If you’re an educator not at a top 25 American university, you might want to stop reading right now.

Disruption.

You’re either on the right or wrong side of it.

I’ve detailed numerous subsets of the economy and society that have been transformed by sharp shifts in technological innovation.

But the one industry that has stealthily moved into the heart and center of technological disruption is education.

For centuries, universities and higher learning institutions had a stranglehold on critical information required to successfully perform in the cutting-edge knowledge economy of those times.

Then on September 15, 1997, a mere 21 years ago, Google search launched its free services to the world and grabbed the monopoly of information away from the college system.

This website effectively caused the cost of information to crater to zero and its free website is ranked #1 as of February 2019 with over 4.5 billion monthly active users.

The ensuing 21 years has been a renaissance in the ability to distribute information propelled by this one platform, and the result is that billions have the ability to study and read up on what they want and when they want.

The ability to learn for free combined with a tight labor market is a promising landscape for job seekers, with analysts forecasting more opportunities for professionals without a degree.

Job-search site Glassdoor amassed a list of various employers no longer bound by requiring applicants to possess a 4-year bachelor’s degree.

These firms aren’t your second-rate companies either made up of gold standard workplaces such as Google, Apple, and IBM.

In 2017, IBM's vice president of talent Joanna Daley confided that about 15% of IBM’s new hires don't have a four-year bachelor qualification.

She emphasizes hands-on experience through coding boot camp or industry-related vocational classes as explicit criteria to get hired.

This development bodes poorly for the future of universities and boosts the prospects of alternative education.

Online college offers working adults ample flexibility in furthering their education.

According to the most recent federal statistics from 2016, roughly one out of every three, or 6.3 million college students learned online.

Even though online courses are becoming more widespread, the best and brightest aren’t attending these schools.

However, it did hijack the marginal student that was on the fence for a 4-year university and brought them into the orbit of for-profit online courses and the revenues that came with it.

That was the first stage of online forces imposing financial pressure on the education marketplace.

Now analysts are discovering the second major trend with higher rated students opting out of the university system altogether.

In many cases, a 4-year university degree is a bad value proposition.

Why is that?

Costs.

In a capitalistic economy that lives and dies by the mantra of buy low and sell high – universities seem to be getting sold short lately.

The exorbitant costs to obtain a 4-year degree has led to an outsized student debt bubble and removed the mystique of this once treasured qualification.

A growing chorus of bipartisan voices has pigeonholed student debt as a major problem across the country.

In the previous presidential election, Democratic candidate Bernie Sanders called this situation “outrageous” as national student debt has spiraled out of control to the amount of $1.5 trillion.

This has been a terrible commercial for the younger generations to follow in the footsteps of the indebted Millennial generation.

And with Generation Z tech savvy at building stand-alone firms buttressed by Instagram and YouTube platforms, why go to college anymore?

Or to nail one of those jobs developing iPhones in Cupertino, why not take a few coder boot camps and self-develop a portfolio impressive enough to score an Apple interview?

The bottom line is that there are workarounds for a fraction of the price.

And because tech firms have outpaced analog companies in salaries and hiring for the past two decades, there is an outsized bias on compiling technical skills that will lead a candidate down a path to a salary of over $100,000 quicker than a 4-year degree can.

Not many other industries can claim the same.

The cracks are beginning to reveal themselves in the overall university apparatus.

Universities had years of record revenue that they reinvested into the system to enhance programs, staff, buildings, stadiums, and infrastructure.

The financial catalyst was the rise of the Chinese college student.

The latest statistics nailed the number of Chinese nationals in America studying for 4-year degrees at over half a million.

Many of those were trained up with engineering-related degrees and bolted back home to find jobs at Baidu (BIDU), Tencent, or Alibaba (BABA) powering Chinese Inc.

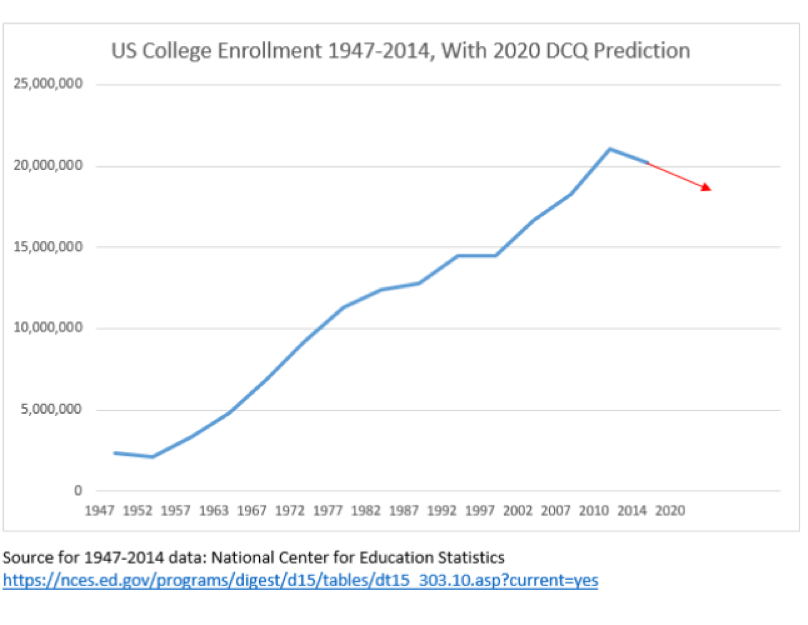

However, the drop off in demographics from young Chinese and Americans are forcing universities to fight for a shallower pool of candidates with less attractive degrees relative to the value of degrees of past generations.

The second-tier universities are hardest hit with examples galore.

Alcorn State University in Mississippi saw a dramatic 69.45% decrease in applications in 2018 and its rural location didn’t help either.

Alabama State University is feeling the pinch with a 33.06% drop in application in recent years.

If you thought the University of New Orleans was clawing its way back to relevancy after Hurricane Katrina, you are mistaken with its 38.23% drop in applications.

Military schools haven’t been spared either with applications to The United States Air Force Academy crashing 28.12% over the past ten years.

A confluence of deadly trends is about to beset the university system and schools will likely go bust.

Technology is giving a reason for students to bypass the system while also speeding up the financial timebombs many universities are about to confront.

Then we must ask ourselves, will universities even exist in the future?

Probably, but perhaps just the top 25 elite schools that are still worth the high costs.