I love inflation.

Thanks to the relentless increase in prices, the value of my home has risen by $4 million over the last ten years, and $2 million over the last three years alone.

And I’m not the only one.

Some 66% of Americans own their own homes and may have seen similar price increases or more.

So, what if the price of a gallon of milk goes up by $1? I’ll happily pay that if it means my largest personal investment appreciates at triple-digit rates. Besides, I’m lactose intolerant anyway, and all my kids have grown up.

I’ll tell you what else inflation does. It makes stocks really cheap. That’s because investors fear that the Fed will raise interest rates by too much, destroy company earnings, and trigger a recession.

This is counterintuitive because companies actually benefit from inflation because they can get away with faster price increases more often, boosting profits. I took my kids out to a graduation dinner yesterday and practically had to take out a second mortgage to do so.

Personally, I believe that such a stock market bottom is close. But while the last bottom was within 10%, or 200 S&P 500 (SPX) points in terms of price, it is only 50% in terms of time. That signals a great new bull market for stocks beginning sometime this summer. Then anything you touch will double in three years.

You will look like a genius….again!

You can see who agrees with me by looking at which stocks are already getting bought up. Coca-Cola (KO), Johnson & Johnson (JNJ), and Procter & Gamble (PG) are the kind of safe, dividend-paying, brand name stocks that very long-term investors like pension funds love to own. They tend to buy and hold….forever.

No meme stocks here.

It isn’t just the Fed that is raising interest rates, which can only control overnight rates. The US budget deficit is falling at the fastest rate since WWII, possibly taking us to a budget surplus by year-end. As a result, the money supply is shrinking at the fastest rate in 60 years.

QT, or quantitative tightening, will fan the flames when it starts on January 1, ultimately taking up to $9 trillion out of the financial system.

Remember all that liquidity from QE, near-zero rates, and massive government spending that saved the economy from Armageddon? Play for movie in reverse and you get the oppositive result, i.e. falling share prices….at least for a while.

The battle as to who is right about the direction of the economy continues unabated. Is it bonds or stocks? At the rates that stocks have been plunging, stocks are essentially anticipating another Great Depression.

Ten-year US Treasury yields that soared from 1.33% to 3.12% in a mere six months are proclaiming that happy days are here again and will last forever. Since January, the average monthly mortgage payment has jumped by $450 a month. If that isn’t recessionary, I don’t know what is.

As a 53-year veteran of these markets, I can tell you that the bond market is always right. That’s because the money spent on equity research has shrunk to a shadow of its former self in recent decades, while bond research is as strong as ever.

Always listen to the guy with the $10 million budget and ignore the one with the $500,000 budget, which means that in the coming months, equity prognosticators will realize the error of their ways and come over to my way of thinking once again.

The Fed Minutes were not so horrible, downplaying the risk of a full 1% rate rise, triggering a 1,000-point rally in the Dow. With five up days in a row, this is starting to look like THE bottom. Is this the light at the end of the tunnel?

Q1 GDP dives 1.5% in its final read. It’s the worst quarter since the pandemic began during Q2 2022. Weekly Jobless Claims dropped 8,000 to 210,000.

NVIDIA Rips, surprising to the upside on almost every front, sending the stock up $30, or 18.75%. Mad Hedge followers bought (NVDA) last week. This is one of the best-run companies in the world. I expect the shares to rise from the current $178.51 to $1,000 in five years. Buy (NVDA) on dips.

The Consumer will keep driving the economy, says Bank of America CEO Brian Moynihan. Betting against the American consumer has always been a fool’s errand. I’m with Brian. Cash levels this high were never followed by recessions.

Only 18% of Americans will increase stockholdings this year, which is usually what you get at market bottoms. It was closer to 100% at the December top. Yet another signal that we are approaching the bottom in price, if not time.

New Home Sales dive in April, down 16.6% on a signed contract basis, the weakest in two years. The macro is definitely conspiring against the market. It’s all about interest rates. The average monthly mortgage payment has rocketed by $450 a month since January. Inventories have also soared from 6 to 9 months.

Advertising is in free fall, especially the online version, a usual pre-recession indicator. It is the easiest and first expense companies cut when they expect flagging sales. Look no further than yesterday’s astonishing 43% collapse in Snap (SNAP). Notice that TV commercials are getting endlessly repeated as the number of advertisers and ad rates fall. If I see one more ad for Interactive Brokers, I’ll shoot myself.

The EV Shortage worsens, with wait times for a new Tesla extending beyond a year. I can sell my Model X for more than I paid for it three years ago. Gasoline at $6.00 is converting a lot of drivers, and gas lines this summer loom. Big three dealers are price gouging on the few EVs they have, charging well over list. Good luck finding a Rivian pick-up; that’s a two-year wait. Maybe that makes (TSLA) a “BUY” down here?

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still historically cheap, oil peaking out soon, and technology hyper-accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

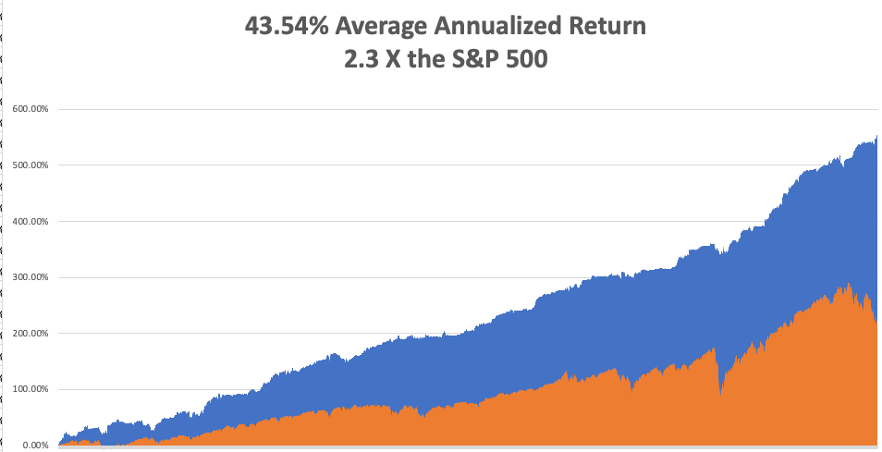

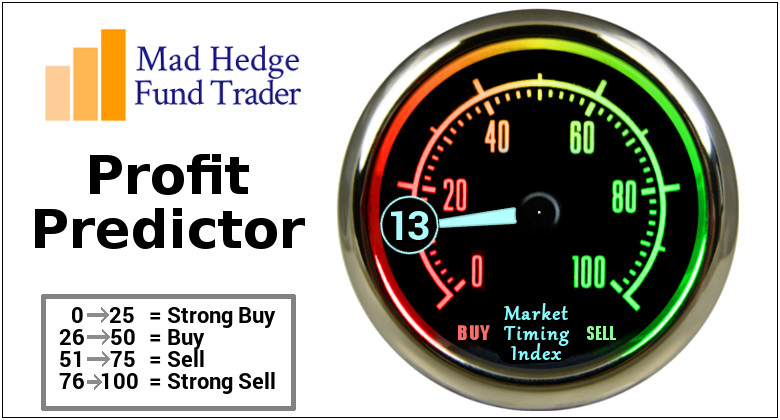

With some of the greatest market volatility seen since 1987, my May month-to-date performance recovered to +8.80%.

My 2022 year-to-date performance exploded to 38.98%, a new high. The Dow Average is down -9.30% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high 61.22%.

Last week was a quiet one, with me using the monster rally to add new shorts in Apple (AAPL) and the S&P 500 (SPY).

That brings my 14-year total return to 551.54%, some 2.40 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to 43.54%, easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 84 million, up 1.5million in a week, and deaths topping 1,004,000 and have only increased by 2,000 in the past week. You can find the data here.

On Monday, May 30, markets are closed for Memorial Day.

On Tuesday, May 31 at 9:00 AM EST, the S&P Case Shiller National Home Price Index for March is released.

On Wednesday, June 1 at 10:00 AM, JOLTS Job Openings for April are published.

On Thursday, June 2 at 8:30 AM, Weekly Jobless Claims are out. We also learn the ADP Private Employment Report for May.

On Friday, June 3 at 8:30 AM, the big Nonfarm Payroll Report for May is disclosed. At 2:00 the Baker Hughes Oil Rig Count is out.

As for me, as a lifetime oenophile, or wine lover, I long searched for the Holy Grail of the perfect bottle. I finally found my quarry in 1989.

During the 19th century, Russia was still an emerging country that sought to import advanced European technology. So, they sent agents to the top wine-growing regions of the continent to bring back grapevine cuttings to create a domestic wine industry. They succeeded beyond all expectations building a major wine industry in Crimea on the Black Sea.

Then the Russian Revolution broke out in 1918.

Czar Nicholas II and his family were executed, and eventually, the wine industry was taken over by the Soviet state. They kept it going because wine exports brought in valuable foreign exchange with which the government could use to industrialize the country.

Then the Germans invaded in 1941.

Not wanting the enemy to capture a 100-year stockpile of fine wine, the managers of the Massandra winery dug a 100-yard-deep cave, moved their bottles in, bricked up the entrance, and hid it with shrubs. Then everyone involved in storing the wine was killed in the war.

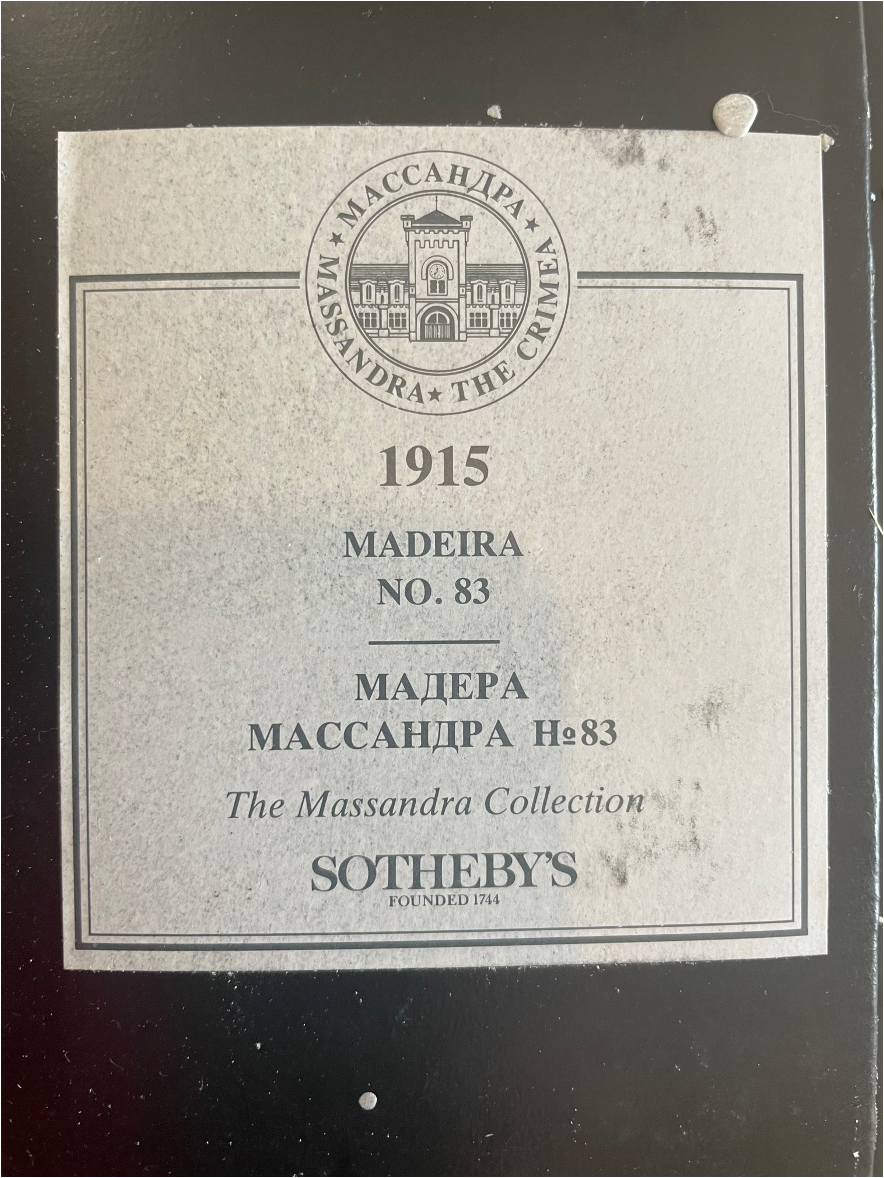

Some 45 years later, looking to expand the facility, some Massandra workers stumbled across the entrance to the cave. Inside, they found a million bottles dating back to the 1850s kept in perfect storage conditions. It was a sensation in the wine collecting world.

To cash in, they hired Sotheby’s in London to repackage and auction off the wine one case at a time. It was the auction event of the year. For years afterwards, you could buy glasses of 100-year-old ports and sherries from the Czar’s own private stock at your local neighborhood restaurant for $5, the deal of the century.

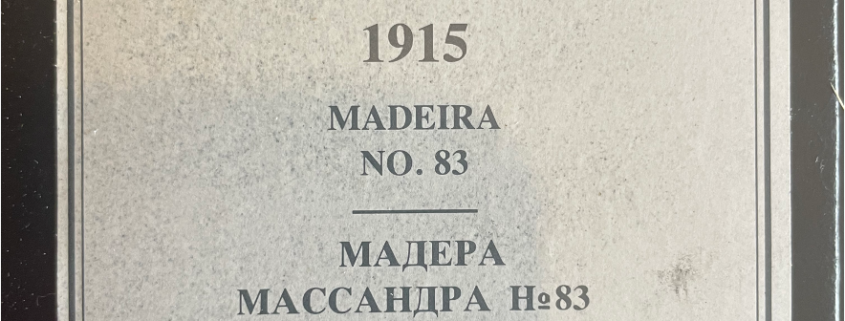

I attended the auction at Sotheby’s packed Bond Street offices. The superstars of the wine collecting world were there with open checkbooks. I sat there with my paddle number 138 but was outbid repeatedly and wondered if I would get anything. In the end, I managed to pick up some of the less popular cases, a 1915 Madeira, a 1936 white port, and a 1938 sherry for about $25 a bottle each.

For years, these were my special occasion wines. I opened one when I was appointed a director of Morgan Stanley. Others went to favored clients at Christmas. My 50th, 60th, and 70th birthdays ate into the inventory. So did the birth of children number four and five. Several high school fundraisers saw bottles earn $1,000 each.

One of the 1915’s met its end when I came home from the Gulf War in 1992. Hey, the last Czar didn’t drink it and looked what happened to him! Another one bit the dust when I sold my hedge fund at the absolute market top in 1999. So did capturing 6,000 new subscribers for the Mad Hedge Fund Trader in 2010.

It turns out that the empties were quite nice too, 100-year-old hand-blown green glass, each one is a sculpture in its own right.

I am now reaching the end of the road and only have a half dozen bottles left. I could always sell them on eBay where they now fetch up to $1,000 a bottle.

But you know what? I’d rather have six more celebrations than take in a few grand.

Any suggestions?

Stay Healthy,

John Thomas

CEO & Publisher