After ignoring the constant chaos in Washington for 17 months, it finally mattered to the stock market.

Guess what was at the top of the list of retaliatory Chinese import duties announced last week?

California wine!

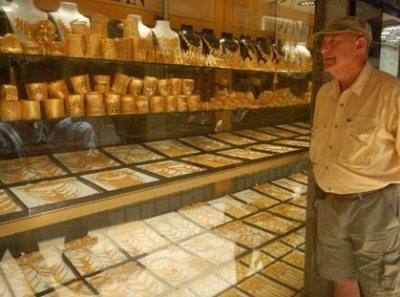

The great irony here is that half of the Napa Valley wineries are now owned by Chinese investors looking for a bolt-hole from their own government. Billionaires in China have been known to disappear into thin air.

And after years of trying, we were just getting Chinese consumers interested in tasting our fine chardonnays, merlots, and cabernet sauvignons.

It will be a slap in the face for our impoverished farmworkers who actually pick the grapes, who have just been getting back on their feet after last fall's hellacious fires.

Do you suppose they will call the homeless housing camps "Trumpvilles?"

California is on the front line of the new trade war with China.

Not only is the Middle Kingdom the largest foreign buyer of the Golden State's grapes, almonds, raisins, and nuts, it also is the biggest foreign investor, plowing some $16 billion in investments back here in 2016.

Down 1,700 Dow points on the week and a breathtaking 1,400 points in two days. It was the worst week for the markets in two years. And the technology and financial stocks suffered the worst spanking - the two market leaders. The most widely owned stocks are seeing the worst declines.

We certainly are paying the piper for our easy money made last year. The Dow Average is now a loser in 2018, off 4.1% and back to November levels.

The Dow 600 point "flash crash" we saw in the final two hours of trading on Friday was almost an exact repeat of the February 9 swoon that took us to the exact same levels.

There was no institutional selling. It was simply a matter of algorithms gone wild. The news flow that day was actually quite good.

Our favorite stock, Micron Technology (MU) announced blockbuster earnings and high target (for more depth, please read the Mad Hedge Technology Letter).

Dropbox (DBX) went public, and immediately saw its shares soar by 50% in the aftermarket. The president signed an emergency funding bill to keep the government open, despite repeated threats not to do so.

Which means the market fell not because of a fundamental change in the US economy. It is a market event, pure and simple.

I therefore expect a similar outcome. Only this time, we don't have an $8 billion unwind of the short volatility trade ($VIX) to deal with, as we did in February. That's why I thought markets would bottom at higher levels this time around.

There is only one problem with this theory.

The chaos, turmoil, and uncertainty in Washington is finally starting to exact a steep price on shareholders. Uncertain markets commend lower price earnings multiples than safer ones.

As a result, multiples are now 15% lower than the January high at 19.5X, and much more for individual stocks. And multiples have been falling even though earnings have been rising, quite substantially so. Such is the price of chaos.

Will markets bottom out here on a valuation basis as they did last time? Or will the continued destruction of our democracy command a higher price? We will find out soon.

Clearly the S&P 500 200-day moving average at $255.95 is crying out for a revisit, which we probably will see first thing Monday morning. Allow more shorts to get sucked in, and then you probably have a decent entry point to buy stocks for the rest of 2018.

Indeed, it was a week when the black swans alighted every day. First, the twin hits from Facebook (FB), followed by the worst trade war in eight decades. Then came the Chinese retaliation.

While the damage suffered so far has been limited, investors are worried about what is coming next.

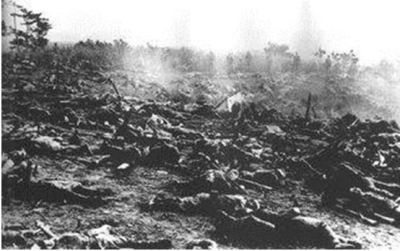

One of the last supervising adults left the White House, my friend and comrade in arms, National Security Advisor H.R. McMaster. His replacement is Fox News talk show host John Bolton, who is openly advocating that the US launch a pre-emptive nuclear strike against North Korea.

Bolton has quite a track record. He is the guy who talked President Bush into invading Iraq. Now, that would trigger a new bear market in the extreme!

As I did not predict five black swans in five days, the Mad Hedge Trade Alert Service took a hit this week, backing off of fresh all-time highs.

The trailing 12-month return fell to 46.49%, the 8-year return to 284.01%, bringing the annualized average return down to only 34.08%.

Given all of the above, economic data points for the coming holiday shorted trading week seem almost quaintly irrelevant. But I'll give them to you anyway.

On Monday, March 26, at 10:30 AM, we get the February Dallas Fed Manufacturing Survey.

On Tuesday, March 27, at 9:00 AM, we receive an update on the all-important CoreLogic Case-Shiller National Home Price NSA Index for January. A 3-month lagging housing indicator.

On Wednesday, March 28, at 8:30 AM EST, the second read of Q1 GDP comes out.

Thursday, March 29, leads with the Weekly Jobless Claims at 8:30 AM EST, which hit a new 49-year low last week at an amazing 210,000. At 9:45 AM, we get the February Chicago Purchasing Managers Index. At 1:00 PM, we receive the Baker-Hughes Rig Count, which saw a small rise of three last week.

On Friday, March 30, the markets are closed for Good Friday.

As for me, I'll be doing my Christmas shopping early this year before the new Chinese import tariffs jack up the price for everything by 15% to 25%.

I'll be doing all of this courtesy of Amazon (AMZN), of course. Since I arrived here at Lake Tahoe, it has snowed 6 feet in two days in a storm of truly biblical proportions. We got a total of 18 feet of snow in March. By the time I dig out, it will be time to go home.

Good luck and good trading.

John Thomas