentina, and comes up with a measure of currency under and over valuation.

What are its conclusions today? The Swiss franc (FXF), the Brazilian real, and the Euro (FXE) are overvalued, while the Hong Kong dollar, the Chinese Yuan (CYB), and the Thai Baht are cheap. I couldn?t agree more with many of these conclusions. It?s as if the august weekly publication was tapping The Diary of the Mad Hedge Fund Trader for ideas. I am no longer the frequent consumer of Big Macs that I once was, as my metabolism has slowed to such an extent that in eating one, you might as well tape it to my ass. Better to use it as an economic forecasting tool, than a speedy lunch.

![mcdonaldsJapan]() The Big Mac in Yen is Definitely Not a Buy

The Big Mac in Yen is Definitely Not a Buy

Tesla has announced a new battery swapping service that will enable drivers to get a full charge for their all-electric Model S-1 sedans in 90 seconds. The service will be available at strategically located charging stations around the country, and will cost $60, about the cost of an equivalent full tank of gas.

The swap is fully automated. You just drive over a machine and it is all done for you. No crawling under the car on your back is required.

There, owners will have the option of getting a fast charge for free in 45 minutes, or the instant battery swap. Given that the 270-mile range of the car is greater than the range of by bladder, I?ll probably be opting for the former.

The move offers some very interesting long-term implications. It certainly means that Tesla is not worried about the life of its 1,000-pound lithium ion batteries, which cost about $32,000 per vehicle to produce. If the range starts to fade, you just take it in for a swap.

In any case, the company?s mercurial founder and Iron Man model, Elon Musk, has other plans for old, depleted batteries. For a start, they can be used as backup storage devices for solar powered homes wired by his other firm, Solar City (SCTY), a top performing stock of 2013.

In the meantime, Tesla?s shares are impossibly maintaining a stratospheric price of over $100, valuing the company at $11 billion, and making it the number one performing American stock this year. This is despite announcing its first recall for a minor weld holding down the rear seat.

I tell my kids that I rode a time machine ten years into the future, bought the Tesla, and brought it back home to drive them. Ever the wise aleck, my oldest son asked why I didn?t obtain something more valuable, like a sports statistics magazine showing who will win the next ten Super Bowls. Now, that would be useful!

For a video of Elon demonstration the battery swap process last week and a fabulous piece of marketing, please click here. No wonder people are going gaga over this company!

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Seminar, which I will be conducting in New York, NY on Tuesday, July 2, 2013. An excellent three-course lunch will be provided. A PowerPoint presentation will be followed by an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $209.

The formal luncheon will run from 12:00 to 2:00 PM. I?ll be arriving an hour early and leaving late in case anyone wants to have a one on one discussion, or just sit around and chew the fat about the financial markets.

The event will be held at a prestigious private club on Central Park South, the details of which will be emailed to you with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

In these frenetic, violent, take no prisoners markets I managed to grab a few precious minutes with Mad Day Trader, Jim Parker.? Jim uses a dozen proprietary short-term technical and momentum indicators to give some much-needed guidance in these trying times.

It?s all about the bond market, says Jim. Sell every rally until proven otherwise. After bottoming this morning at $107.76, the long bond ETF (TLT) could run back up to as high as $113, where it will be a great SELL. Followers of the short bond ETF (TBT) should leap at the chance to reload at $71, down from the recent high of $76.

Making trading particularly treacherous this week will be the unusual number of Fed Open Market Committee members opining on their future policies. Several investment houses put out buy recommendations for bonds this morning. But they are all early. Once traders covered their initial shorts in the fixed income space, they never got back in, as the decline was so precipitous, including myself. That means there is enough firepower on the short side to take us all the way to the 2.90%-3.00% range in yield terms.

Jim doesn?t want to go near stocks here, and believes that broad ranges are setting up that will be good for the next two to three months. We tickled the first support level this morning at 1,562, and the following rally should be sold. We may well test 1,530 and 1,440 below, and bounces from there should be sold as well. Apple (AAPL) has to hold $386 to double bottom. If it does, the long side opportunity there will be huge, as this is close to down half from the all time high. Long term players might even get a double.

Parker doesn?t want to touch gold, or the precious metals, with a ten foot pole. Oil (USO) will test the lower end of a $12 range at $85 that has prevailed for the past year, from $85-$97. Copper (CU) might be double bottoming here at $2.95/pound. If it fails, we could lose another 30-40 cents very quickly. Please excuse the mismatch between the ETF?s and the underlying, but time is short. You?ll just have to extrapolate.

The Mad Day Trader will go on sale as a stand-alone product this coming Monday, July 1, my first major upgrade to your service.

While Global Trading Dispatch focuses on investment over a one week to six-month time frame, Mad Day Trader will exploit money-making opportunities over a ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

As with our existing service, you will receive ticker symbols, entry and exit points, targets, stop losses, and regular real time updates. At the end of each day, a separate short-term model portfolio will be posted on the website.

The new service will generate long and short-selling signals for a range of widely traded exchange traded funds (ETF?s). These include stock indexes (SPY), bonds (TLT), (TBT), foreign exchange (FXY), (FXE), (FXA), commodities (CU), (CORN), energy (USO), (UNG), and precious metals (GLD), (SLV).

There is also a special focus on the leading hot stocks of the day. This will be followed up with a series of educational webinars that will be an important resource for the serious trader.

I have been following Jim?s alerts for the past five years, and his impeccable market timing has become an important part of the ?unfair advantage? that I provide readers. The time has finally come to offer Mad Day Trader as a stand-alone product.

A trading service with this degree of success and sophistication normally costs $20,000 a year. As a client of The Mad Hedge Fund Trader, you can purchase Mad Day Trader alone for $2,000 a year or $699 a quarter. Or you can buy it as a package together with Global Trading Dispatch, which we call Global Trading Dispatch Pro, for $4,000 a year, a 20% discount to the full retail price.

Existing subscribers to Global Trading Dispatch are invited to upgrade their subscription to include both products. Just send an email to Nancy at customer support at support@madhedgefundtrader.com . Please put ?Mad Day Trader Upgrade? in the subject line.

She will calculate the remaining value of your current subscription and give you a full credit towards the new one-year Global Trading Dispatch Pro subscription. She will then send you instructions on where to send a check. As no two amounts will be the same, our store is unable to handle personalized orders.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.