Global Market Comments

June 14, 2013

Fiat Lux

Featured Trade:

(UPDATED 2013 SUMMER STRATEGY LUNCHEON SCHEDULE),

(THE YEN CARRY TRADE BLOW UP),

(FXY), (YCS), (DXJ), (SNE), (HMC), (TM),

(THE SERVICE JOB IN YOUR FUTURE), (MCD)

CurrencyShares Japanese Yen Trust (FXY)

ProShares UltraShort Yen (YCS)

WisdomTree Japan Hedged Equity (DXJ)

Sony Corporation (SNE)

Honda Motor Co., Ltd. (HMC)

Toyota Motor Corporation (TM)

McDonald's Corp. (MCD)

Come join me for lunch for the Mad Hedge Fund Trader?s Global Strategy Updates, which I will be conducting throughout Europe during the summer of 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, currencies commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store at http://madhedgefundradio.com/ and click on ?STRATEGY LUNCHEONS?.

New York City - July 2

London, England - July 8

Amsterdam, Netherlands - July 12

Berlin, Germany - July 16

Frankfurt, Germany - July 19

Portofino, Italy - July 25

Mykonos, Greece - August 1

Zermatt, Switzerland - August 9

When I staggered downstairs at 11:00 PM to check the close for the Tokyo stock market, my eyes just about popped out of my head. Yikes! Down 6.3%! The yen was up another 2% to ?94 against the US dollar as well!! It looked like the world was in for another round of ?RISK OFF? with a turbocharger. Fasten your seatbelts, and pack an extra pair of shorts.

So I called an old friend in Japan who always seems to know what is going on whenever the wheels fall off there. Ed Merner is the CEO of the Atlantis Japan Growth Fund (LSE-AJG), who has long been rated the number one stock picker in the Land of the Rising Sun. Ed?s fund, which trades on the London Stock Exchange, was, at one point, up a gob smacking 53% this year without a stitch of leverage.

When the ink was barely dry on the US Japan peace treaty in 1950, Ed?s father uprooted his family from the rural High Sierra hamlet of Truckee, California, and moved them to Tokyo. That gave him a front row seat to the economic miracle that followed in the fifties and sixties.

Ed started managing money just a few years before me, in 1970. He toiled away as a portfolio manager at Schroeder?s & Co. in Tokyo for 25 years and then launched his own firm in 1995. Ed, who is a fascinating individual and a genuine nice guy, is the man I always turn to for my long-term view on Japan. Suffice it to say, Ed knows which end of a piece of sushi to hold upward, and is said to be able to snatch a fly midair with a pair of chopsticks. His Japanese is flawless, and he is now regarded as a local celebrity.

Ed says that the ?Rebirth of Japan? story is anything but over, and in fact, is just getting started. He thinks that the Nikkei index could soar from the current ?12,445 to above the 1989 all time high of ?39,000 in years to come. What we are seeing now is a long overdue rest for the world?s best performing major stock market. Bank of Japan mouthing?s of empty platitudes, rather than concrete action is what triggered the current rout.

Much of the money that went into Japan this year was of the hot, algorithm driven variety. You saw this in the dominance of the index names in trading, like Sony (SNE), Toyota (TM), and Honda Motors (HMC). Individual stock picking almost ceased to exist as an investment strategy. When the same hedge funds all tried to unwind their Japanese stock longs and yen shorts at the same time, you got the predictable flash fire in the movie theater. Margin calls became the order of the day.

As the index money leaves in this correction, it will be replaced by more traditional mutual fund and individual investors, who have a more stable orientation. Stock selection will become more fundamentally driven. That?s when Japan transitions from the flavor of the day to a serious core investment.

Now is about the time you should expect that to happen. Japan?s upper House of Councilors election will take place on July 21, and Prime Minister Abe?s ruling Liberal Democratic Party will win by a landslide. After that, you can expand Abe?s plans for an overdue major restructuring of the economy to mature from idle speculation to specific proposals. That is what the market wants to hear. Until then, he is loath to ruffle political feathers. He is going to have to break a lot of eggs to make this omelet.

On the table in his ?Third Arrow? plan are deregulation of virtually all financial markets, modernization of the health care system, immigration reform to open the way for more foreign workers, and rationalization of a bloated government bureaucracy. International trade will get streamlined and capital investment incentivized. More infrastructure spending will be aimed at maintenance and repair, so there will be no more ?bridges to nowhere.?

Oh, and he wants to enable the national pension fund system to step up its purchases of Japanese stocks. Abe wants to compress all of the deregulation that the US has enacted in the past 30 years into the next three.

The truly encouraging thing here is that Abe?s early actions are already bearing fruit. ?Arrows? 1 and 2 put the country on track to double its money supply in two years and paved the way for a staggering $150 billion in new public works spending. The crash in the yen this prompted is causing corporate earnings to go through the roof. Those results will be reported in the fall.

Then, the best company performance in two decades and a national reorganization plan on the scale of Roosevelt?s New Deal will be the impetus for the next leg up in the Great Japanese Bull Market of the 2010?s. That is why I banged out Trade Alerts on Wednesday to buy Japanese stocks through the Wisdom Tree Japan Hedge Equity ETF (DXJ) and sell short the yen through the Currency Shares Japan Yen Trust ETF (FXY) and the Proshares Ultra Short Yen ETF (YCS).

![Atlantis Japan Growth Fund]() Atlantis Japan Growth Fund

Atlantis Japan Growth Fund

Use the Dip to Buy Japan

Use the Dip to Buy Japan

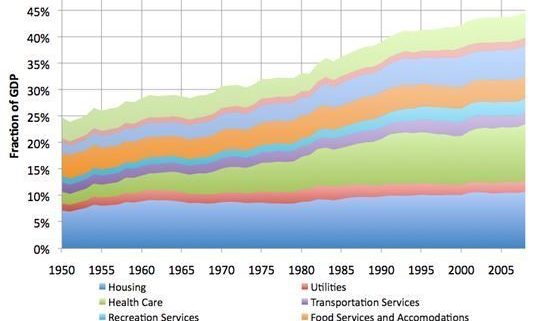

Anyone wondering about the long term future of the US economy should take a look at the chart below. It shows the unrelenting growth of services? share of American GDP growing from 25% to 45% over the last sixty years.

Far and away the fastest growth area has been in health care, and with the first Obamacare programs starting in September, that growth is set to accelerate. Financial services have also been a serious growth creator, for better or for worse. You can turn the chart upside down and the shrinkage in our manufacturing base is equally illustrated.

This is not necessarily a bad thing. Would you rather be mining coal or designing a website? These statistics make us the envy of the world, as services are where the future lies. By creating so many key technologies, our country has been the most successful in climbing up the global value chain.

Services largely comprise pure intellectual content, require no raw materials, and the end product can be transmitted over the Internet. There is a reason why nearly a million foreign students have flocked to the US for an education. Emerging nations like China and South Korea, which only see services generating 10%-15% of their GDP, are wracking their brains trying to figure out how to play catch up.

Global Market Comments

June 13, 2013

Fiat Lux

Featured Trade:

(JULY 16 BERLIN STRATEGY LUNCHEON),

(ANOTHER NAIL IN THE NUCLEAR COFFIN),

(SCE-PF), (NLR), (CCJ)

(THE CHINA VIEW FROM 30,000 FEET)

(FXI), (DBC), (DYY), (DBA), (PHO)

Southern California Edison Trus (SCE-PF)

Market Vectors Uranium+Nuclear Enrgy ETF (NLR)

Cameco Corporation (CCJ)

iShares FTSE China 25 Index Fund (FXI)

PowerShares DB Commodity Index Tracking (DBC)

PowerShares DB Commodity Dble Long ETN (DYY)

PowerShares DB Agriculture (DBA)

PowerShares Water Resources (PHO)

Come join John Thomas for lunch at the Mad Hedge Fund Trader?s Global Strategy Update, which I will be conducting in Berlin, Germany, at 12:00 noon on Tuesday, July 16, 2013. A three-course lunch will be followed by a PowerPoint presentation and an extended question and answer period.

I?ll be giving you my up to date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate. And to keep you in suspense, I?ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $219.

The lunch will be held at a downtown Berlin hotel within sight of the Brandenburg Gate, the details of which will be emailed with your purchase confirmation.

I look forward to meeting you, and thank you for supporting my research. To purchase tickets for the luncheons, please go to my online store.

Southern California Edison (SCE/PF) has announced that it is permanently closing its controversial nuclear power plant at San Onofre. The move is only the latest in a series of closures implemented by utilities around the country, and could well spell the end of this flagging industry. This is further dismal news for holders of ETF?s in the sector, like the Market Vector Uranium + Nuclear Energy ETF (NLR) and Cameco (CCJ).

SCE?s problems started in July, 2012 when a faulty steam generator tube released a small amount of radioactive steam and the plant was immediately shut down. An inspection revealed that 3,000 additional tubes were showing excessive wear, possible due to a design flaw, or perhaps their exposure to 45 years of high intensity radiation.

Supplier, Westinghouse, owned by Japan?s Toshiba Group, rushed in with a replacement generator, which failed within a month. That prompted the Nuclear Regulator Commission to demand a full license reapplication, which promised to be a contentious and expensive multiyear slugfest. That was all SCE needed to throw in the towel and move for permanent closure. About 1,100 workers will be laid off.

San Onofre has been a continuous target of environmentalist litigation since it was opened in 1968. You could have found a better place to build a nuclear power plant than the birthplace of the environmental movement. After the Fukushima nuclear disaster in 2010, another Westinghouse plant, Senator Barbara Boxer was not too happy about it either. It turns out there was no practical evacuation plan in the event of an emergency. Some 25 million people live within 100 miles of the facility, and there is no way you move these numbers anywhere in a hurry. The region is totally gridlocked even in a normal rush hour. That prompted Boxer to lead a series of congressional hearings, not just about San Onofre, but the entire aging nuclear industry nationwide.

The development means that Southern California Edison will have to write off the $2.1 billion in capital investment and upgrades that it has carried out over the last 20 years. Decommissioning will cost another $2 billion. These are the most expensive and toxic demolitions on the planet. Stored nuclear waste will remain on sight until a national solution is found. The costs will be entirely passed on to the region?s long-suffering electric power consumers.

I know the San Onofre plant well, as it is right on the border of the Marine Corps. base at Camp Pendleton. My dad was stationed there during WWII and was followed by a long succession of descendants. I used it as a landmark for inbound VFR flights to the base. I also practiced amphibious assaults on the beach, with traditional landing craft, light armored reconnaissance vehicles (LAR), and advanced hovercraft (LCAC). I also had to swim once. On R&R, San Onofre offered one of the best surfing beaches on the coast.

I am not holding my breath for the nuclear industry. For more depth on the topic, please see my earlier piece, ?New Nuclear Demolished by New Natural Gas? by clicking here.

Not Exactly a Crowd Pleaser

Not Exactly a Crowd Pleaser

A Navy Assault LCAC

A Navy Assault LCAC

I have long sat beside the table of McKinsey & Co., the best management consulting company in Asia, hoping to catch some crumbs of wisdom. So, I jumped at the chance to have breakfast with Shanghai based Worldwide Managing Director, Dominic Barton, when he passed through San Francisco visiting clients.

These are usually sedentary affairs, but Dominic spit out fascinating statistics so fast I had to write furiously to keep up. Sadly, my bacon and eggs grew cold and congealed. Asia has accounted for 50% of world GDP for most of human history. It dipped down to only 10% over the last two centuries, but is now on the way back up. That implies that China?s GDP will triple relative to our own from current levels.

A $500 billion infrastructure oriented stimulus package enabled the Middle Kingdom to recover faster from the Great Recession than the West, and if this didn?t work, they had another $500 billion package sitting on the shelf. But with GDP of only $5.5 trillion today, don?t count on China bailing out our $15.5 trillion economy.

China is trying to free itself from an overdependence on exports by creating a domestic demand driven economy. The result will be 900 million Asians joining the global middle class who are all going to want cell phones, PC?s, and to live in big cities. Asia has a huge edge over the West with a very pro-growth demographic pyramid. China needs to spend a further $2 trillion in infrastructure spending, and a new 75-story skyscraper is going up there every three hours!

Some 1,000 years ago, the Silk Road was the world?s major trade route, and today intra-Asian trade exceeds trade with the West. The commodity boom will accelerate as China withdraws supplies from the market for its own consumption, as it has already done with the rare earths.

Climate change is going to become a contentious political issue, with per capita carbon emission at 19 tons in the US, compared to only 4.6 tons in China, but with all of the new growth coming from the later. Protectionism, pandemics, huge food and water shortages, and rising income inequality are other threats to growth.

To me, this all adds up to buying on the next substantial dip big core longs in China (FXI), commodities (DBC) and the 2X (DYY), food (DBA), and water (PHO). A quick Egg McMuffin next door filled my other needs.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.