One couldn?t help but notice the outbreak of recollection, reminiscing and schadenfreude that took place yesterday when the NASDAQ briefly tipped over 5,000.

I remember it like it was yesterday. I am still amazed by the frenzy that took place, witnessing the kind of bubble one only sees twice a century. And I was right in the thick of it, living in nearby Silicon Valley.

Business school students were raising $50 million with a one-page business plan. An analyst predicted that Amazon (AMZN) shares would double to $400 in a year. It happened in only four weeks.

All of my attorneys quit, taking up prestige jobs as chief legal counsels at new start ups, taking stock in lieu of pay, dollar bills dancing in front of their eyes. They were replaced by the ?B? team. Other law firms started accepting stock as payment of legal fees.

I knew more than one office secretary who took pay cuts to $15,000 a year in exchange for stock, which they later sold for $2 million.

When I tried to expand my company, I couldn?t find a larger office to rent. San Francisco had run out of office space. So I bought a house for $7 million instead and worked from there. That was no problem, as everyone had $7 million then.

But what I remember most fondly were the parties. The beneficiaries of every IPO sought to celebrate with the biggest party in Bay Area history, each one eclipsing the last. An entire industry of creative party organizers sprung up, seeking to outdo every competitor.

I remember most fondly the Vodka luge carved out of a giant block of ice, where a pretty hostage poured 100 proof super cooled rocket fuel straight down your throat. By midnight, the passed out bodies started piling up on the periphery.

Those were the days!

Which brings us to today, when handwringing is breaking out all over. Investors are afraid that we are just now putting in the double top of the century in NASDAQ, with a very neat 15 years taking place between peaks.

Is it time to sell?

I think not.

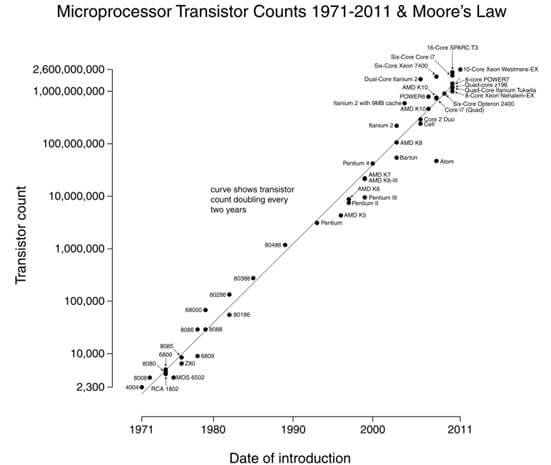

Today, we see a completely different world from the one we knew in 2000. Global GDP then was a mere $32 trillion. Today it is 2.5 times higher at $78 trillion. Using this simplistic measure, the GDP adjusted value of NASDAQ should be 12,187.

The high tech index peaked at a price earnings multiple of 100 times earnings. Today it is 30 times. That means the multiple adjusted high for NASDAQ today would be 16,650.

Technology stocks then didn?t pay dividends. Today, look at Apple (AAPL), which pays a 1.50% dividend worth $11.25 billion in annual payouts. This revenue stream provides enormous support under the market, and almost makes Apple shares perform more like bonds than stocks.

Which brings me to a new investment thesis.

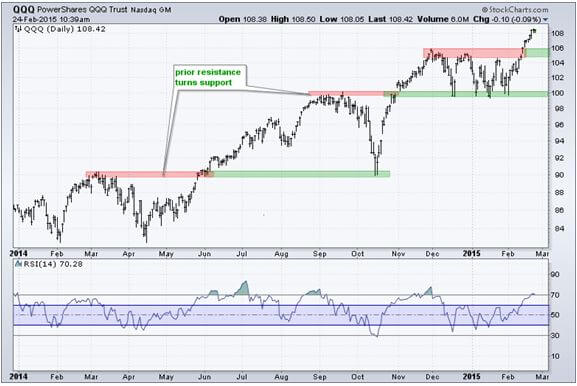

What if the stocks that peaked in 2000 are only now just breaking out and starting long bull runs? I am thinking of quality technology names that have completed long, sideways, basing moves. Ebay (EBAY), Broadcom (BRCM), and Cisco (CSCO) leap to the fore.

The possibilities boggle the mind.

I think that in order to get NASDAQ to really get the bit between its teeth, one thing has to happen. Apple has to stop going up.

You really only had to make one stock call in 2014. You had to be overweight Apple. If you did, you were a star. If you didn?t, then you are still probably looking for a new job on Craig?s List.

Managers are behaving as if the past were a prologue, loading the boat with Apple with their eyes firmly fixed on the rear view mirror. That explains the blowout 13% jump in Steve Jobs? creation so far in 2015, some $90 billion in market capitalization.

All you need is for investors to stop buying Apple for 15 minutes and rotate into other big tech names. That was my logic behind my Trade Alert to buy Cisco two weeks ago. If that occurs, it will be off to the races for NASDAQ once again.

Remember that old saw in technical analysis land, ?the longer the base, the bigger the air above it.?

A vodka martini, anyone?